Unique Info About Dscr In Balance Sheet Going Concern Note Disclosure

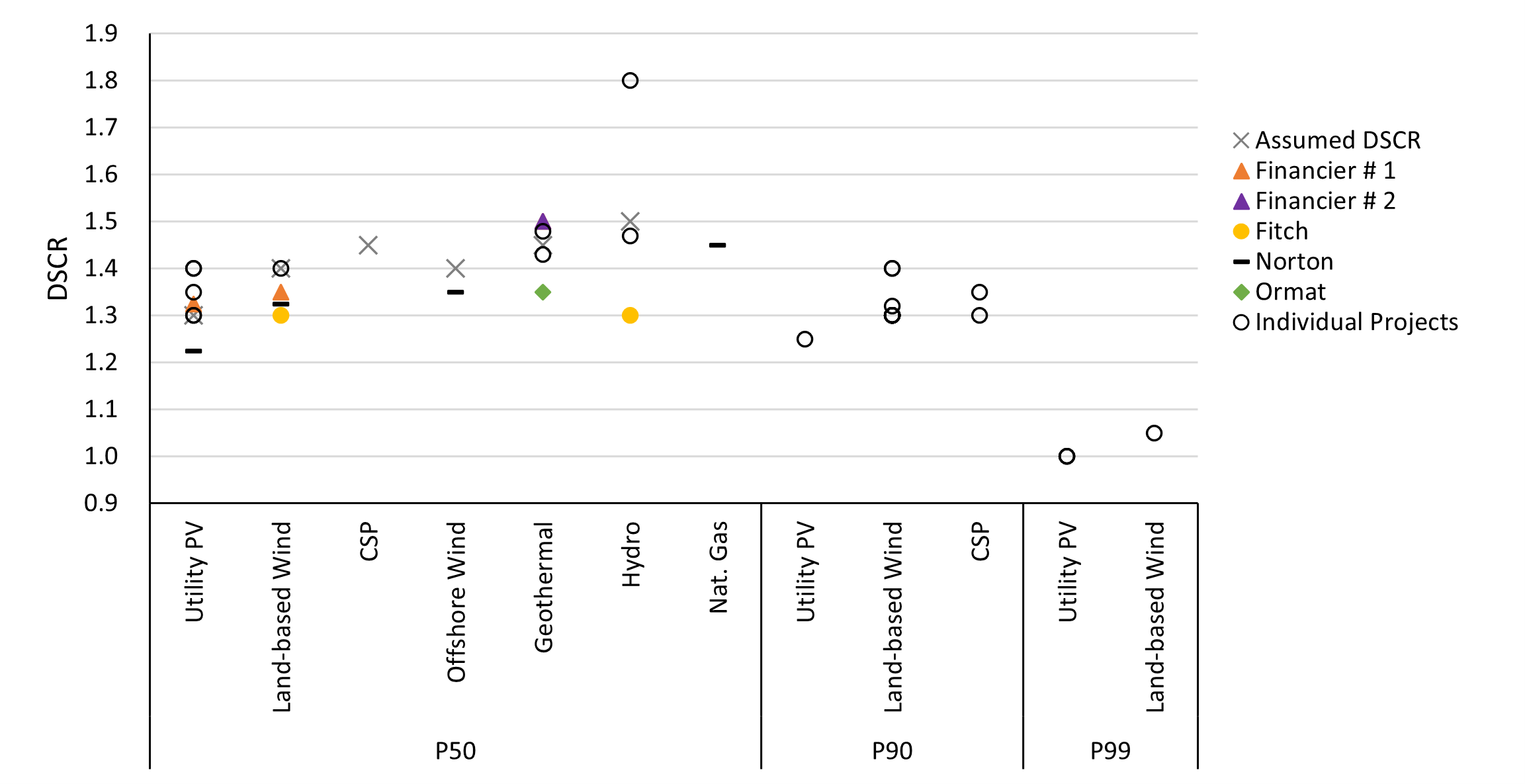

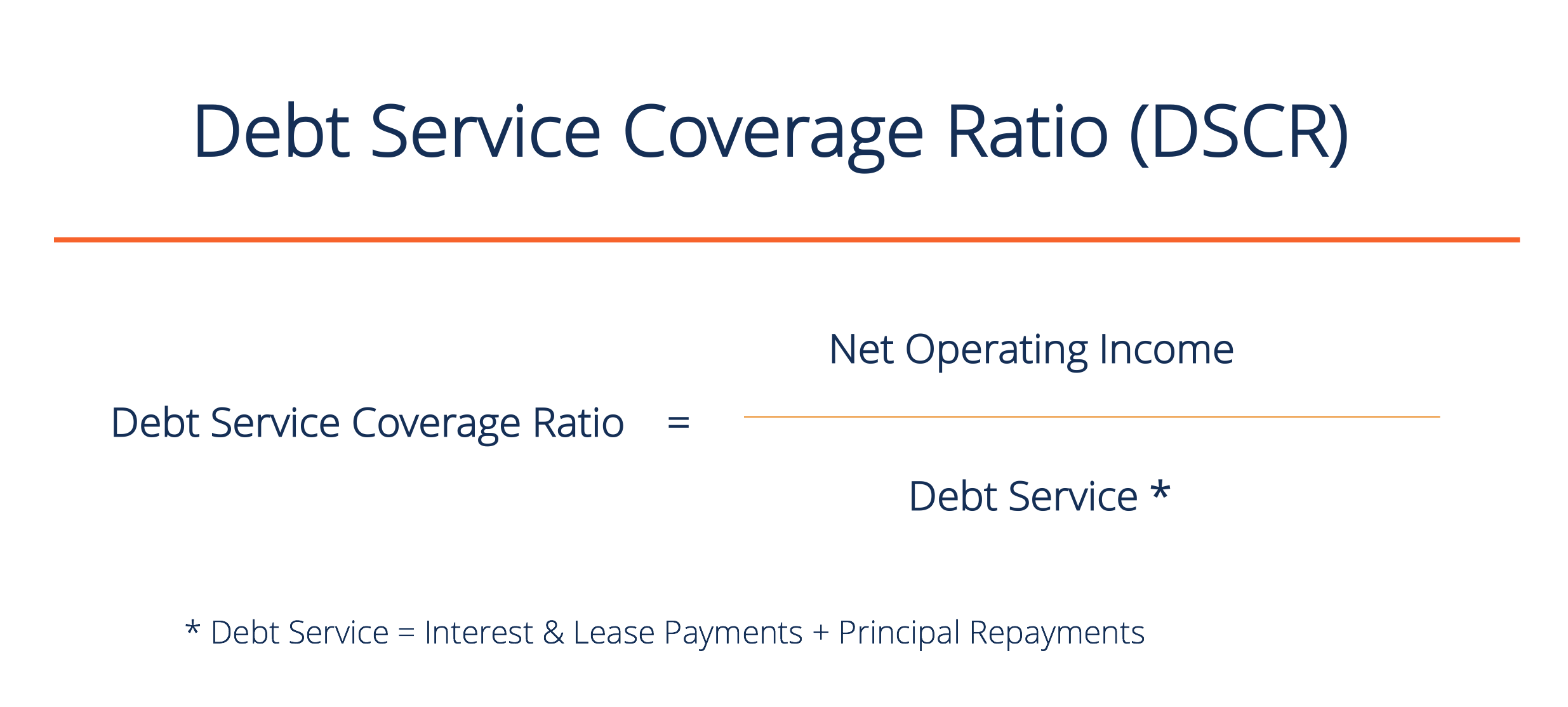

Most companies will use a combination of cash flow and debt interest and principal payments to calculate their dscr.

