Awesome Tips About Rental Income In Statement Cash Flow As3

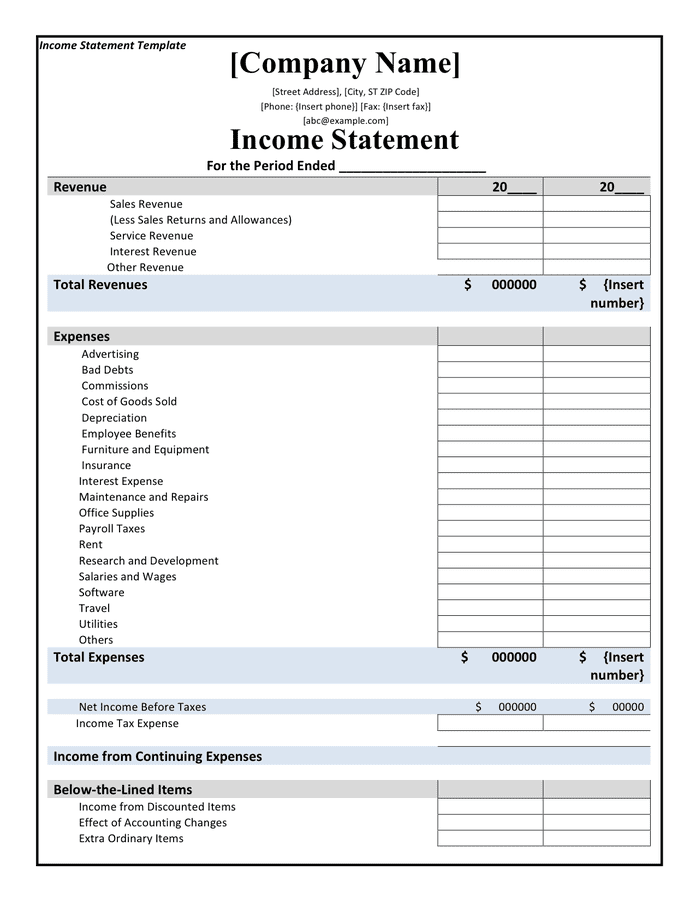

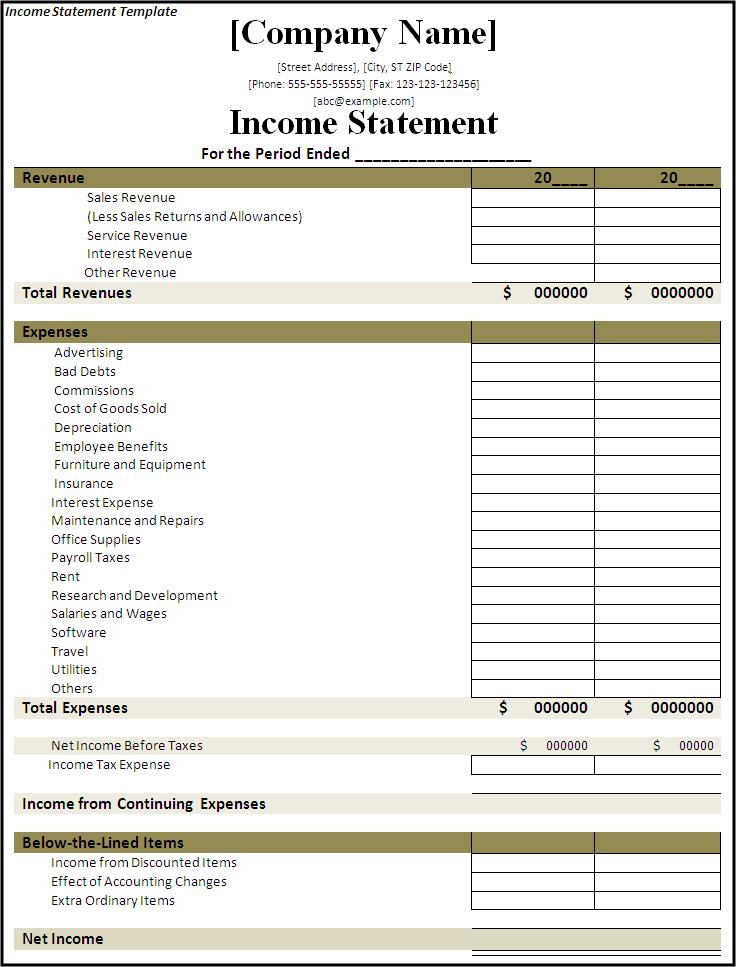

Here are the key components that should be included:

