Fantastic Info About Common Shares On Balance Sheet Income Tax Receivable

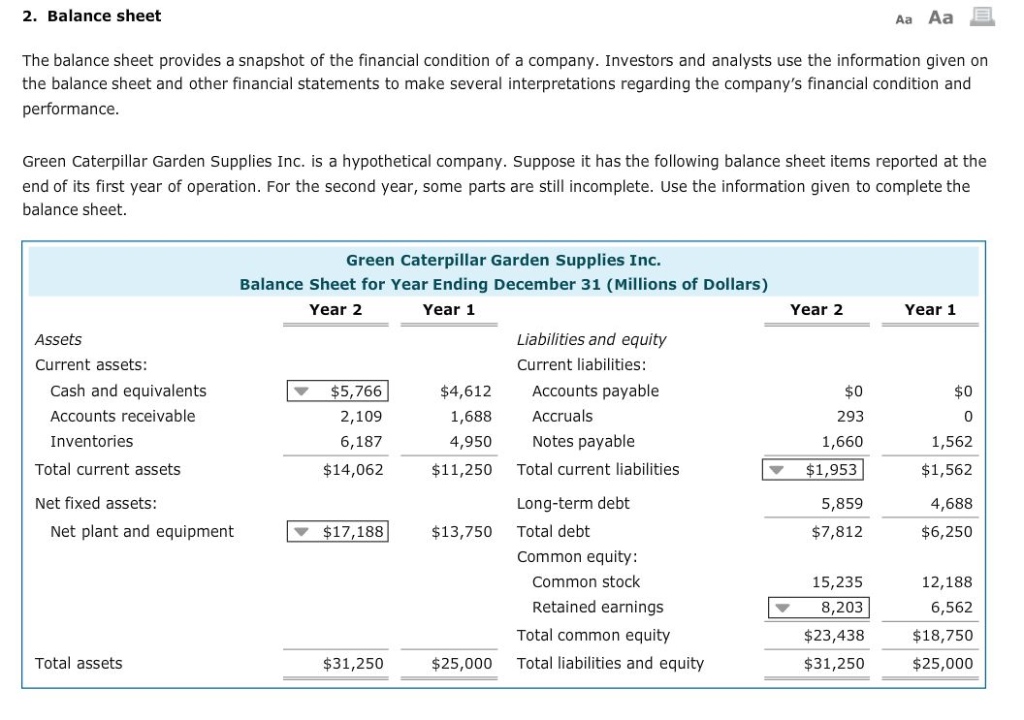

However, with the sharp increase in free cash flow generation, cash & equivalents on the balance sheet have jumped considerably.

