Can’t-Miss Takeaways Of Info About Explanation Of A Balance Sheet List Owners Equity In Accounting

Add up liabilities and owners’ equity.

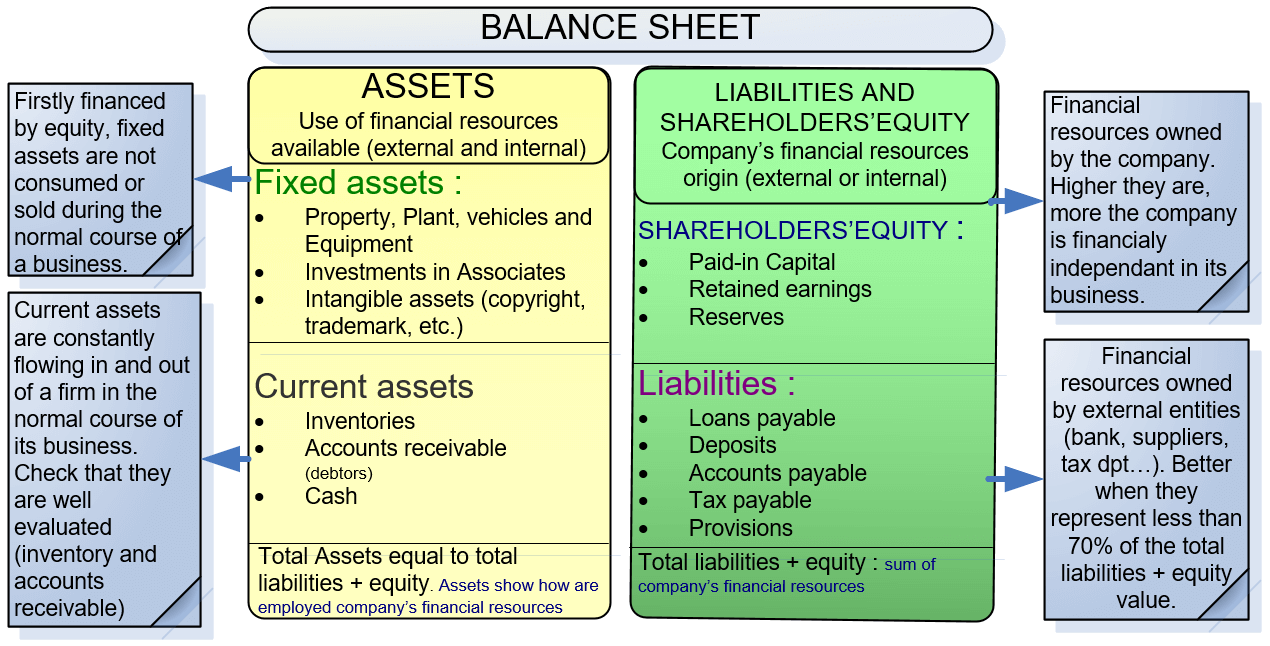

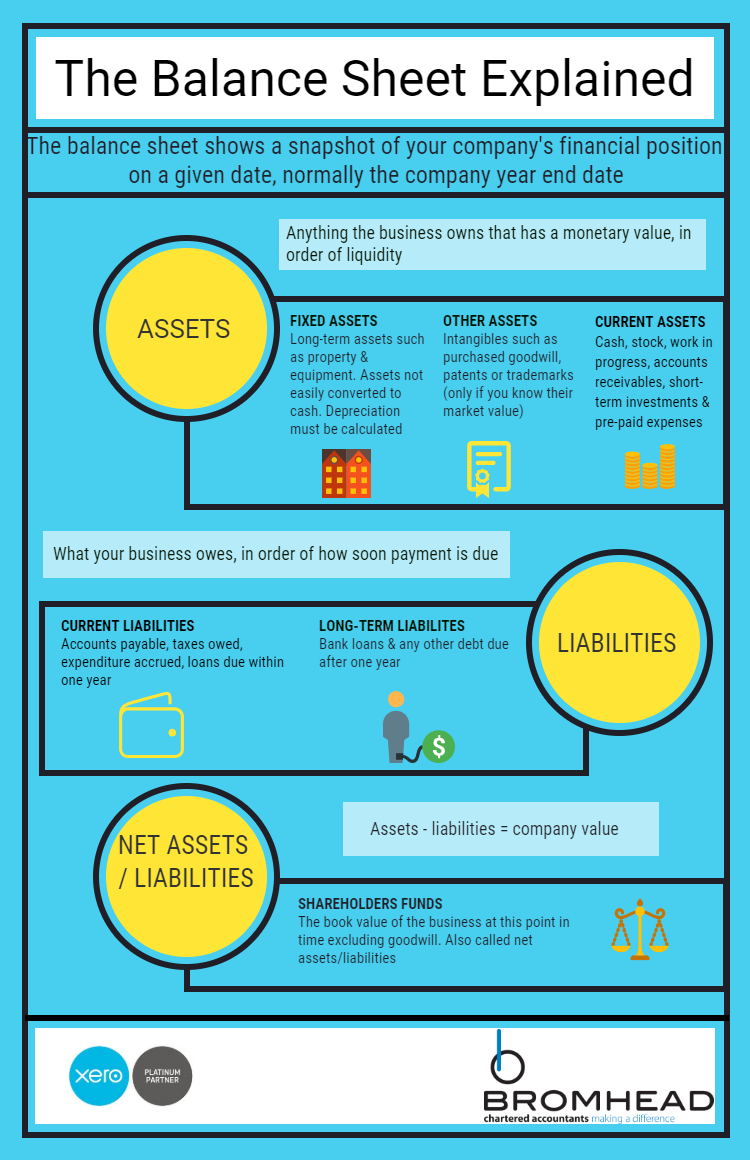

Explanation of a balance sheet. The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. It summarizes a company’s financial position at a point in time. The balance sheet is a key financial statement that provides a snapshot of a company's finances.

It records the assets and liabilities of the business at the end of the accounting period after the preparation of trading and profit and loss accounts. Essentially it’s a list of what a company owns, what it owes, and how much is invested in it. The balance sheet is a statement that shows the financial position of the business.

