First Class Info About Form 26as Format Unearned Revenue Cash Flow Statement

It is also known as tax credit statement or annual tax statement.

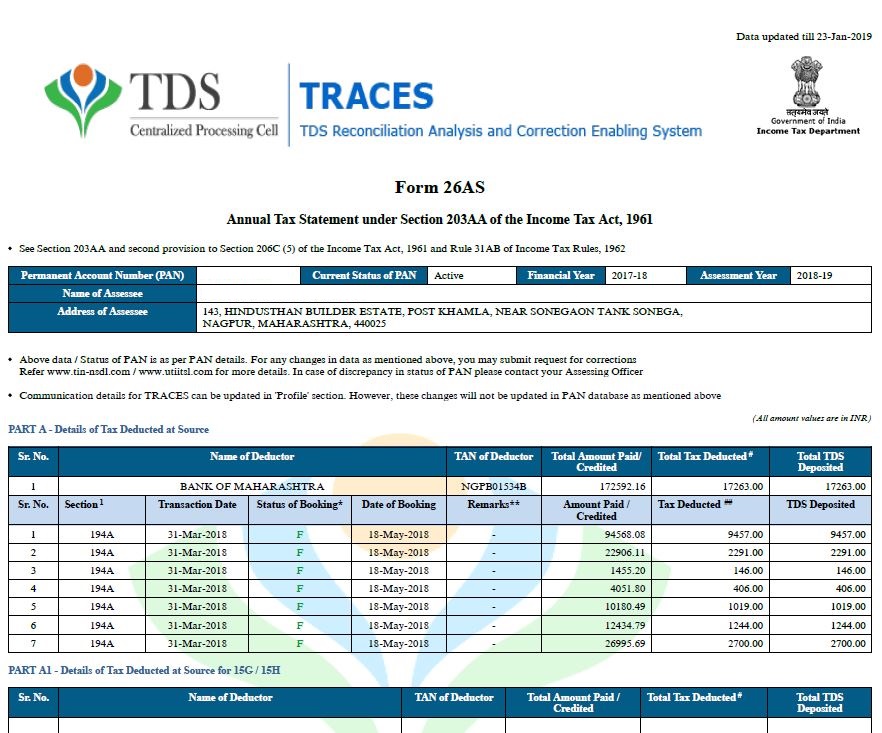

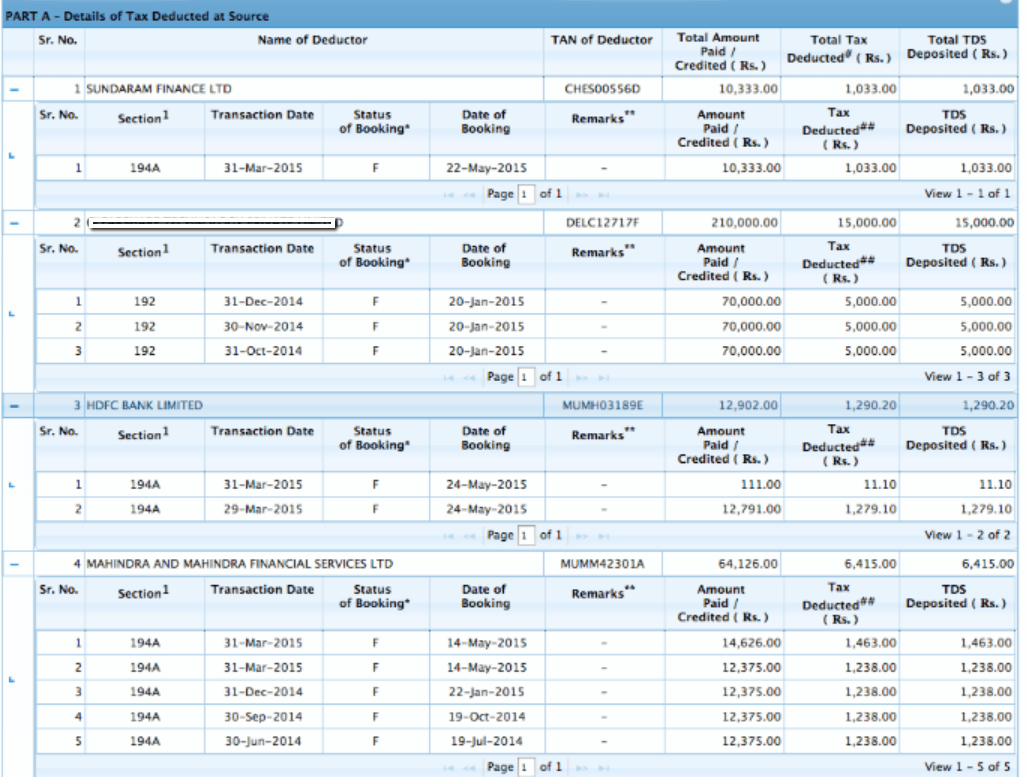

Form 26as format. It also contains details of tax, which is deducted at source and details of advance tax. Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer. Click on the ‘view form 26 as (tax credit)' option.

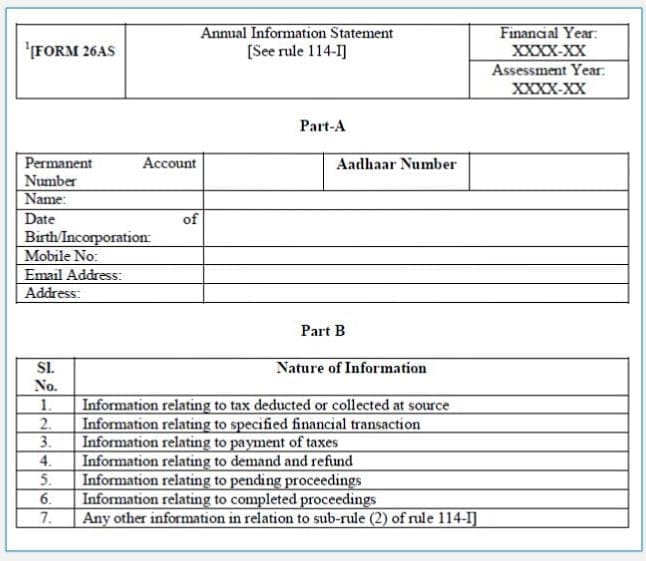

Introduction form 26as is a consolidated tax statement issued to the pan holders. What are the format and components of form 26as? The central govt has recently notified the changes to form 26as.

