Inspirating Tips About Income Tax Expense Balance Sheet Meaning Of Reconciliation Cost And Financial Accounts

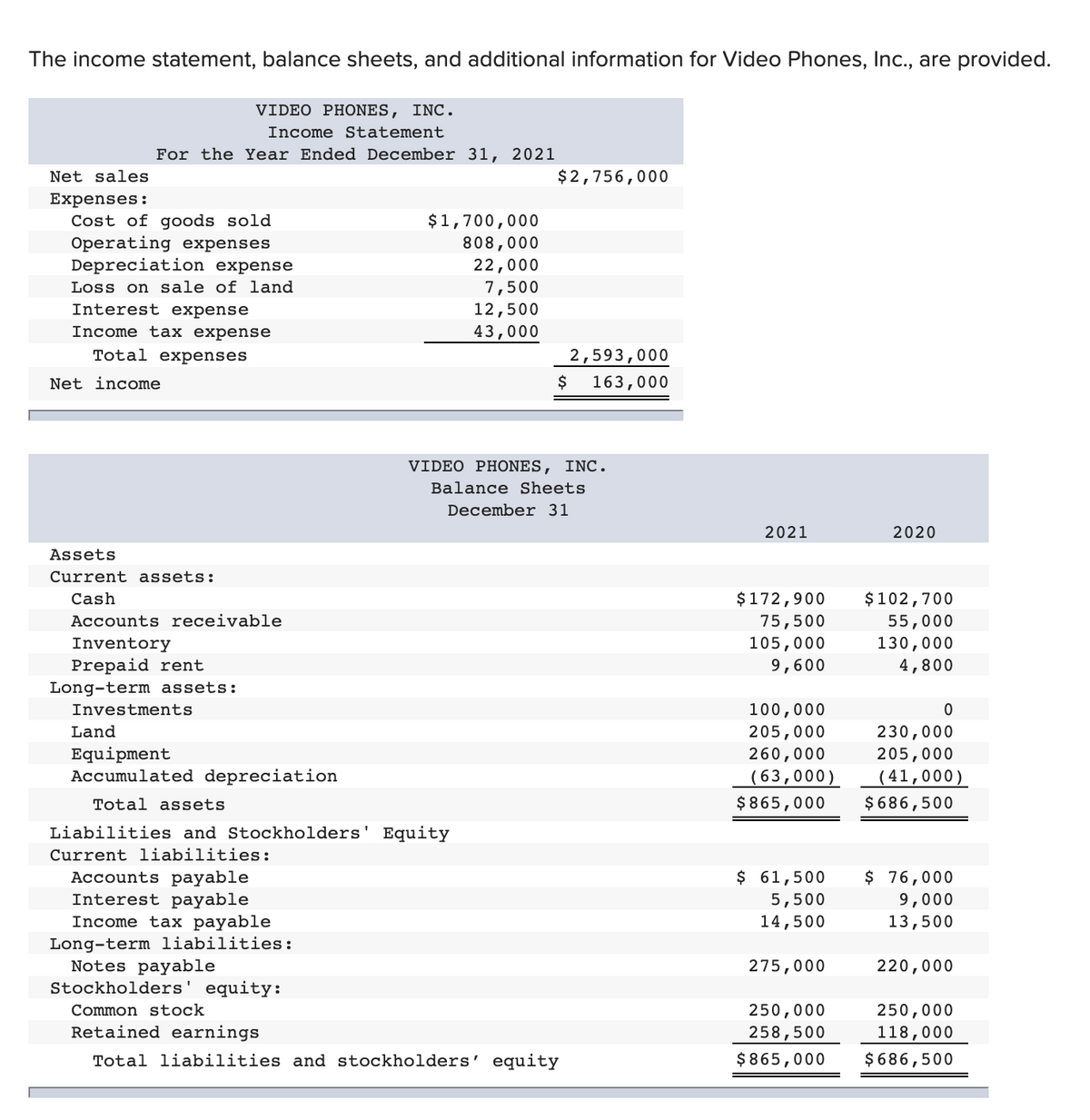

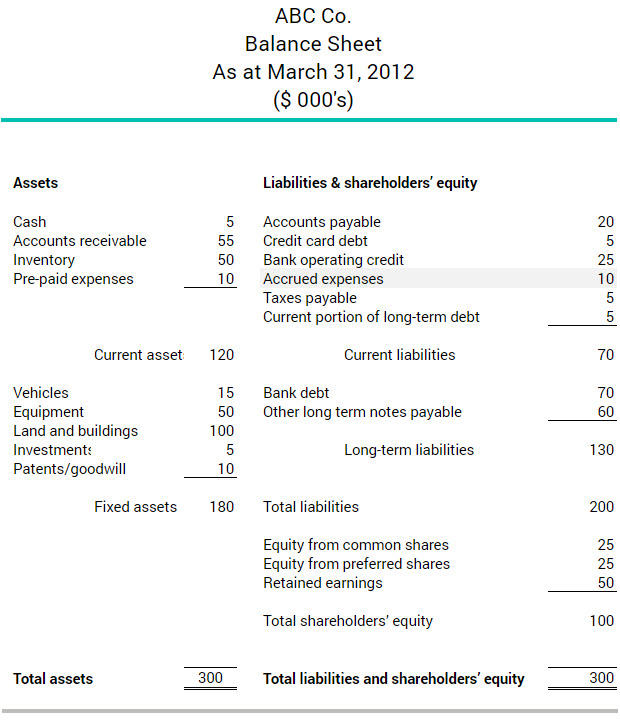