A quick glance at the balance sheet of a small business or large corporation can give investors clues about the company's financial health and net worth at a specific point in time. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. You can think of it like a snapshot of what the business looked like on that day in time.

A balance sheet is a financial statement that displays the liabilities, equity, and assets of a business, and thus the organization’s total value. And capital represents the portion left for the owners of the business after all liabilities are paid. Along with an income statement and a cash flow statement, a balance sheet helps show the financial.

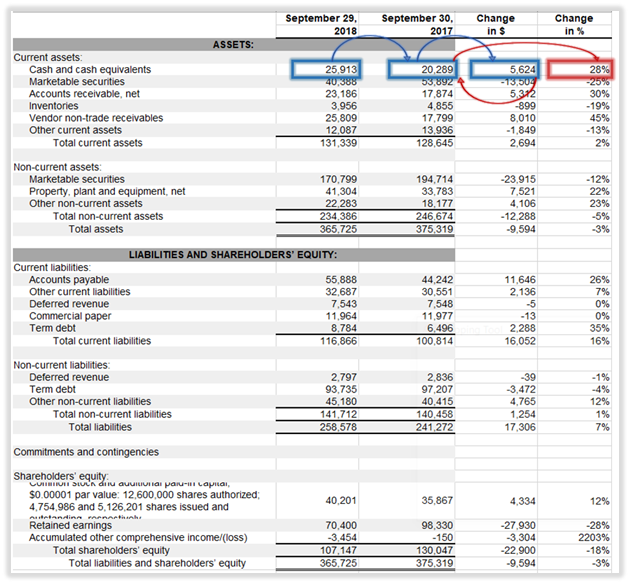

The balance sheet is split into two columns, with each column balancing out the other to net to. The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time. A balance sheet is a financial statement that reports a company's assets, liabilities and shareholder equity at a specific point in time.

