Amazing Tips About Income And Cash Flow Statement Of A Farm Business Cost Goods Sold For Service

Financial statements are essential tools for managing farm businesses.

Income and cash flow statement of a farm business. Download a cash flow template. Key components of a cash flow include: A cash flow budget is a projection of future flows that would include expected payments or payments to accounts receivable.

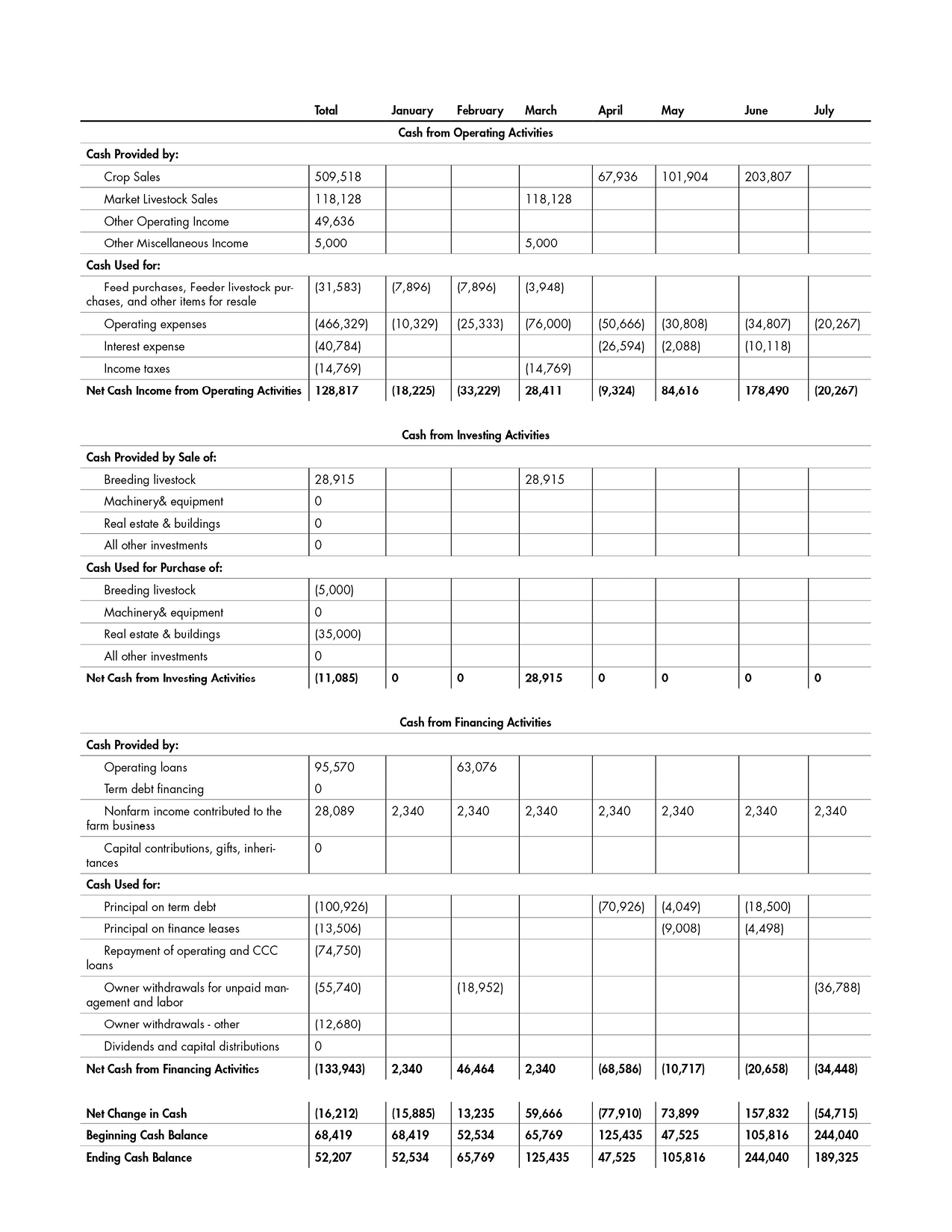

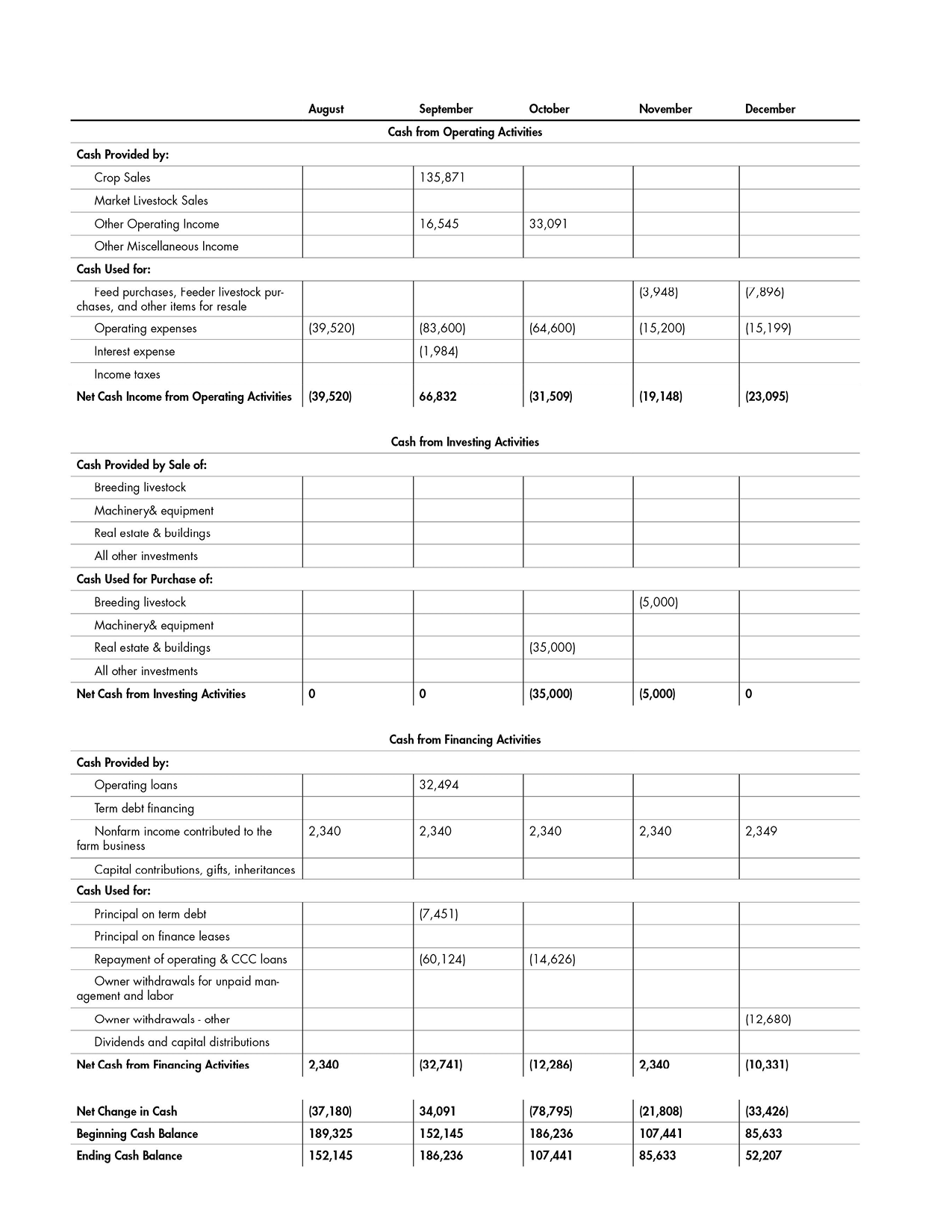

Although the manager or owner may not be the person who develops the. The statement of cash flows summarizes cash activity. The statement of cash flows is divided into five sections:

Income statement • main idea: Cash inflows = production sales, capital sales, borrowed funds, contributed capital, etc. The statement measures how well the farm generates cash to cover operating expenses and meet financial obligations (debt).

The income statement is a report of the farm business’ financial performance during a given time frame. The cash flow statement provides information on how changes from the balance sheet and cash transactions (income) affect the farm business’ overall cash position. Learning objectives the learning objectives for this module are for participants to:

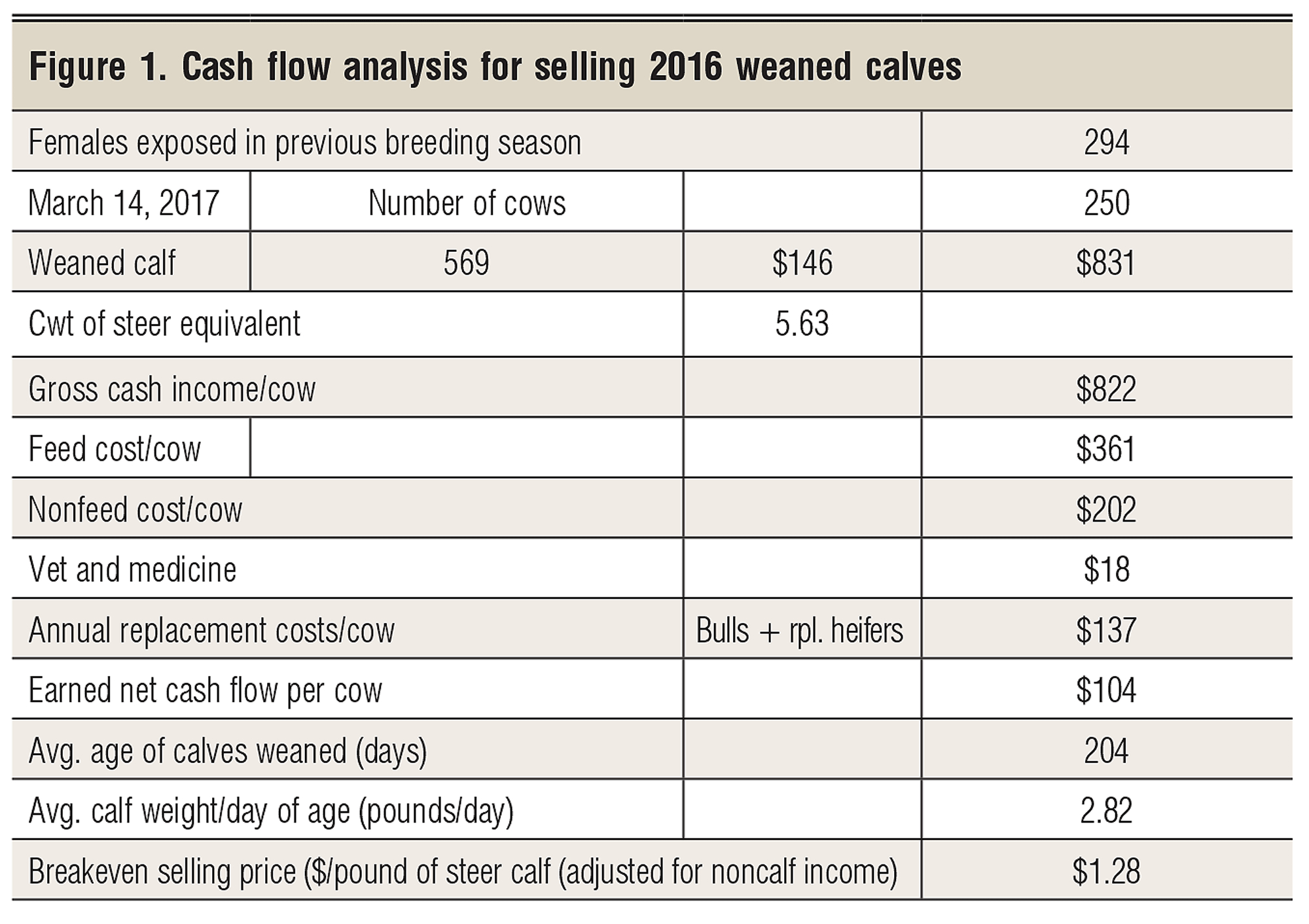

Cash income and cash expenses; It merely shows the sources and uses of cash. Farm income refers to profits and losses that are incurred through the operation of a farm or agricultural business.

A complete set of financial statements for agriculture include: Often, an accountant or bookkeeper will produce statements from the financial records of the business. Product sales generate a return to the expenses incurred when making the product.

Income statement is divided into two major categories, viz., income and expenses. The statement of cash flows is a financial statement that summarizes the movement of cash coming in and going out of a farm business. A farm income statement (sometimes called a farm profit and loss statement) is.

Combining business and personal finances brings all expenses to the forefront, creating an avenue for crucial budgeting conversations. It analyzes how cash was used to meet financing, investing, and operating activities during a specific period. It measures profit or loss in a given time period.

Our discussion will focus on the three most commonly used financial statements: Used in combination with the balance sheet and income statement, the cash flow statement can be a useful way of determining a. Income includes cash receipts, capital sales of business and changes in inventory value of items produced in the farm.

The statement of cash flows tracks the sources and uses of cash in your farm business and adds insight to the understanding of your financial position and performance. Financial statements include the balance sheet, income statement, statement of owner equity, statement of cash flows and cash flow projection. Key takeaways the cash flow statement and the income.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)