Heartwarming Info About Owners Equity In Balance Sheet Cash Flow Statement Practical Questions

Owner’s equity is not always a reflection of the value or sales price of the business.

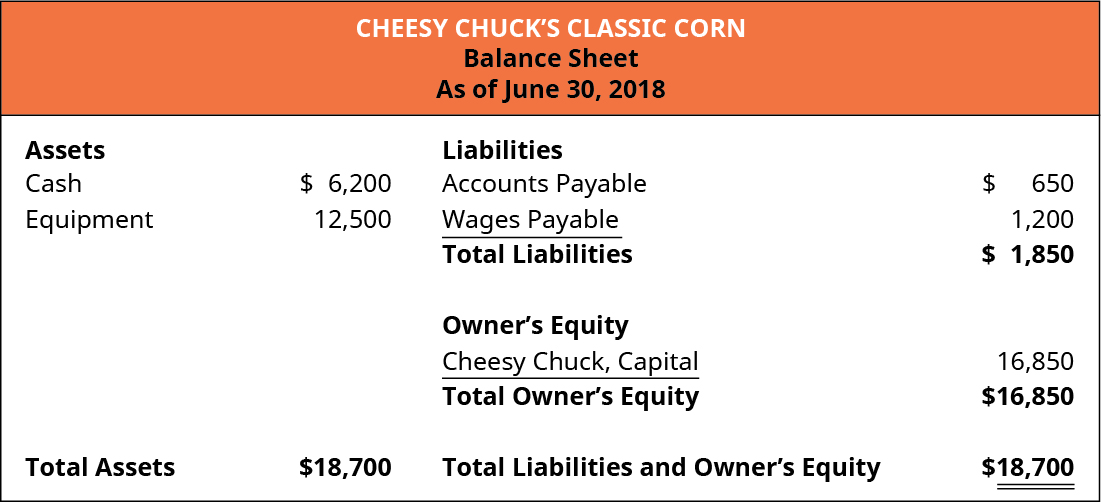

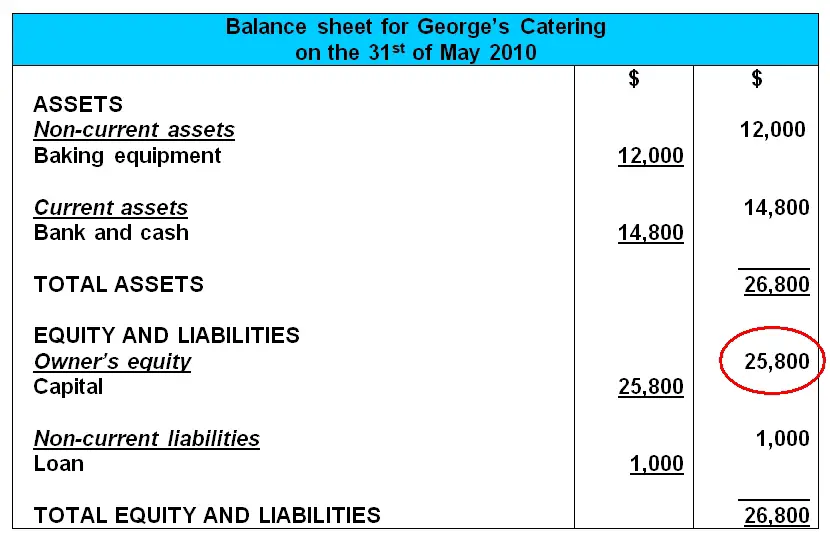

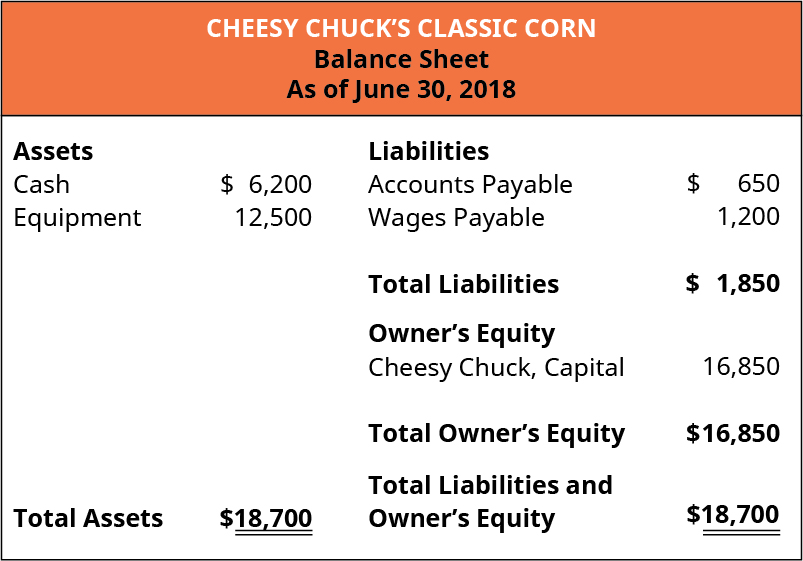

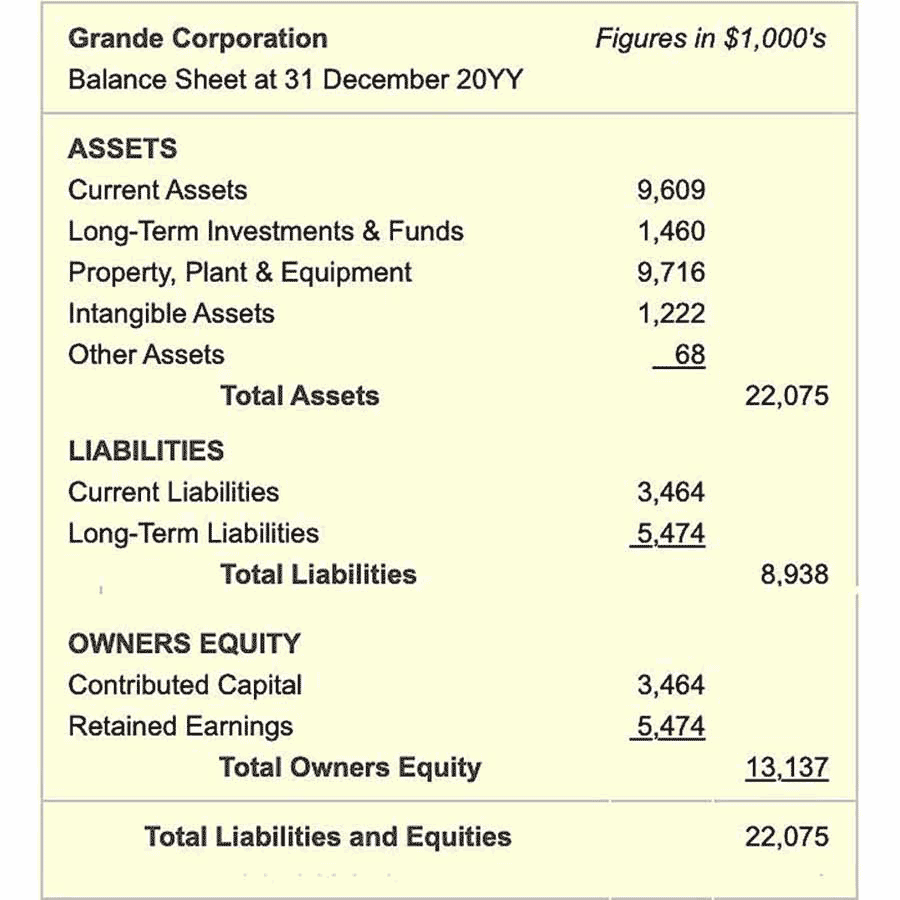

Owners equity in balance sheet. Second, owners equity role when companies declare bankruptcy or liquidate. Owner’s equity is the amount that belongs to the business owners as shown on the capital side of the balance sheet, and the examples include common stock, preferred stock, and retained earnings. The calculation of equity is a company's total assets minus its total liabilities, and.

In the balance sheet of a sole proprietorship, owners' equity refers to the sum total of the following transactions: Equity represents the shareholders’ stake in the company, identified on a company's balance sheet. On a company’s balance sheet, owners’ equity shows what the owners of the business (or shareholders) would have if the company paid off all its debt with its assets.