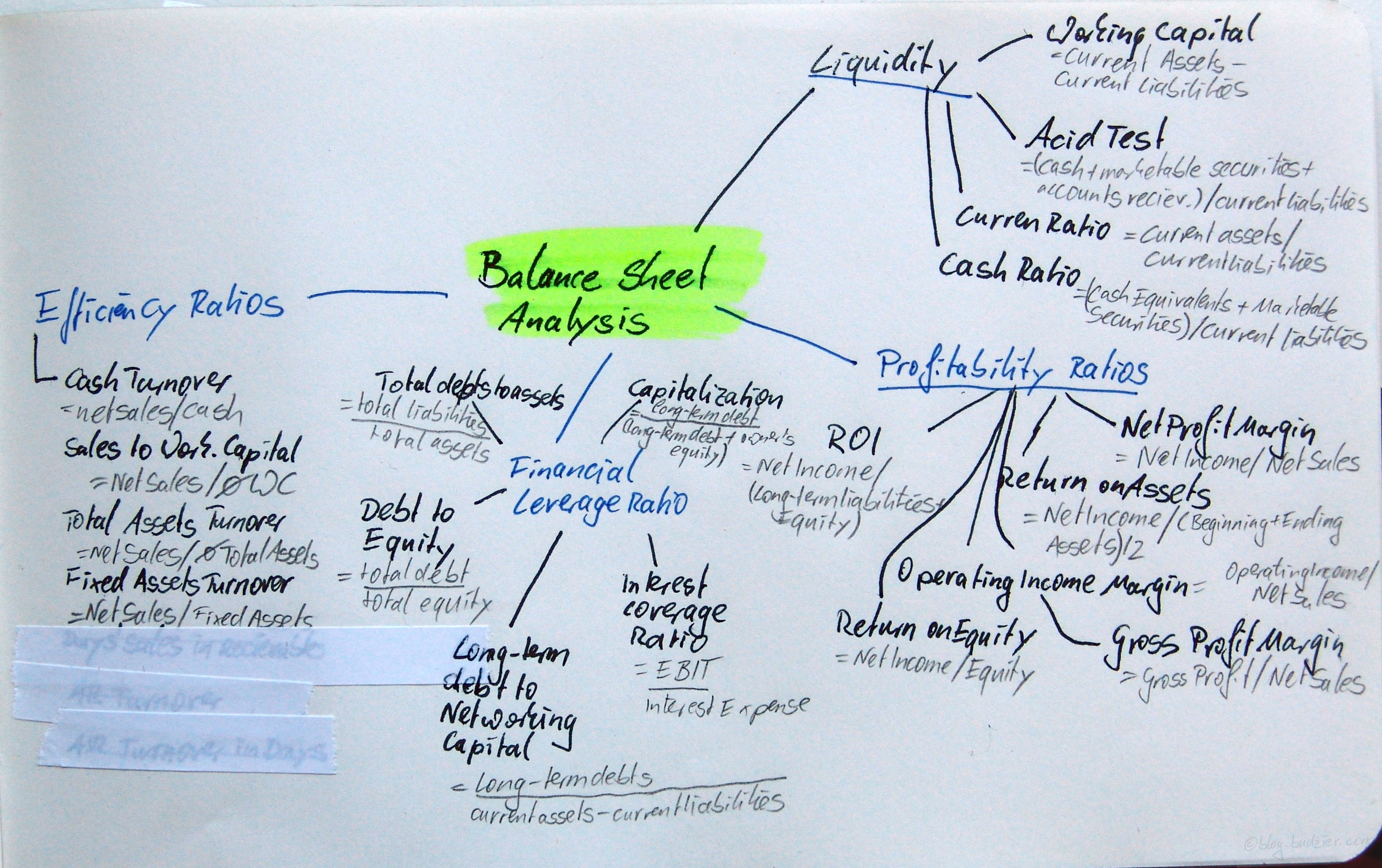

Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity. The fundamental accounting equation states that a company’s assets must be equal to the sum of its liabilities and shareholders’ equity. Assets = liabilities + shareholders’ equity.

It can also be referred to as a statement of net worth or a statement of financial position. It reports a company’s assets, liabilities, and equity at a single moment in time. A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time.

Following is a sample balance sheet, which shows all the basic accounts classified under assets and liabilities so that both sides of the. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity. At the same time, bank reserve balances — another large liability on the central bank’s balance sheet — are $3.54 trillion, according to the latest data.

Balance sheets serve two very different purposes depending on the audience reviewing them. Based on provisional unaudited data. Changes in balance sheet accounts are also used to calculate cash flow in the cash flow statement.

While income statements and cash flow statements show your business’s activity over a period of time, a balance sheet gives a snapshot of your financials at a particular moment. Current assets, unlike land, are items that can be converted into cash within one year like cash itself, inventory, and accounts receivable. The latest balance sheet data shows that intel had liabilities of us$28.1b due within a year, and liabilities of us$53.6b falling due after that.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

:max_bytes(150000):strip_icc()/balancesheet_final-1ed1eab17daa4b3aac72b3da9fbe50ef.png)

/investing-lesson-3-analyzing-a-balance-sheet-357264_FINAL-ff829eab9bf045c981c883c323bc0ca6.png)