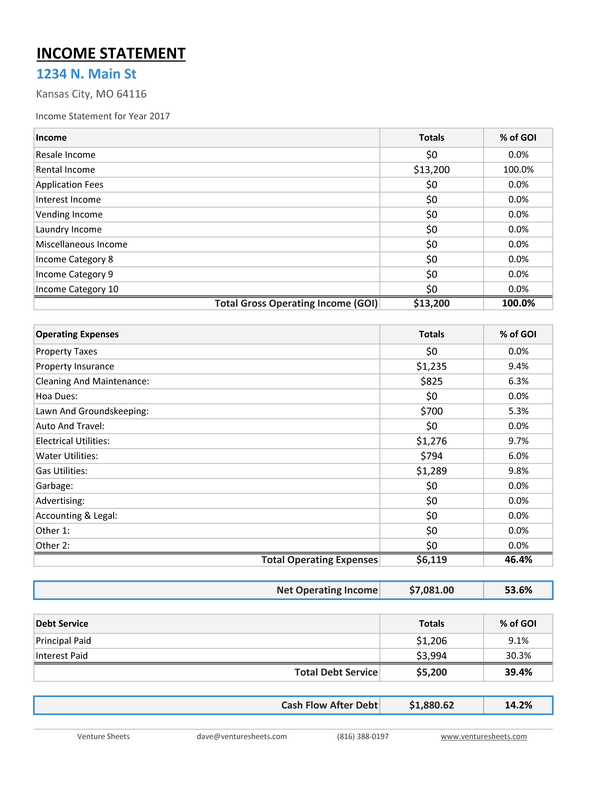

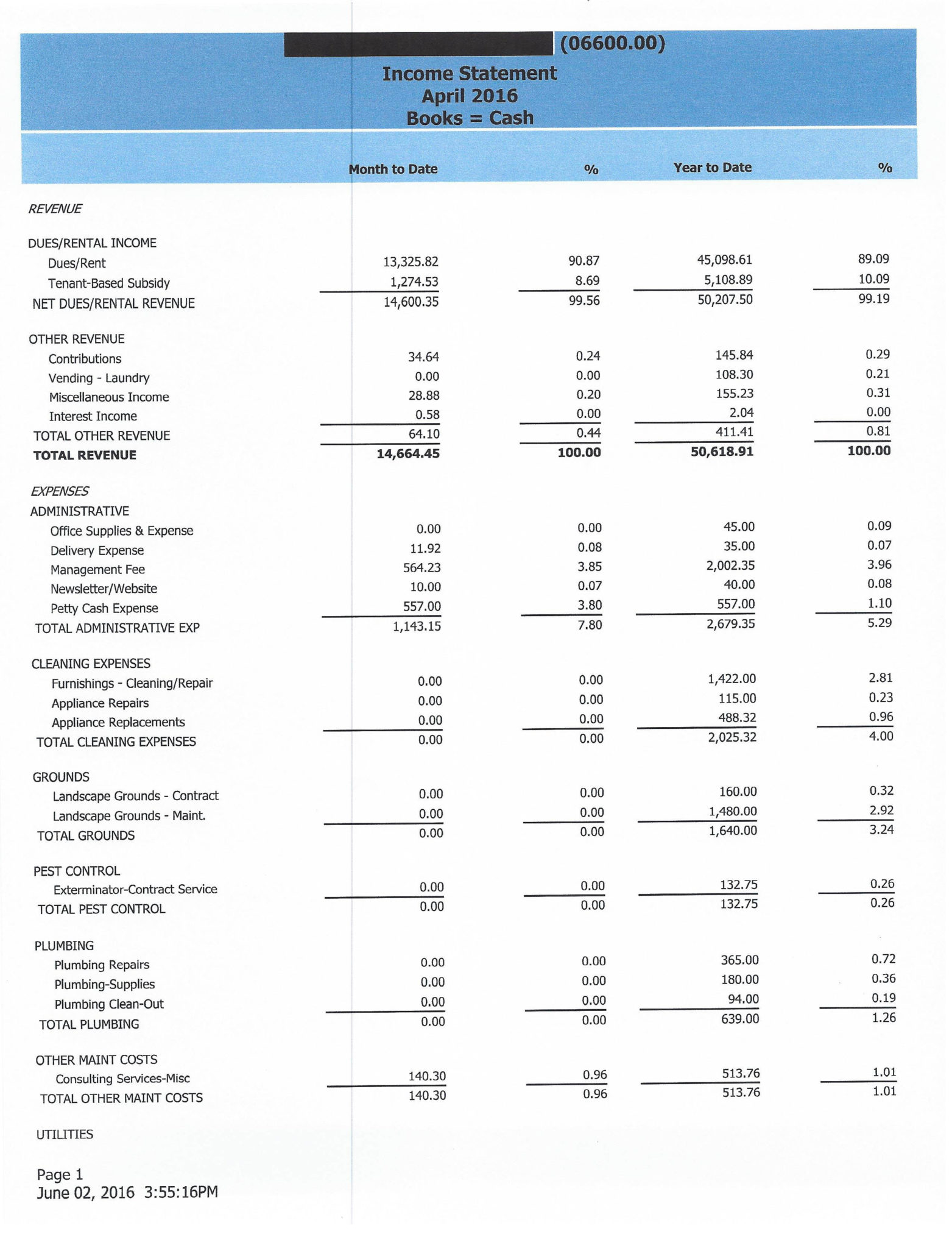

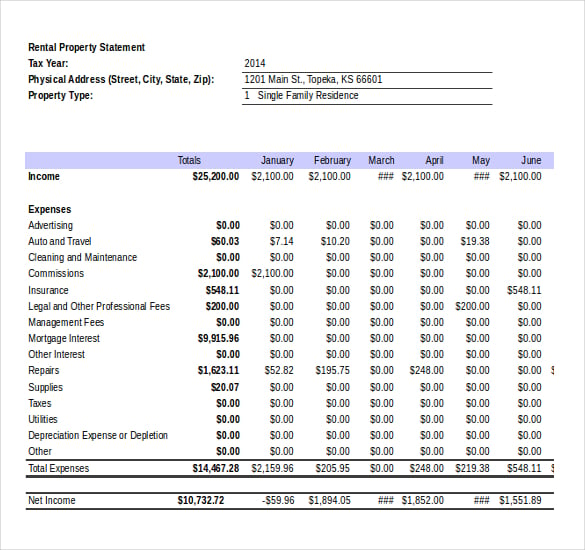

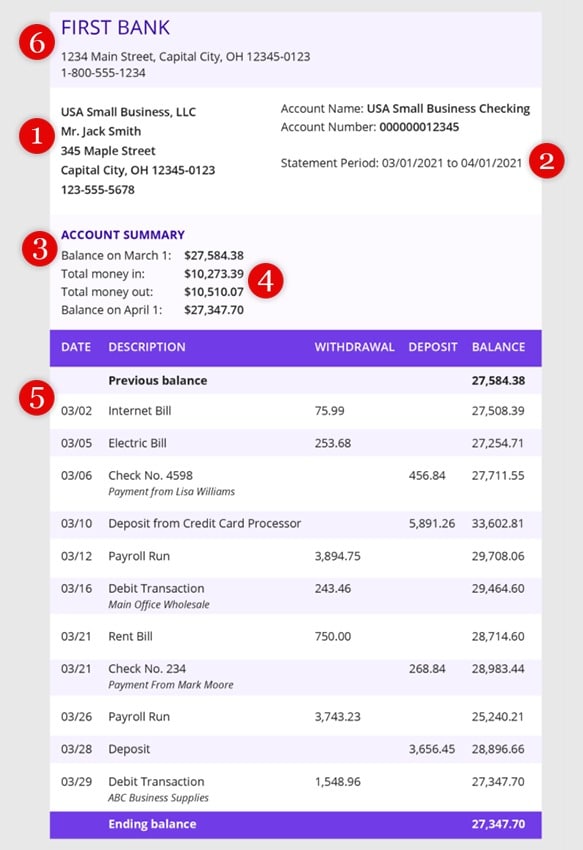

