First Class Info About Closing Entries For Retained Earnings Opinion On Financial Statements

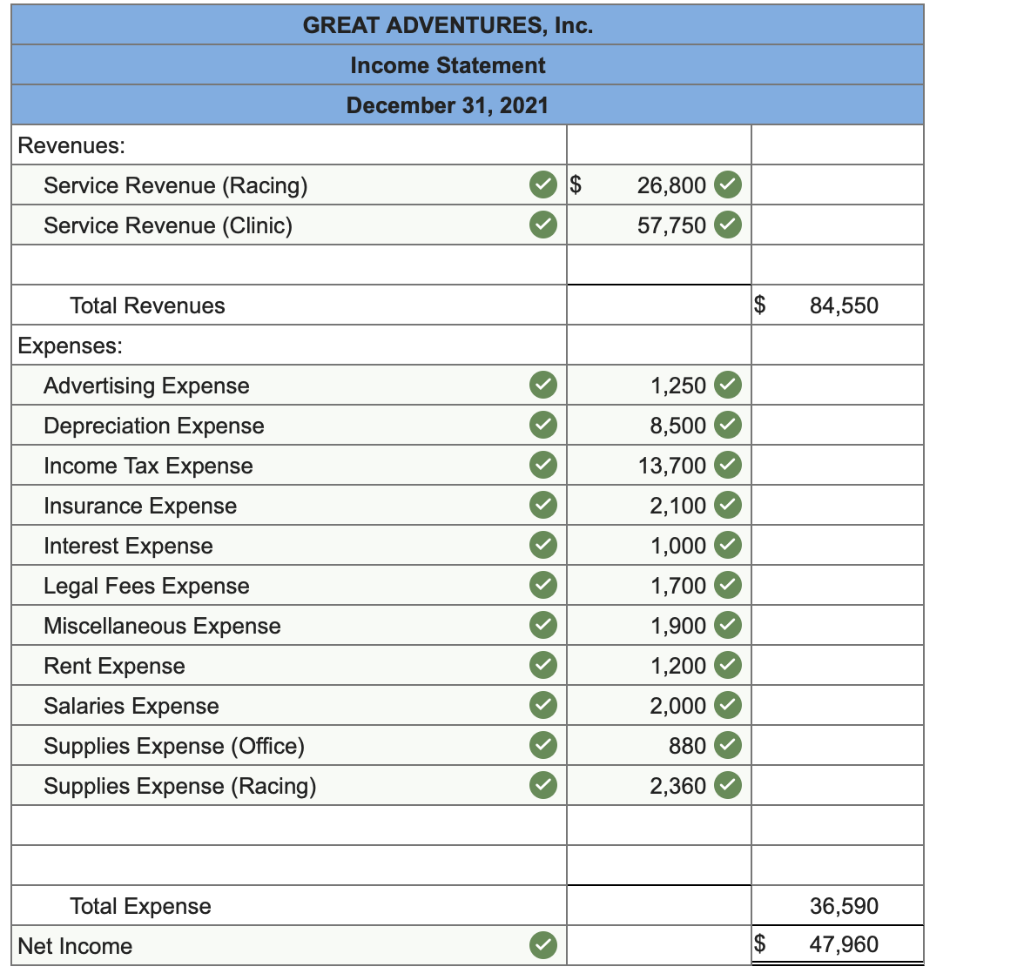