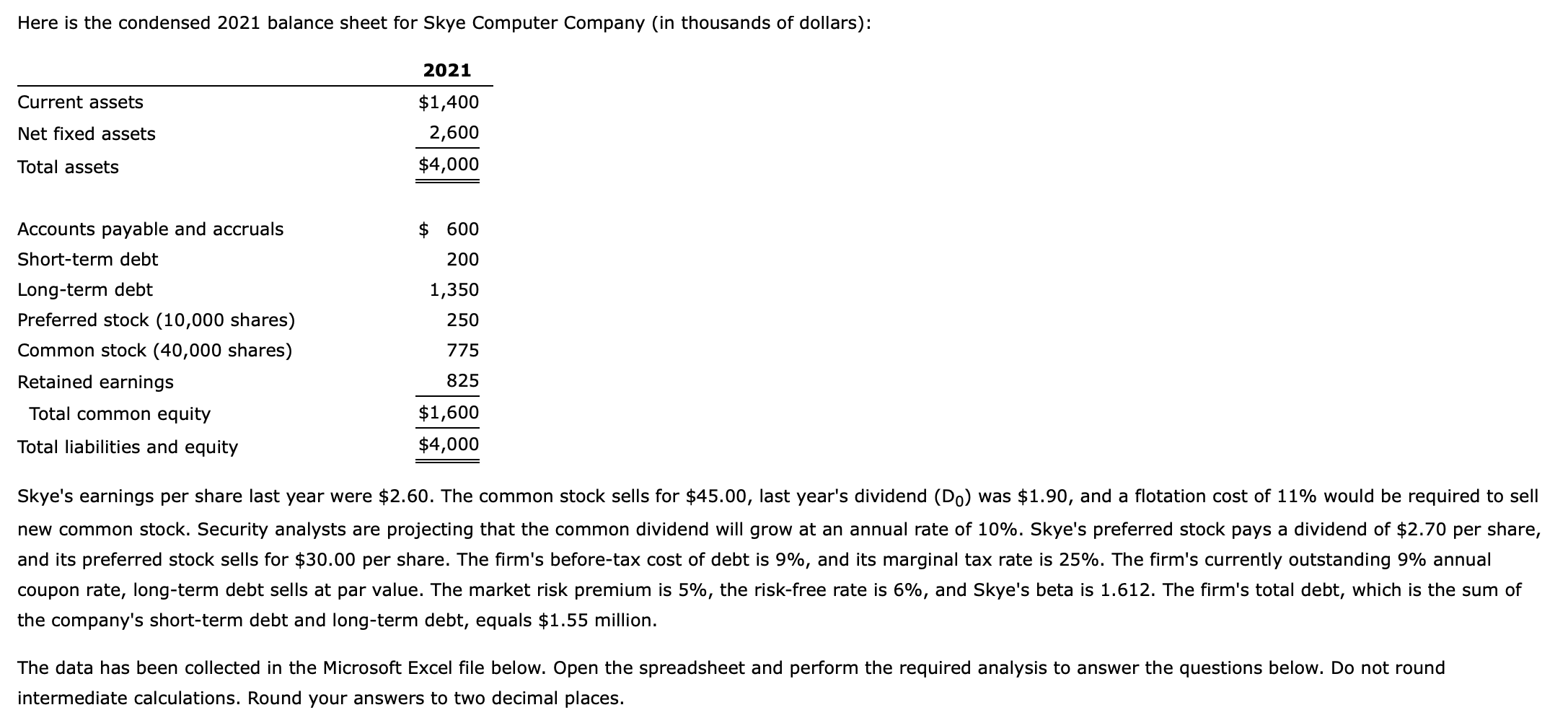

Common shares on balance sheet. The balance sheet is one of the three core financial statements that are used to. Common stock represents ownership rights in a company. Common shareholders are behind bondholders and preferred stockholders when it comes to receiving dividends or assets in the event of a.

