Fun Info About A Personal Balance Sheet Summarizes Format Profit Loss Spreadsheet Example

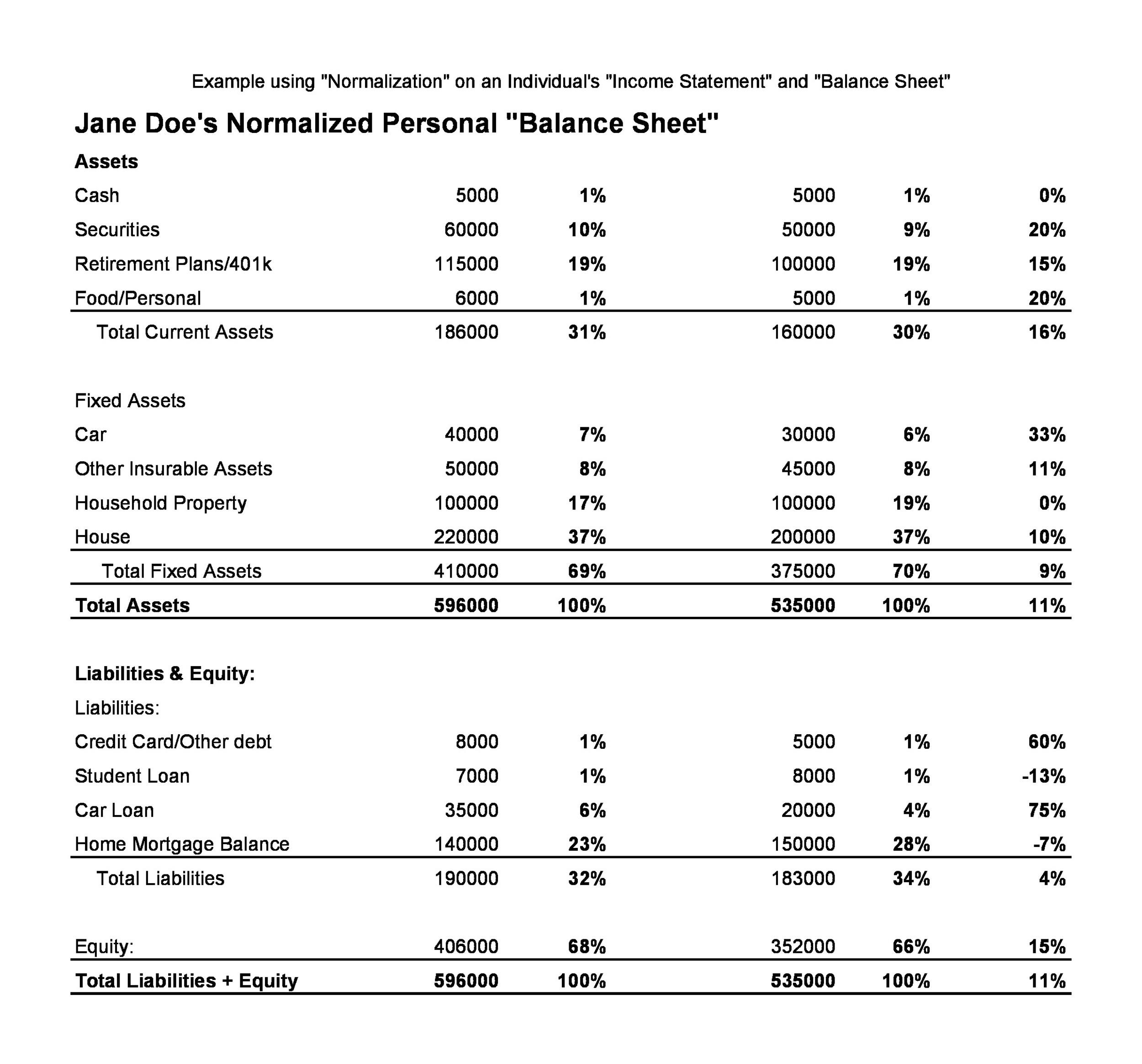

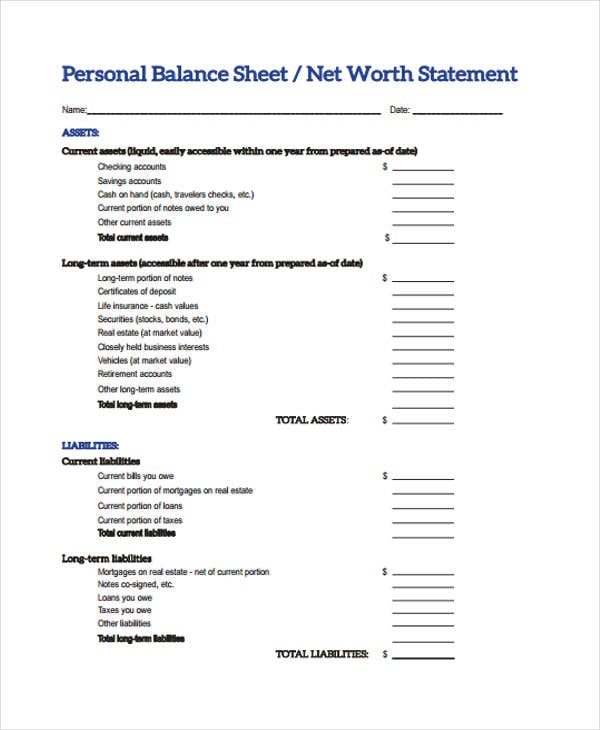

A personal financial statement, or pfs, is a document or set of documents that outlines a person or family’s financial position.