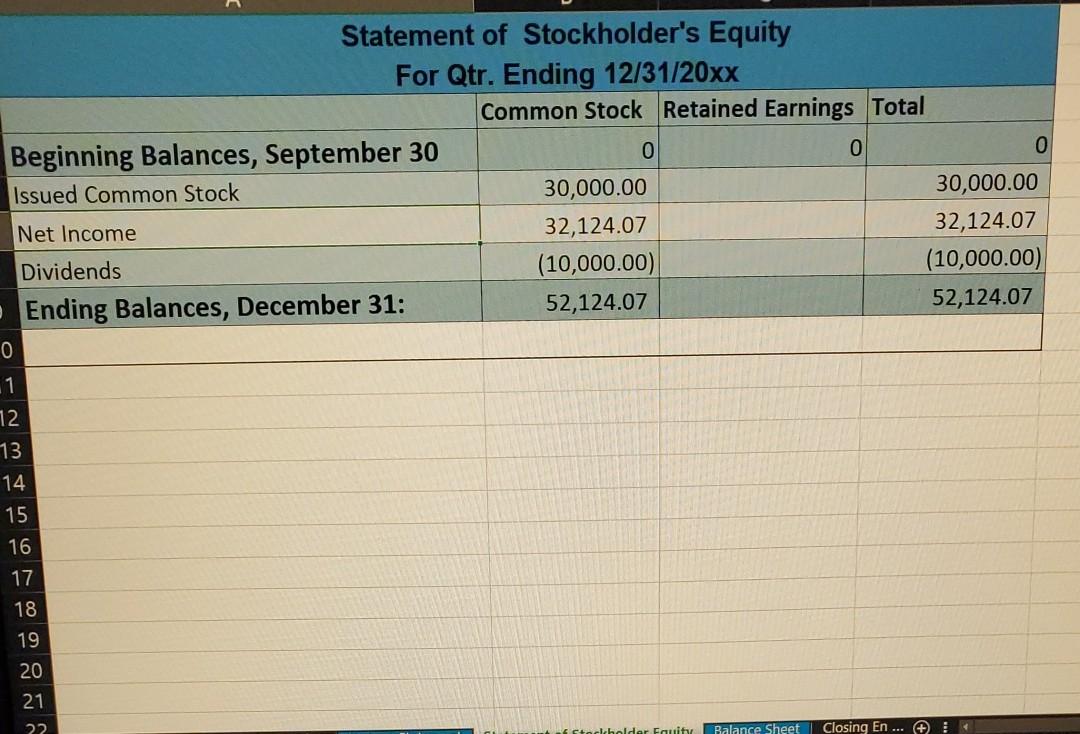

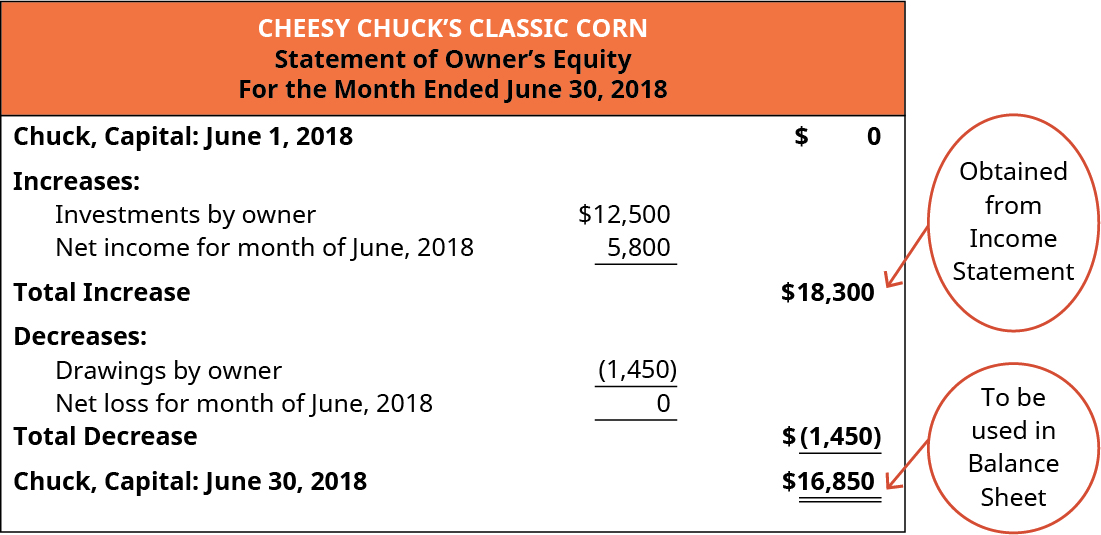

2.1 2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate highlights the study of accounting requires an understanding of precise and sometimes complicated terminology, purposes, principles, concepts, and organizational and legal structures. The balance sheet is one of the three core financial statements that are used to. New aged care act and support at home program update.