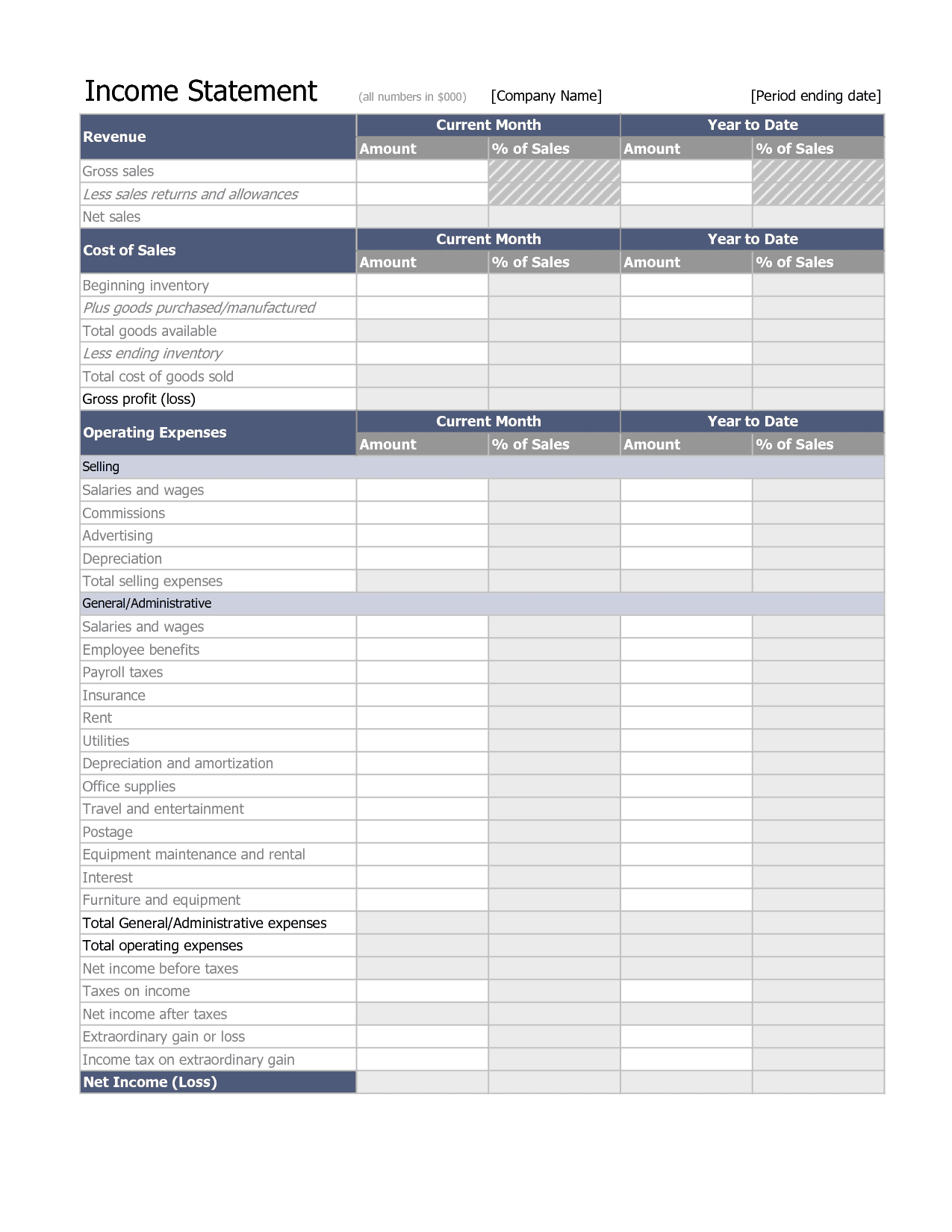

A balance sheet is one of three main financial statements businesses use to understand their financial health, the others being an income statement and cash flow statement.

