Best Info About Warranty Expense Income Statement How To Draw An

So, if a company estimates that warranty claims are.

Warranty expense income statement. The expense should be reported on the. In the notes to the financial statements, the company explains, “we provide for estimated product warranty expenses when we sell the related products. A warranty that a customer can purchase separately from the related good or service (that is, it is priced or negotiated.

Percentage of the sold products that will probably need a repair or a replacement based on previous experiences 3. Units sold, the percentage that will be replaced within the warranty period, and the cost of replacement. 8.3.1 warranties that can be purchased separately.

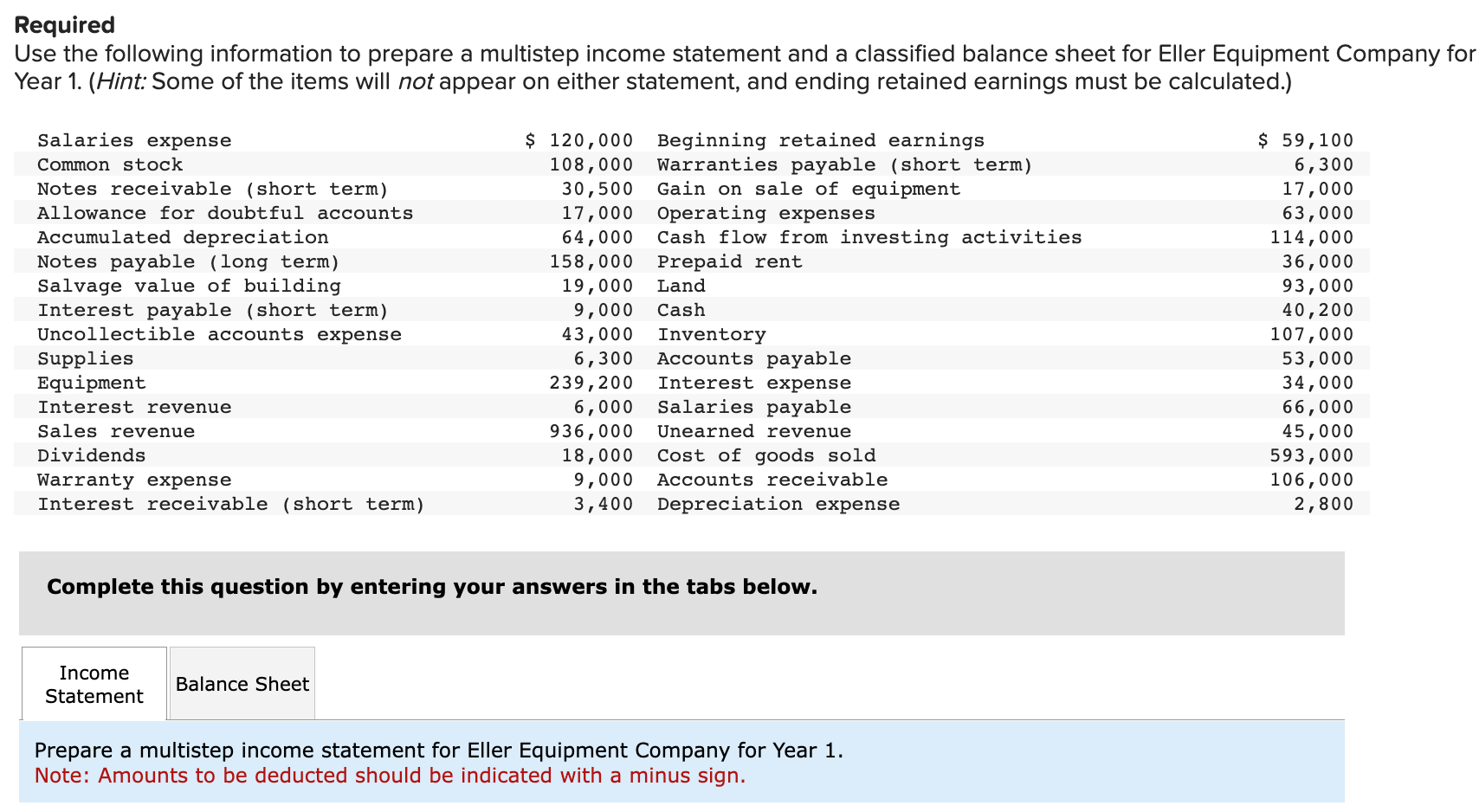

Immediate recognition is appropriate because the. Warranty expenses will be recorded as expenses on the income statement. That expected cost is recorded as a liability on its balance sheet and as an expense on its income statement.

