Painstaking Lessons Of Info About Pro Forma Budget Example Reasons For Reconciliation Of Cost And Financial Accounts

3 types of pro forma statements.

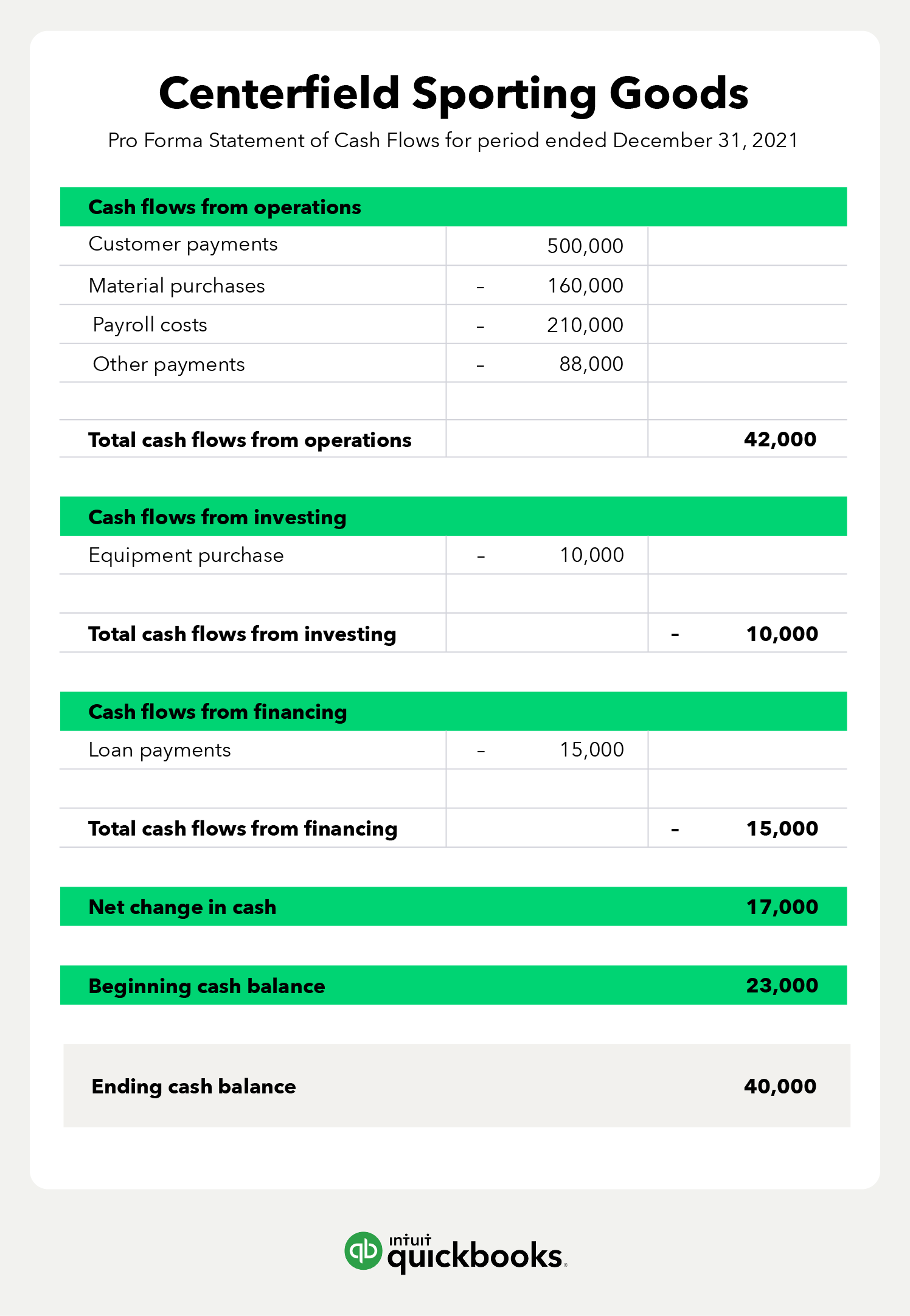

Pro forma budget example. Budgets are formulated based on pro forma financial statements to plan based on expectations. Another type of pro forma document is a pro forma cash flow that shows both you and potential investors the outflows and inflows of your. Pro forma cash flow:

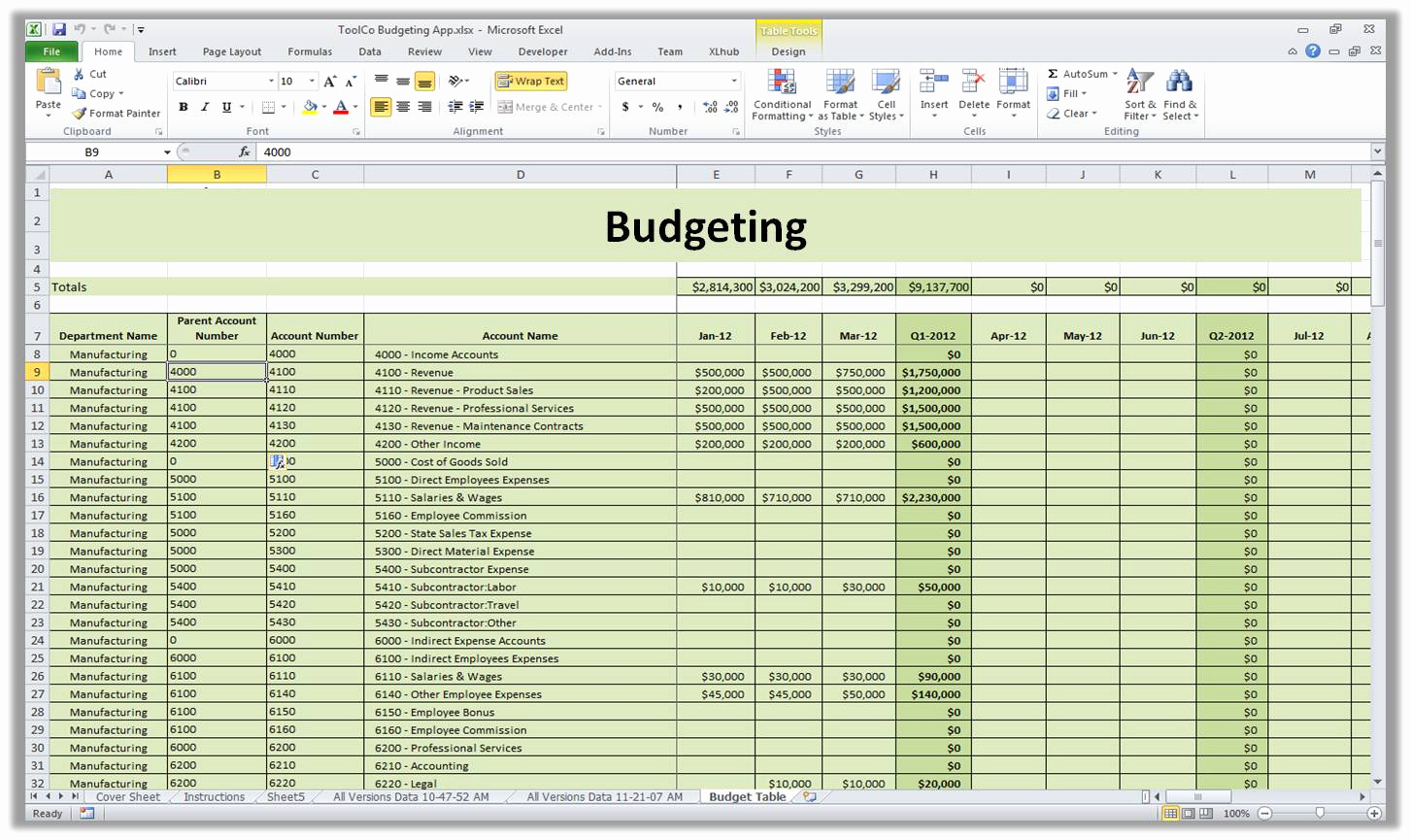

Your income this year is $37,000. Small business owners can use pro forma statements to draft forecasted financial statements, budgets, and quotes. According to your pro forma annual income statement, your financial.

The only real difference is that you’ll use some. Pro forma cash flow statement refers to the cash flow statement prepared by the business entity to prepare the projections of the amount of cash inflow and cash outflow they. Maybe your company is considering changes to its operating structure.

