Looking Good Tips About Total Liabilities Divided By Net Worth The Financial Position

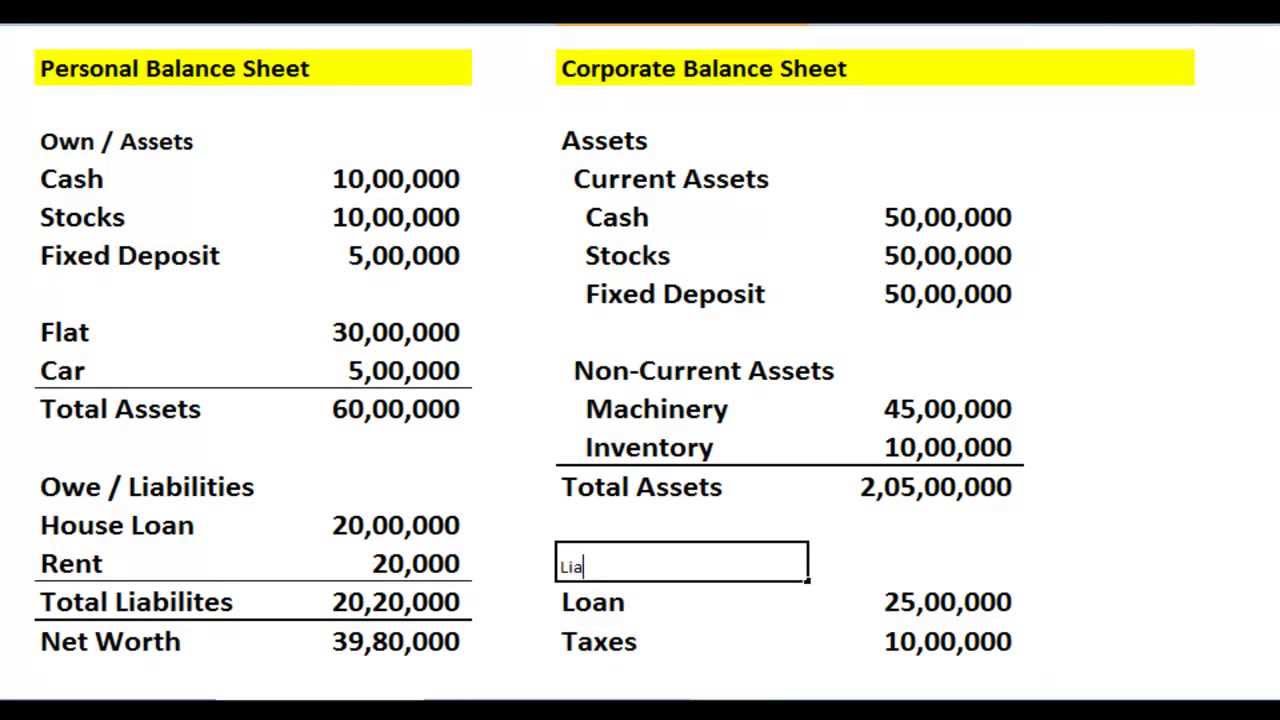

You can calculate your net worth by subtracting your liabilities (debts) from your assets.

