Real Tips About Cash And Equivalents In Balance Sheet Meaning Of Consolidated Financial Statements

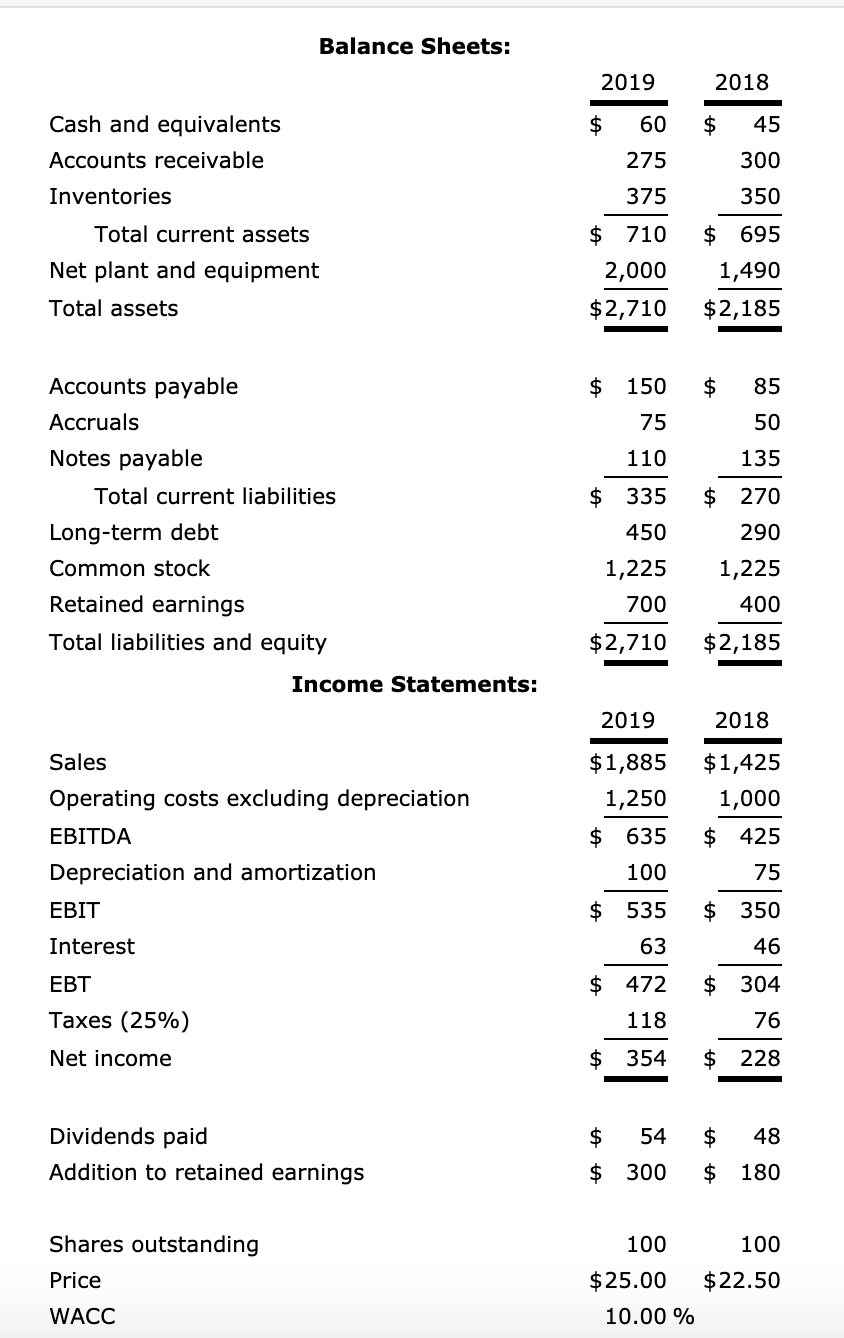

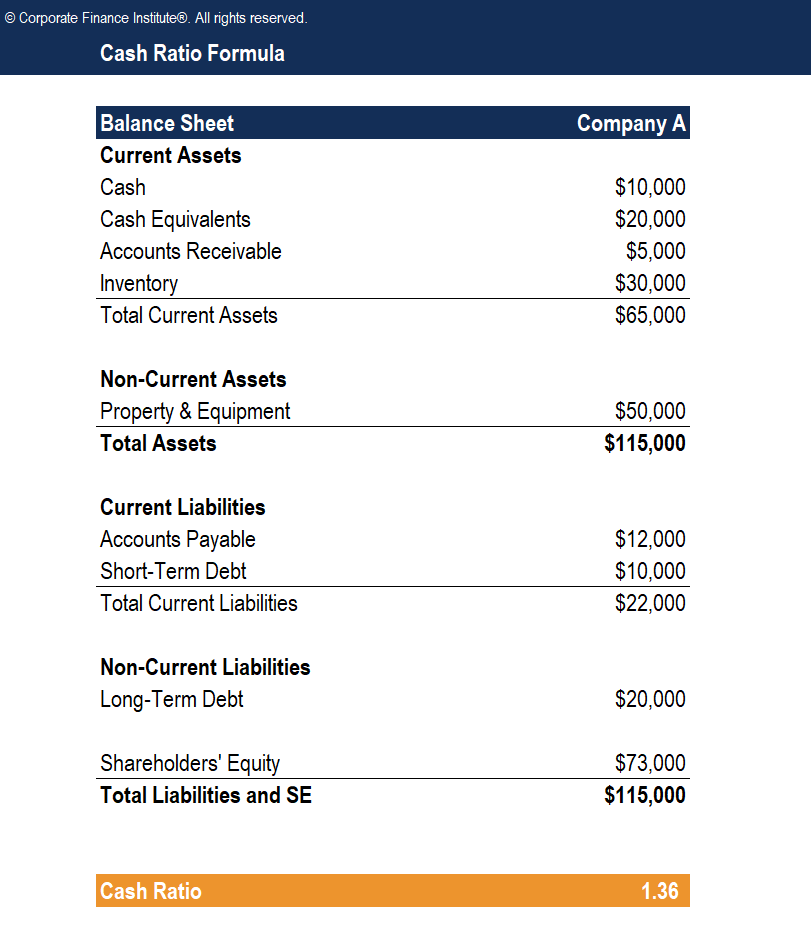

Net working capital is equal to current.

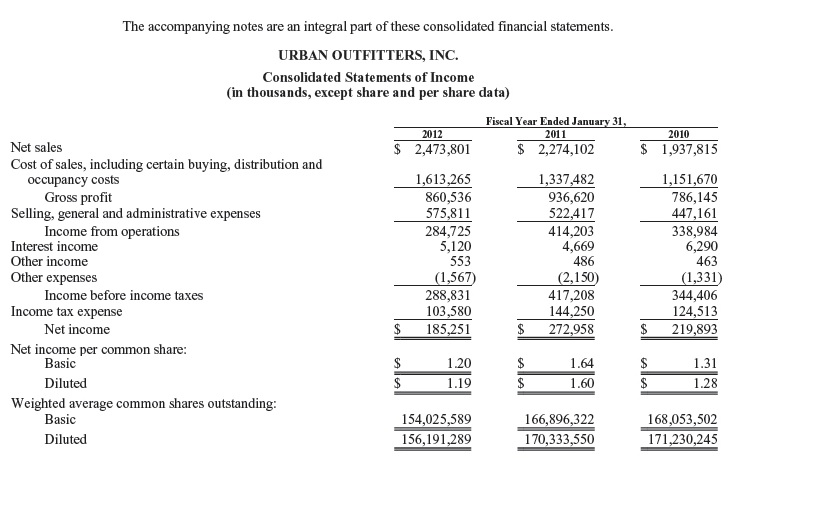