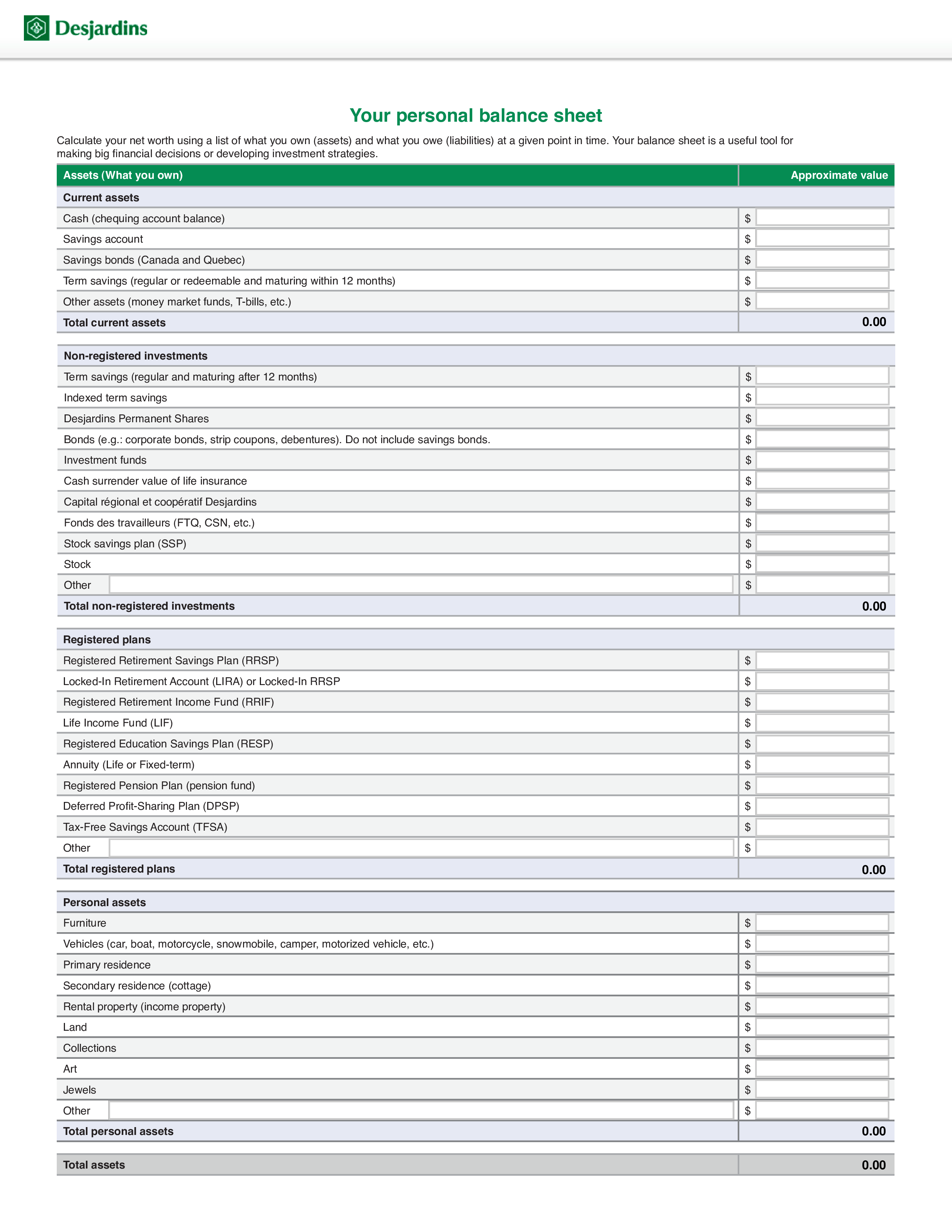

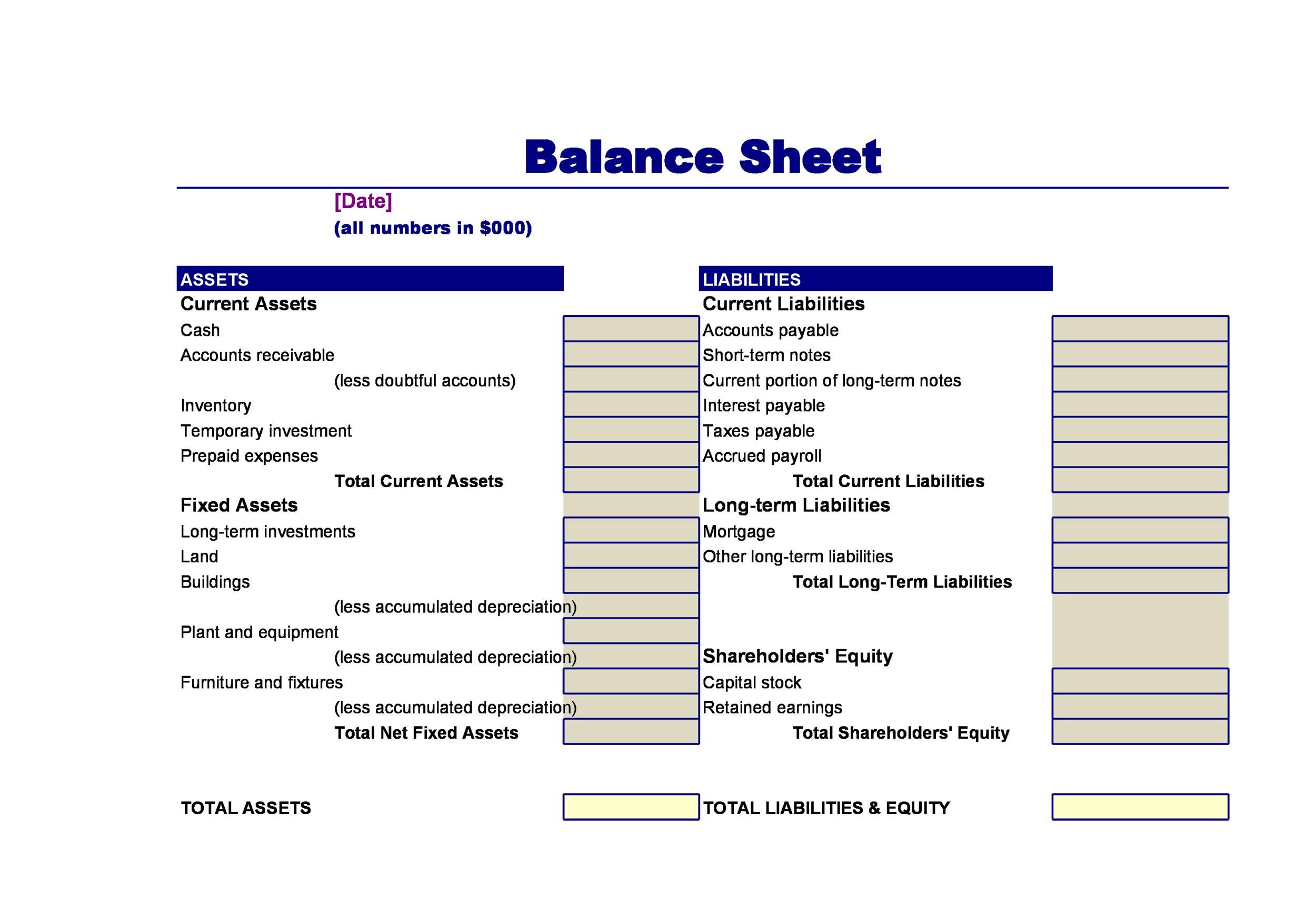

A personal balance sheet summarizes personal balance sheet format. A financial statement that lists items of value owned, debts owed, and a person's net worth. Categorize your total assets step 5: 18+ personal balance sheet templates.

