Sensational Info About All Relevant Information Should Be Included In The Financial Reports Controller Position

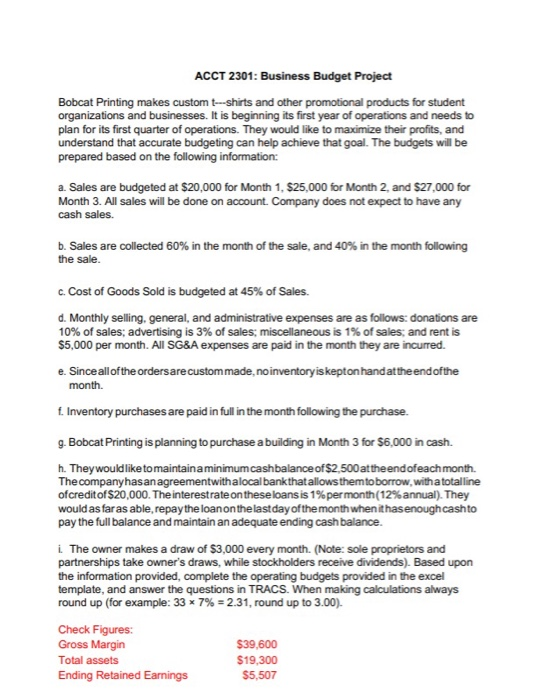

Financial statements should be useful to readers.

