Ideal Info About Purchase Of Equipment On Cash Flow Statement Audit Report

When equipment is purchased, it is not initially reported on the income statement.

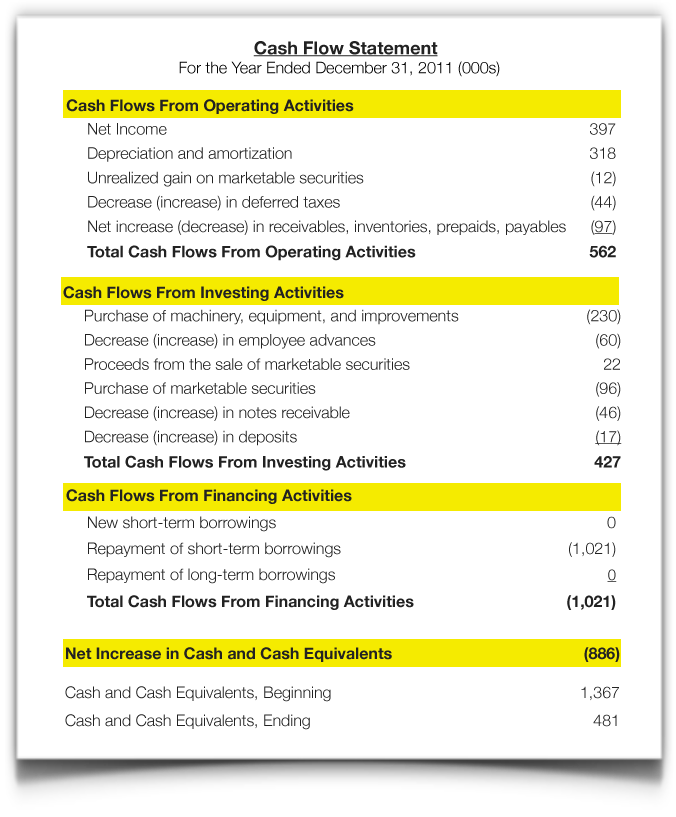

Purchase of equipment on cash flow statement. The first section of the statement of cash flows is described as cash flows from operating activities or shortened to operating activities. The cfs highlights a company's cash management, including how well it generates. Analysis until fsp corp has made a cash payment related to the equipment, the equipment acquisition is a noncash activity that should not be reflected in the statement of cash flows.

The input that will cause this change to be reflected in a three statement model will most likely be located on the pp&e schedule under “capital expenditures.”. Proceeds from the sale of pp&e In summary, the purchase of equipment is reported as a cash outflow in the investing activities section of the statement of cash flows.

Both are investing activities and would be reported in the investing activities section of the statement of cash flows. In this section of the cash flow statement, there can be a wide range of items listed and included, so it’s important to know how investing activities are handled in accounting. Once completed, these activities are then reported on a company’s cash flow statement.

The cash flow statement reflects the actual amount of cash the company receives from its operations. An investing activity also refers to cash spent on investments in capital assets such as property, plant, and equipment, which is collectively referred to as capital expenditure, or capex. Rather, the equipment's cost will be reported in the general ledger account equipment, which is reported on the balance sheet.