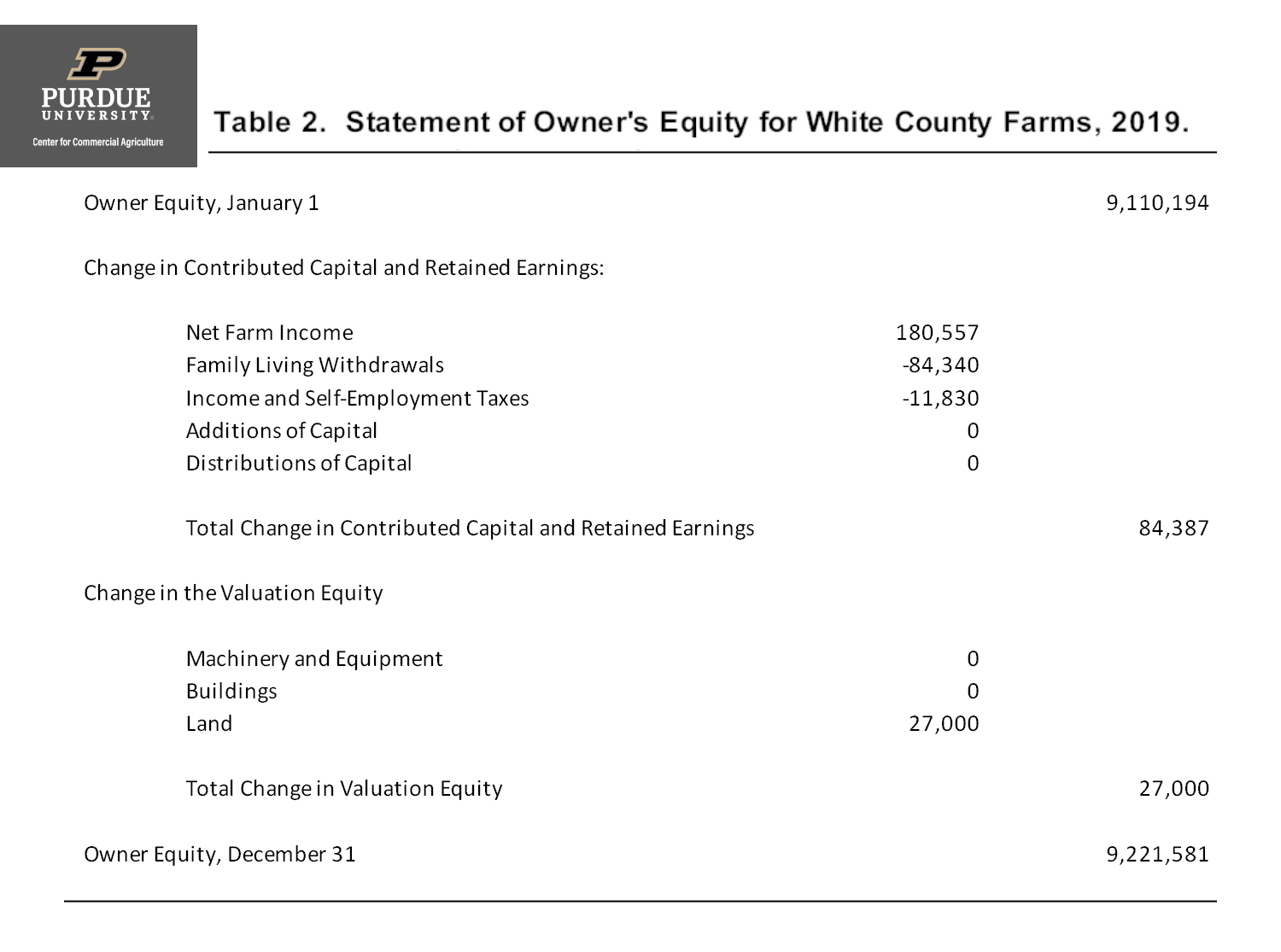

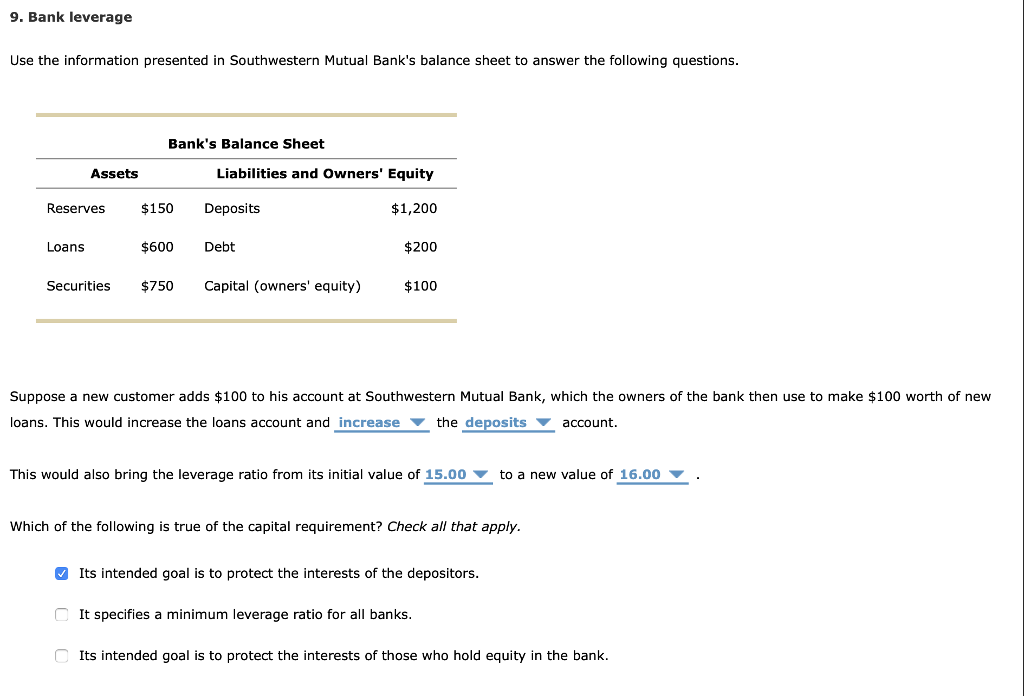

Analyzing owners’ equity is an important analytics tool, but it should be done in the context of other tools such as analyzing the assets and liabilities on the balance sheet of berkshire. Owner’s equity is an important section of a company’s balance sheet. Remember the balance sheet formula:

The equity of the owner is calculated by subtracting all liabilities of a company from the assets of the company. How to calculate owners’ equity. Find the total liabilities for the period, which is also listed on the balance sheet.

Assets = liabilities + owner's equity. Definition of owner's equity owner's equity is one of the three main sections of a sole proprietorship's balance sheet and one of the components of the accounting equation: A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

Owner’s equity is recorded in the balance sheet at the end of an accounting period. It can be negative if the business’s liabilities are greater than its assets. Understanding owner’s equity is important for maintaining optimal capital structure and liquidity.

Owner’s equity grows when an owner increases their investment or the company increases its profits. Only sole proprietor businesses use the term owner's equity, because there is only one. The balance sheet is based on the fundamental equation:

Owners’ equity can be calculated by extracting a number of items from a firm’s financial statements. The owner’s equity is recorded on the balance sheet at the end of the accounting period of the business. To calculate owner’s equity, you need to subtract total liabilities from total.

The answer is yes! So, the simple answer of how to calculate owner's equity on a balance sheet is to subtract a business' liabilities from its assets. Therefore, this equation should always be true.

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)