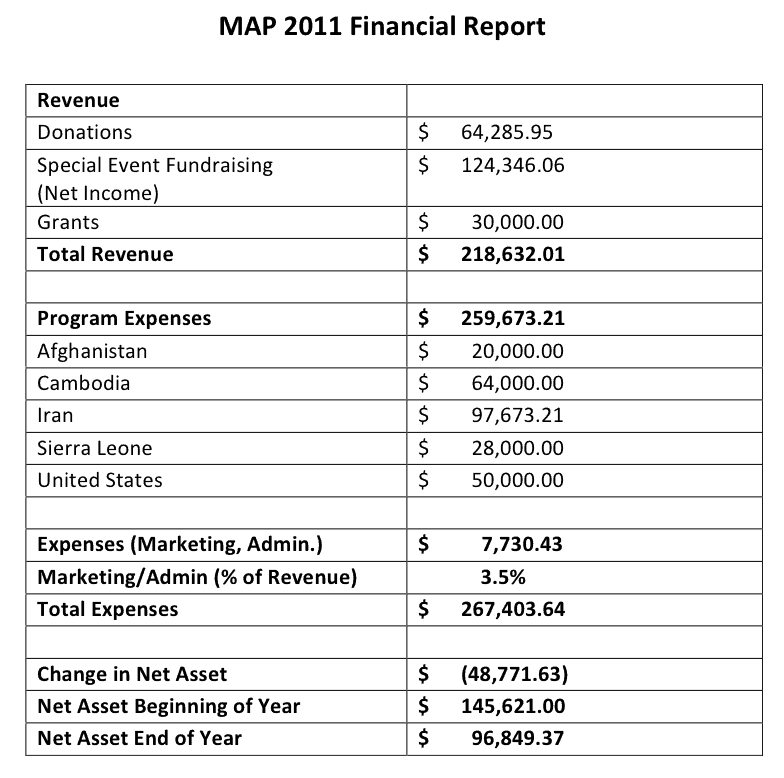

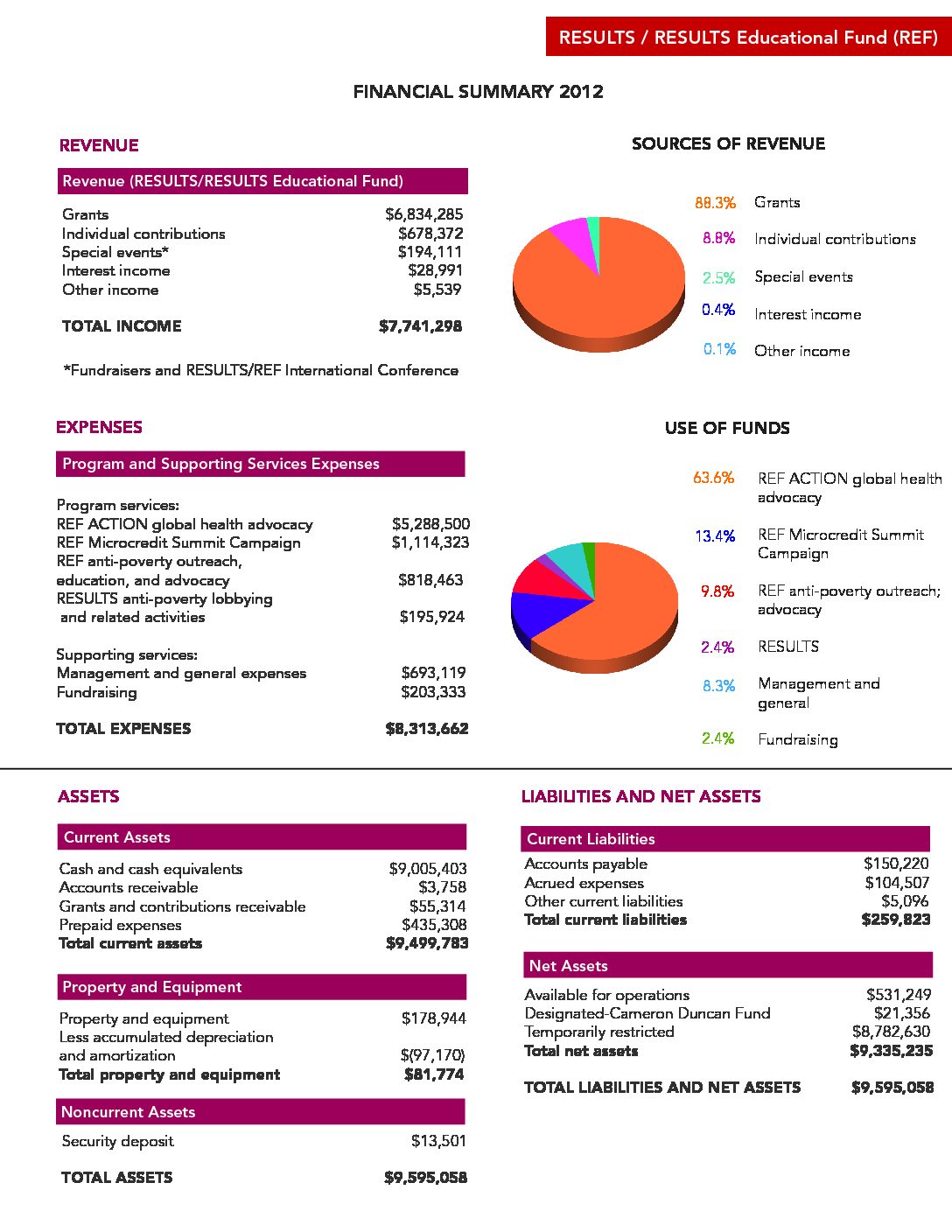

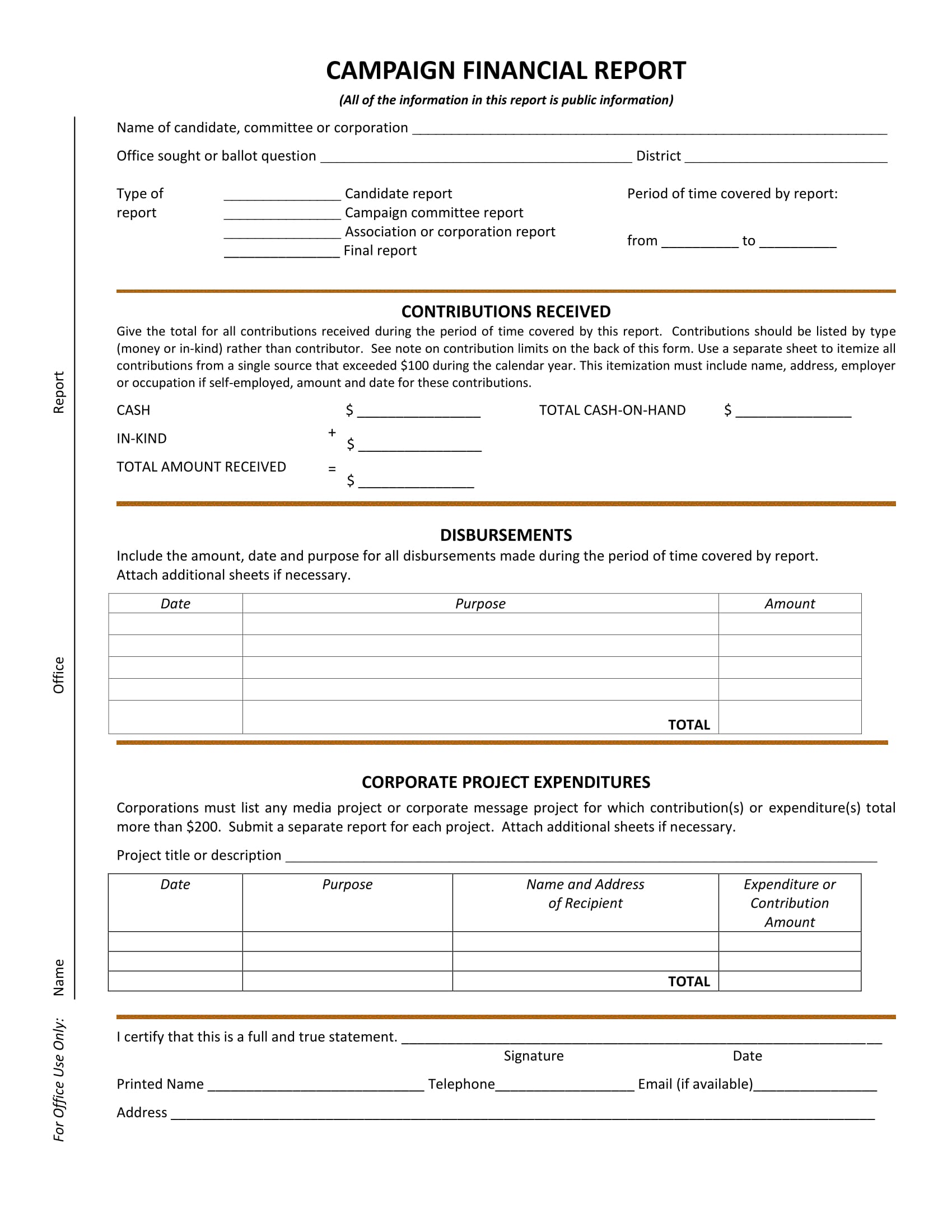

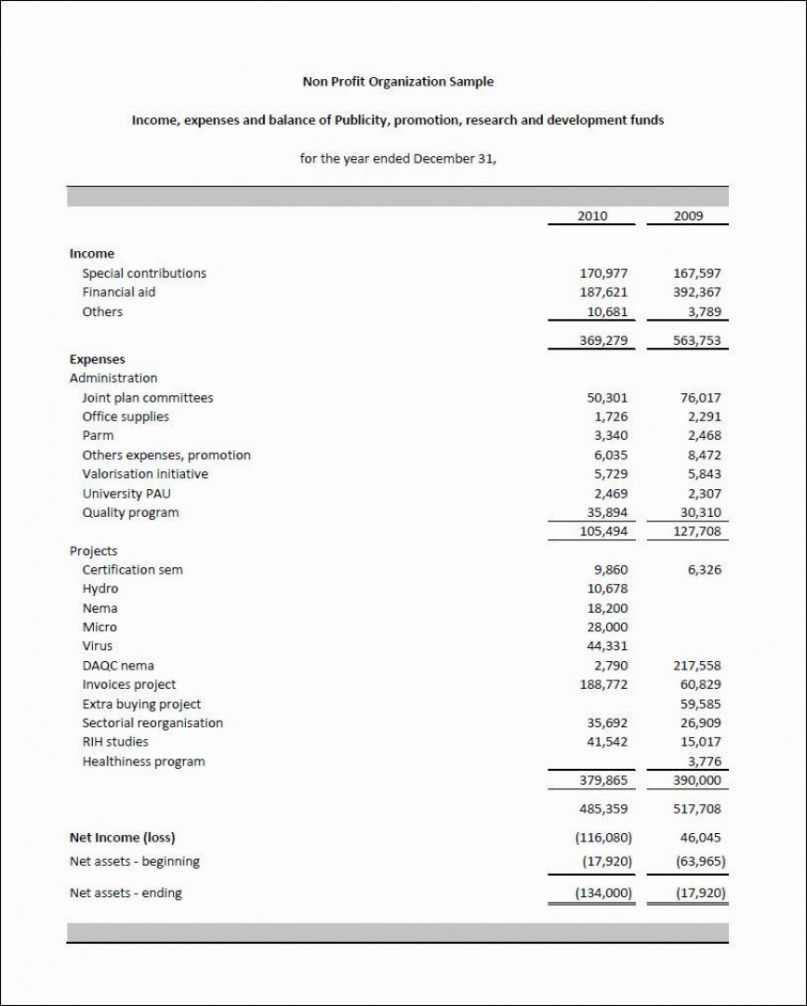

All relevant information should be included in the financial reports. Double check calculations and ensure all relevant information has been included. The financial information in the financial reports should represent what it purports to represent. They should therefore abide by a set of underlying assumptions and characteristics.