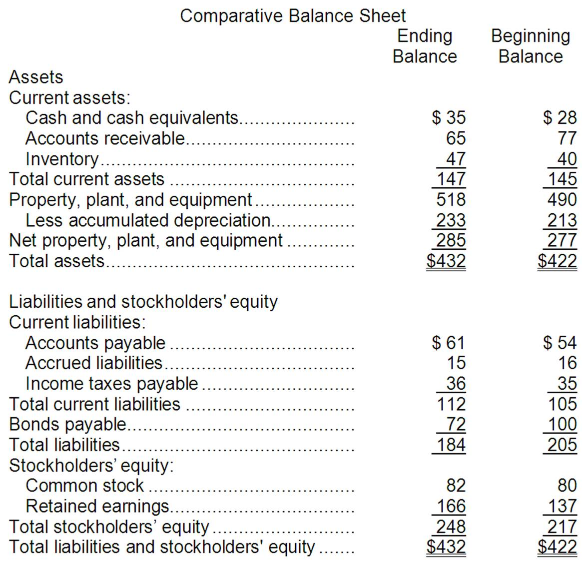

Cash and cash equivalents in balance sheet. Instructor sarah kelley. Learn what cash and cash equivalents are in accounting. Fair value will be their cost at acquisition plus accrued interest to the.