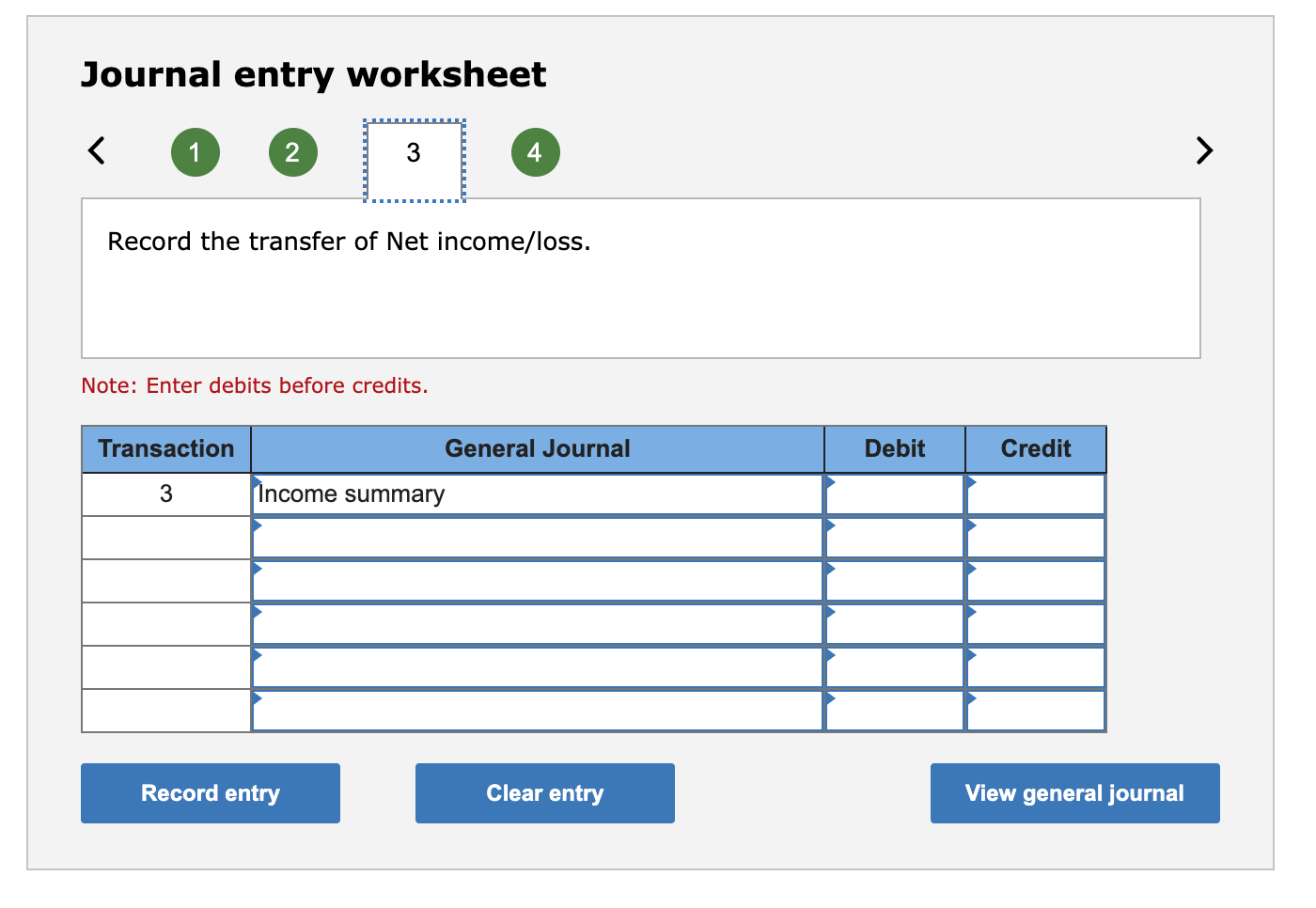

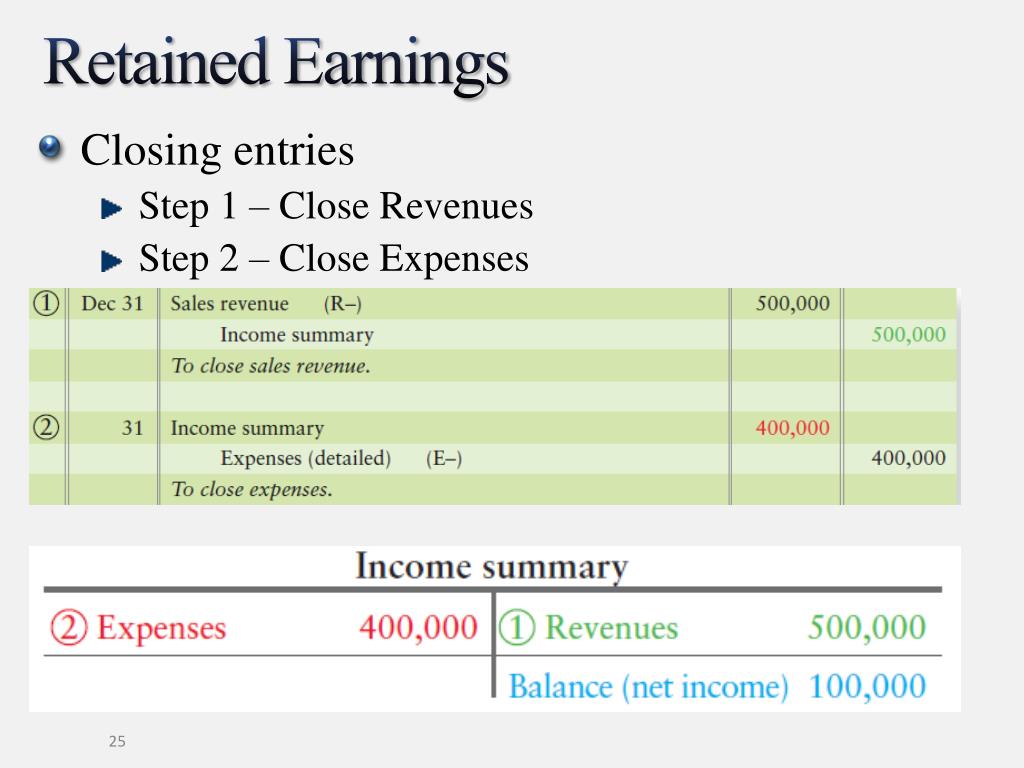

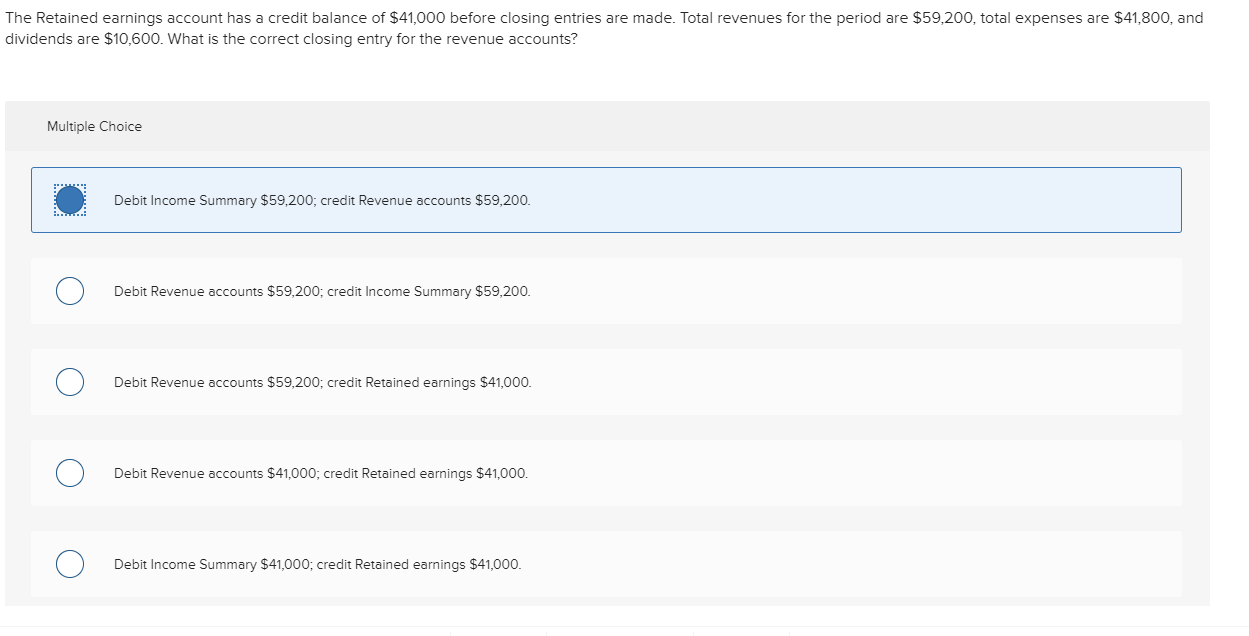

Now that we have closed income and expenses, we need to move the balances from the income summary to retained.

