Unique Info About Common Balance Sheet Horizontal Analysis On

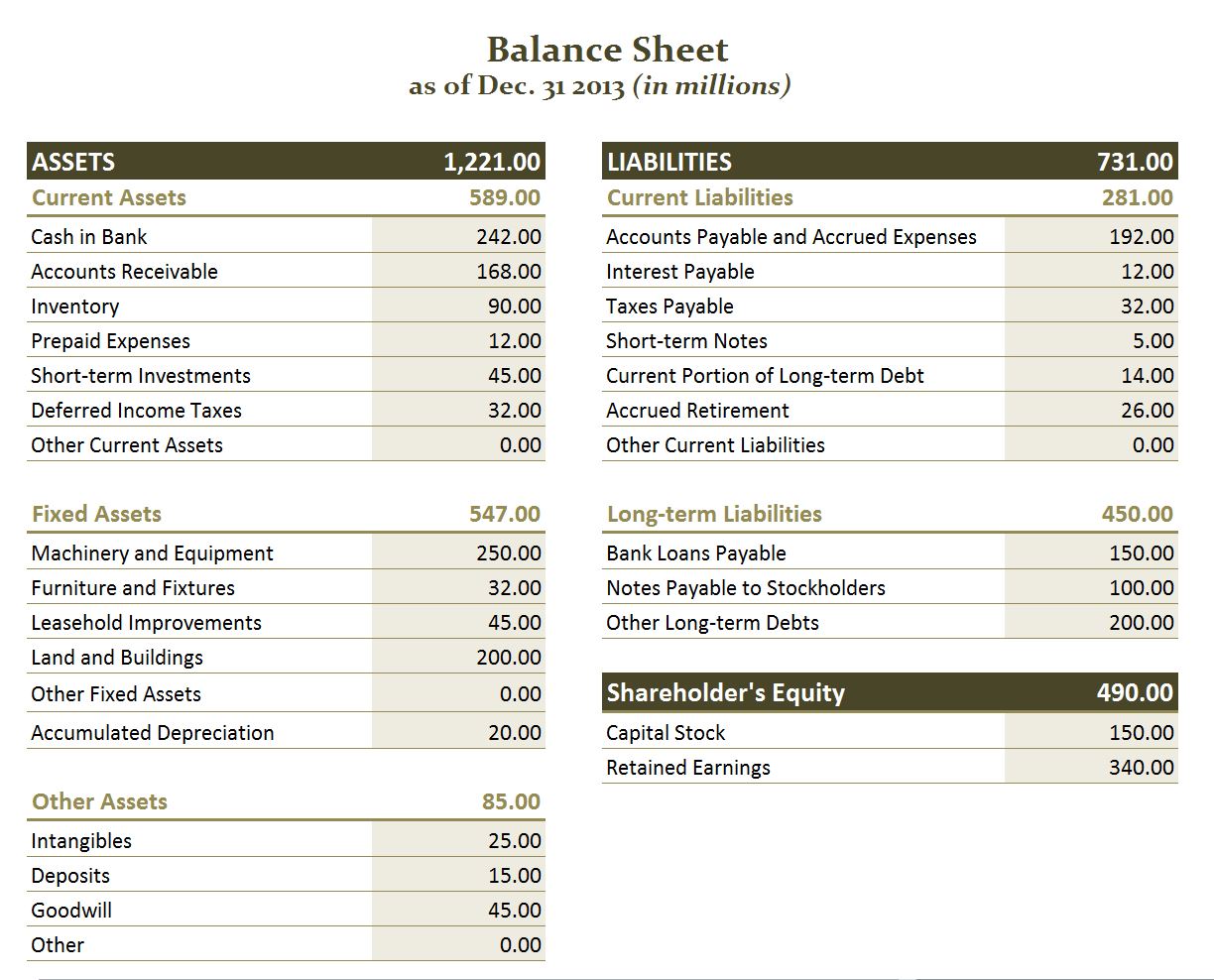

The balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’ equity.