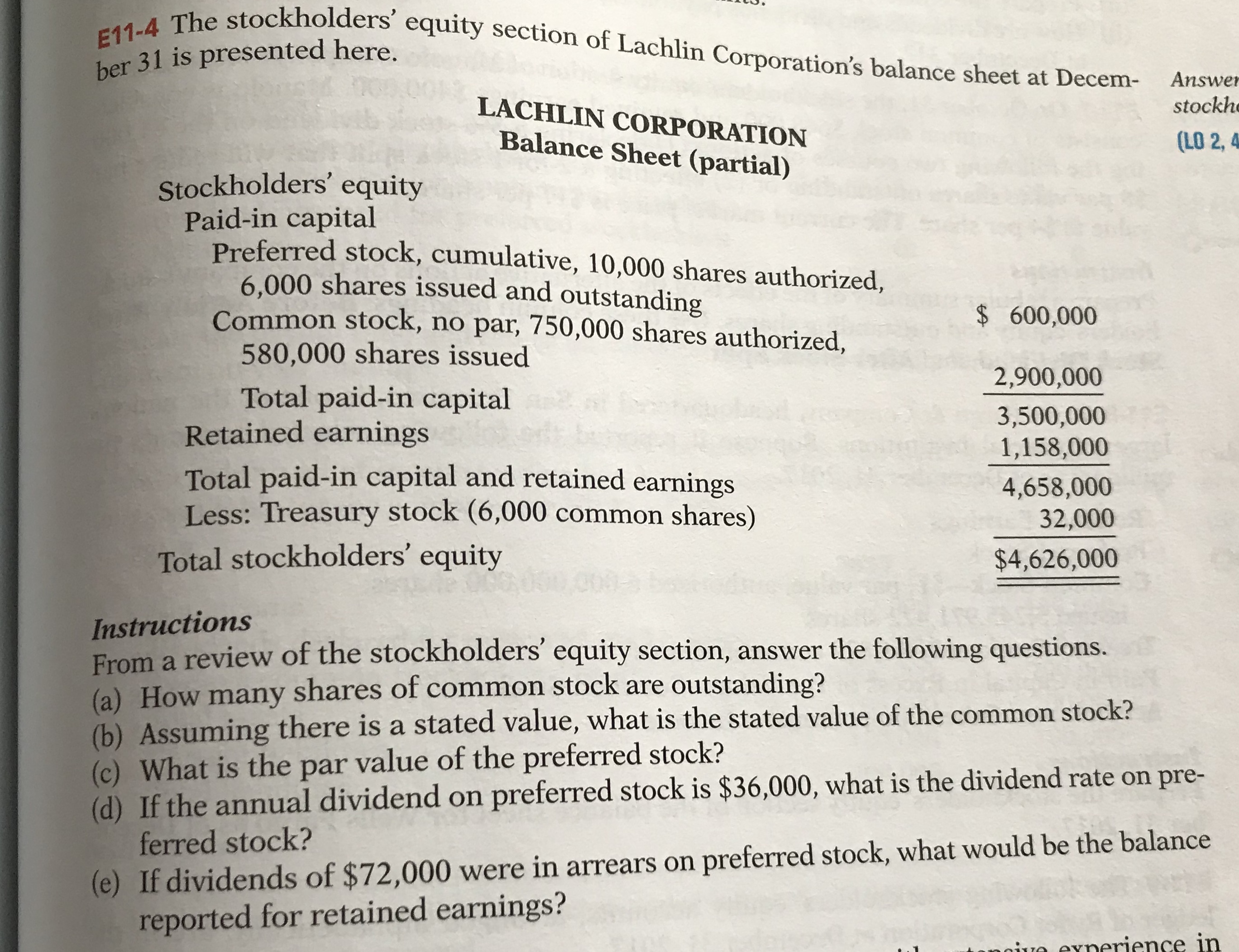

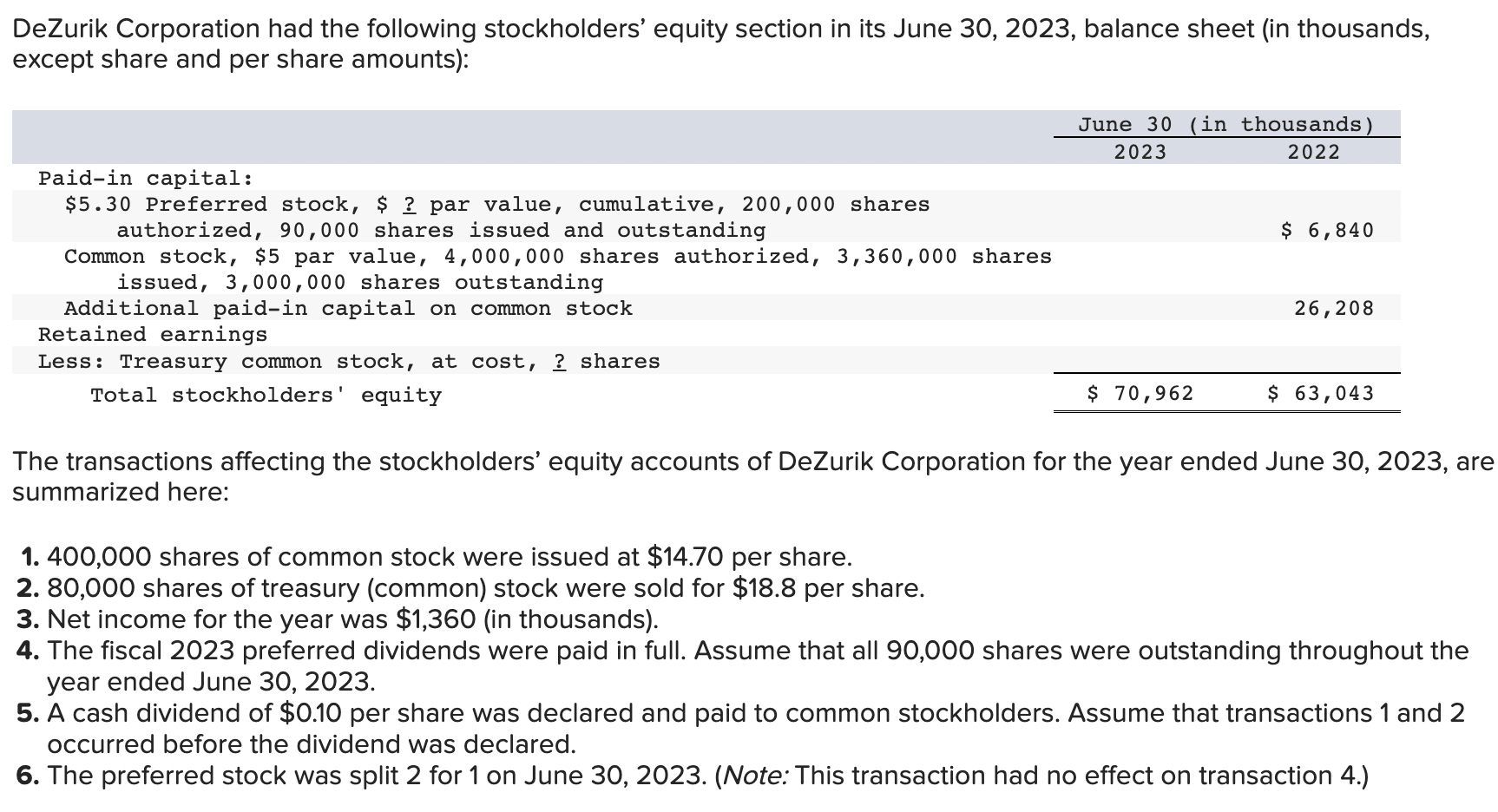

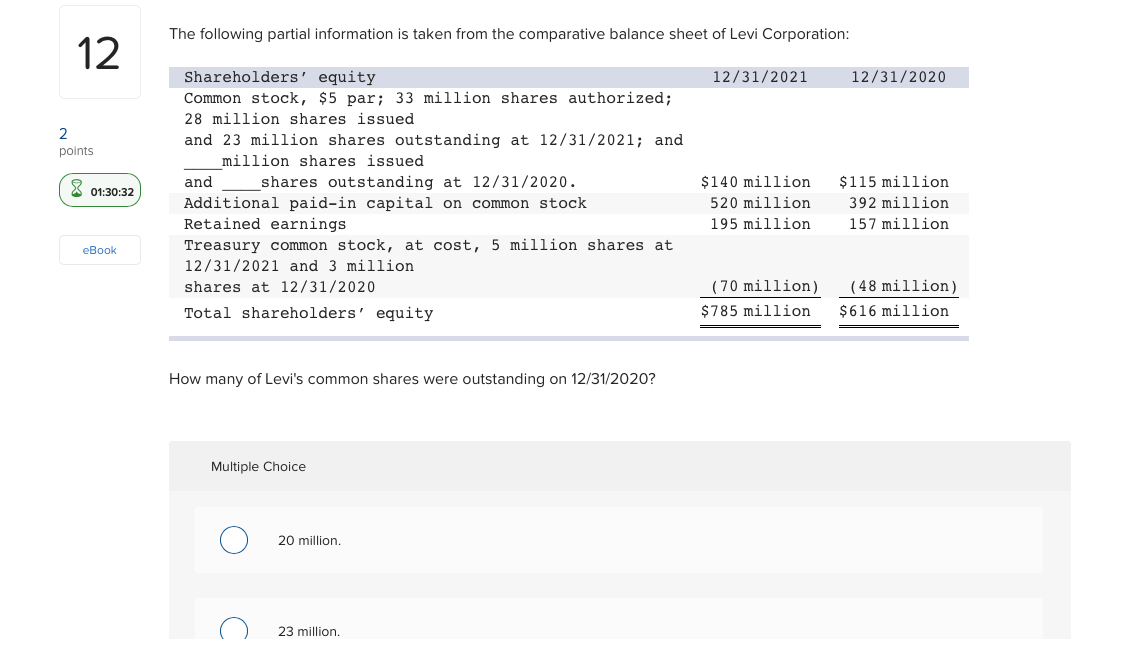

The common stock outstanding of a company is simply all of the shares that investors and company insiders own. The amount of common stock is recorded in the shareholder’s equity section of a balance sheet. Par value is the nominal value assigned to each share of stock.