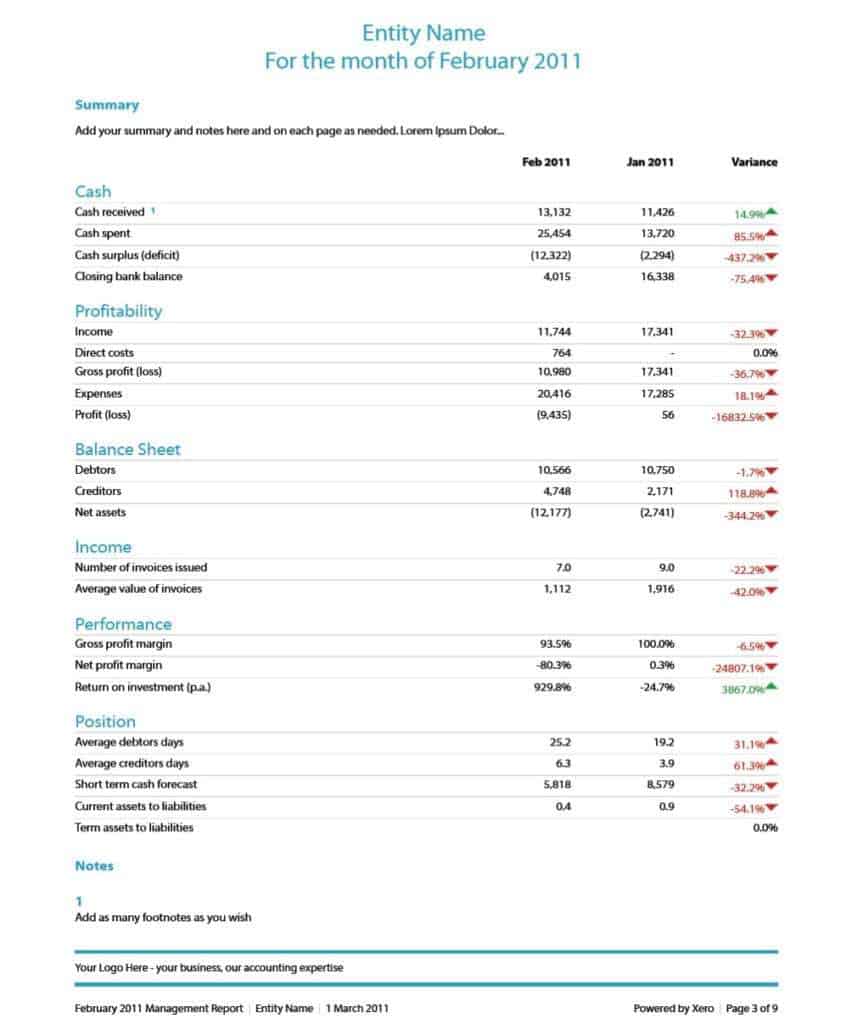

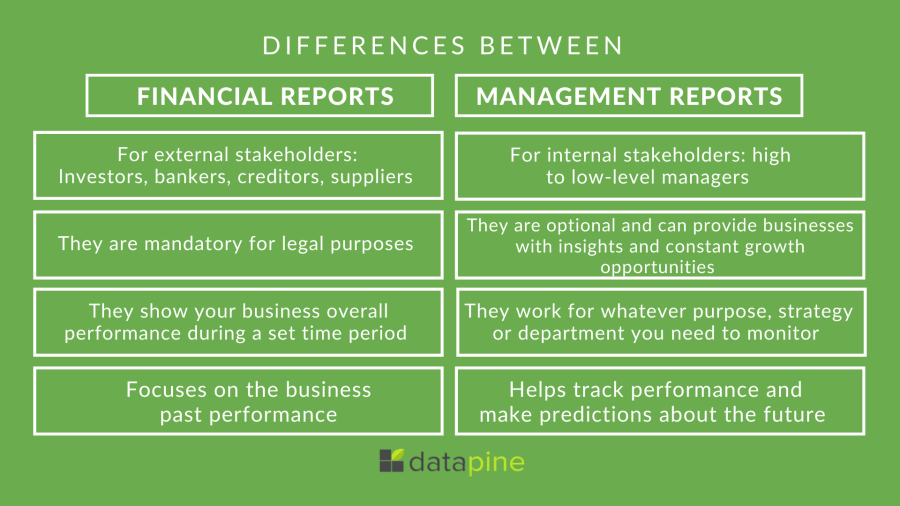

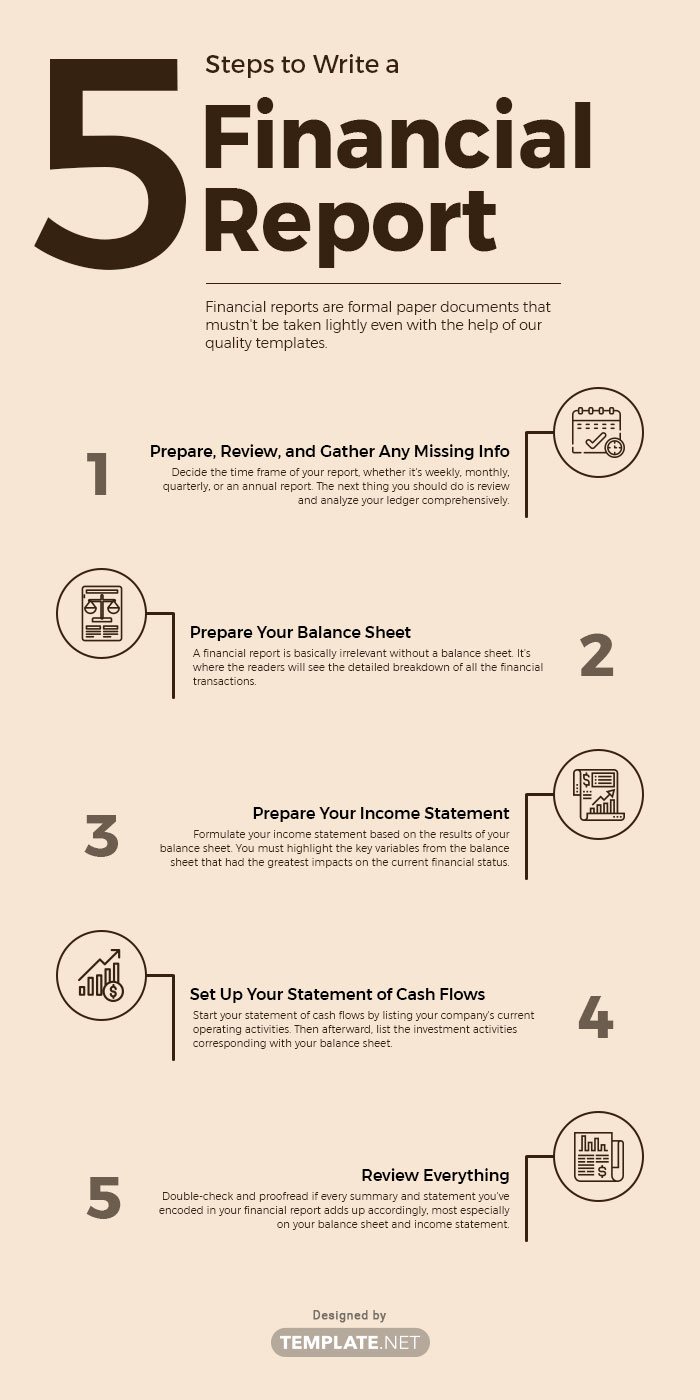

Financial reporting is the process of documenting and reporting your company’s financial activities over a set period of time, for example quarterly or yearly. Generally, public companies are required to disclose only information that can have a material impact on the financial results of the company. Monthly, quarterly, and annual reports, which include the income statement, balance sheet, and cash flow statement.

