Real Tips About Free Cash Flow From Income Statement Debit And Credit Trial Balance

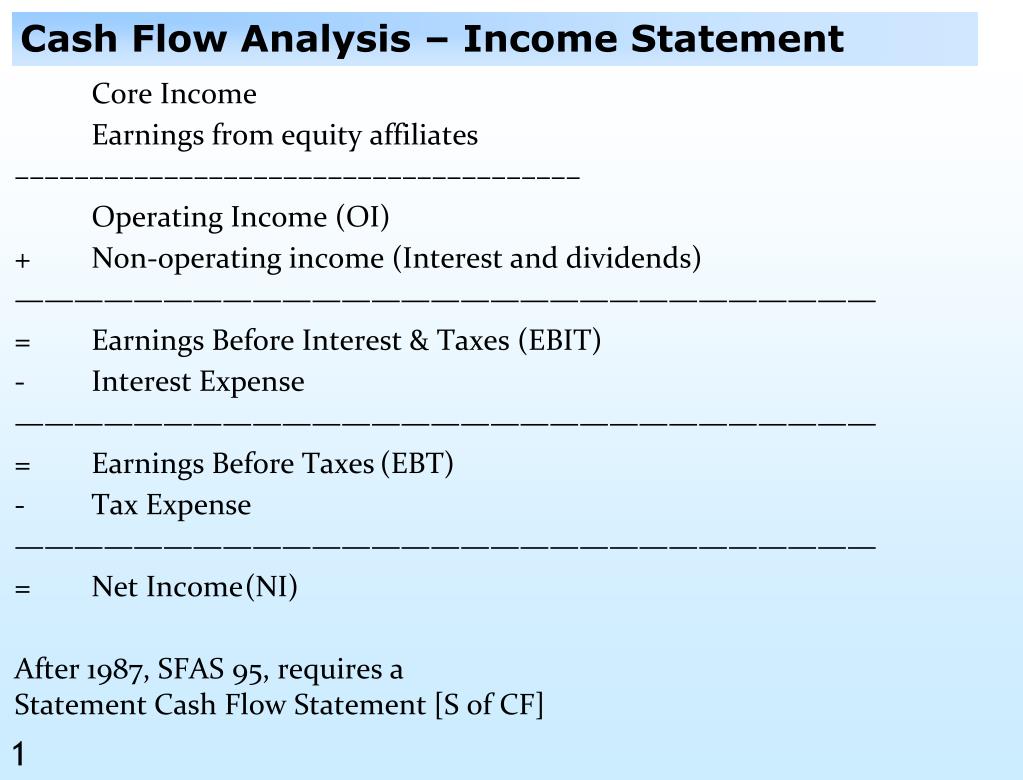

A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period.

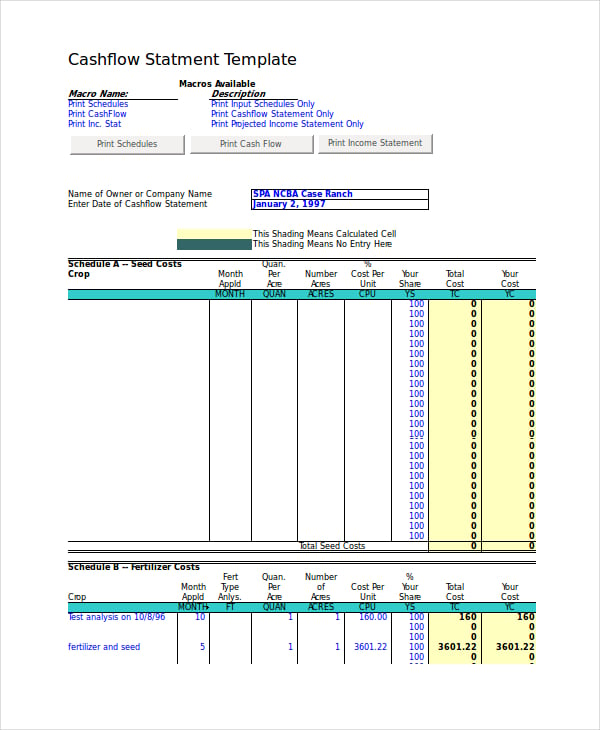

Free cash flow from income statement. Get the cash flow statement for plum acquisition corp. Determine the starting point identify the starting point for calculating the free cash flow. Element source net income income statement.

Net income deducts depreciation, while the free. While some might be easier to calculate than others, knowing how to evaluate the financial health of your business and profitability is crucial. Like with the cash flow statement,.

Income statement and free cash flow. Identify the company financial statements this task involves identifying the company's financial statements. Determine the current period for analysis, whether it's monthly, quarterly, or annually.

This task sets the foundation for the rest of the process. Regardless of whether a cash outlay is counted as an expense in the calculation of income or turned into an asset on the balance sheet, free cash flow tracks the money. Decide if you will be using cash flow from operations or net income as the starting point.

Free cash flow, on the other hand, measures the actual cash flow that is available to shareholders. Quarterly cash flow projections template; Below, we will walk through each of the steps required to derive the fcf formula from the very beginning.

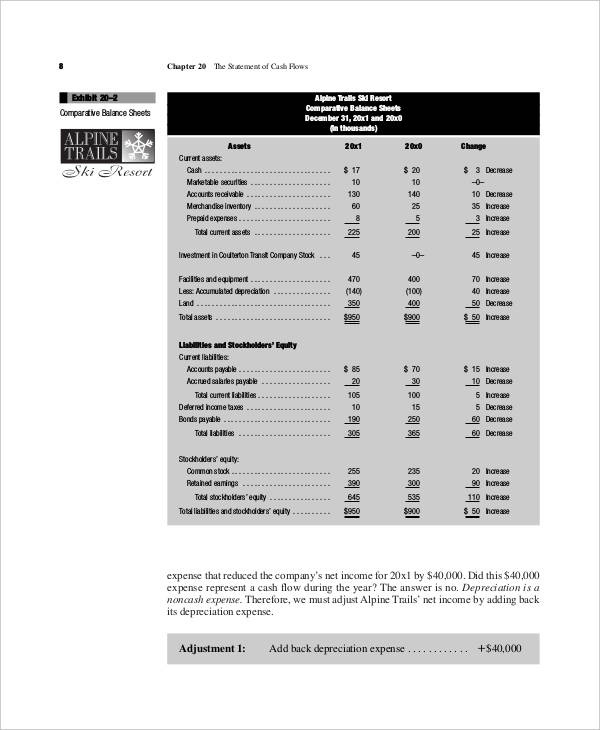

Every calculation of the cash flow from operating activities starts with the net income. The cash flow statement or statement of. You can find the information needed to calculate free cash flow on a company's statement of cash flows, income statement, and balance sheet.

Investors use free cash flow to help assess a company's performance and what lies ahead. Written by jeff schmidt what is the statement of cash flows? Since we are not provided with the cash flow statement, we will use the balance sheet and the income statement to derive these figures.

Company name year an option will be. While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time. Make adjustments for movement in working capital step 6:

There are two differences between net income and free cash flow. * constant currency (c.c.) adjusts prior year for movements in currencies. Financials are provided by nasdaq data link and sourced from audited reports submitted to the securities and exchange commission (sec).

Calculate the cash flows from investing activities For a 3:4 mix it will be 3/7. Innovation rate increased to 20%;

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)