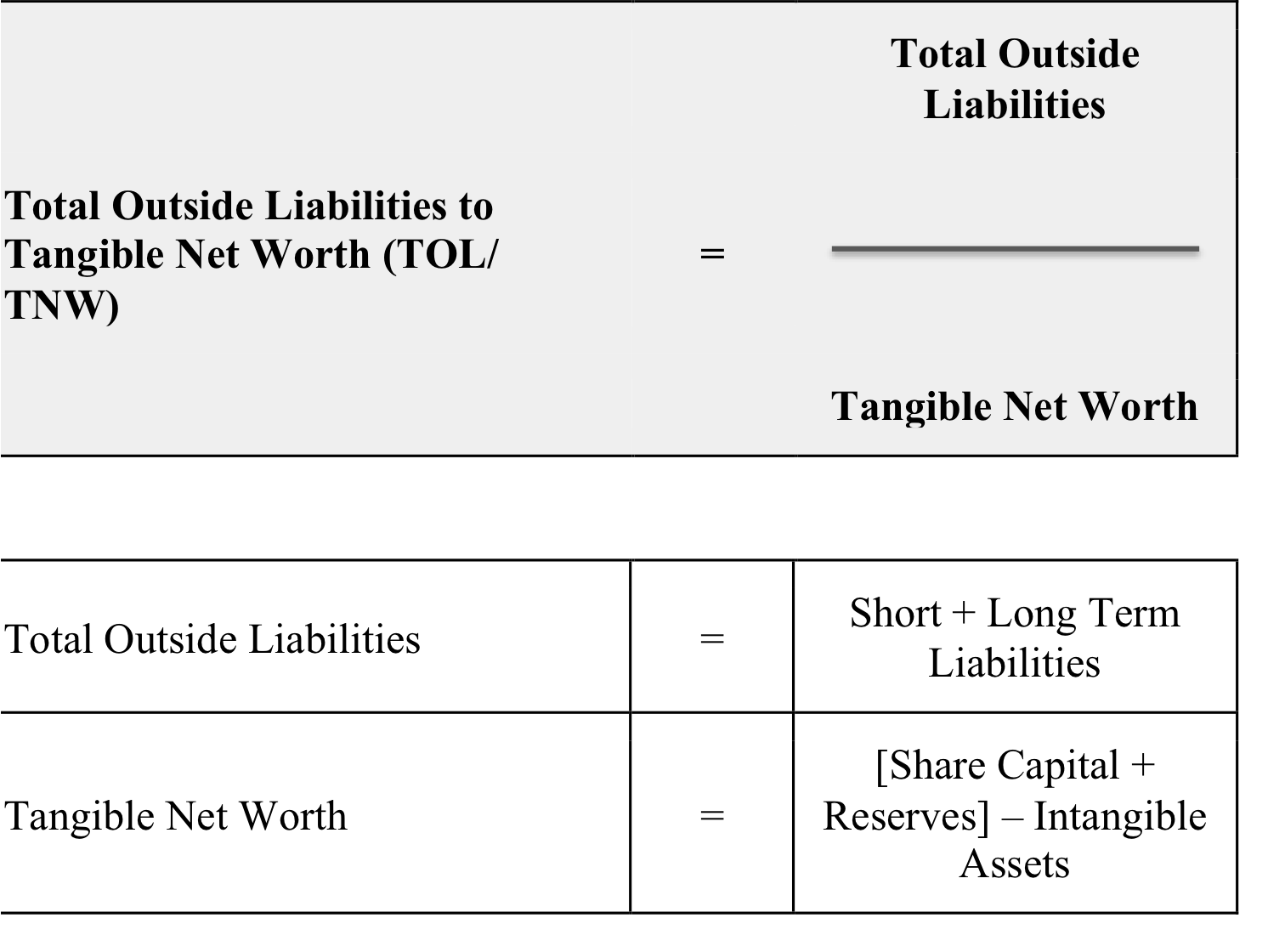

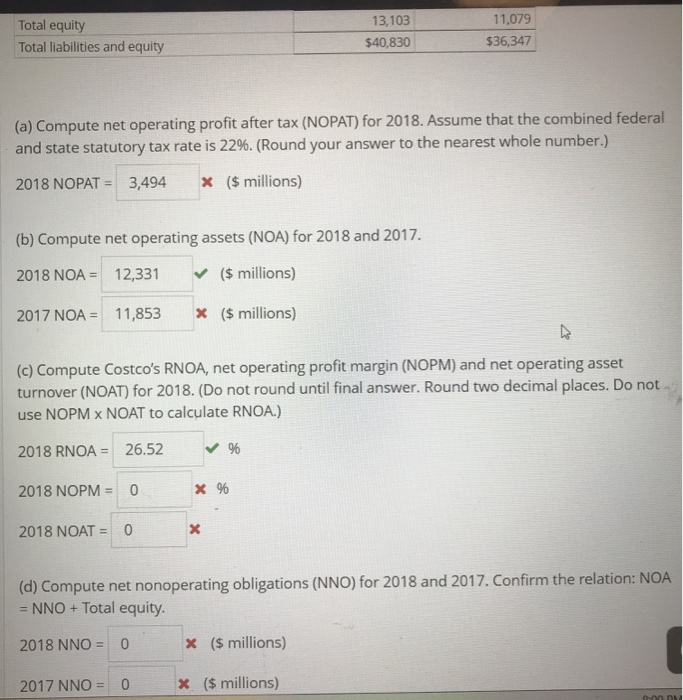

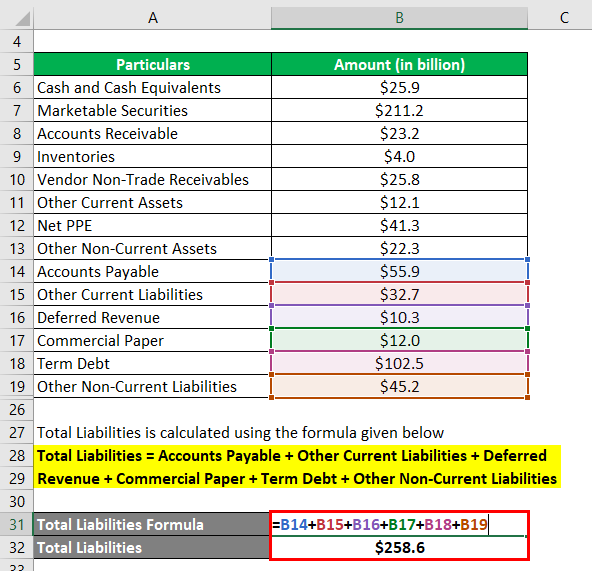

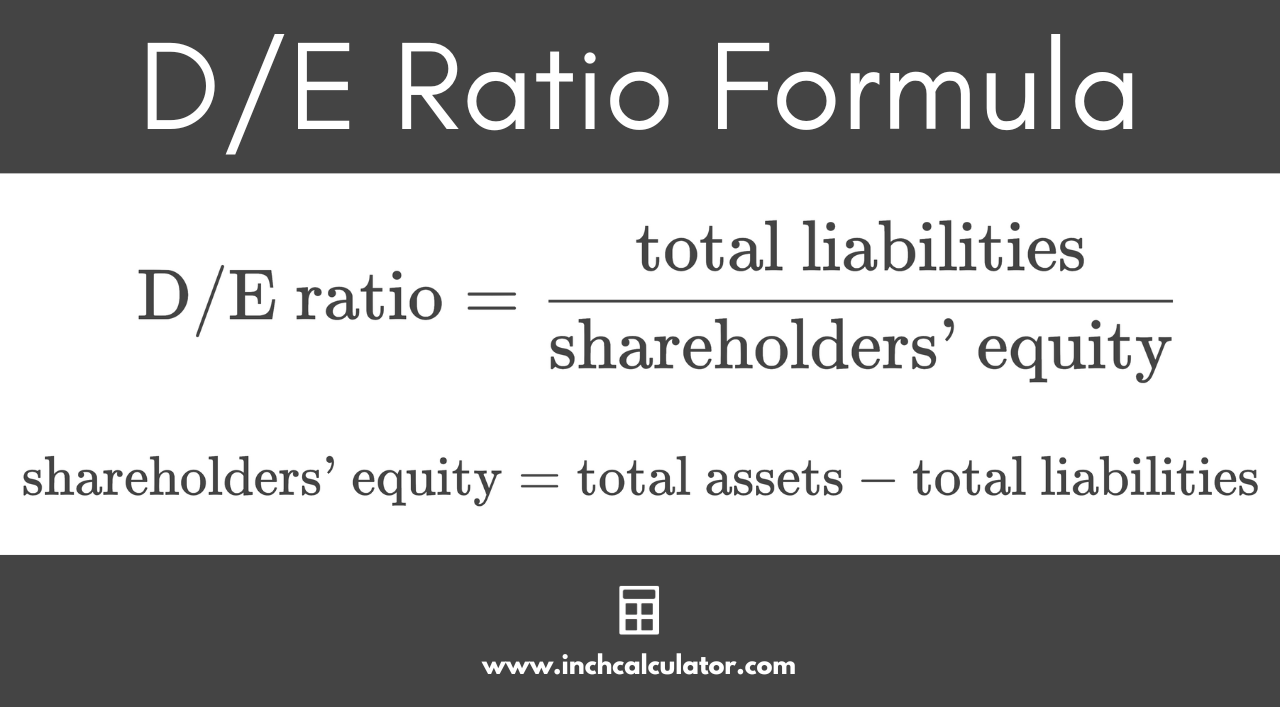

Total liabilities divided by net worth. If your assets exceed your liabilities, you will have a positive net worth. It is calculated by dividing the total. Total liabilities to net worth ratio is a financial metric that compares a company’s total liabilities to its net worth or shareholder’s equity.

