Recommendation Info About Statement Of The Financial Position A Business Cash Flow

Beyond costs, achieving singapore’s ambitious green

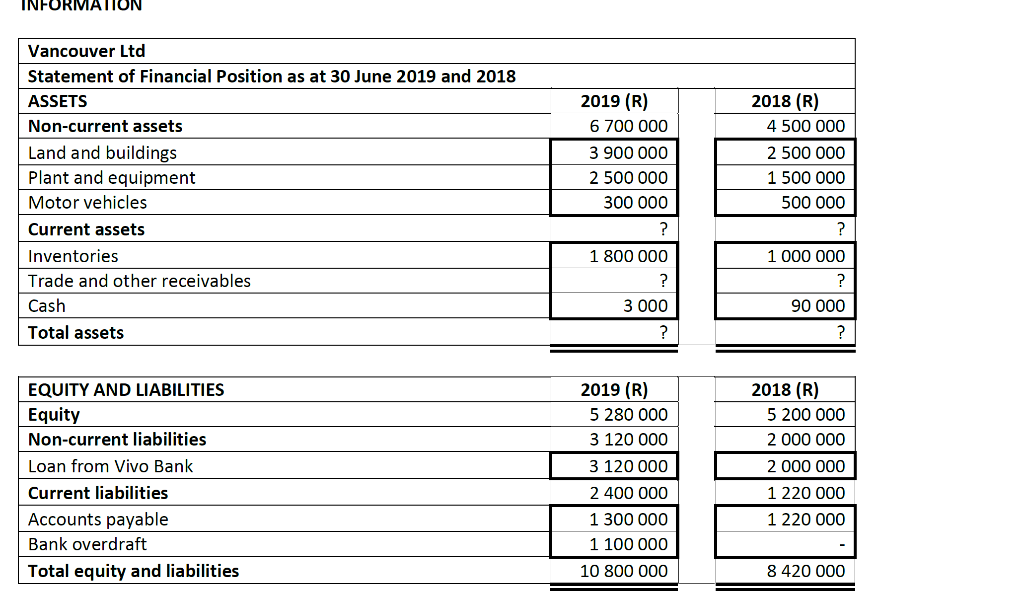

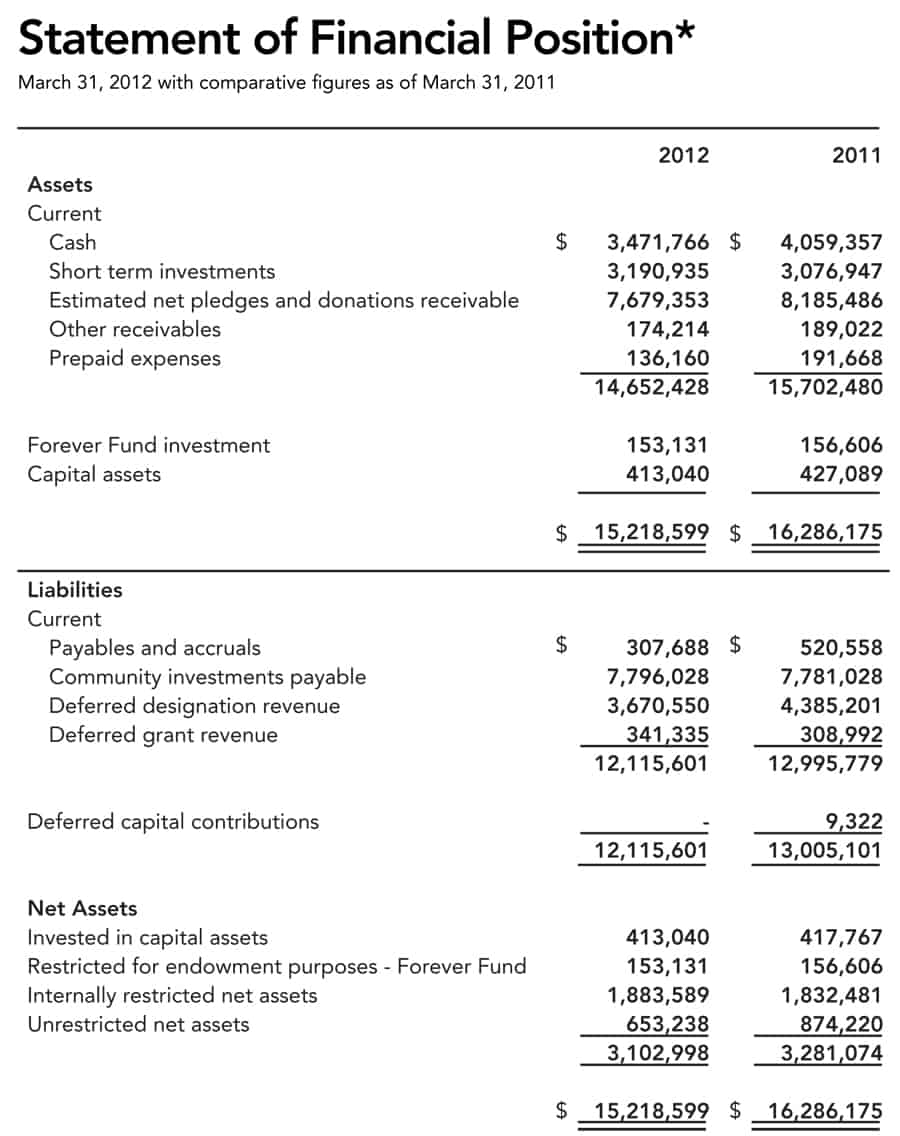

