Amazing Info About Three Primary Financial Statements Ratio Analysis Excel

These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value.

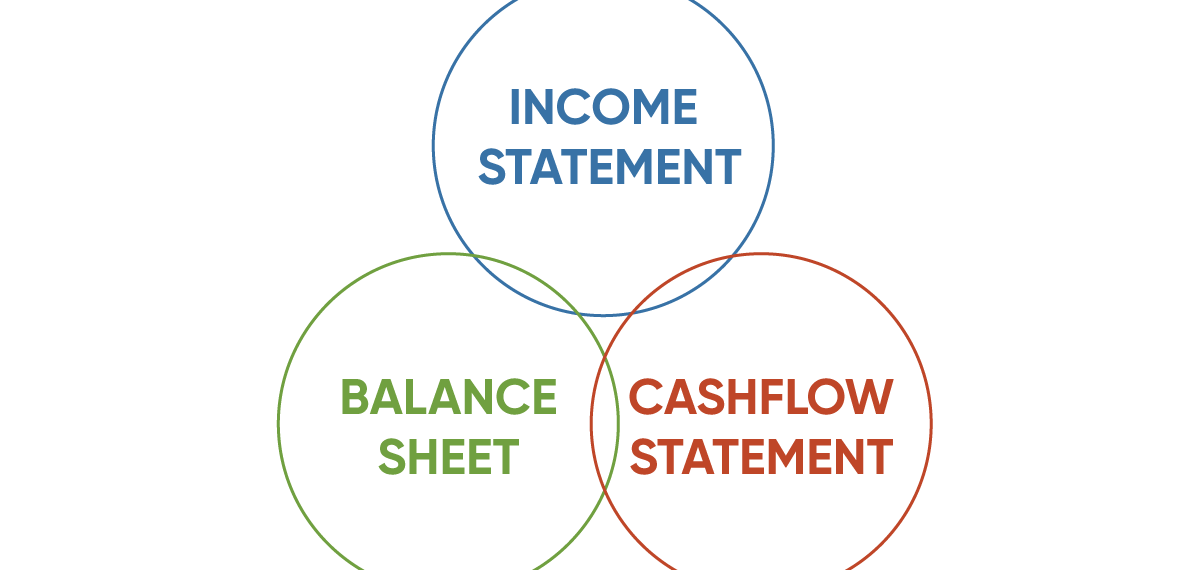

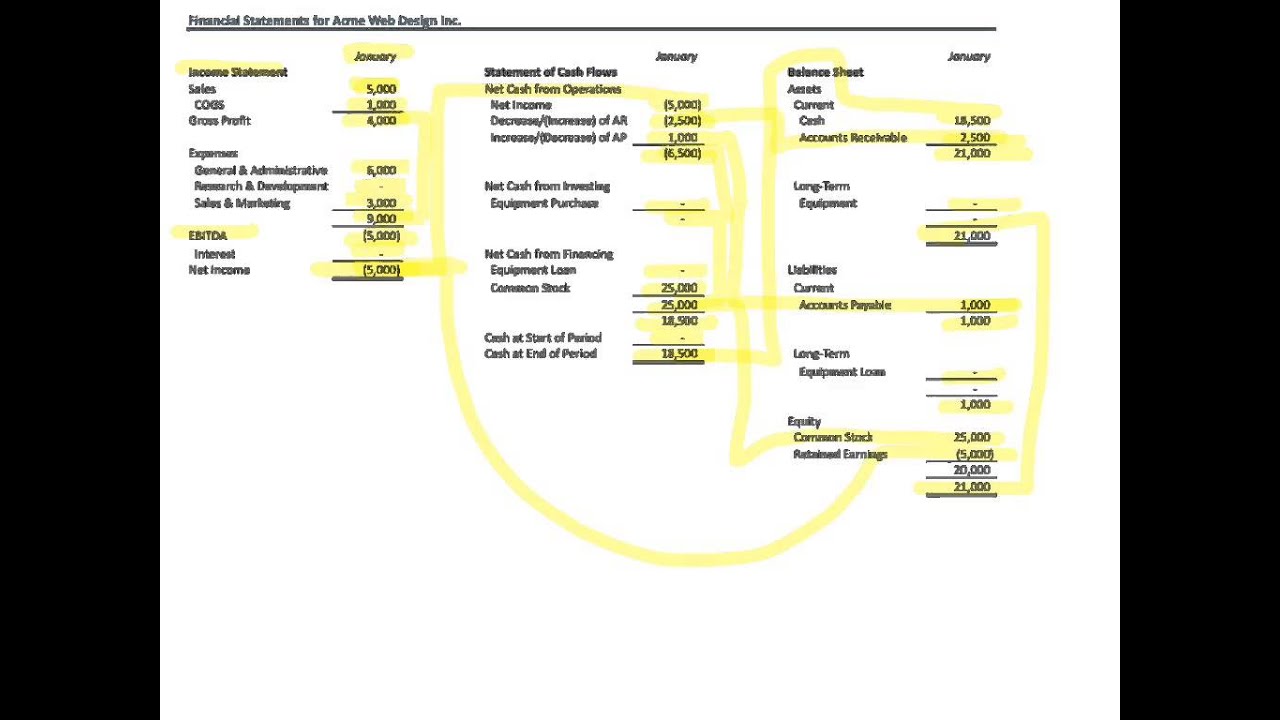