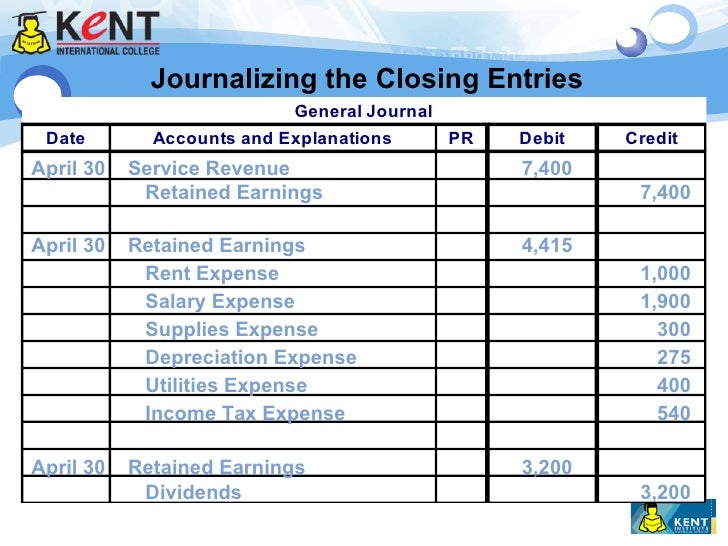

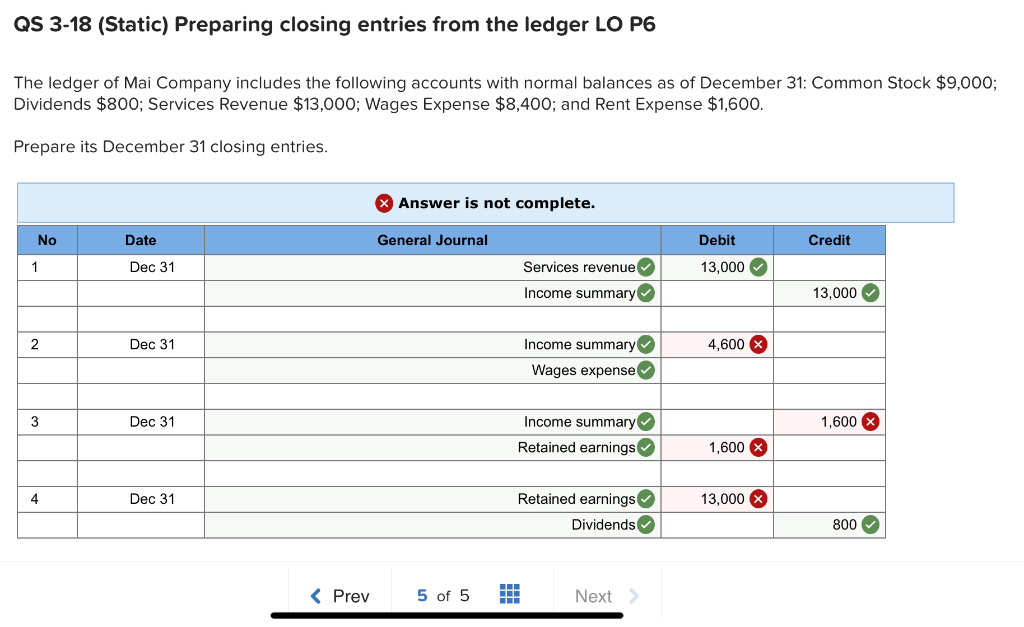

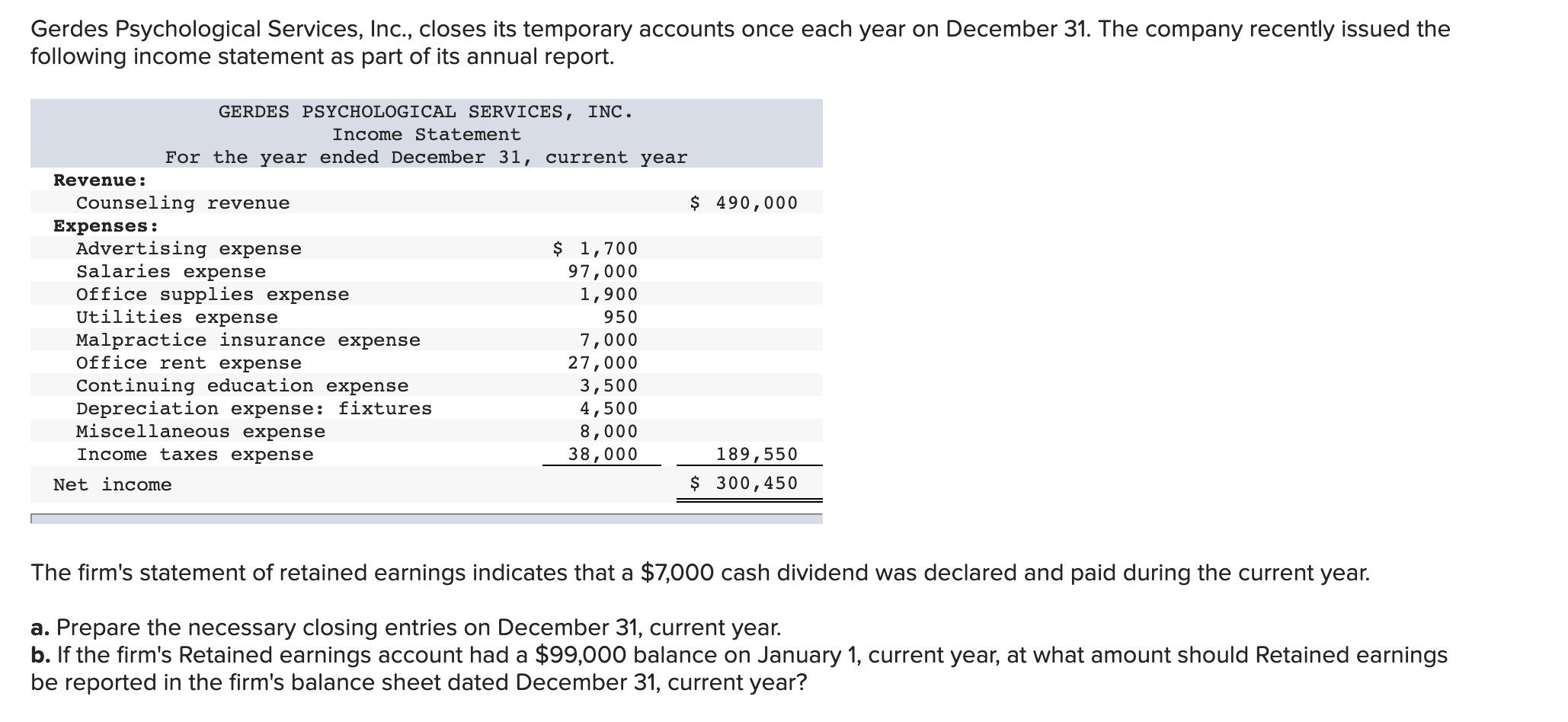

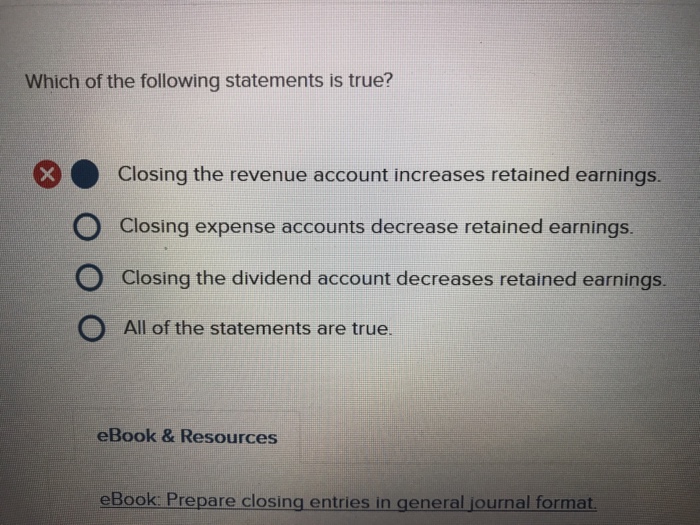

Closing entries for retained earnings. Closing entries prepare a company for the next accounting period by clearing any outstanding balances in certain accounts that should not transfer over to the next period. The closing entries are the journal entry form of the statement of retained earnings. Closing entries are journal entries posted at the end of an accounting period to reset temporary accounts to zero and transfer their balances to a permanent.