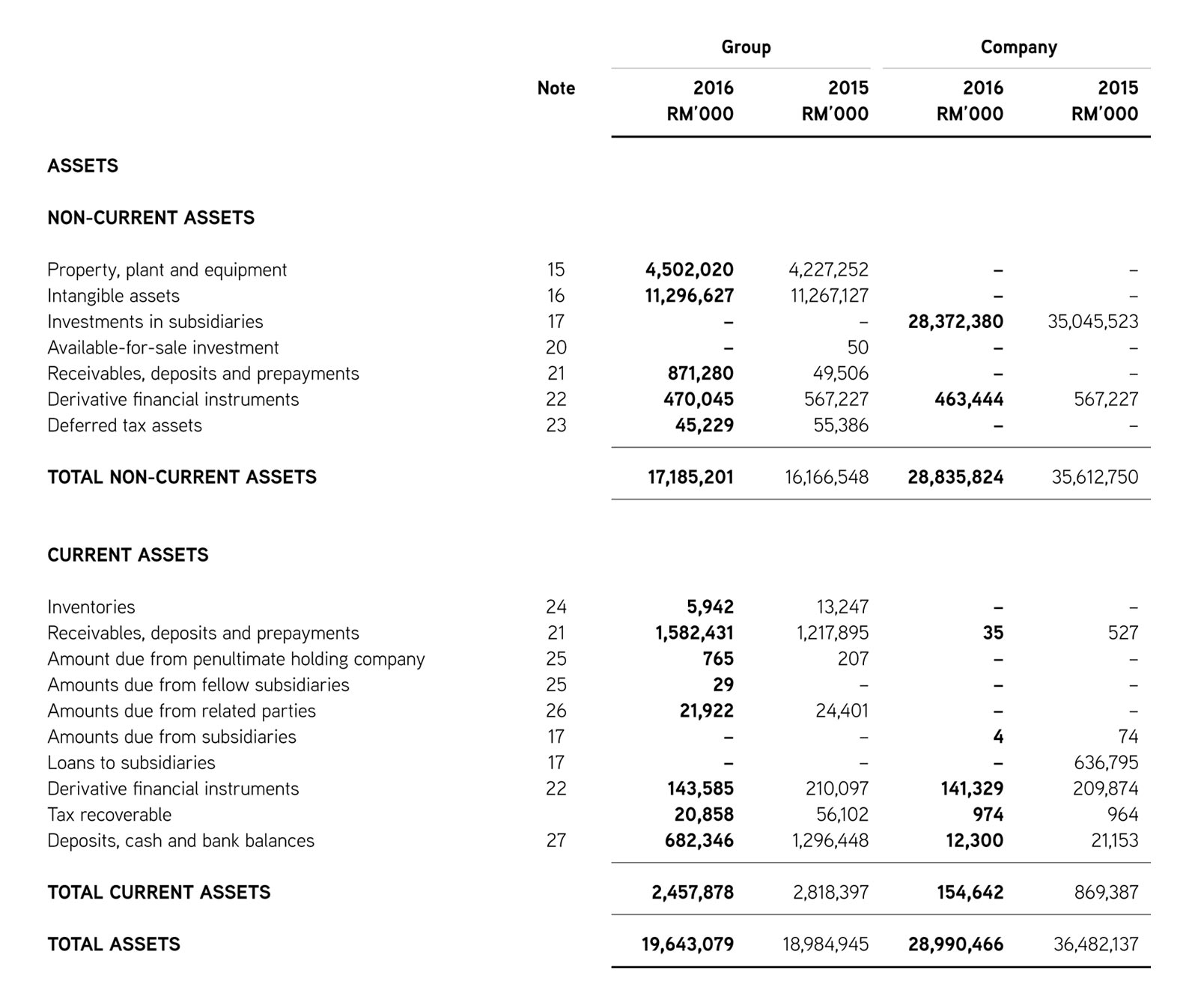

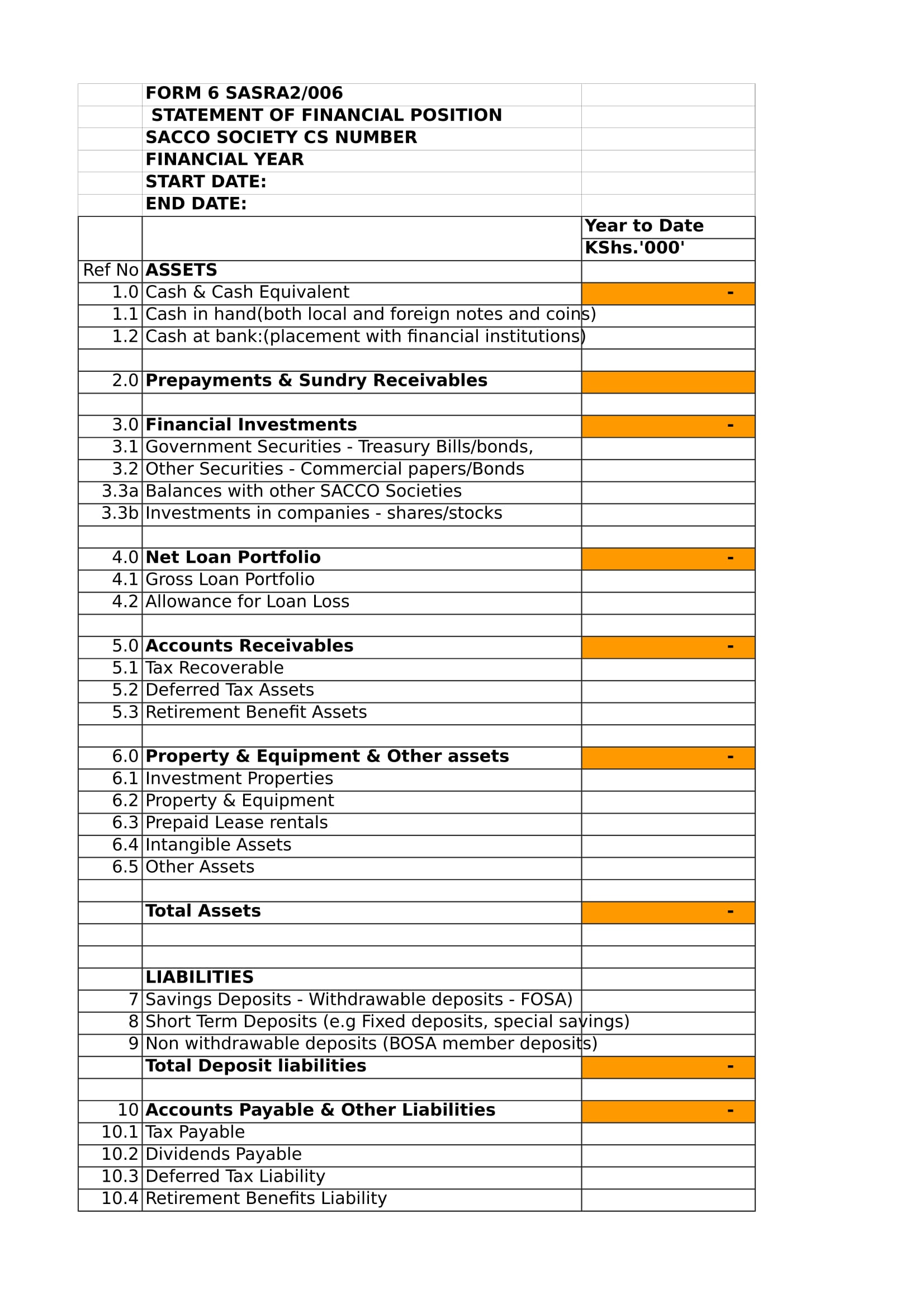

Statement of the financial position of a business. Notably, this is one of the highest rebates announced in recent years. There are two key elements to the financial statements of a sole trader business:. It is one of the three main financial statements used in business finance, along with the income statement and the cash flow statement.