Dividing fixed assets of $100,000 by. Savings divided by income this is basically the flip side of the one above! Current assets minus current liabilities.

This ratio demonstrates the relationship between contributions of creditors and ownership. Subtract total liabilities from total assets to show the adjusted net worth. In order to calculate it, all we have to do is to subtract total liabilities from total assets.

Bizstats financial ratio glossary accounts payable:sales : Debt to equity ratio = (short term debt + long term debt + fixed payment obligations) / shareholders’ equity debt to equity ratio in practice if, as per the balance. Net worth is calculated by subtracting all liabilities from assets.

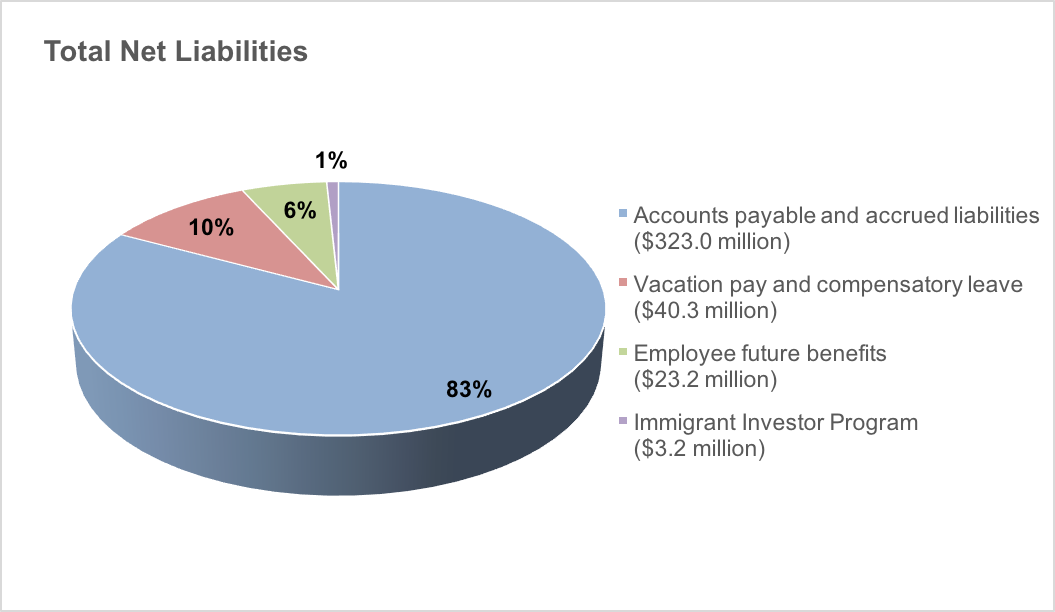

When considering companies, intangible assets are also subtracted from. The total liabilities is the sum of all the monies owed to creditors. Based on 1 documents.