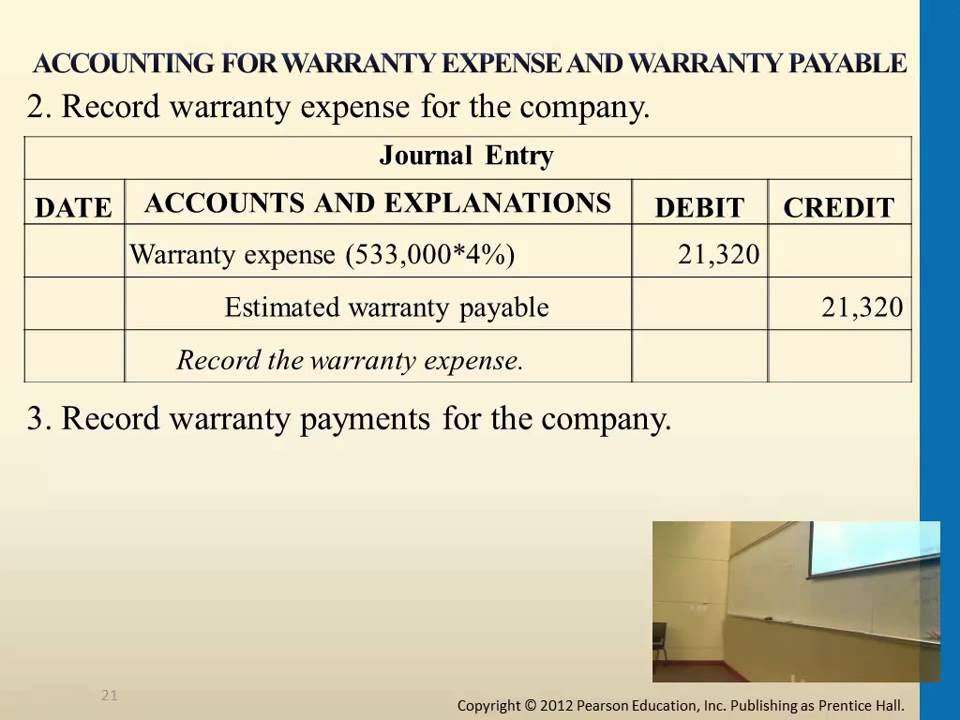

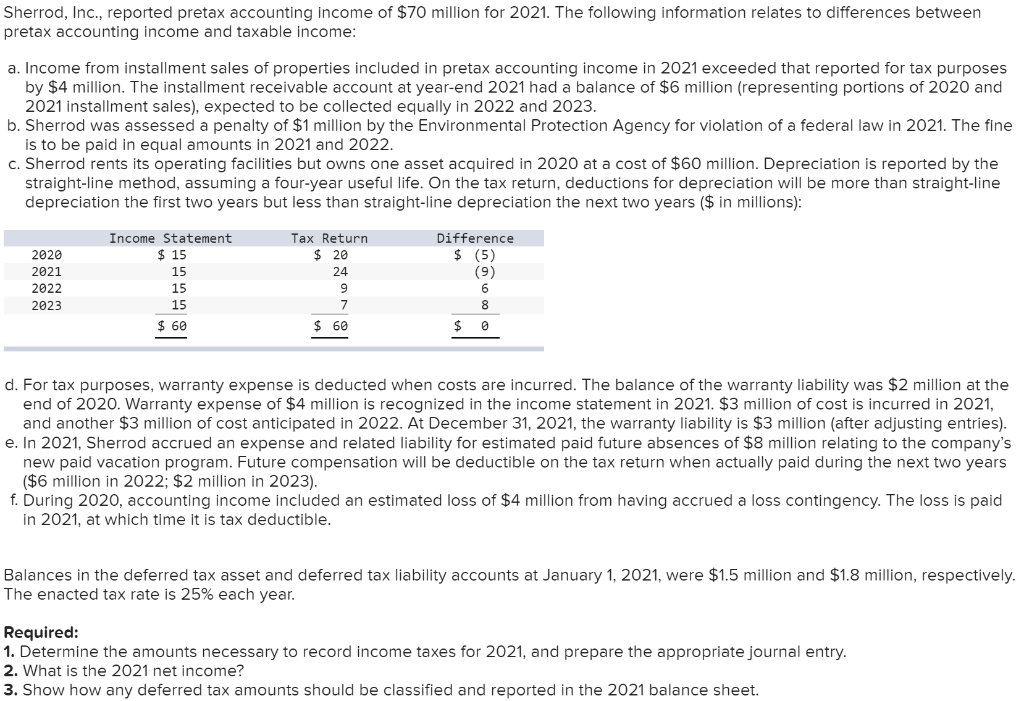

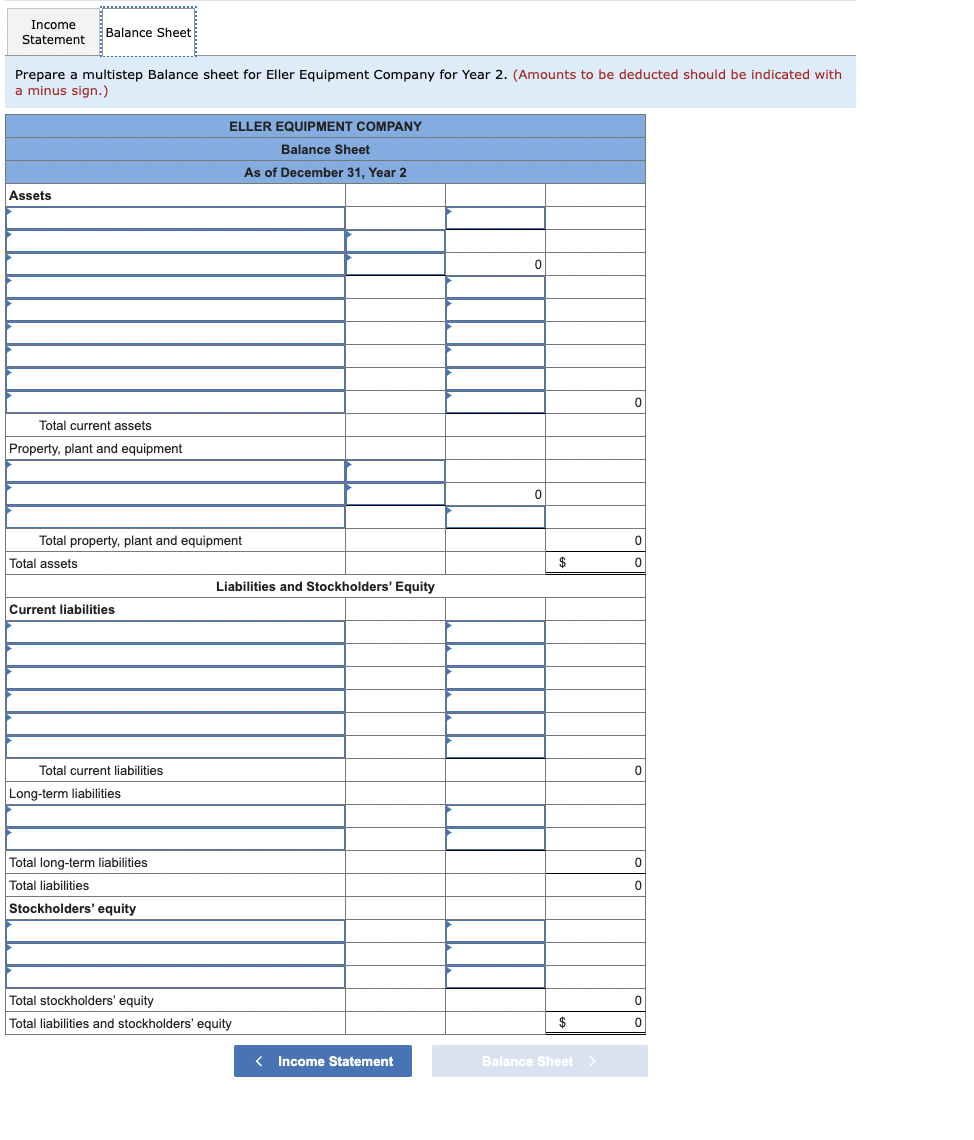

Note that the expected future cost to repair or replace is matched. As you’ve learned, not only are warranty expense and warranty liability journalized, but they are also recognized on the income statement and balance sheet. Deferred tax asset example:

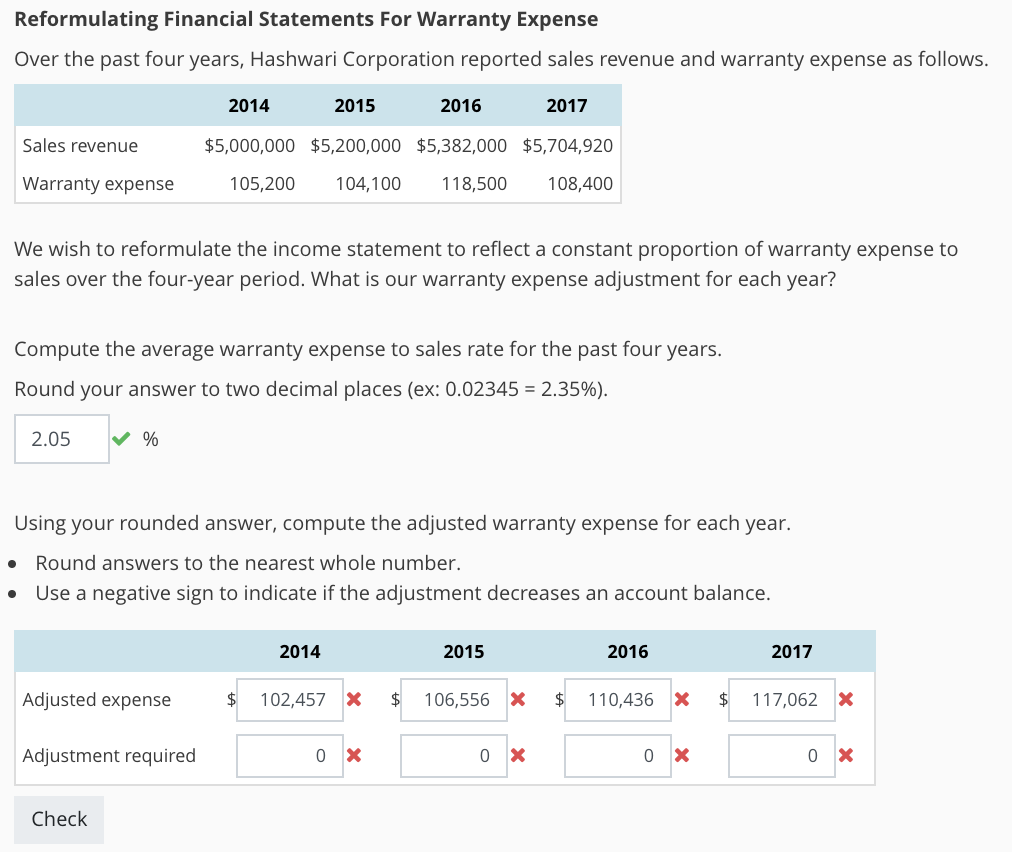

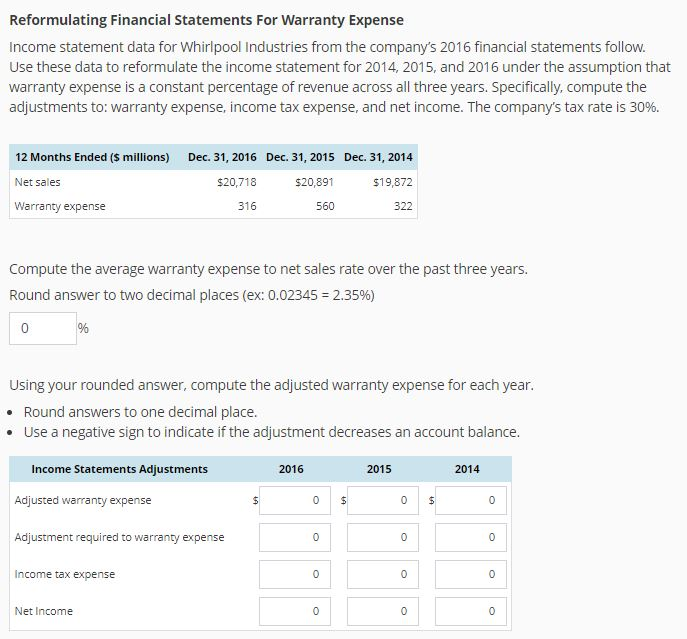

The impact is only to the balance sheet. Thus, this warranty is expected to cost a total of $27,000 (ten thousand units × 3 percent or three hundred claims × $90 each). The tax rate for the year is 30%, and the company estimates warranty expense will be 2% of its revenue.

Updated june 24, 2022 many companies that sell products establish warranty policies that help customers replace, repair or receive refunds for damaged or defective products. Number of units sold during a particular accounting period 2. According to the us gaap, since a warranty is an assurance or promise of the seller to his buyer, it will be the expense of the seller if claimed by the buyer, which will be debited to.

Warranty expense is the cost associated with a vendor or manufacturer’s commitment. To estimate the warranty expense for a company, we need to know three main things: Warranty expense = 