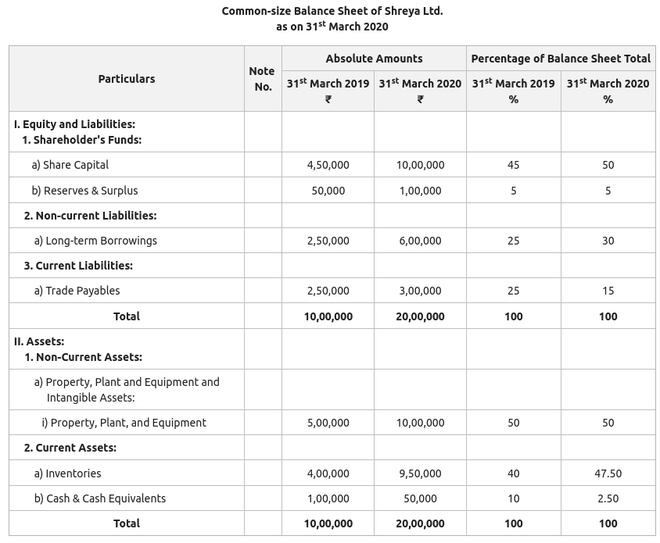

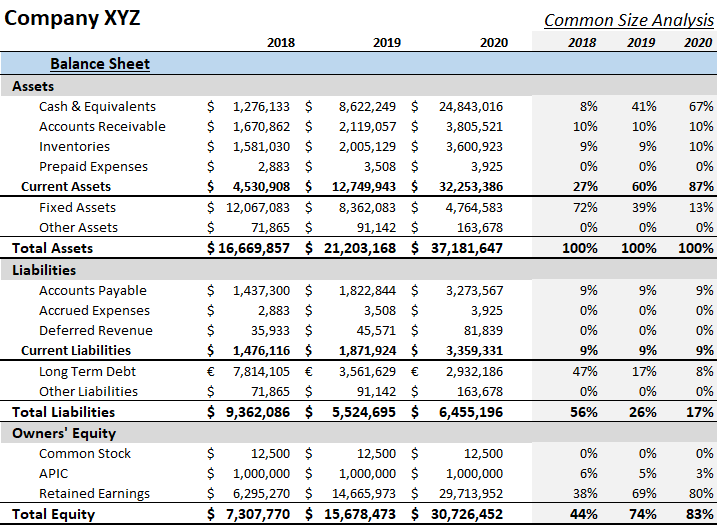

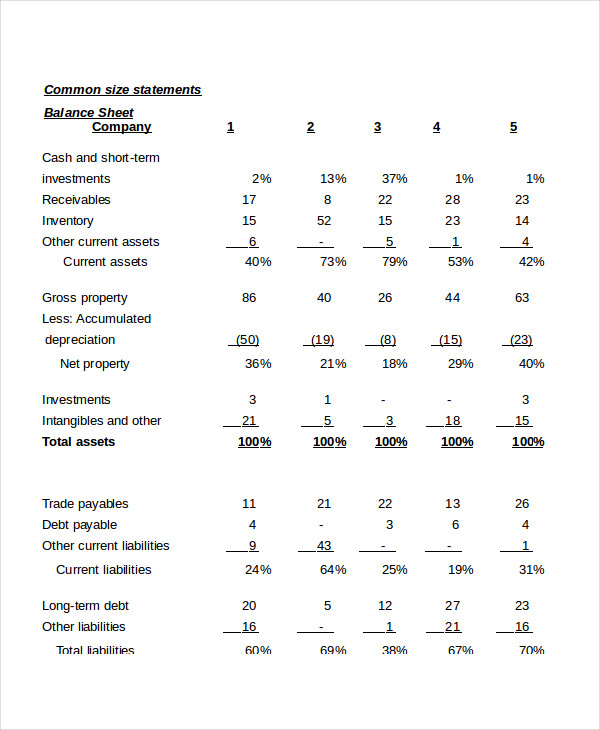

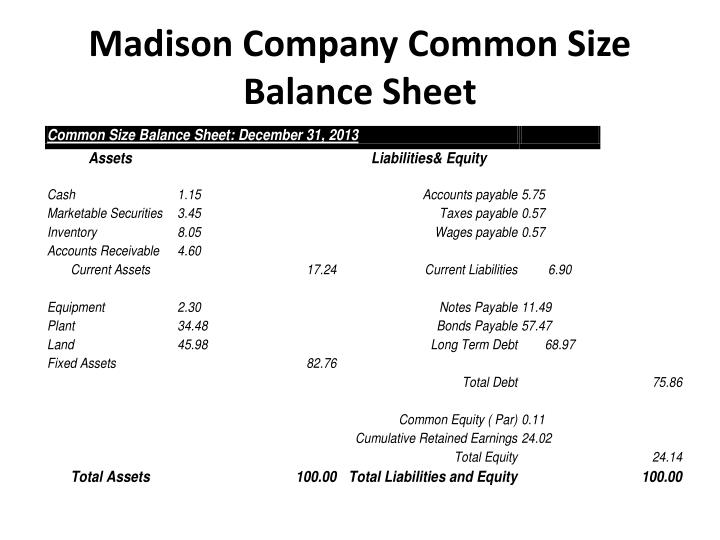

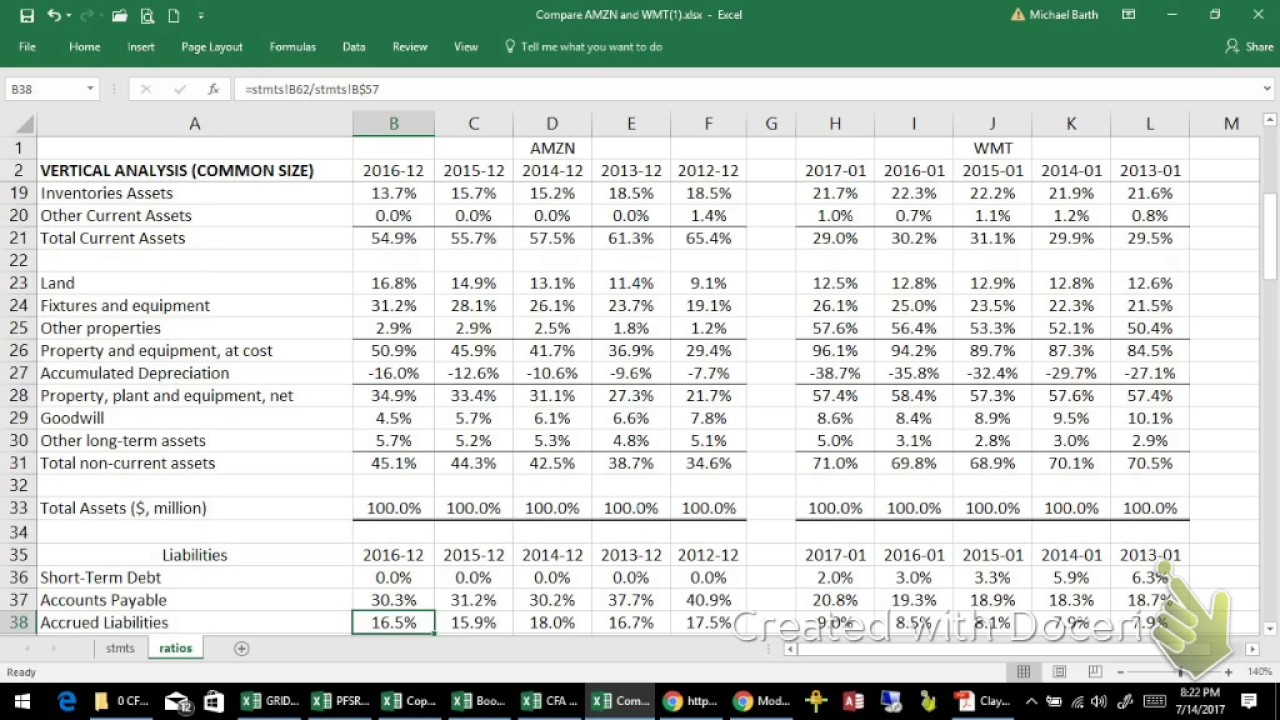