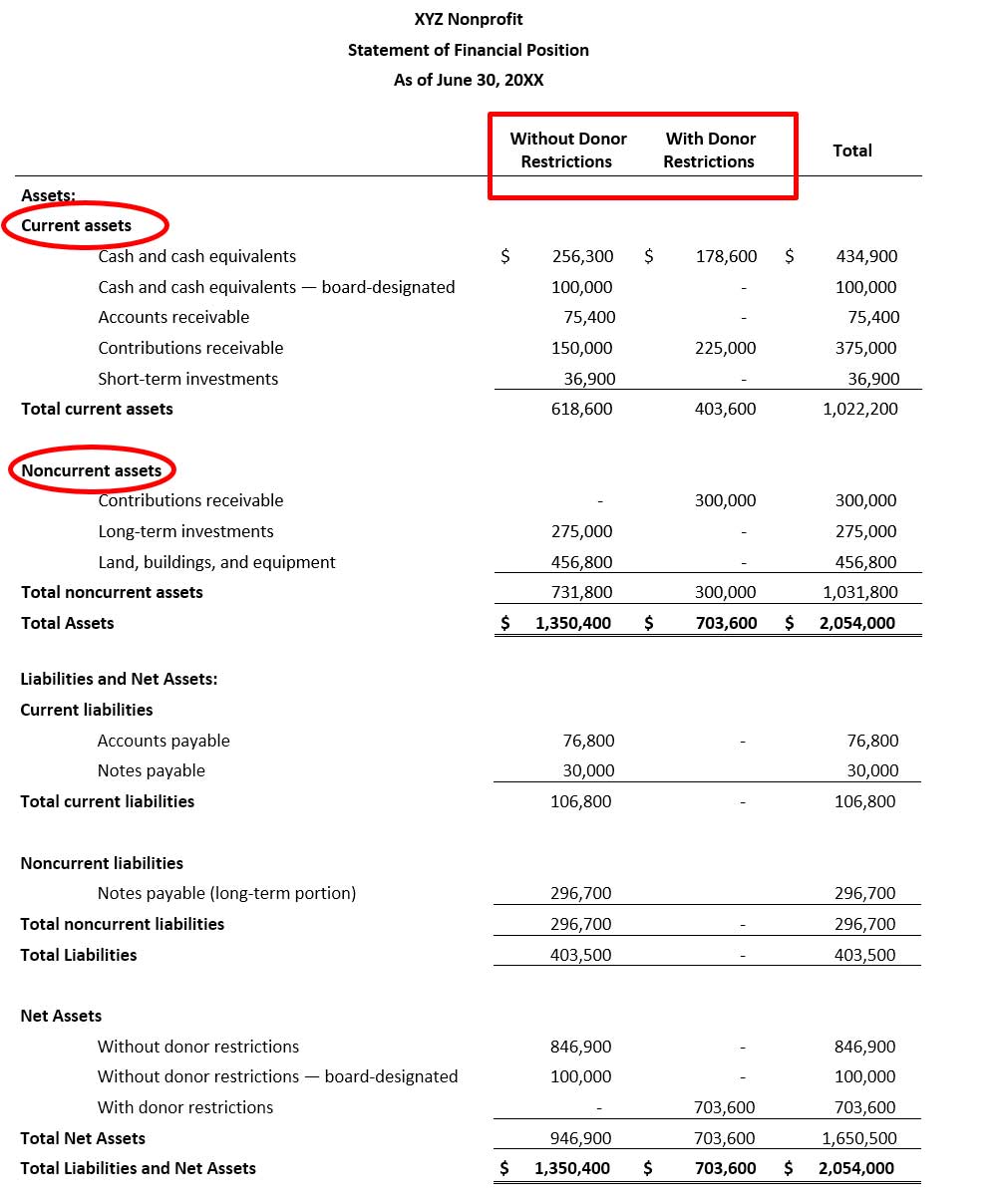

Thus, it provides an overview of what a company owns. Assets = liabilities + equity here, assets are what the firm owns. It allows you to see what resources it has available and how they were financed as of a specific date.

A balance sheet conveys the “book value” of a company. It identifies a businesses assets and liabilities and specifies the capital (equity) used to fund the business operations; Statement of financial position, also known as the balance sheet, gives the understanding to its users about the business’s financial status at a particular point in time by showing the details of the company’s assets along with its liabilities and owner’s capital.

By comparing figures for other years, you can compare performance with previous year and highlight any risks or opportunities. It lists the assets, liabilities, and owner’s equity. Investors value a company by examining its financial position based on its financial statements and calculating certain ratios.

Who uses a statement of financial position? It is called the balance sheet as the net assets are equal to. A statement of financial position shows the value of a business on a particular date.