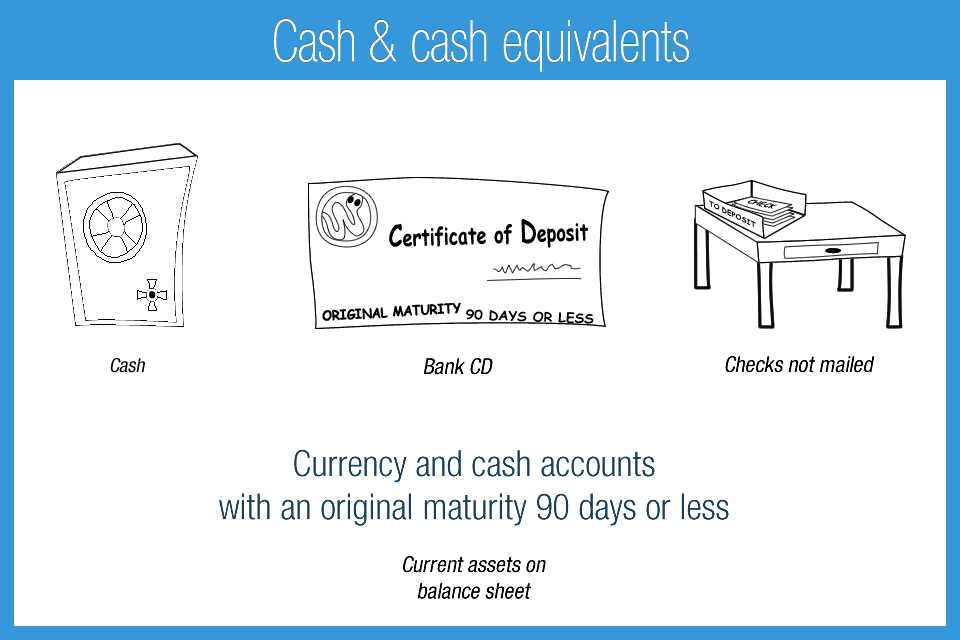

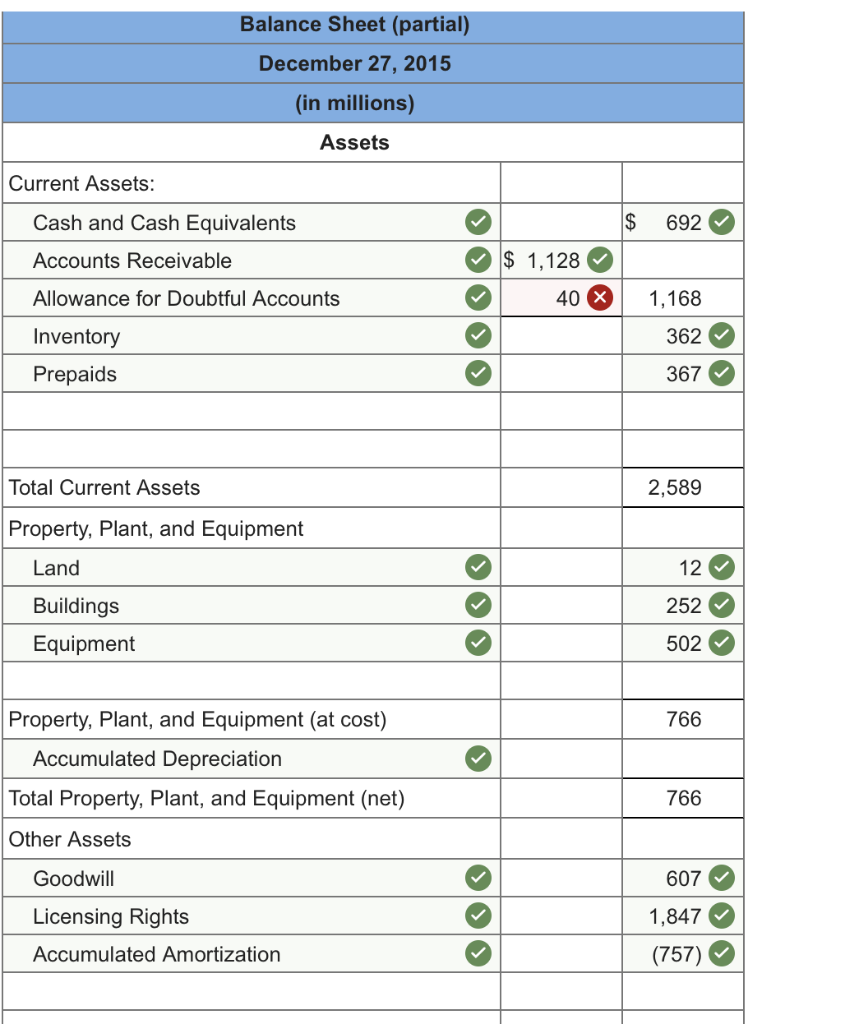

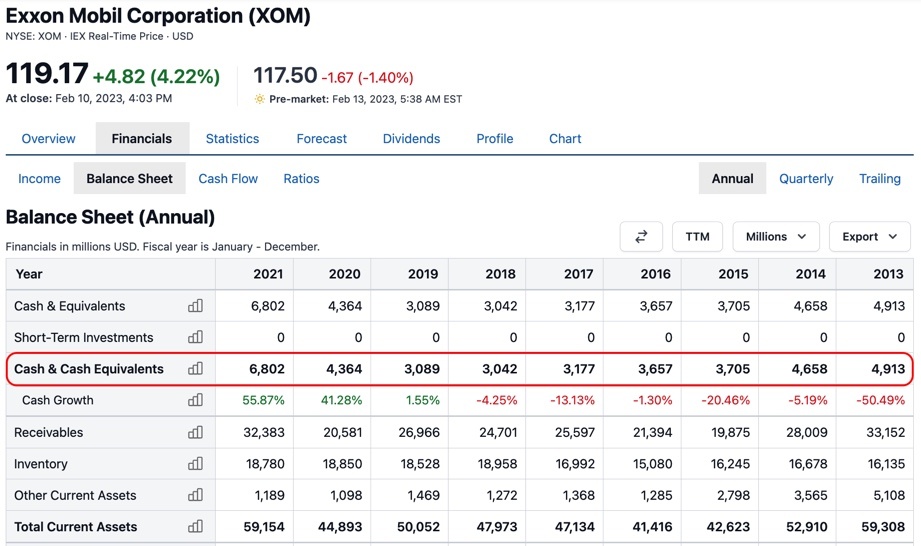

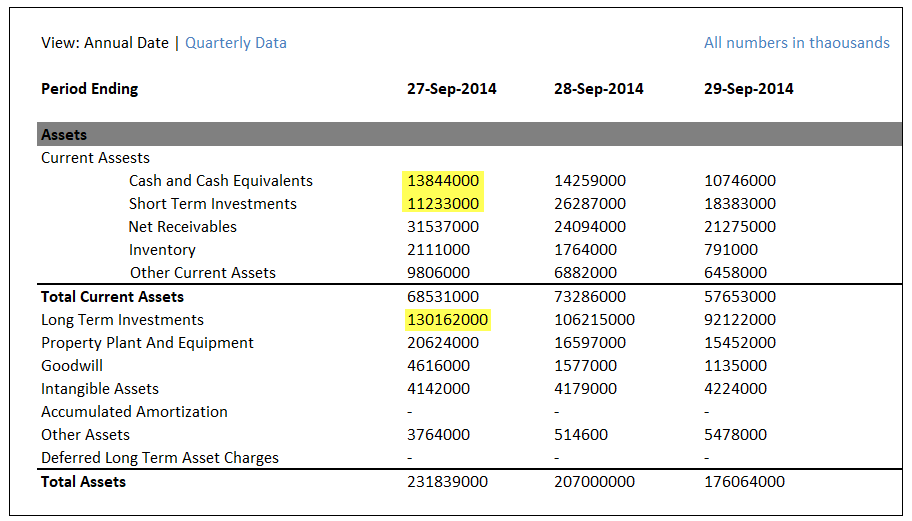

Cash and cash equivalents ( cce) are the most liquid current assets found on a business's balance sheet. The phrase cash and cash equivalents is found on balance sheets in the current assets section. Intermediate financial accounting 1 6.2 cash and cash equivalents recognition, measurement, and disclosure cash is the most liquid of the financial assets and is the.