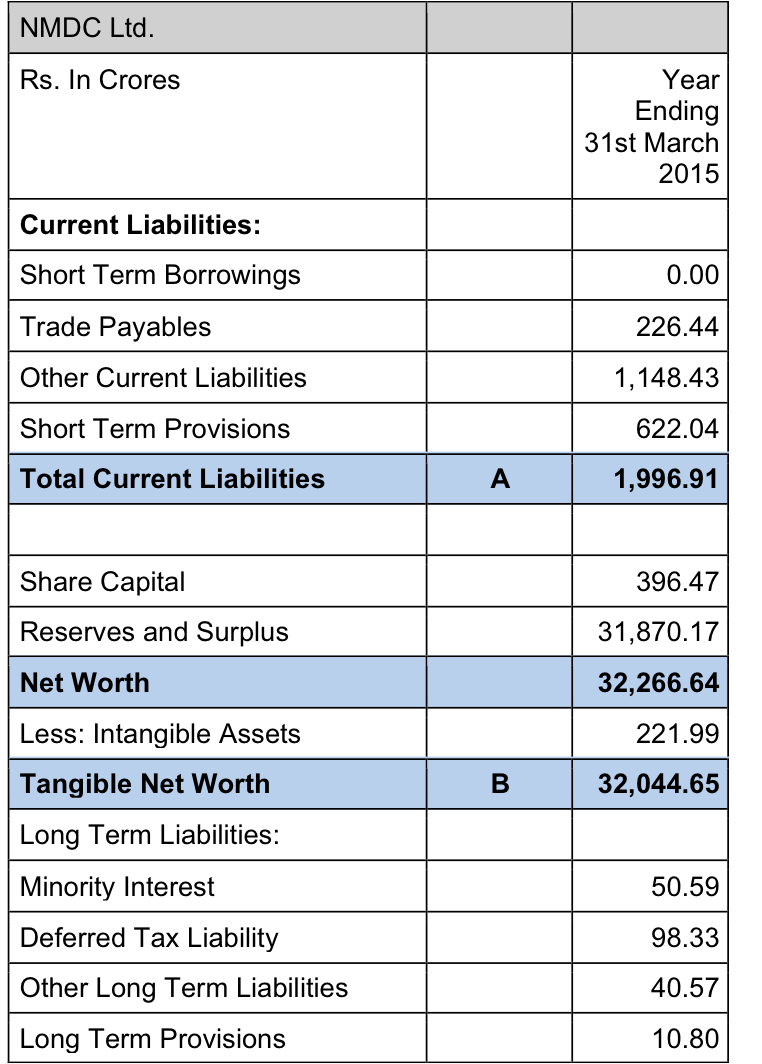

The net worth is the difference between the sum of all assets and the liabilities. Total liabilities to net worth ratio means, as of any date of determination (i) total liabilities divided by (ii) the shareholders ’ equity ( based on the. Total liabilities divided by tangible net worth how to interpret:

Accounts payable divided by annual sales, measuring the speed with which a company pays vendors relative to. Instead of telling you how much you’re spending every month, it. A company can use working capital to grow its business.

At the end of 2020, we. Subtracting total liabilities of $200,000 from total assets of $500,000 will yield a net worth in balance sheet of $300,000.

![[Solved] Based on the following data, determine the total](https://media.cheggcdn.com/media/130/1309f10f-f5d0-47bd-8339-70f27363e13f/phpVxUq4P)