Here’s A Quick Way To Solve A Info About Goodwill Impairment Entry Adidas Financial Statements 2019

The order in which a company tests each asset or asset group within a reporting unit for impairment is important because the goodwill impairment model.

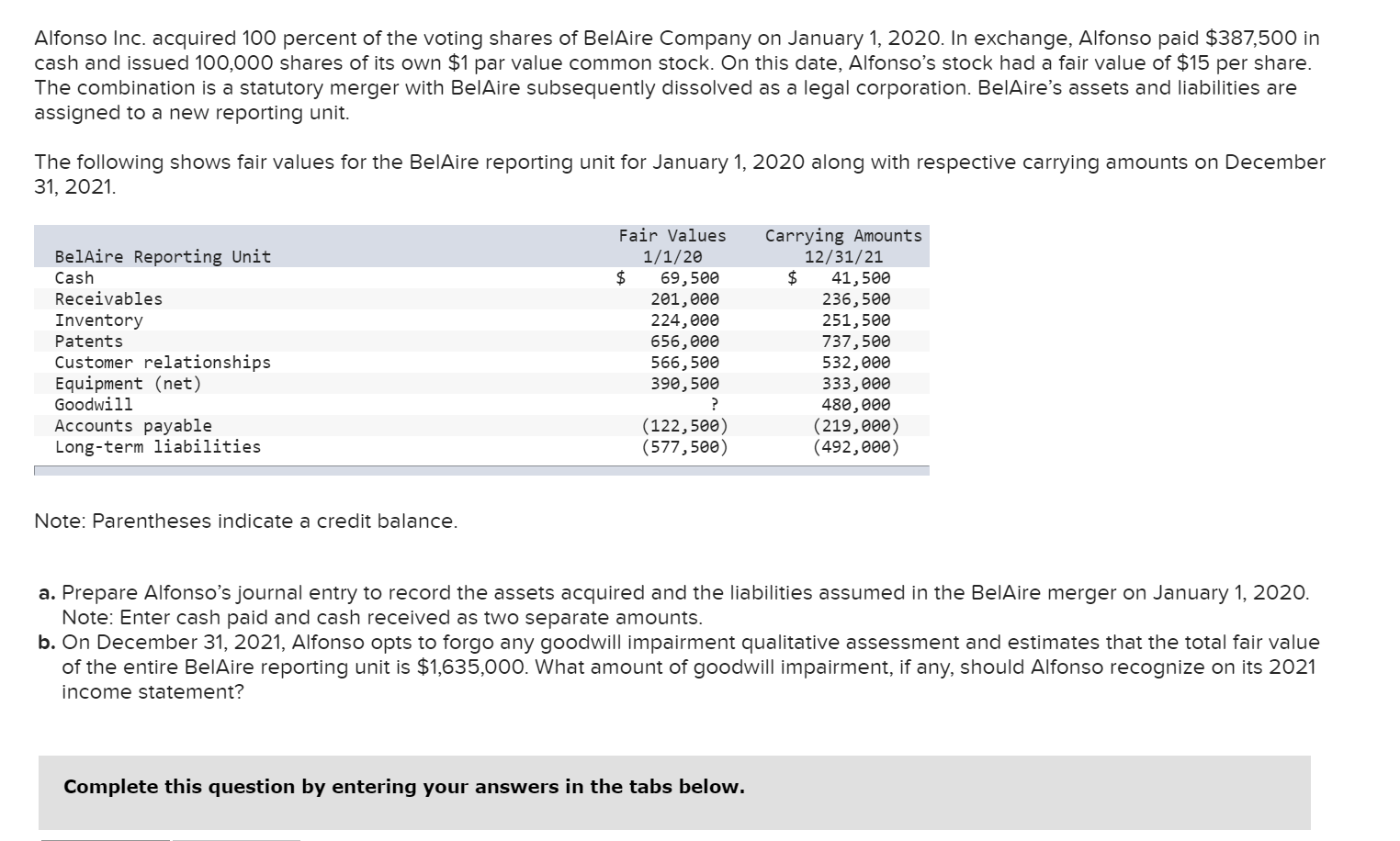

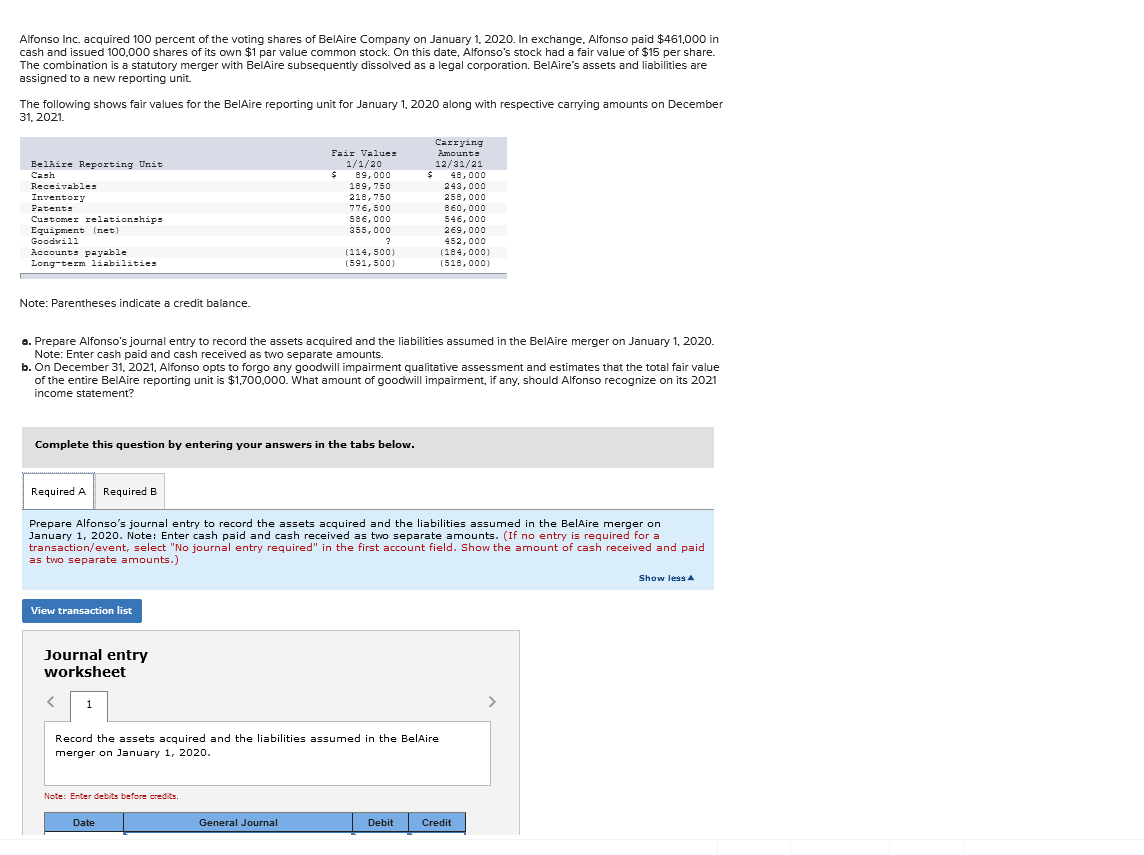

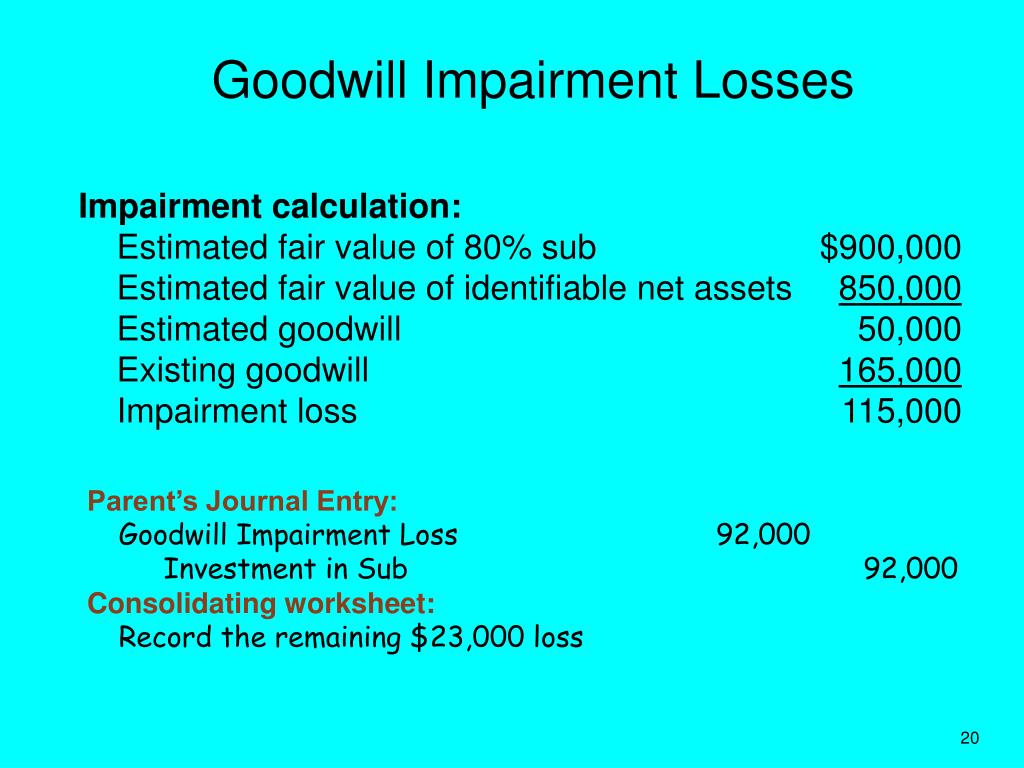

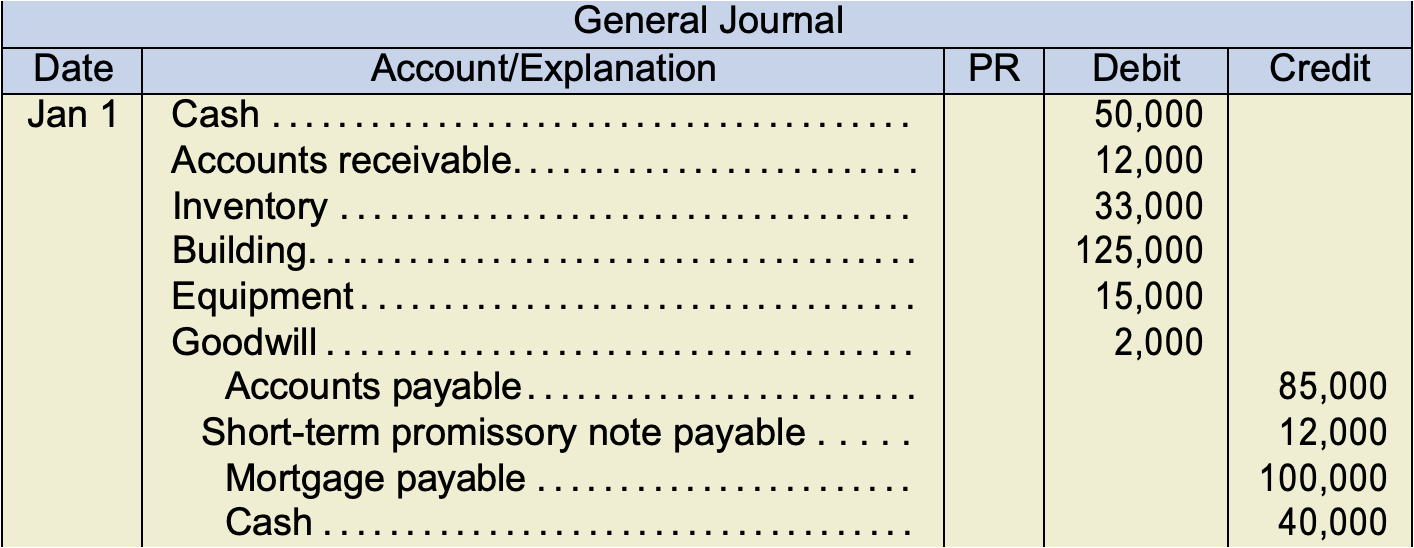

Goodwill impairment entry. Answer the goodwill calculation would include deferred consideration of $188,679 being $200,000 x 1/1.06 1. Overview the financial accounting standards board (fasb or board) issued final guidance1 that simplifies the accounting for goodwill impairment for all entities by. Record the journal entry to.