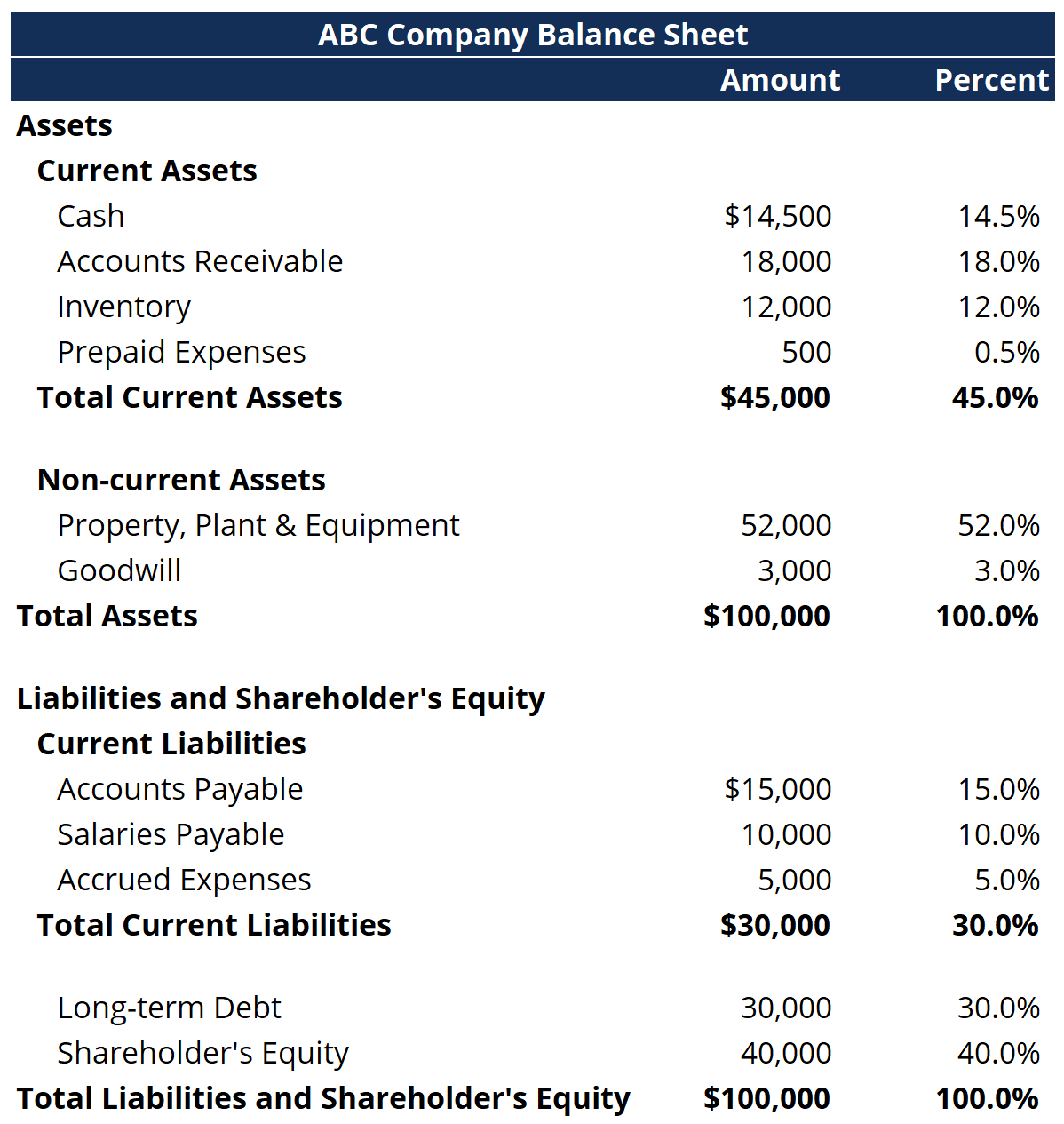

Common balance sheet. Formula for common size balance sheet = (line item / total assets)*100 uses of common size balance sheets: A common size balance sheet displays the numeric and relative values of all presented asset, liability, and equity line items. Fm) announces four balance sheet strengthening initiatives (the refinancing):