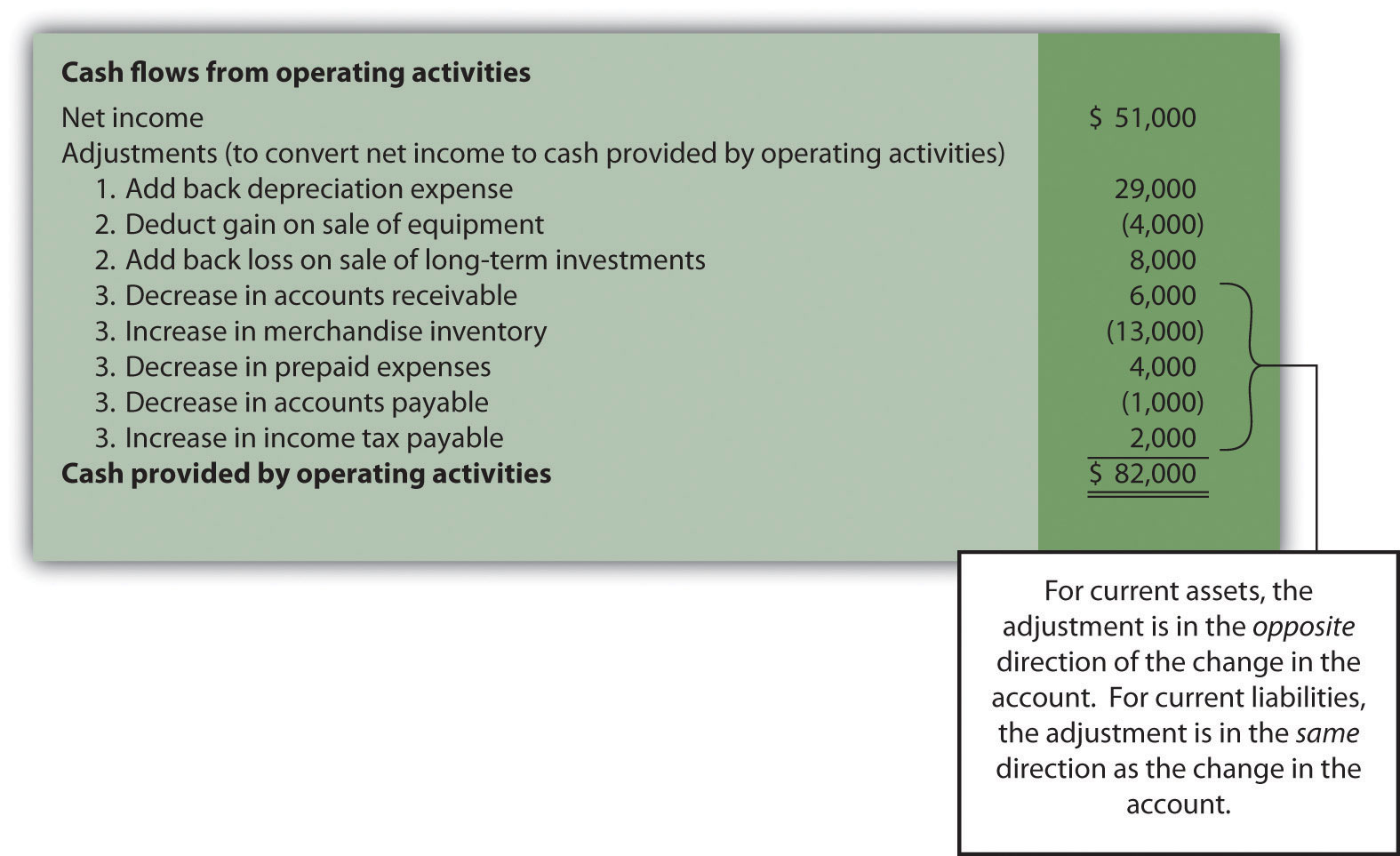

For this purpose cash flows are classified into three key activities: Although the presentation of operating cash flows differs between the two methods,. A statement of cash flows provides investors with information about cash inflows and outflows and the resulting change in cash and cash equivalents.

The cash flow statement bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities. More specifically, it is initially recorded in the equipment fixed assets account, which is then aggregated into the fixed assets line item on the balance sheet.

Cash on hand and demand deposits (cash balance on the balance sheet). Instead, it is reported on the balance sheet as an increase in the fixed assets line item. On may 31 good deal purchases office equipment (a new computer and printer) that will be used exclusively in the business.

Cash flow from investing activities is cash earned or spent from investments your company makes, such as purchasing equipment or investing in other companies. After calculating cash flows from operating activities, you need to calculate cash flows from investing activities. How should the equipment acquisition be reflected in fsp corp’s december 31, 20x1 statement of cash flows?

Also called capital expenditures or cash equivalent, this cash outflow includes the purchase of any property, plant, or equipment your company makes (and the sale of these items would be a cash inflow). Purchase of a fixed asset: The purchase of equipment appears as a cash outflow under cash flow from investing activities.

There were no other transactions in may. Operating activities are the business activities other than the investing and financial activities. A balance sheet comparing may 31 amounts to april 30 amounts and the resulting differences or changes is shown here:

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)