This would also be included in the consolidated statement of. 1) a preliminary qualitative assessment, 2) stage one of a quantitative assessment, and 3). This article discusses and shows both ways of measuring.

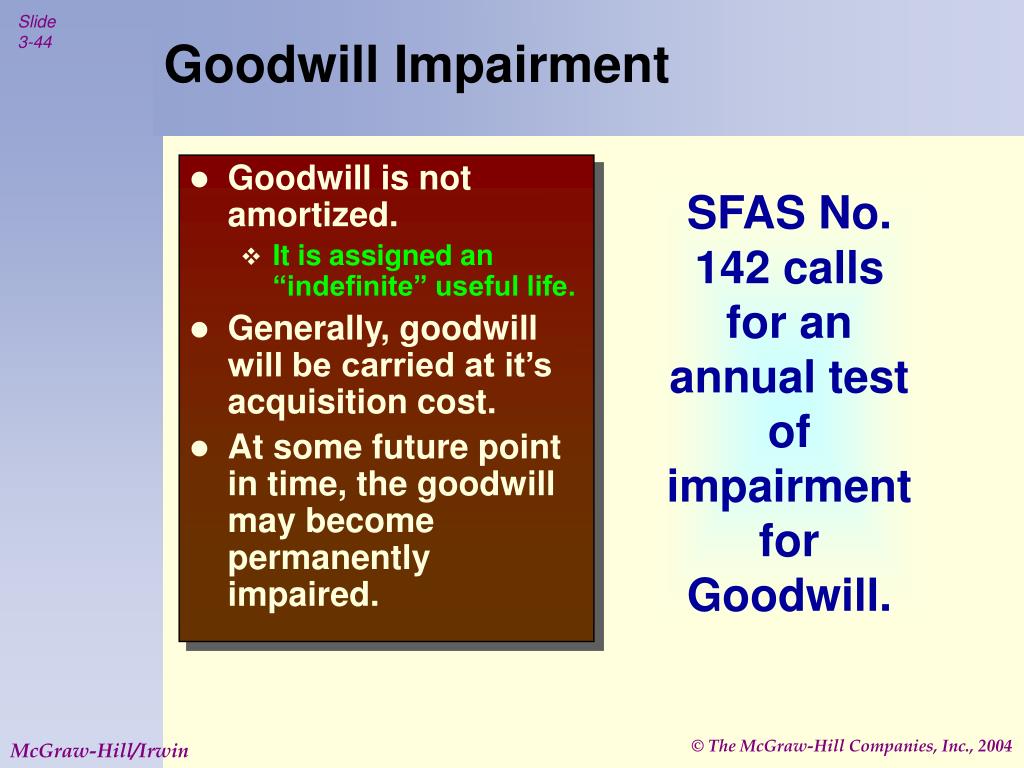

Gross goodwill and the impairment review. Why it matters the current guidance simplified the goodwill impairment test to address concerns related to the old guidance’s cost and complexity by eliminating step 2 (see. While entities have been required to test goodwill for.

Let’s consider unit alpha. Assess qualitative factors review the situation to see if it is necessary to conduct further impairment testing, which is considered to be a likelihood. A goodwill impairment test progresses in three broad stages:

Consider an impairment review of gross goodwill. In summary, goodwill impairment testing involves determining recoverable values for cgus annually and recognizing any excess of carrying amounts over. Because the fair value of the reporting unit ($380 million) is lower than its carrying value ($400 million), there is impairment of $20 million.

Goodwill impairment is an expense item on the income statement in. Goodwill in accounting is an intangible asset generated when one company purchases another company at a price that is higher than that of the sum of the fair value of net. A cgu or a group of cgus to which goodwill has been allocated is being tested for impairment when there is an indication of possible impairment, or.

Any goodwill impairment loss is recognized for both the parent and nci, and allocated between both on a rational basis. Why does goodwill impairment matter? How goodwill accounting has evolved.

The guidance addresses various aspects. Remember that the net assets are equal to assets minus liabilities.