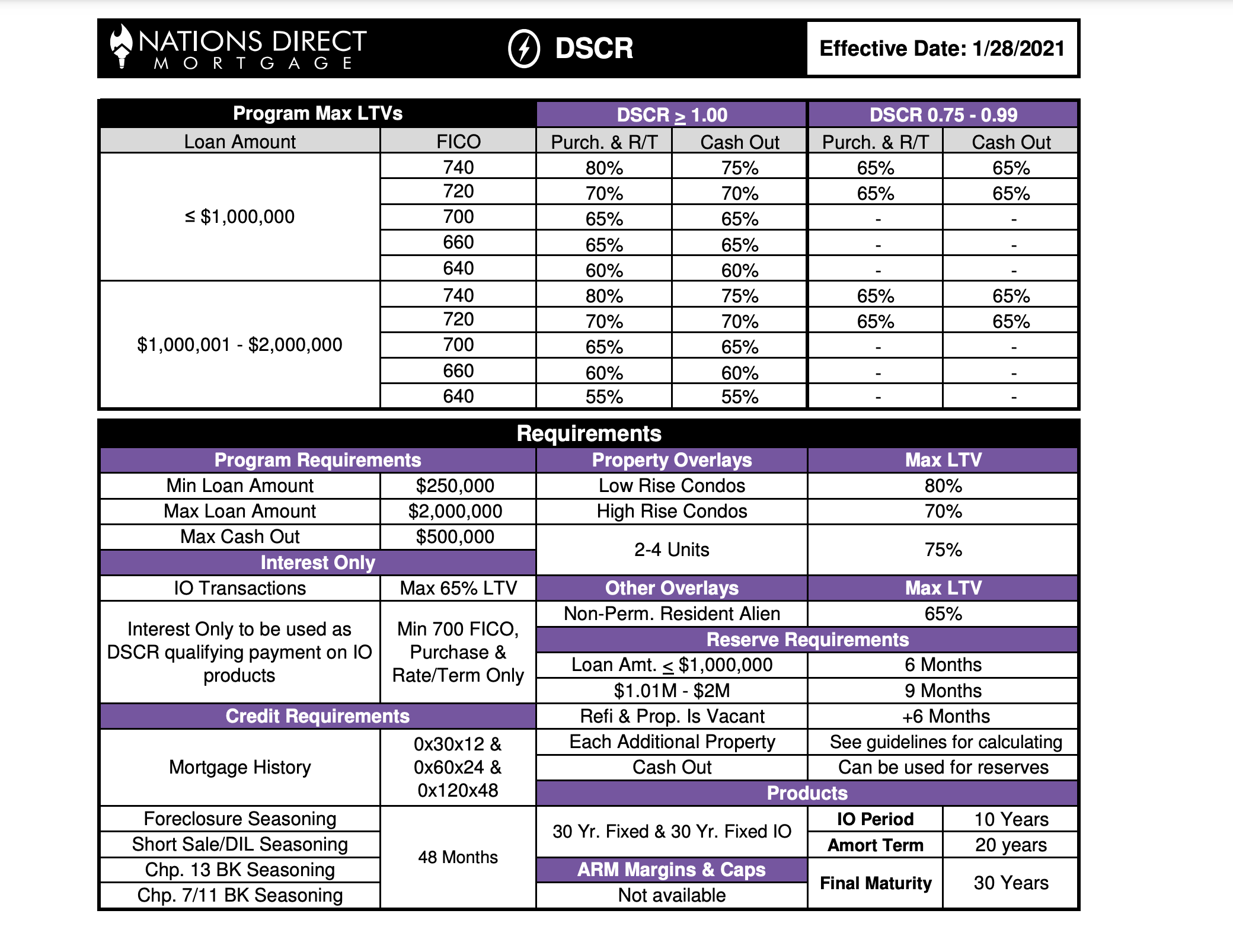

Dscr in balance sheet. It is also a commonly used ratio in a leveraged buyout transaction to evaluate the debt capacity of the target company, along with other credit metrics such as total debt/ebitda multiple, net debt/ebitda multiple, interest. Investors may use it as one of the many metrics to check the viability of their investment into a. Using those entries, users can simply find the debt service coverage ratio ( dscr ).