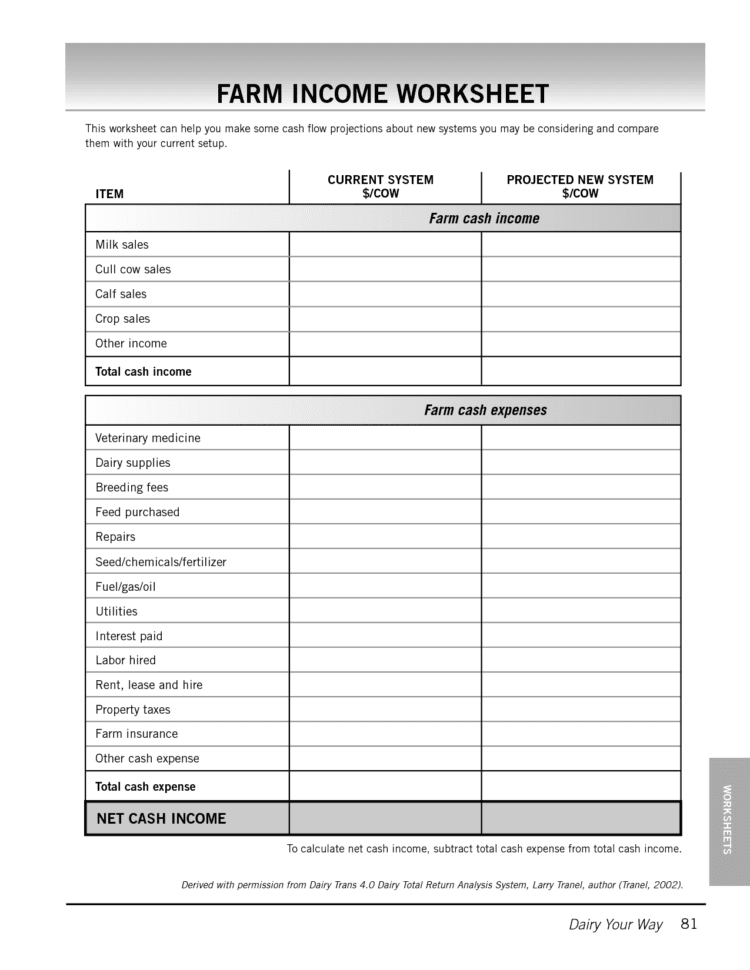

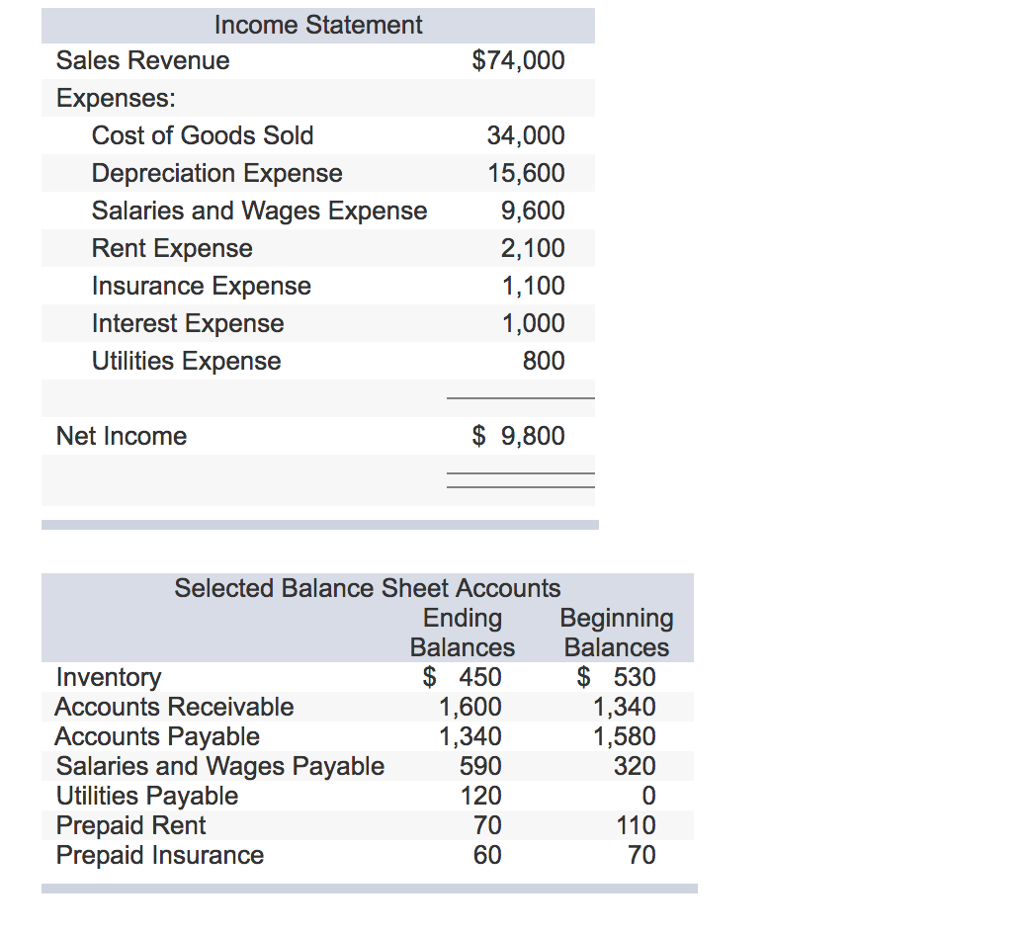

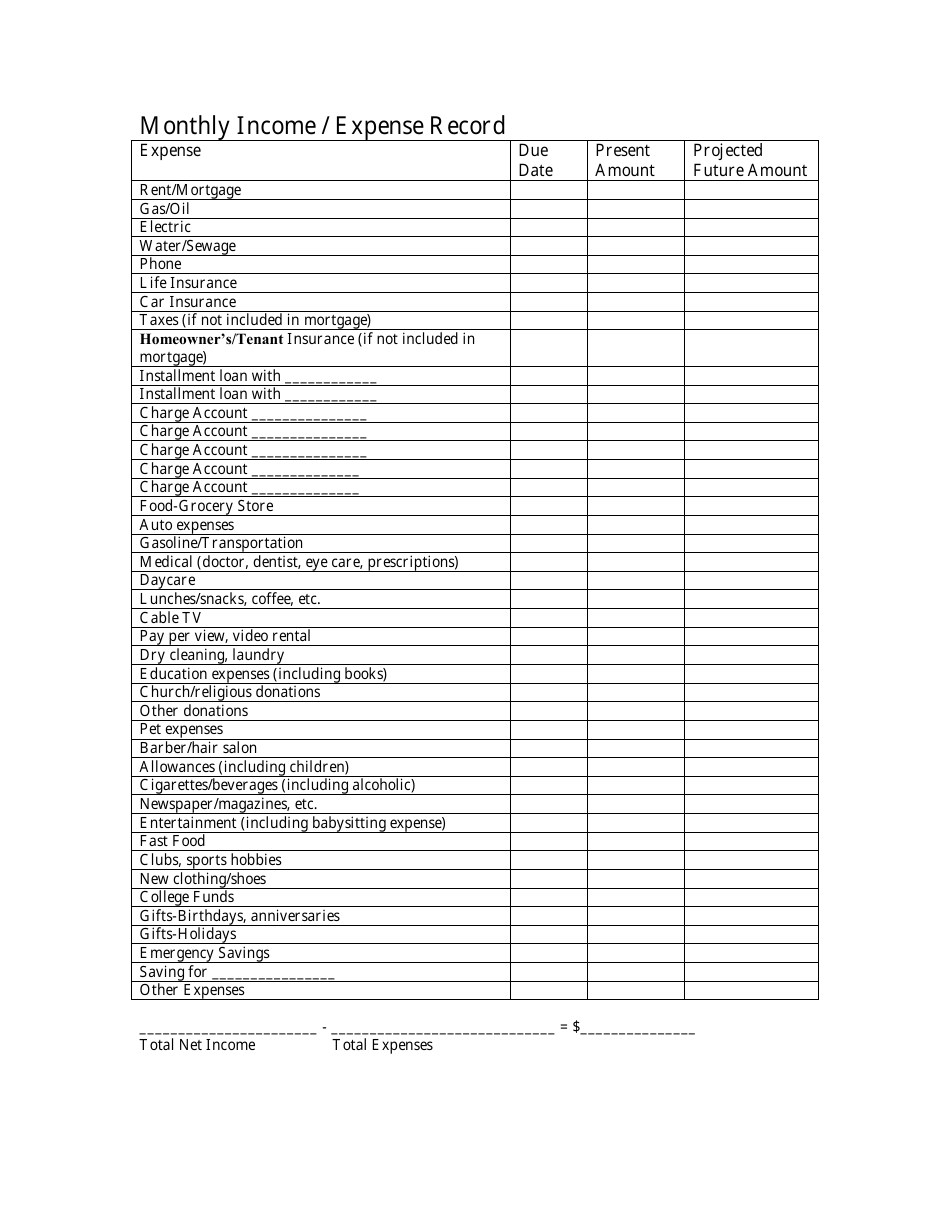

Income tax expense balance sheet. Add up all your gains then deduct your losses. Presentation of income tax expense. Taxable income x tax rate = income tax expense.

Input the appropriate numbers in this formula: Taxable income x tax rate = income tax expense for example, if