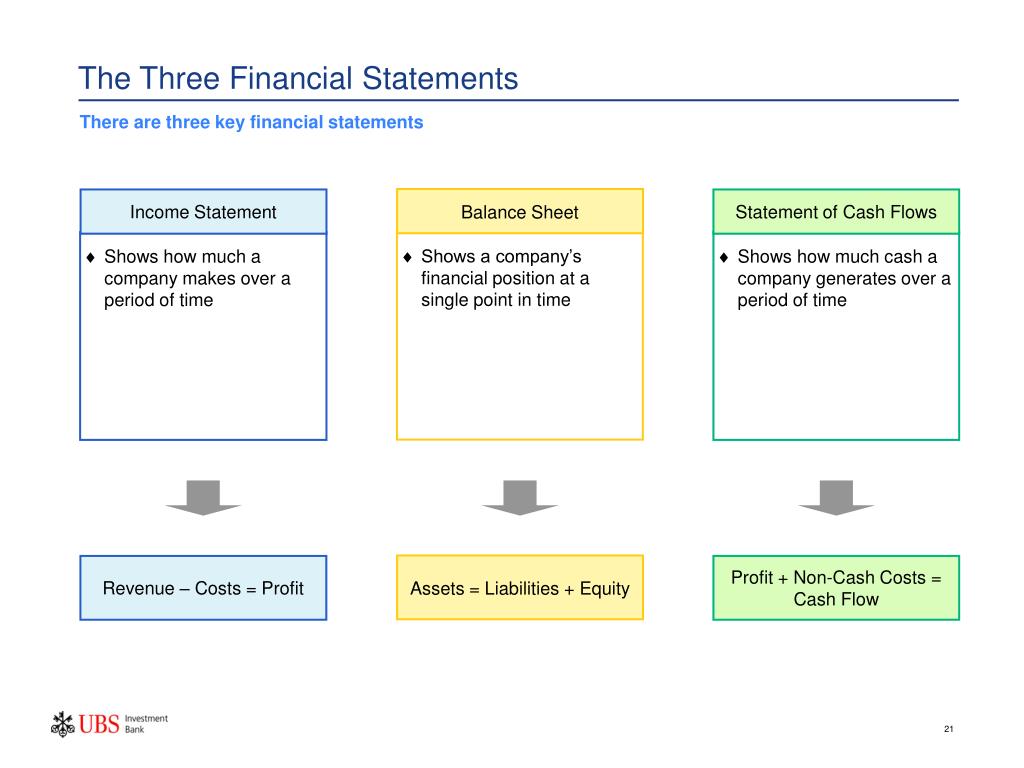

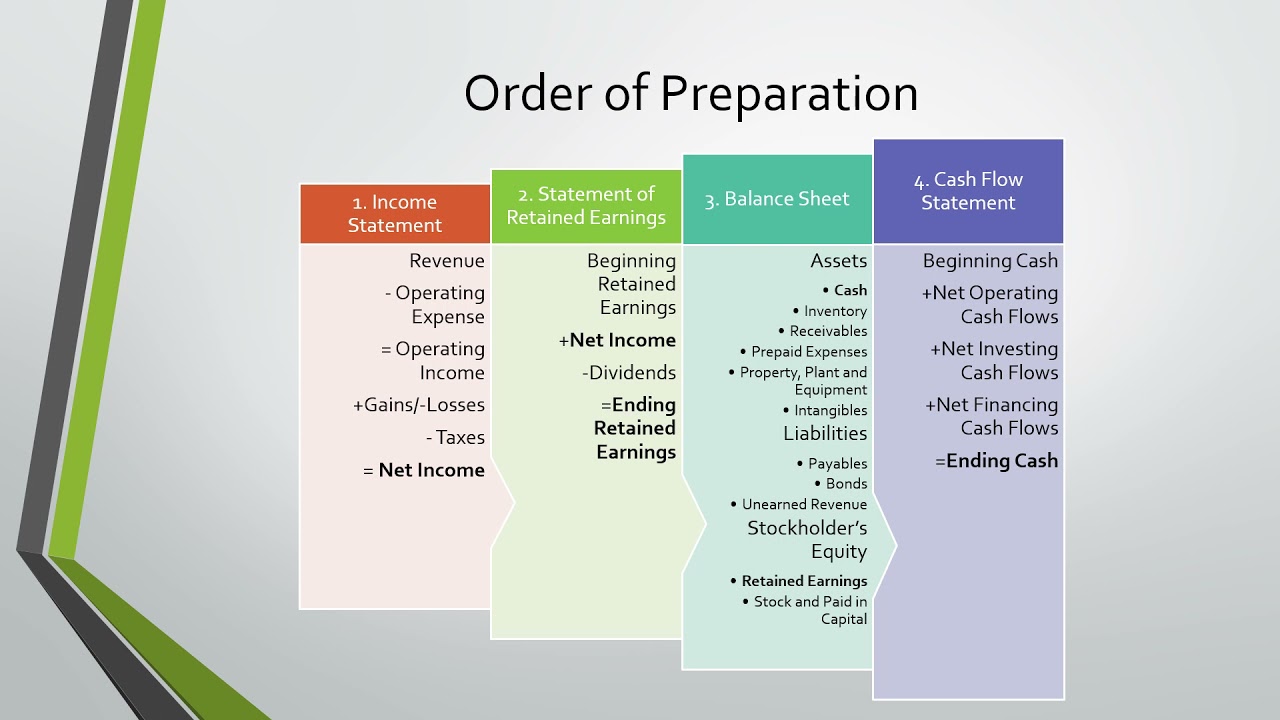

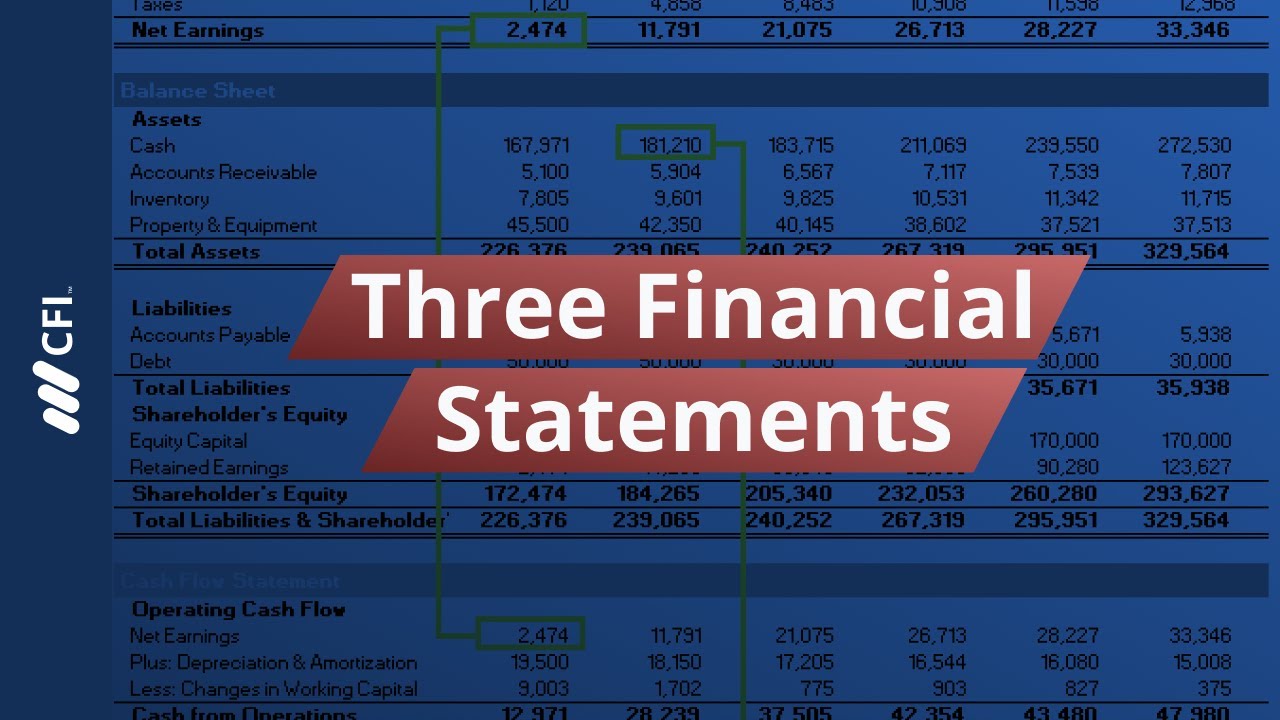

Three primary financial statements. A financial statement segments into three divisions; The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement. In financial modeling , your first job is to link all three statements together in excel, so it’s critical to understand how they’re connected.

