Awe-Inspiring Examples Of Info About Cash Flow For Business Profit And Loss Statement Taxi Driver

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

6 ways to manage cash flow for your business 1.

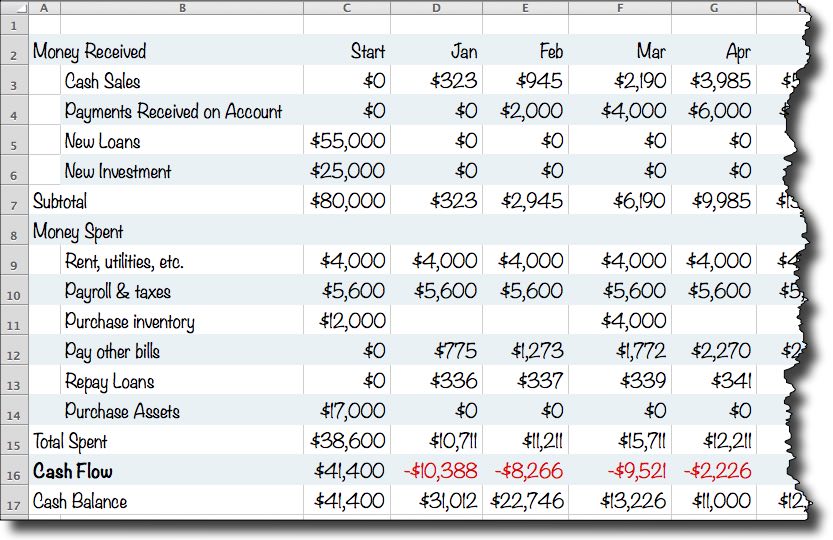

Cash flow for business. Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. How to calculate business cash flow. Hire skilled workers.