your company had a total taxable income of $1. The income tax expense will reduce the.

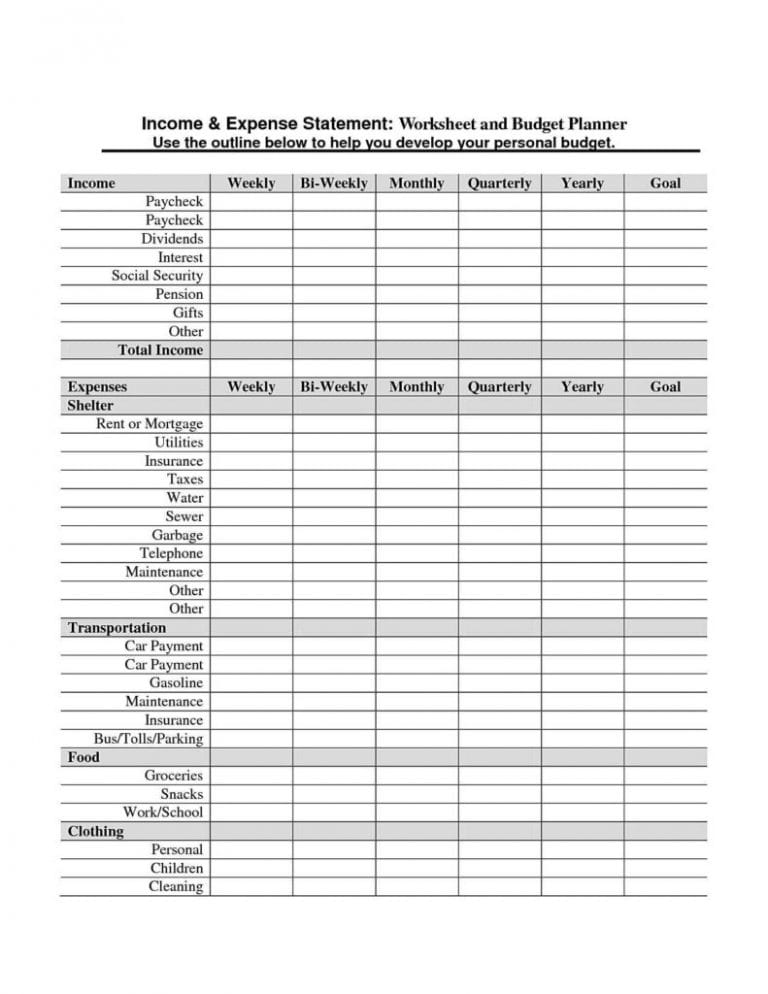

The income statement, or profit and loss statement, also lists expenses related to taxes. Income tax is an expense on profits earned for a specific accounting period; Income tax payable is a liability account that is shown on the balance sheet.

They are often regarded as the heart and soul of corporate. You use it to record any income tax amount that you owe but have not yet paid. 2023 — following feedback from taxpayers, tax professionals, and payment processors and to reduce taxpayer confusion, the internal.

Making of balance sheet and profit loss is utmost important. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. The last item is the tax.