30 products x $20 per product = $600 in this case, we can make the journal entry for warranty expense by debiting the $600 into the warranty expense.

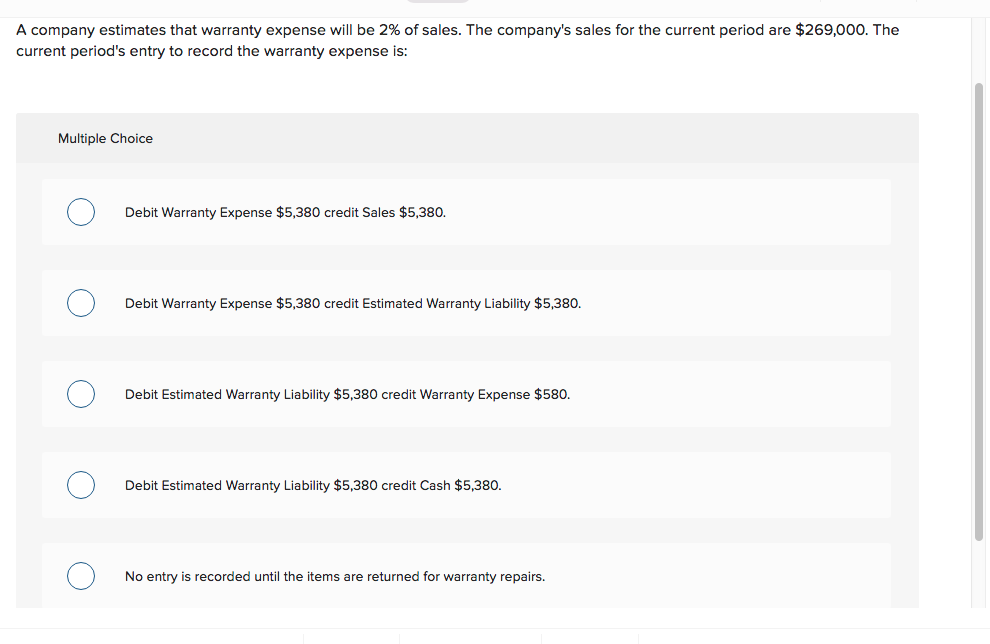

To record the warranty expense, we need to know three things: Thus, the income statement is impacted by the full amount of warranty expense when a sale is recorded, even if there are no warranty claims in that period. If the company can reasonably estimate the amount of warranty claims likely to arise under the policy, it should accrue an expense that reflects the cost of these.

In this journal entry, warranty expense is recorded as an expense item on the income statement while warranty liability is an obligation that the company owes to the. Provision for warranty is the liability account on the balance sheet and it will be reversed when the. When warranty claims are actually paid, there is no impact to the income statement.

Average cost of repairing or replacing.