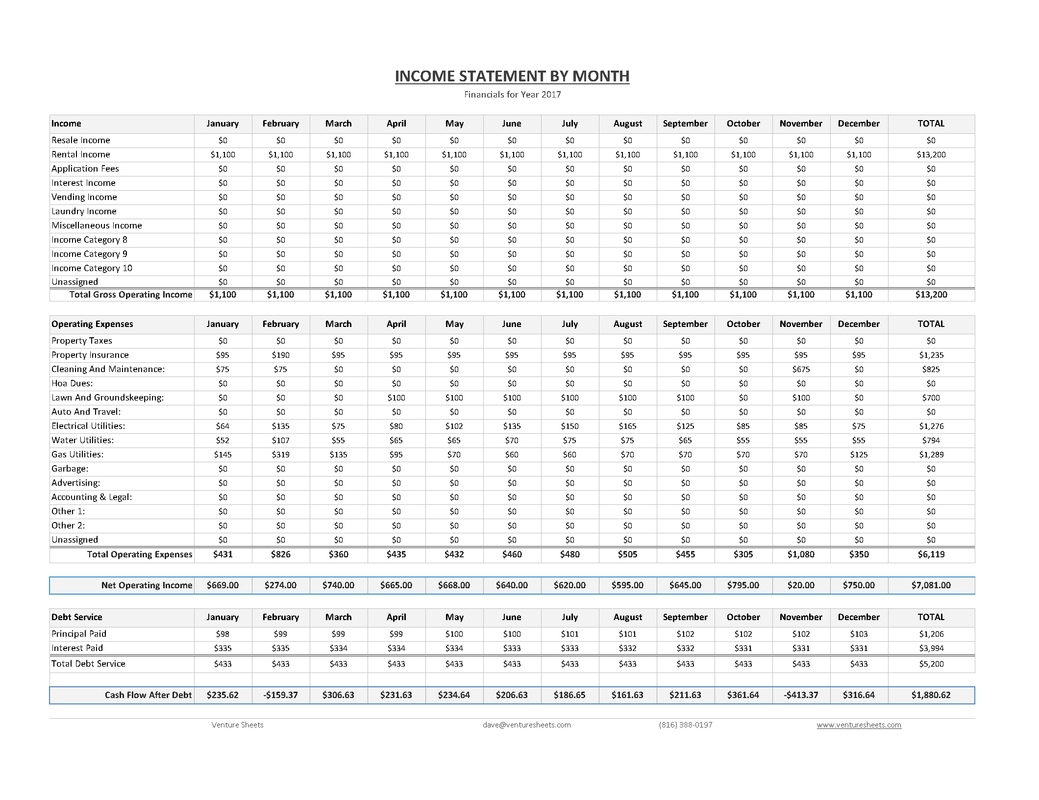

Rental income in income statement. Rent received and landlord expenses paid by the tenant are two examples of rental income. Rental statements can track income associated with your property. The cash flow statement summarizes the amount of cash moving through the company during a.