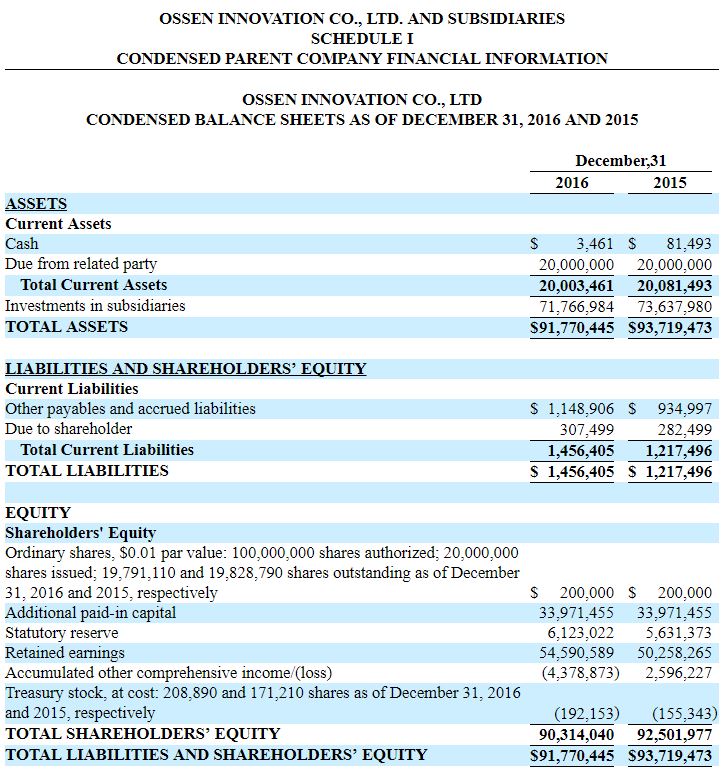

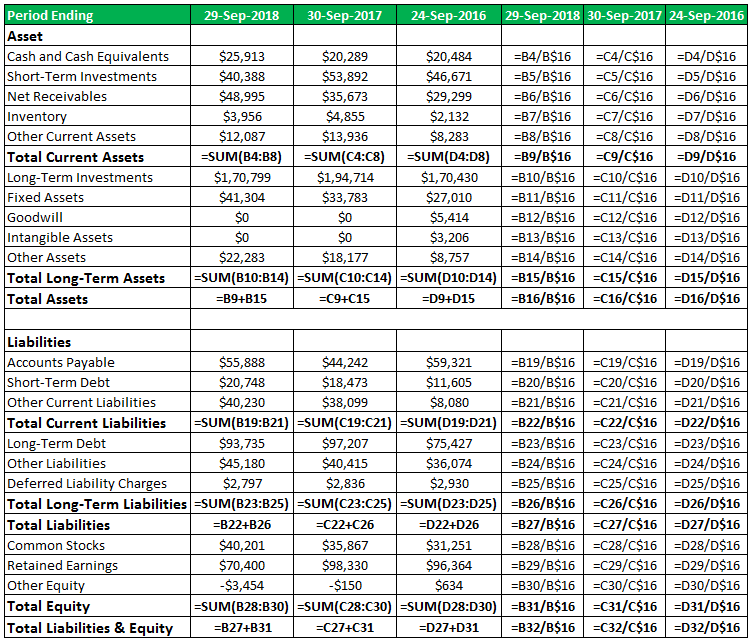

The current size of the fed's balance sheet is $7.7 trillion. To common size a balance sheet, the analyst restates each line item contained in the balance sheet as a percent of total assets. This mainly reflects the phasing impact arising from the difference between transaction date and delivery date;

A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment. What does common size balance sheet mean? Assets = liabilities + equity.

First quantum minerals ltd. To express the amounts as the percentage of the total, the total assets or total equity and liabilities are taken as 100. It's used to determine how the company is using its assets.