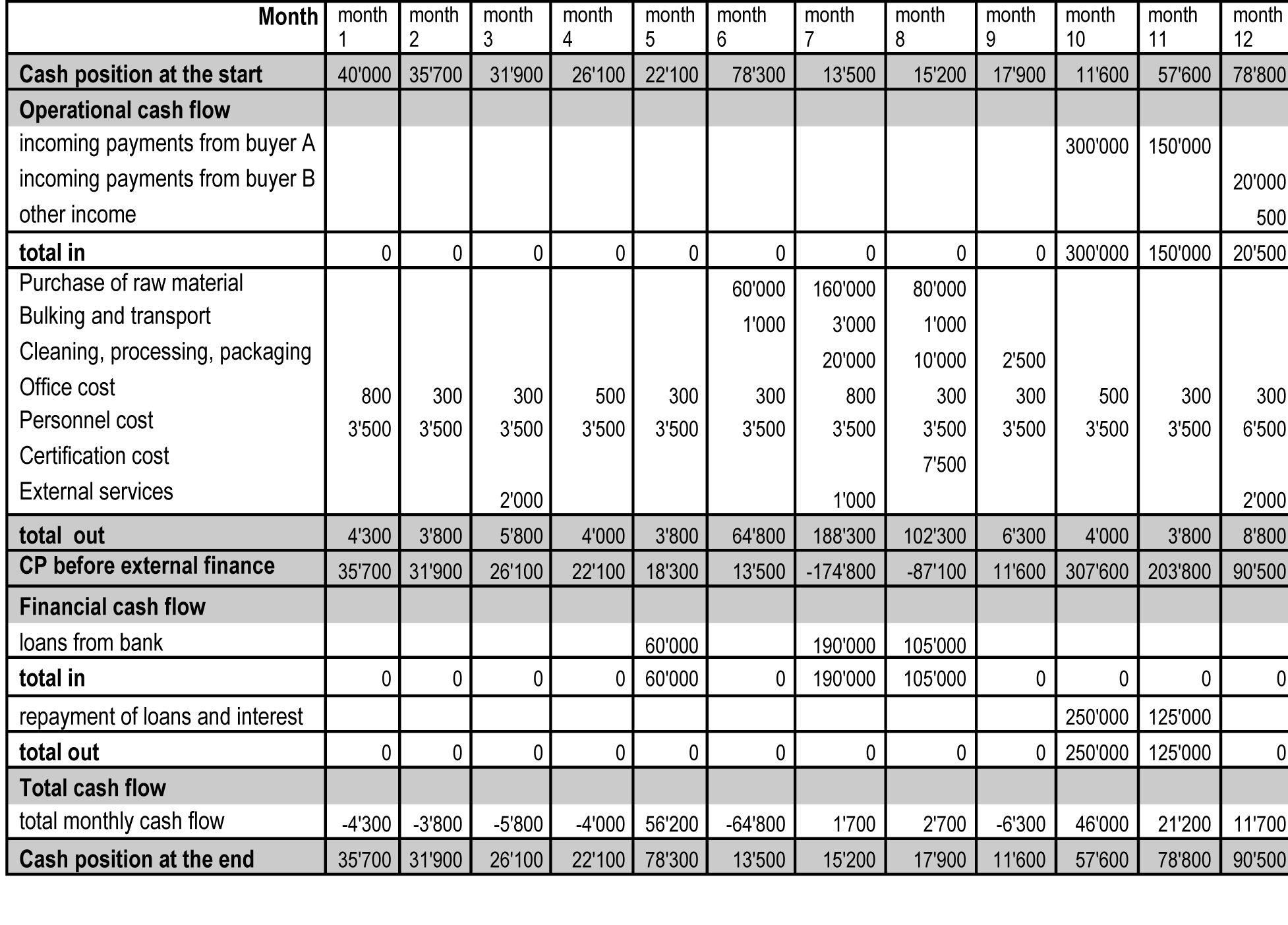

Cash flow is a fundamental financial kpi that businesses use to gauge their financial health. The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. A cash flow statement tracks all the money flowing in and out of your business.

Unfortunately, for small business owners, understanding and using cash flow formulas doesn’t always come naturally. Cash flow is one of the simpler top line metrics that you can use to determine the. This value can be found on the income statement of the same accounting period.

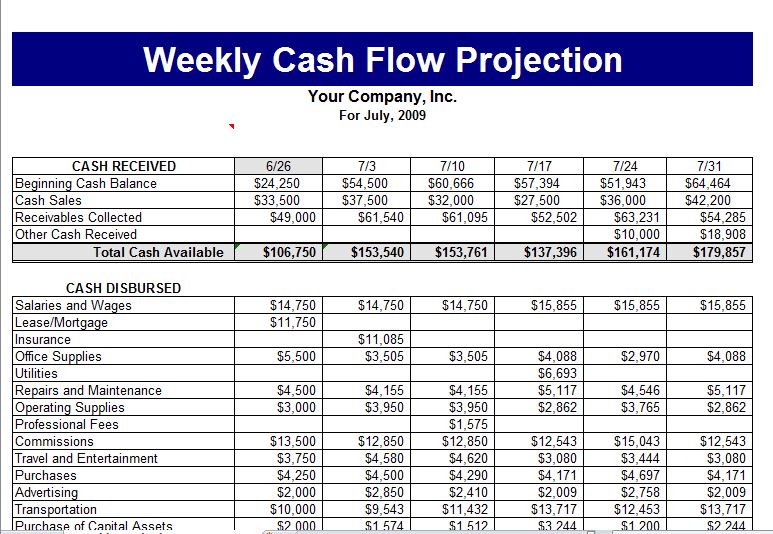

Best for lower credit scores: Entrepreneurs believe hiring skilled employees. That’s what a cash flow forecast is about—predicting your money needs in advance.

Cash flow is money that comes into the business through sales and money that goes out. Determine the overall change in cash for the period. In theory, cash flow isn’t too complicated—it’s a reflection of how money moves into and out of your business.

So much so that 60% of small business owners say they don’t feel knowledgeable about accounting. Look at sales versus cash flow. The statement of cash flow depicts a company's sources of money and where it spends it.

Learn how to calculate the flow. Like other financial kpis, cash flow is calculated with a formula, using raw figures for the money that’s flowing into and out of a business. Plan ahead to make sure you always have money to cover payments.

It will also be listing. Remember to plan your financial commitments, such as tax and super. You can use your cash flow statement to:

The average debtor pays two weeks late, according to accounting platform xero. By cash, we mean money you can spend. All the strategy, tactics, and ongoing business activities mean nothing if there isn’t enough money to pay the bills.

The cfs measures how well a. Cash flow is the money that flows in and out of your business throughout a given period. Cash flow is the heartbeat of your business.