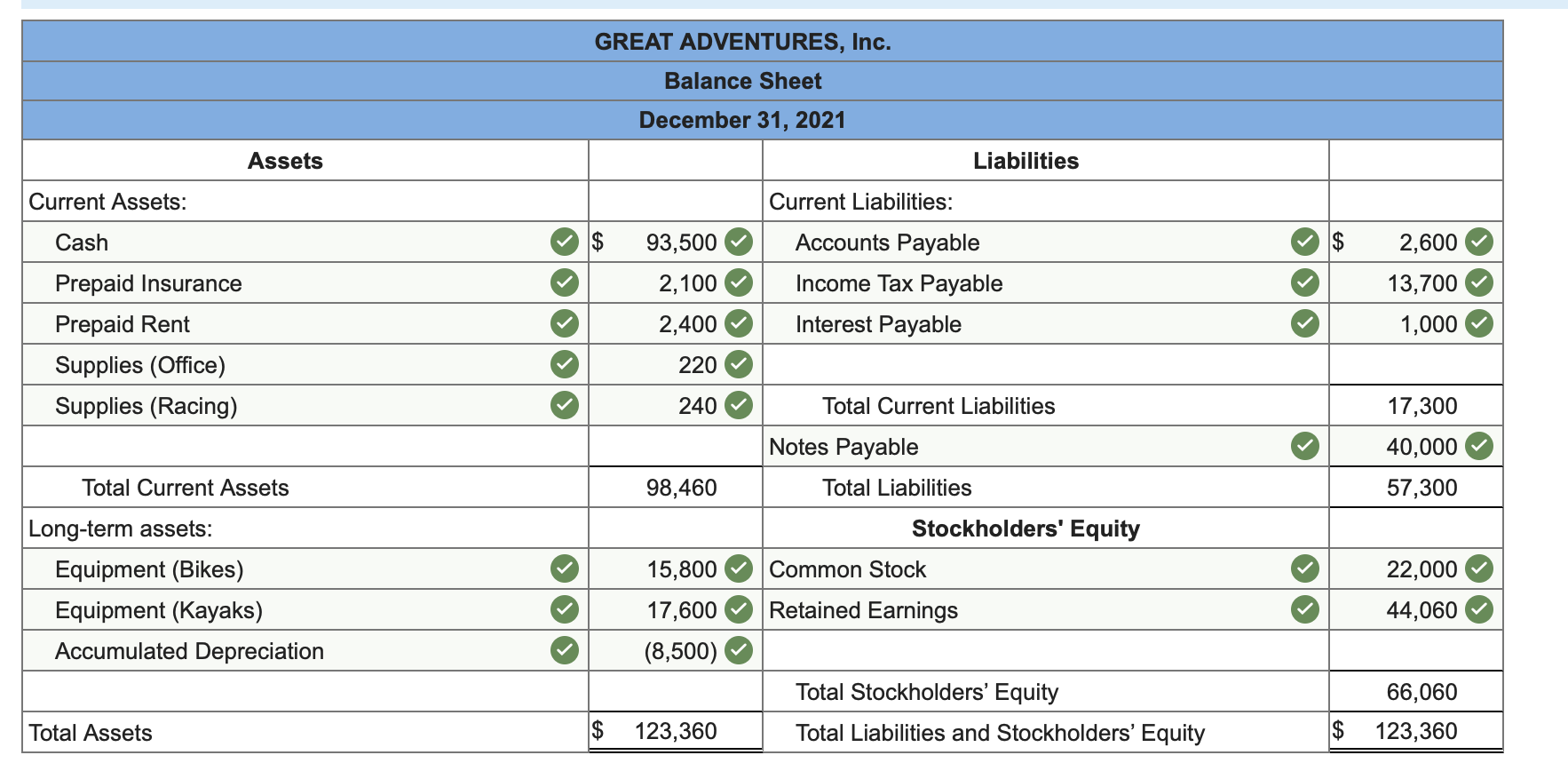

The retained earnings account is updated from the statement of change in equity accounts. Note that by doing this, it is. In case of a company, retained earnings account, and in case of a firm or a sole proprietorship, owner's capital account receives the balances of temporary.

For example, if a business made $20,000 in. Close all dividend or withdrawal accounts since dividend and withdrawal accounts are not income statement accounts, they do not typically use the income summary account. Closing entries, with examples.