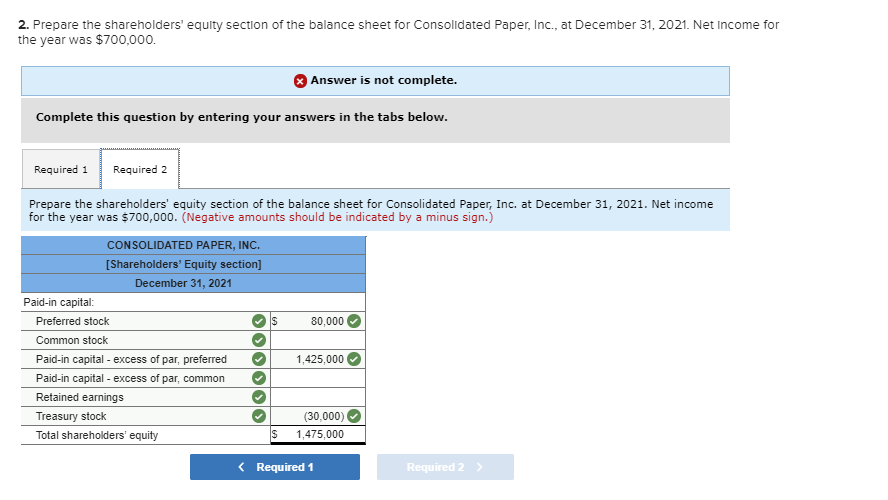

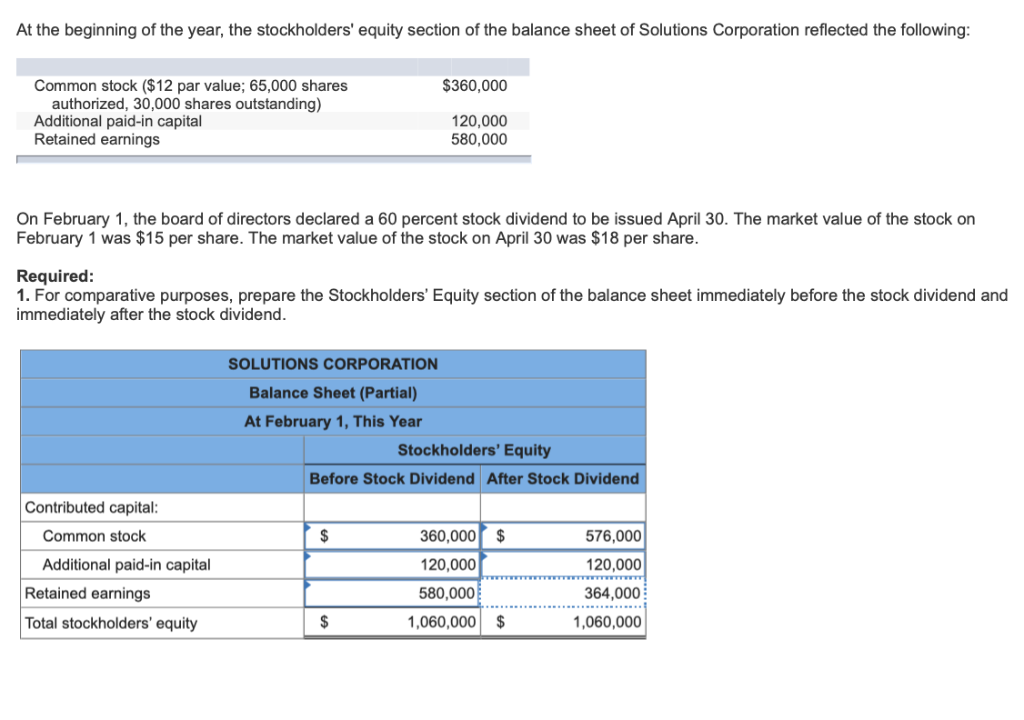

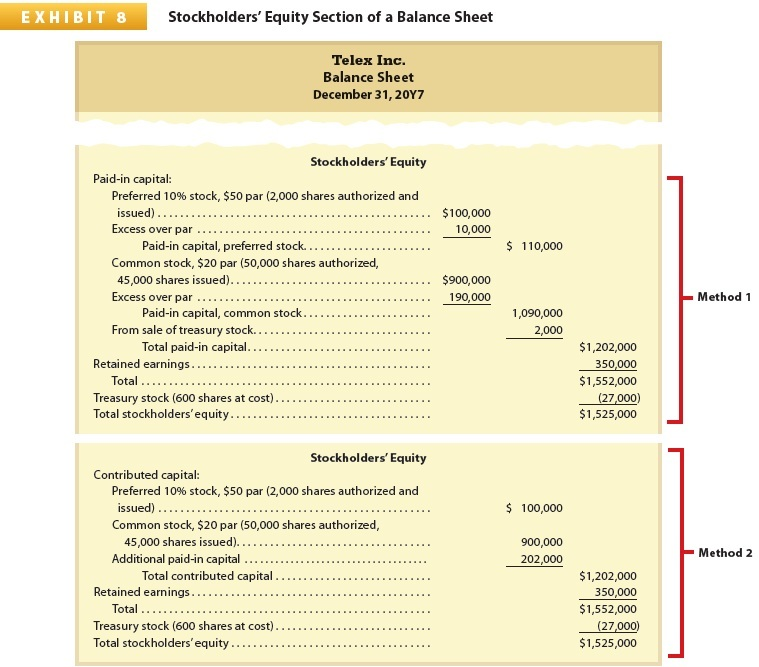

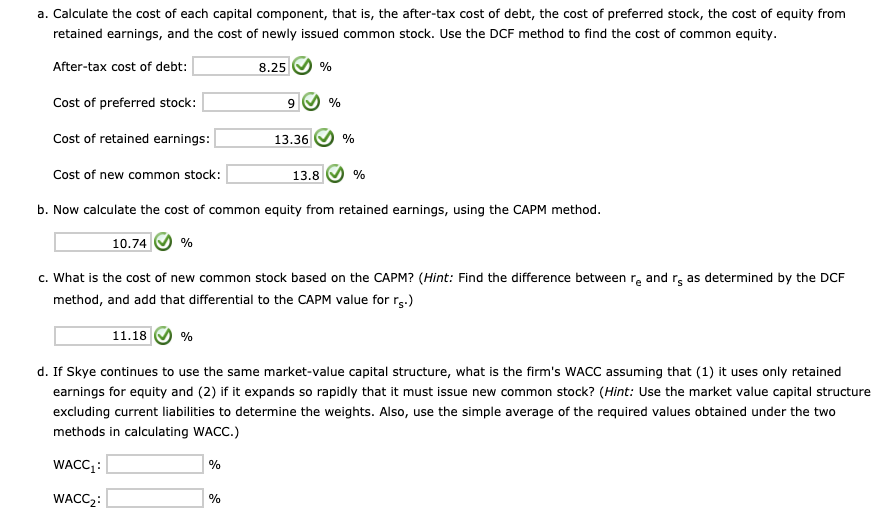

A balance sheet shows a company’s assets and liabilities on a specific date. When companies issue shares of equity, the value recorded on the books is the par value (i.e. Preferred shares and common shares represent two distinct equity issuance classifications that represent partial ownership in companies.

Heidelberg materials will buy back more shares after its debt declined significantly, it said on thursday. Key takeaways common stock is a security that represents ownership in a. No, common stock is neither an asset nor a liability.