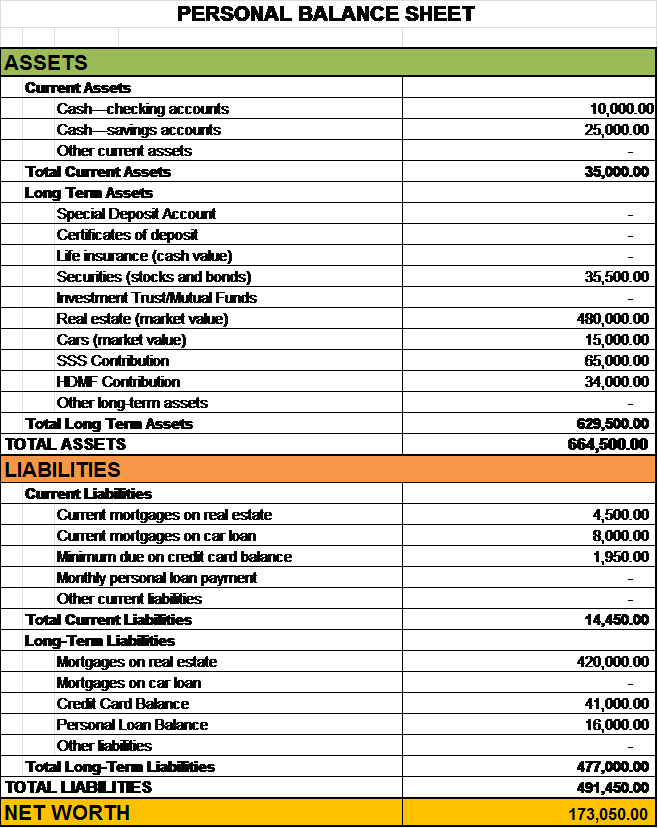

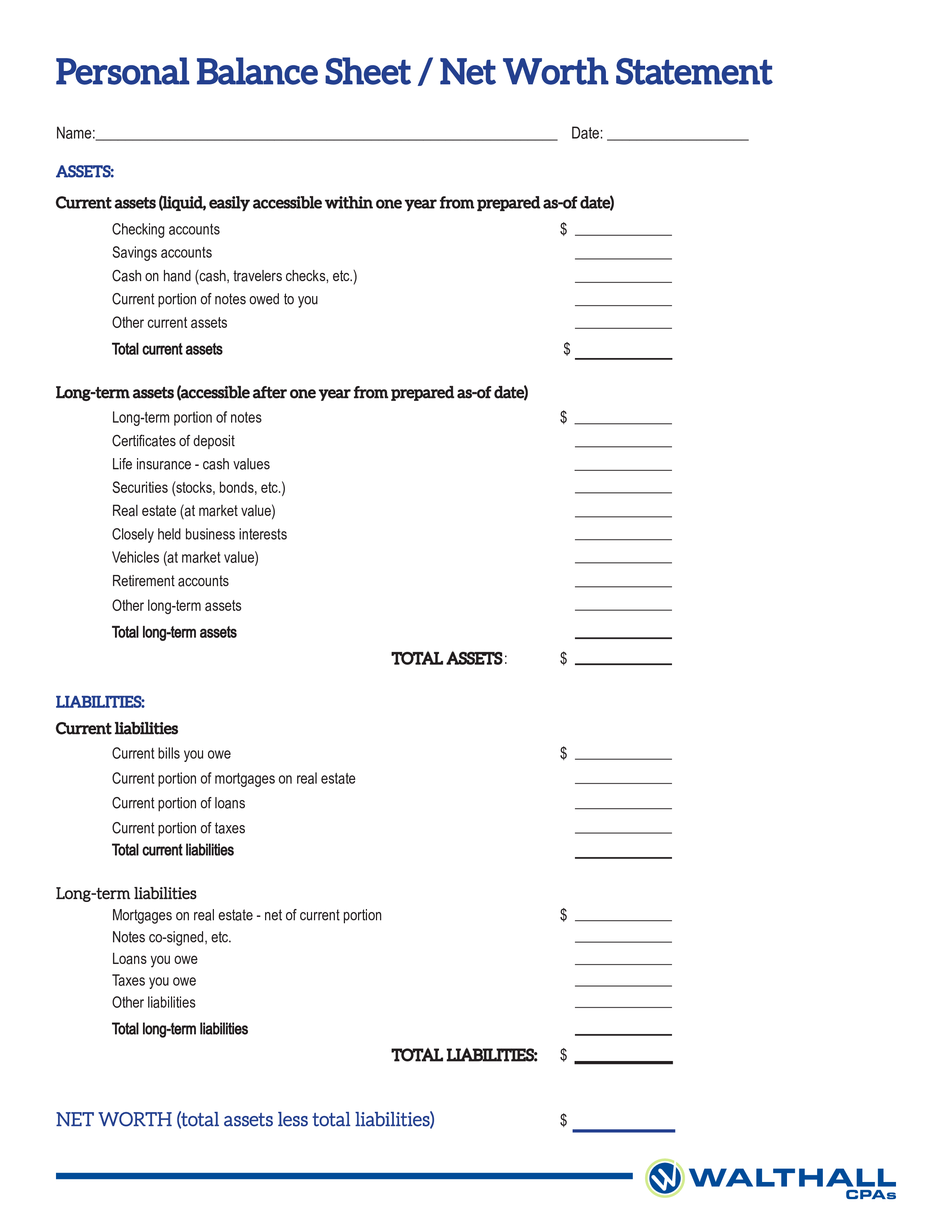

Download the balance sheet template. Subtract the liabilities from the total assets to determine net worth. Add the value of all assets.

Make a list of your debts and where to get the most current values. Calculate the total value of the assets that you own. A loss in value, such as a checking account.

You can use your personal balance sheet to provide you with an overview of your wealth at a specific point in time. Add the total obligations owed. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice.

Gather financial documents getting all your financial documents ensures you have accurate information. Documents you'll need to gather include your recent statements, such as ones from your bank, brokerage (and other investment companies), loans (like your mortgage) and any creditors. The first type of document is called a balance sheet.

A summary of your current personal financial condition. The sample personal balance sheet shown above outlines john’s financial position as of august 8, 2017. As the title suggests, this balance sheet helps compare balances of various accounts at different periodic accountings.

Money and other valuables belonging to an individual or business. Add up your assets the first step is listing all your assets and their current value. Categorize your total liabilities / debts step 6:

The personal balance sheet. You may have different types of assets, including. It lists all of an individual's assets and liabilities, with the difference between the two representing their net worth.

Make a list of your assets and where to get the most current values. The balance sheet contains statements of assets, liabilities, and shareholders’ equity. Quotes are not sourced from all markets and may be delayed up to 20 minutes.

Personal cash flow statement a personal cash flow statement measures your cash inflows and. Checking accounts savings accounts retirement accounts, such as an ira equity in real estate (but don’t include your mortgage, as that is a liability) the market value of other valuable items (e.g., cars) The value of assets owned.