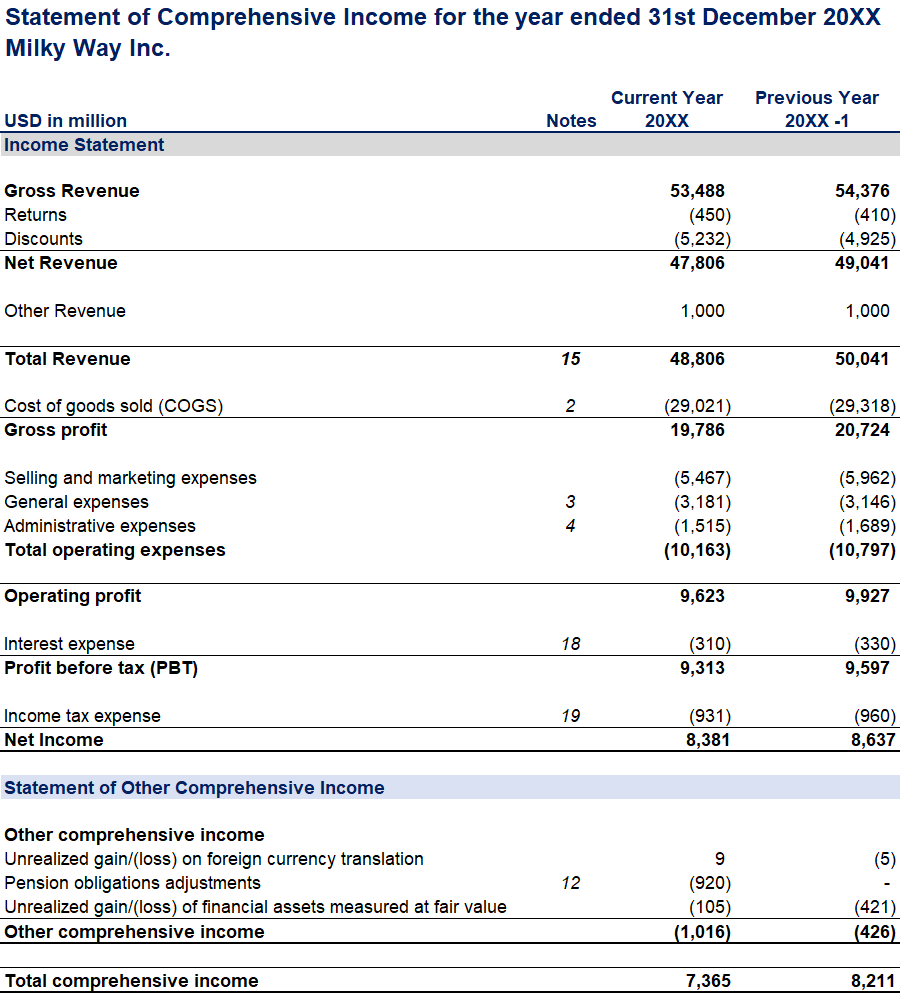

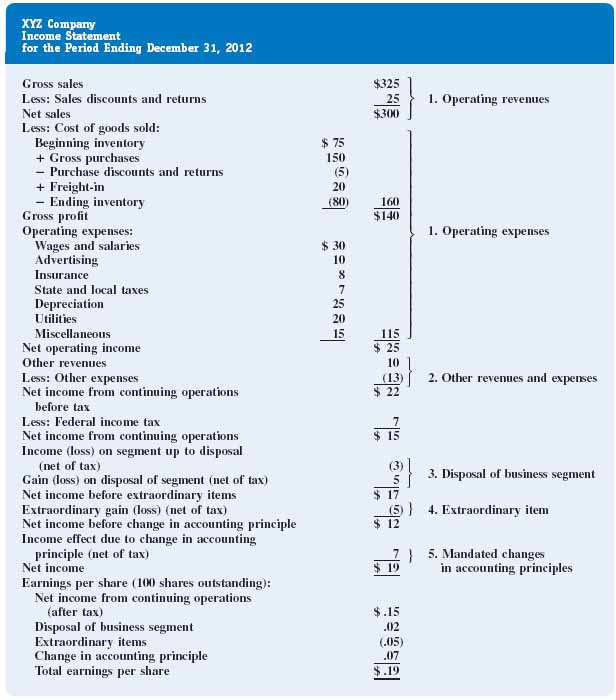

Types of rental property income on a statement normal rent payments. It is filed under section 4 (d) of the income tax act 1967. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

Steps to prepare an income statement. A commercial real estate income and expense statement, often referred to as an income statement or profit and loss statement, provides a summary of the financial performance of a commercial property over a specific period. A good profit and loss statement also serves as a guide for identifying potential opportunities to increase income, reduce expenses, and maximize net operating income (noi).

Classification and presentation of rent income rent income is an income account. They get the refund and they can pay. The income section of the owner statement reflects the rental income received during a specific period.

6 most common rental property financial statements. By filing your tax return on time, you’ll avoid delays to any refund, benefit. If you file on paper, you should receive your income tax package in the mail by this date.

What’s in an income statement for rental properties? The chapea mission 1 crew (from left: An income statement, also called a profit and loss statement (p&l), when used for a piece of real estate, summarizes the revenues (like rental income), and the expenses (like property taxes, maintenance, and insurance) incurred over a specific period of time.

An income statement is one of the most common, and critical, of the financial statements you’re likely to encounter. Also known as an income statement or p&l, a rental property profit and loss statement reports the current financial performance of a property over a specific amount of time. By sherron marcek | april 5, 2022 | rental property income statements — often known as profit and loss (p&l) statements — are a key component of any investment property analysis.

They can also help you keep tabs on when rent is paid and identify any patterns of late payments. It shows your revenue, minus your expenses and losses. Rental income is a normal credit account and is reflected on the profit or loss statement ( statement of financial performance ).

Some landlords collect the first and last month of rent from a new tenant. Rental statements show the date rent is due, how much rent is owed, and late fees. Choosing the correct one is critical.

Income statements help determine the economic feasibility of a rental property and its overall value. Your monthly income statement allows you to analyze your portfolio performance on a. Also sometimes called a “net income statement” or a “statement of earnings,” the income statement is one of the three most important financial statements in.