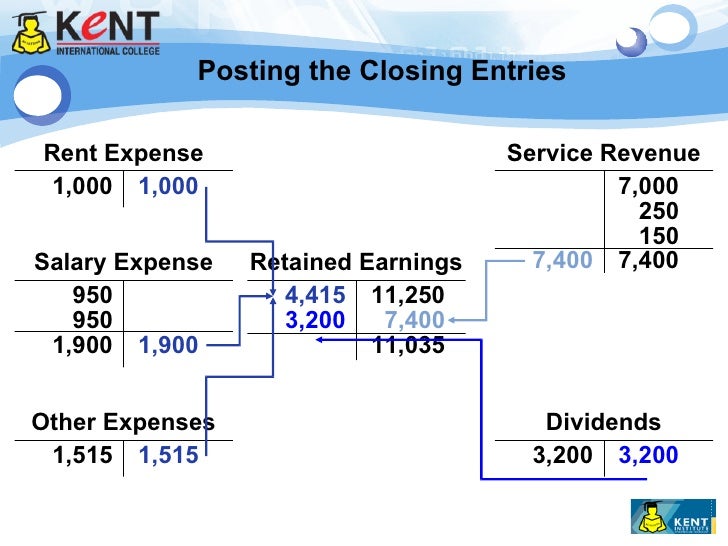

Then, making sure dividends is paid to shareholders at the end of the fiscal year, the dividends. For instance, if you prepare a yearly balance sheet, the. Retained earnings represent the amount your business owns after.

The goal is to make the posted balance of the retained earnings account match what we reported on the statement of retained earnings and start the next period with a zero. As an another example, you should shift any balance in the dividends paid account to the retained earnings account, which reduces the balance in the retained. That is the closing balance of the retained earnings account as in the previous accounting period.

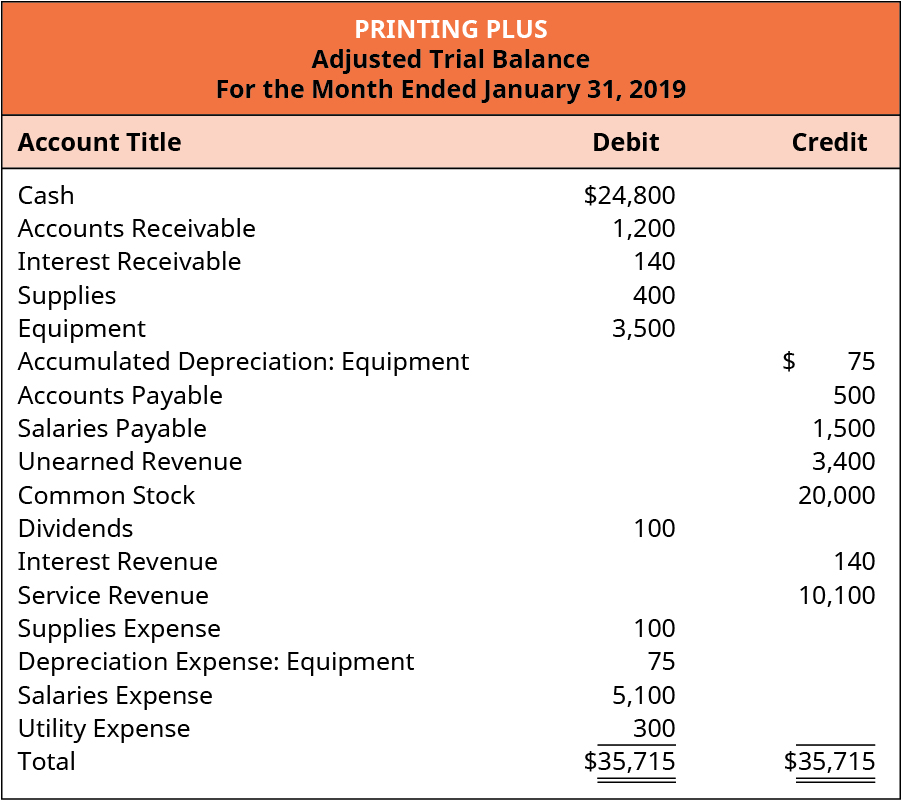

At the end of an accounting period when the books of accounts are at finalization stage, some special journal entries are required to be. Sum of revenues and sum of expenses can also be found on the business's ledger as two of its major closing entries. The final step of closing entries is closing the dividends account.

When dividends are declared by corporations, they are usually recorded by debiting dividends payable and crediting retained earnings.