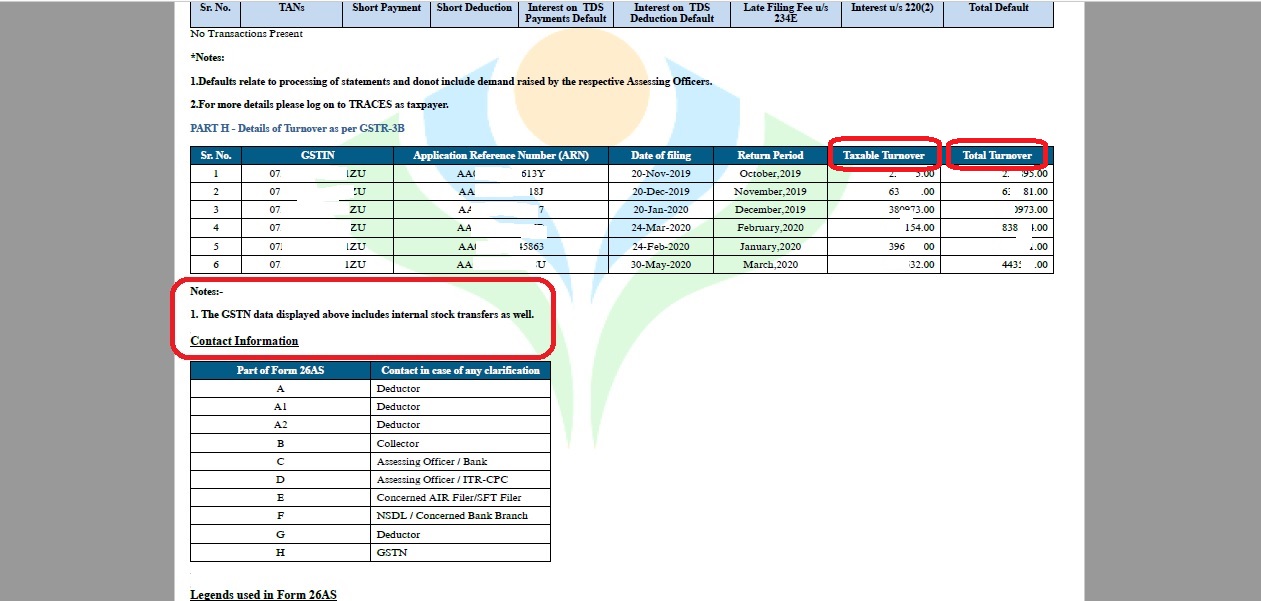

It sheds light on specified financial transactions (sft) and pending. The format of form 26as was introduced in 2020 and came into effect on 1 june 2020. Your tax passbook, i.e., form 26as, will now come with a new format, effective from 1st june,.

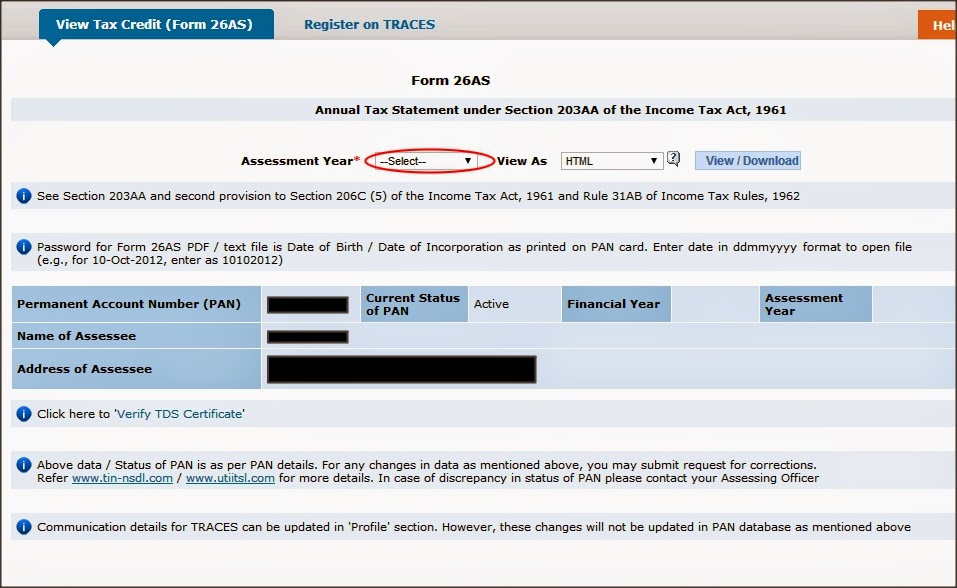

Form 26as includes the information on all the deducted tax on the income of deducted. After selecting the assessment year, you will be presented with different file formats in which you can download form 26as. The website provides access to the pan holders to view the details of tax credits in form 26as.

Click on the link at the bottom of the page that says 'view tax credit (form 26as)' to access your form 26as. Information on source tax deducted. Locate and select the form 16 option from the frequently used forms section.

Form 26as is an official form that contains details of the tax deducted by the deductor. Click view tax credit (form 26as) to view your form 26as’ is the link at the bottom of the page. Click ‘view tax credit (form 26as)’ select the ‘assessment year’ and ‘view type’ (html, text or pdf) click ‘view / download’ note to export the tax credit.

The form 26as structure contains details of all the financial transactions,. To view form 26as or. This new format will enhance the flow of information between taxpayers & tax.

With effect from june 1, 2020, a new format has been notified for form 26as. Use your user id and password to log into your account on the income tax india website. Form 26as is a statement that shows the below information:

Choose the assessment year and the. The new format of form 26as, implemented in june 2020, goes beyond routine transactions. Form26as is an important tax document in india, that every tax payer need to refer at the time of income tax filing, broadly contains the taxes.

To download form 26as, below are the following instructions outlined: Choose the assessment year and the form 26as format. Choose the ‘pdf’ format as it is widely.