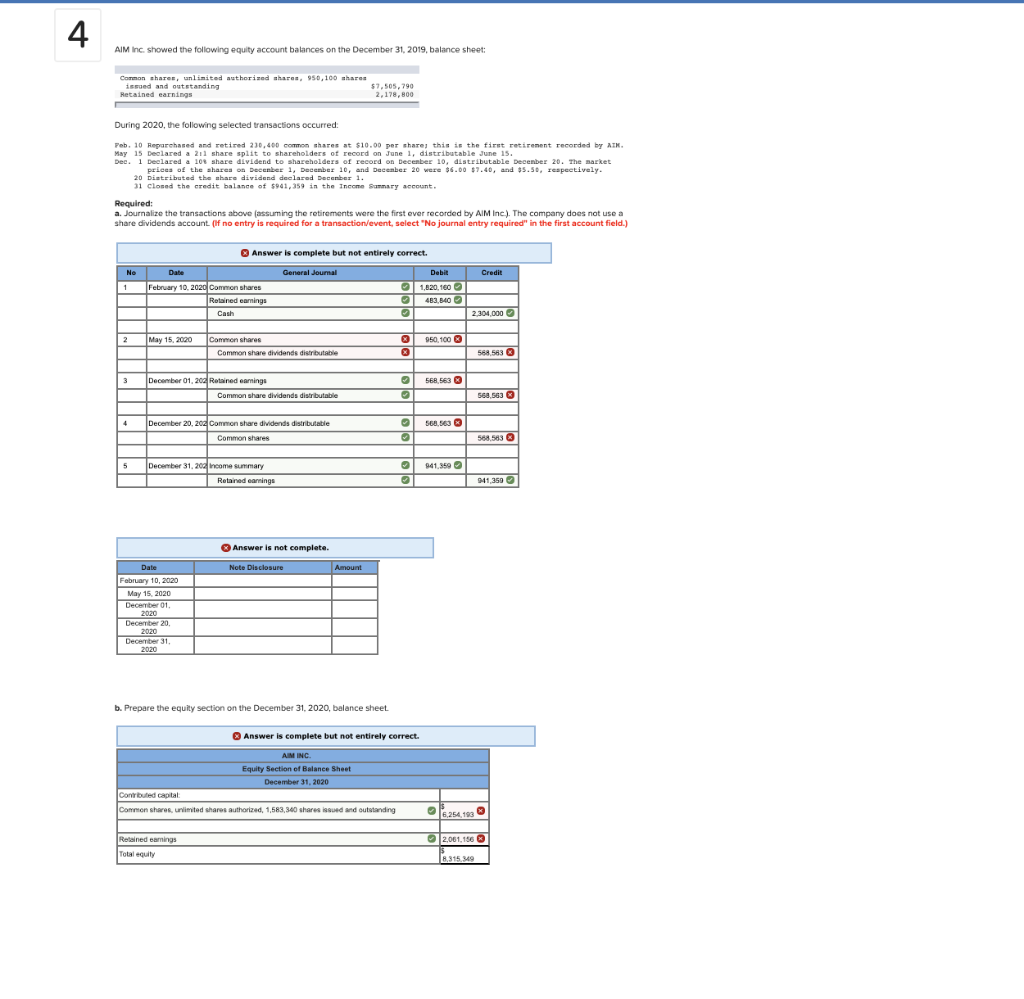

Otherwise referred to as basic shares, common shares are the most prevalent type of stock issued by companies. When a company decides to go public and issue shares to raise capital, it typically offers common stock to investors. On a company's balance sheet, common stock is recorded in the stockholders' equity section.

The first step in calculating common stock on the balance sheet is to determine the total par value of the common stock. It is calculated either as a firm's total assets less its. Minerals resources boss chris ellison has hit back at his critics.

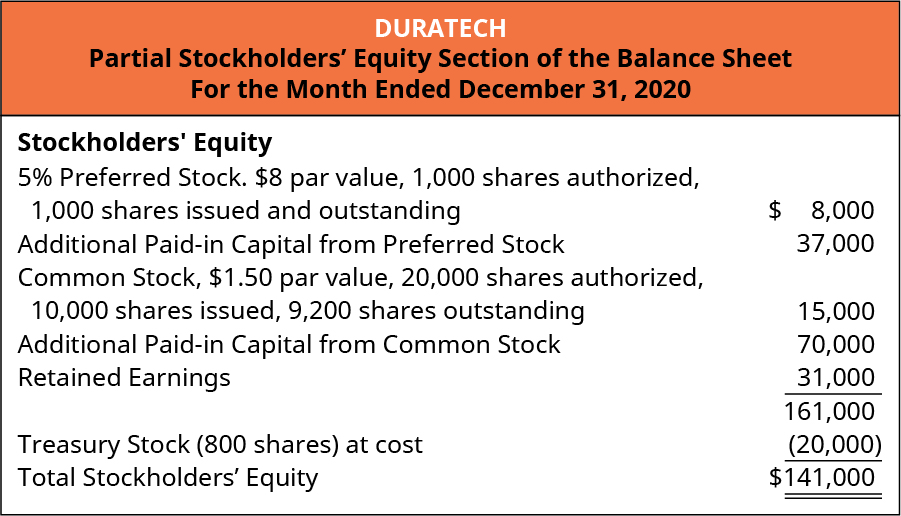

That have not been repurchased). It is usually a small amount, such as $0.01 or $0.10 per share. Sample stockholders’ equity section of the balance sheet;

Stockholders' equity is the remaining assets available to shareholders after all liabilities are paid. Accounting for stockholders' equity. Preferred stock, $100, $100 par (80,000 shares authorized, 10,000 shares issued) $1,000,000:

A balance sheet provides a snapshot of a company’s financial performance at a given point in time. What is stockholders' equity? The latest balance sheet data shows that companhia brasileira de distribuicao had liabilities of r$6.03b due within a year, and liabilities of r$11.6b falling due after that.

Treasury stock may have come from a repurchase or buyback from shareholders, or it may have. Common shares make up one part of a company’s shareholder equity, which also includes any preferred shares that have been issued as well as any retained earnings. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)