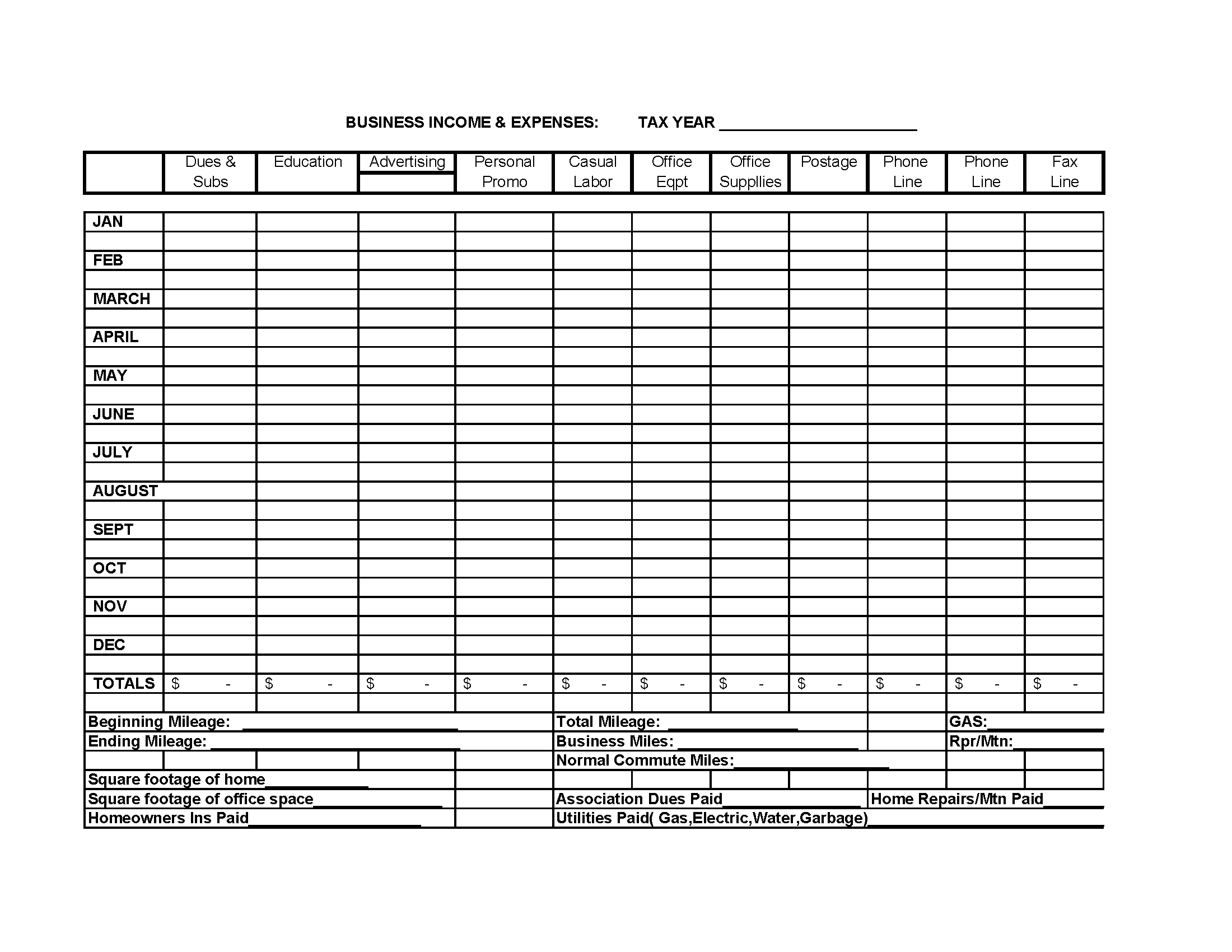

Filing of itr 3 and itr 4 requires the details of profit and loss a/c and balance in the format provided in the. Tax expenses are the total amount of taxes owed by an individual, corporation, or other entity to a taxing authority. Income tax expense on its income statement for the revenues and expenses appearing on the accounting period's income statement, and.

Income tax payable is the tax liability that a business has not yet paid to the applicable government, while income tax expense is the tax charged against taxable. As fixed assets age, they begin to lose their value. There are a lot of tax documents:

For instance, if you have a total taxable income of £10 million and a tax rate of 45%, your income tax. Financial income of €174 million, including positive financial interests of €112 million (returns on cash investments exceed cost of debt) and €66. Updated april 24, 2021 reviewed by margaret james fact checked by michael logan companies produce three major financial statements that reflect their business activities.

The income tax expense is reported as a line item in the corporate income statement, while any liability for unpaid income taxes is reported in the income tax payable line item on the balance sheet.