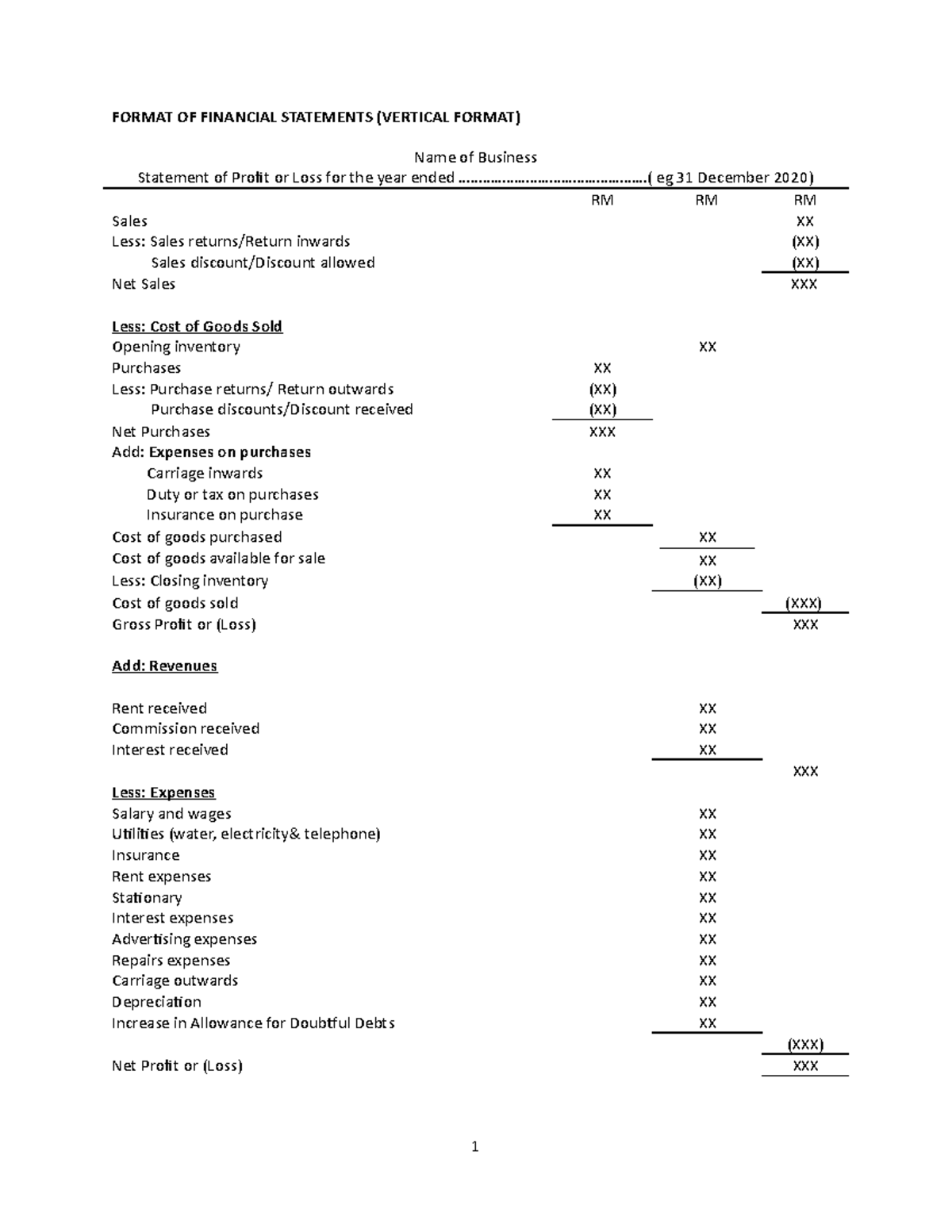

Here are some key points about the. Income statement, showing the financial performance of a business over a period of time.; The statement of financial position formula is:

A statement of financial position, also known as a balance sheet, is a financial statement that provides a snapshot of a company's financial position at a specific point in time. Assets = liabilities + equity. As such, it provides a snapshot of the financial condition of.

Financial statements are a key tool for running your business. Record adjusted ebitda margin fourth. The purpose of a cash flow statement is to take all of the cash flow movements and reconcile them into efficient cash figures, using the aggregate financial data relating to the.

Statement of financial position helps users of financial statements to assess the financial soundness of an entity in terms of liquidity risk,. The statement of financial position, also commonly known as the balance sheet, serves as a snapshot of a company's financial position at a specific point in time. A statement of financial position is used by business owners, investors, and management to quickly get an overview of the financial strengths and potential of a business.

Simply put, a statement of financial position is a snapshot of a company’s entire financial position over a specific time period. These stakeholders use the statement to guide their fiscal decisions for the future. The financial statements show the effects of.

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)