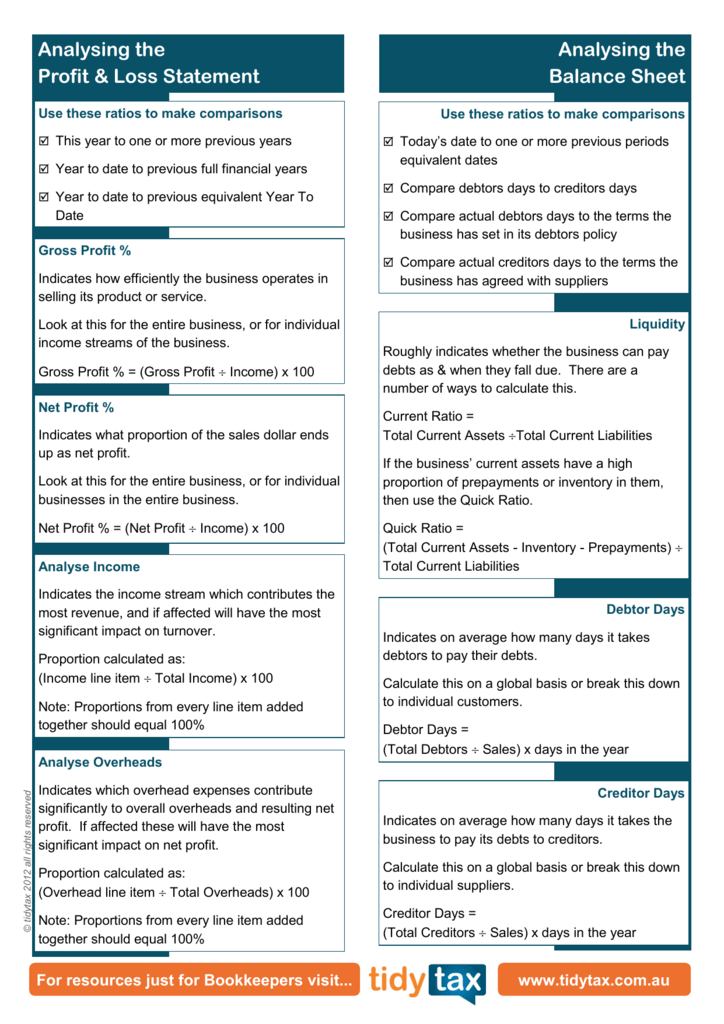

Determining debt service coverage ratio (dscr) from balance sheet with excel formula companies or institutions generally maintain balance sheets depicting their incomes and expenses. Total debt service includes interest and principal on a company's lease, interest, principal, and sinking fund payments. Multiply the ratio by 100 to express it as a percent.

How to calculate debt service coverage ratio from bs. There are two other ways to calculate dscr (in business jargon specifically): It is derived by dividing the net operating income by the total debt service.

This is the company's debt service coverage ratio. In simpler words, the net dscr formula shows the financial health of the company and the use of its cash flow. Conceptually, the idea of dscr is:

It measures the cash flow available to satisfy existing debt commitments. Follow these steps to calculate for your dscr loan: Total debt service = $2,750.

This is one of several methods for. Dscr is often used when a company has any borrowings on its balance sheet such as bonds, loans, and lines of credit. Dscr ratio = noi / total debt service

The debt service coverage ratio, or dscr for short, is a ratio that is used to determine the amount of money that your business can afford to put towards paying off debt. Mathematically, it is represented as, dscr = net operating income / total debt service examples of debt service coverage ratio (with excel template) The company's income is 381 percent of its debt liabilities.

Typically represented by ebitda (earnings before interest taxes depreciation and amortization). The debt service coverage ratio (dscr) is a key measure of a company’s ability to repay its loans, take on new financing and make dividend payments. The sum of all current debts, including principal and interest a deeper dive into the definitions will help you understand these terms better.

The ratio is relevant to personal, public, and. Debt service coverage is usually calculated using ebitda as a proxy for cash flow. 3.81 times 100 is 381.