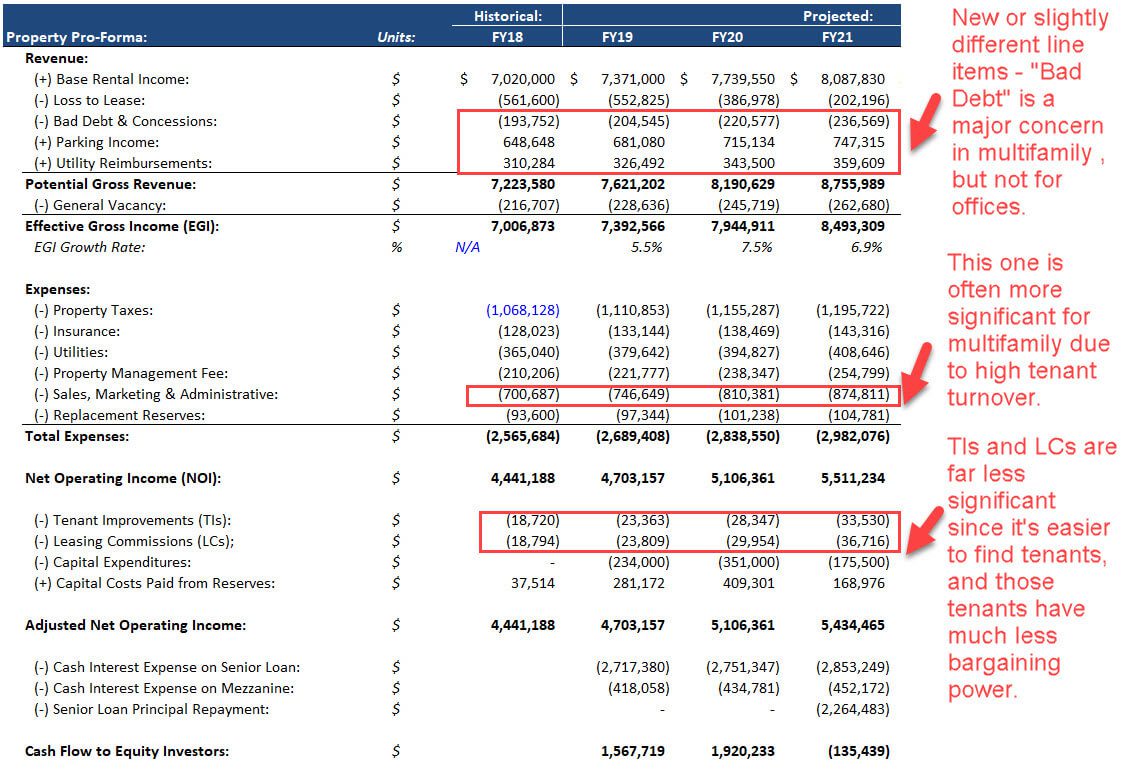

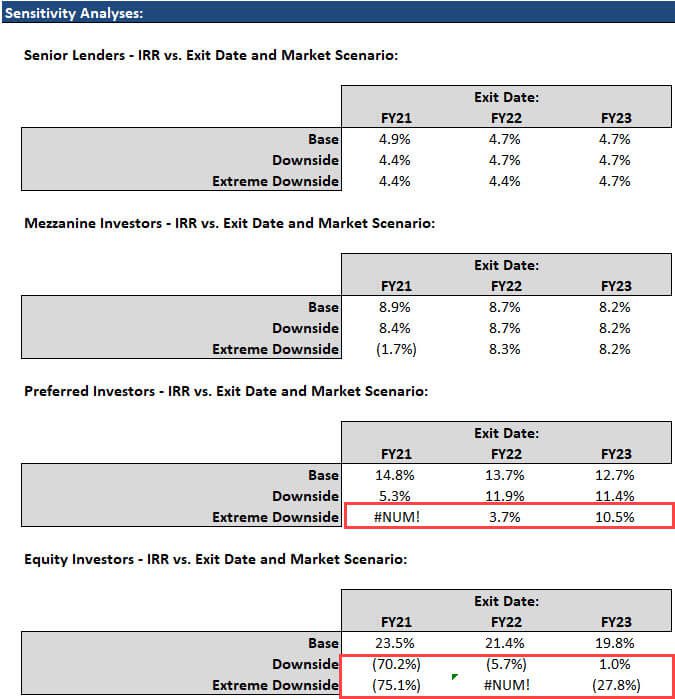

A pro forma budget forecasts revenues and expenses in advance for a particular project, such as a merger, loan, bankruptcy, new debt or equity payments. For example, you might ask yourself “what. What may happen if a business receives a $150,000 loan?

Startups create financial projections in the form of a pro forma income statement — which simply means a financial forecast. Produce a statement to look at how that debt would impact cash flow over a. However, you can create pro forma budget documents to help you plan for specific projects or departments.

For example as the owner of a running business if you wish to invest your money in another business activity or company, making a pro forma budget will assist. Cash flow statements pro forma documents can resemble normal statements, but they’re purely based on hypothetical questions. A pro forma budget is a projected budget based on “what if” scenarios.