Depreciation is a financial accounting method used to allocate the cost of tangible assets over their useful lives. Balance sheets show what a company owns and what it owes at a fixed point in time. Each statement has a unique purpose and provides different insights into a company's financial performance.

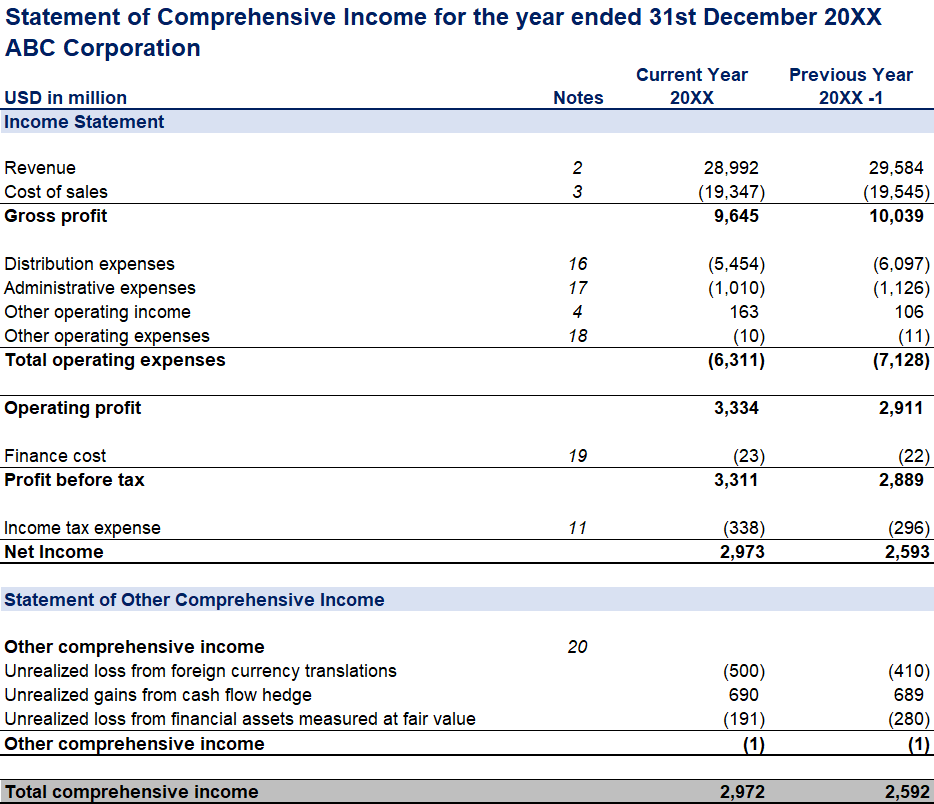

Among these 3 major financial statements, the most important financial statement is the income statement. The income statement is a statement that illustrates the profitability of the company. Click the card to flip 👆 the three primary financial statements are the income statement, the balance sheet, and the cashflow statement click the card to flip 👆 1 / 16 1 / 16 created by ali_worland share share students also viewed

Cpf retirement savings as of 31 december 2022. The balance sheet expresses the financial position of a business. Together, they present a comprehensive overview of a company's financial status.

The project intends to address three key requirements of investors: Cash flow statements can be used to track inflows and outflows and find ways to improve a business's financial position to. The balance sheet the income statement the statement of cash flows because these statements detail a company at a macro level, being familiar with these three primary statements is essential for anyone working in.

This is one of the most important models as it serves as a base for other complex models, such as the leveraged buyout (lbo) model or the discounted cash flow (dcf) model. When combined, these three elements make up the worth of the business for the period the balance sheet covers. By kate christobek.

To answer the common accounting interview question accurately, the principles of accrual accounting (u.s. Its assets, liabilities, and shareholder equity (or capital). The three major financial statements are prepared as a summary of figures and facts showing the financial condition of a business.

Balance sheet , showing the company’s assets, liabilities and shareholders’ equity at a given date (e.g. Depreciation is a financial accounting method used to allocate the cost of tangible assets over t. clearias on instagram: Profit & loss (p&l) statement.

The three financial statements—income sheet, balance sheet, and statement of cash flows—provide granular financial forecasts that explain the future of your company's financial performance. Balance sheet, income statement, and cash flow statement. The three primary financial statements are the income statement, balance sheet, and statement of cash flows.

And (4) statements of shareholders’ equity. The three primary financial statements comprise: I have found that if the principle relationships linking the three primary financial statements are well known, it makes understanding the rest of the model an easier exercise.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)