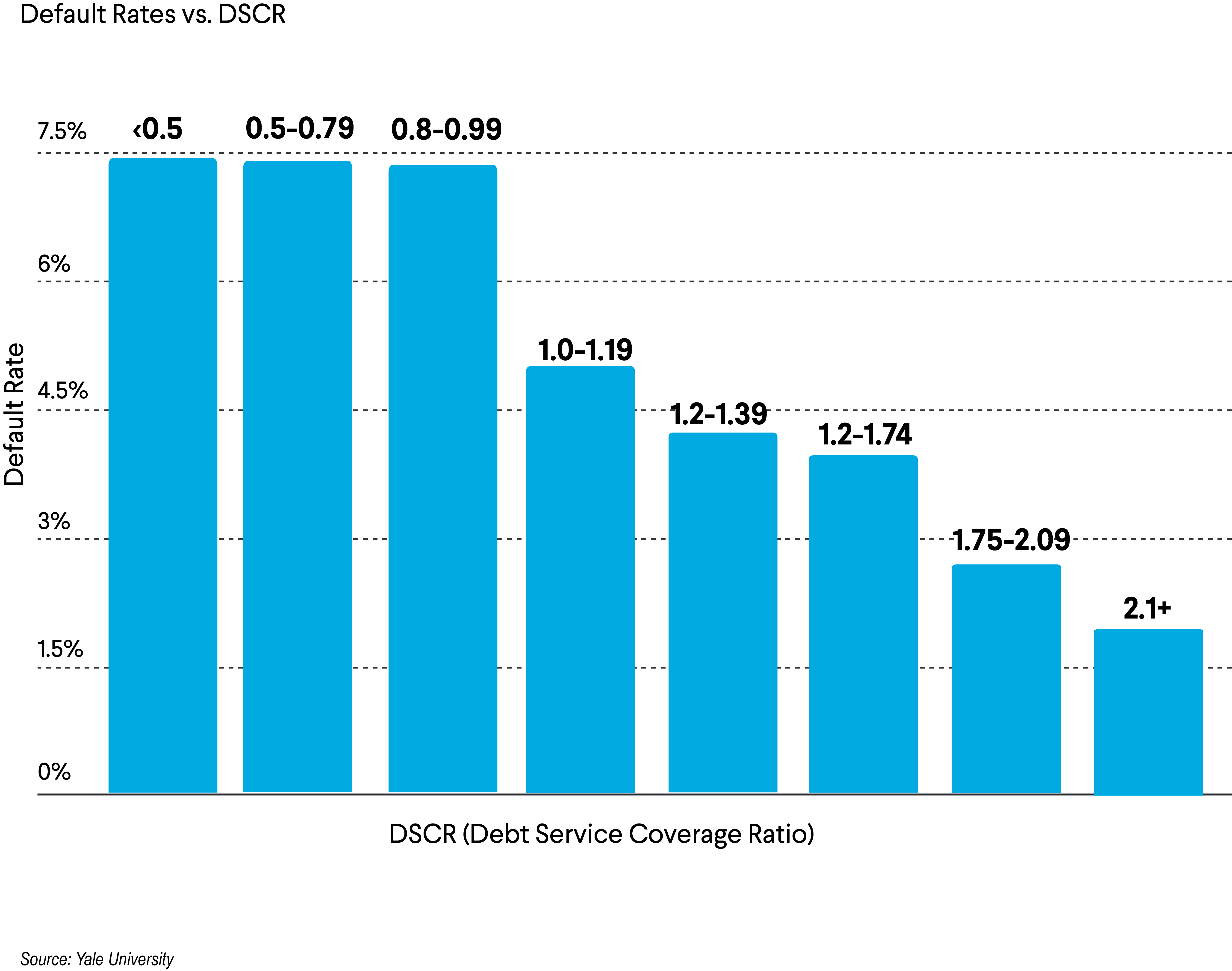

A dscr greater than or equal to 1.0 means there is sufficient cash flow to cover debt service. In other words, it is the ratio of the sufficiency of cash to repay the debt in time. Income taxes make dscr calculations more challenging since interest payments are tax deductible, but principal repayments are not.

:max_bytes(150000):strip_icc()/DSCR1-218052e5bc4240449f1479019381b358.jpg)