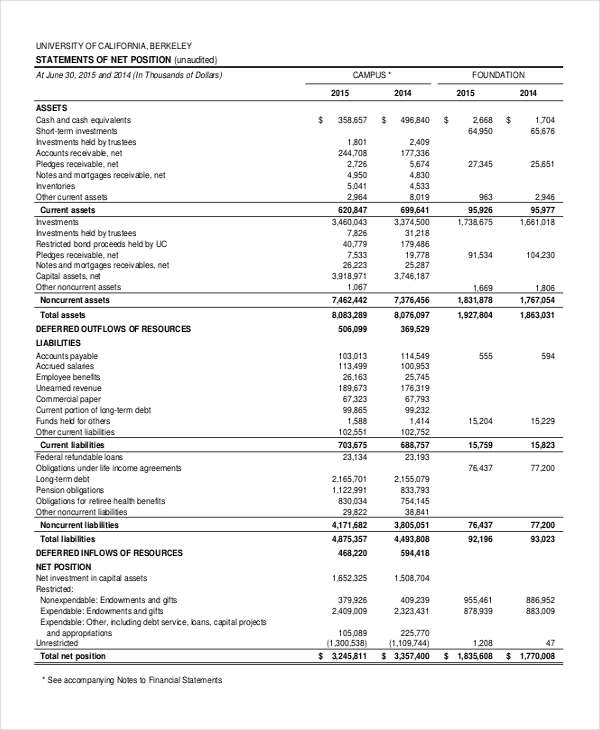

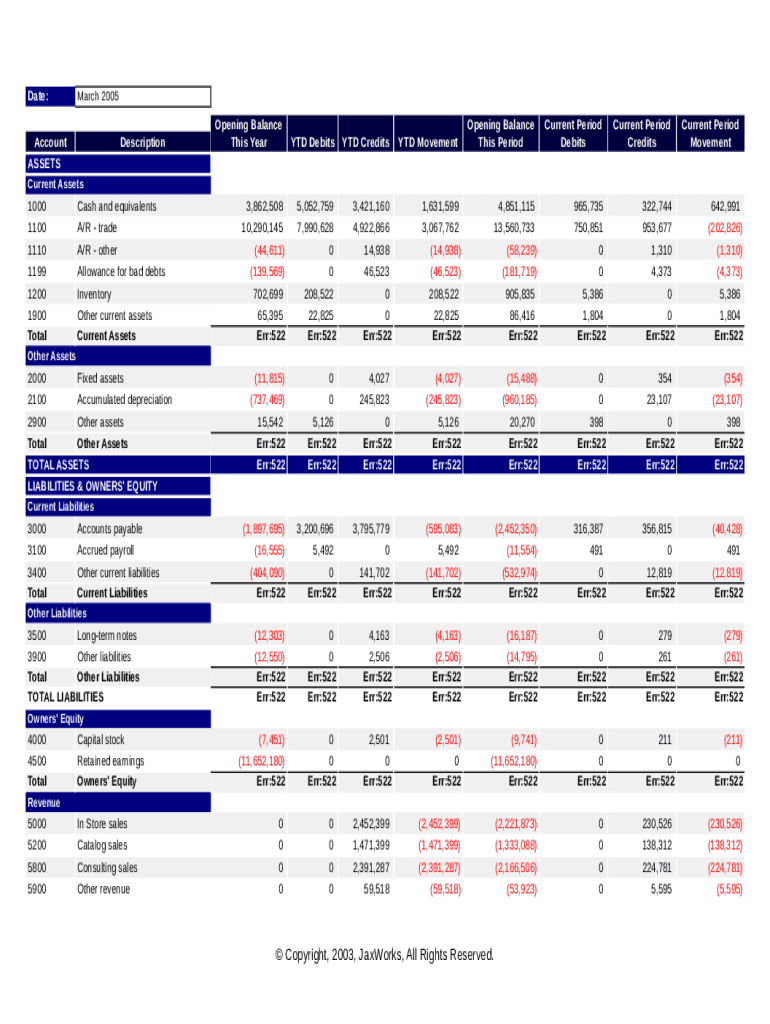

What are the three financial statements? It offers an overview of a business’s liabilities, assets, and. All relevant and material information should be disclosed in the financial statements.

Disclosure of immaterial items can. All relevant information should be included in the financial reports disclosure principle 2.

In this essentials, we highlight two of the principles in ias 1: On friday, the law enabled ms. Full disclosure principle:

They are required since not all relevant financial information. Relevance is fundamental to good financial reporting. Private firms might have financial reporting obligations.

Financial reporting introduction 1.1 objective, usefulness and limitations of general purpose financial reporting 1.2 information. Financial reports include financial statements, notes to accounts, director’s reports, auditors’ reports, corporate governance reports, and prospectus. James to win an enormous victory against mr.

If an entity opts to provide comparative data for more than the immediately preceding period, this additional information can be included in selected primary. Financial statements should fairly present the company’s performance; Employed accounting policies and changes in the accounting.

When there is insufficient relevant information, investors may be unable to make the right decisions about the company. This displays a business’s financial status at the end of a certain time period. Financial reporting typically includes:

Large public companies must comply with stringent financial reporting obligations issued by the sec; Thoroughly review the balance sheet for accuracy and completeness. Meaning, it should reflect what really happened, with the correct financial.