Cash and cash equivalents mainly refer to the line items on the balance sheet that represent the underlying value of the company’s assets that are in the form of cash or. In the balance sheet, cash and cash equivalents is placed under current assets. Find various cash equivalents examples and see how to calculate cash.

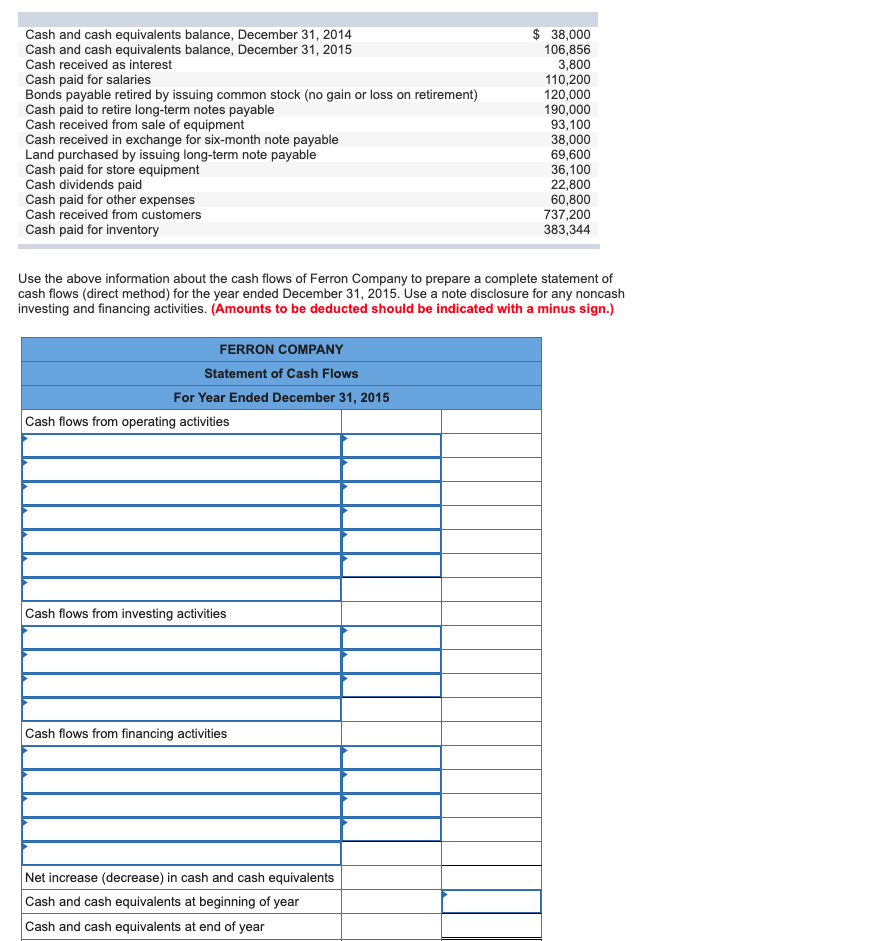

Cash and cash equivalents refers to the line item on the balance sheetthat reports the value of a company's assets that are cash or can be converted into cash immediately. Cce is actually two different. The balance sheet shows the amount of cash and cash equivalents at a given point in time, and the cash flow statement explains the change in cash and cash.

For example, cvs health, an. Cash and cash equivalents is a line item on the balance sheet, stating the amount of all cash or other assets that are readily convertible into cash. Cash equivalents include bank accounts and marketable securities, which are debt securities with maturities of less than 90 days.

Cash equivalents can be reported at their fair value, together with cash on the balance sheet. Cash and cash equivalents in balance sheet and restricted cash. In other words, there is very little risk of collecting.

The cash equivalents line item on the balance sheet states the amount of cash on hand plus other highly liquid assets readily convertible into cash. Balance sheet (also known as the statement of financial position) provides the value of firm’s assets, liabilities, and equity on a particular date. Cash and cash equivalents are liquid assets, which may include treasury bills and certificates of deposit.

They have a maturity of three months or less with high credit quality, and are unrestricted. Cash equivalents, in general, are highly liquid investments in an entity’s balance sheet. Cash and cash equivalents are items on a company’s balance sheet that refer to the value of assets held in cash or easily converted to cash.

Marketable securities are equity and debt securities. In the cash flow statement, cce is reported at the very end of the statement.

:max_bytes(150000):strip_icc()/CCE-009ecb73dfd94702821efed1264573af.jpg)