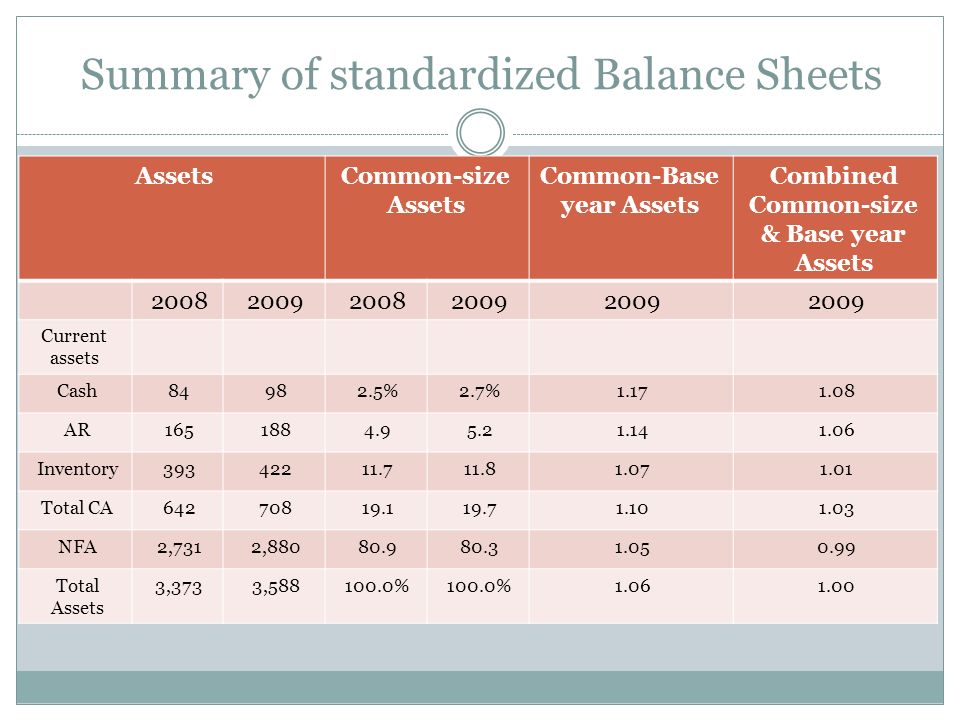

Helps in building trend lines to discover the patterns over a specific period of time. The fed has been reducing the size of its holdings since 2022. Each line item on the balance sheet is restated as a percentage of total assets.

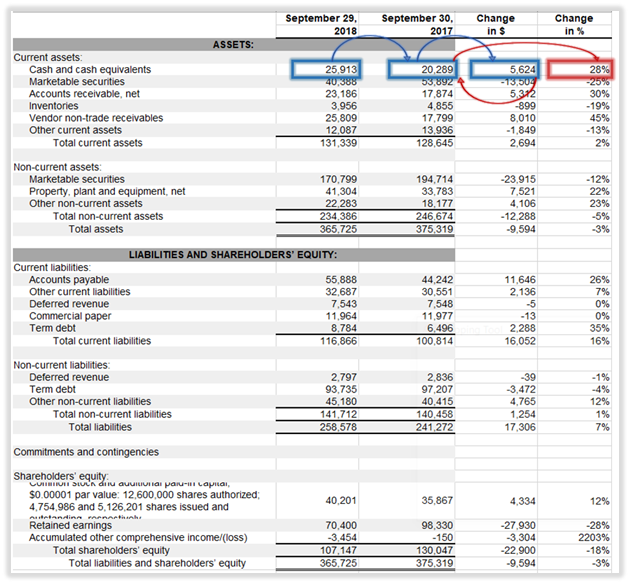

Expressing each item on the balance sheet as a percentage of total assets allows for easy comparison of different categories and helps identify trends over time. Using this statement, users could quickly see the percentage of each item, cash or account receivable, compared to total assets. This format is useful for comparing the proportions of assets, liabilities, and equity between different companies, particularly as part of an industry analysis or an acquisition analysis.

A balance sheet covers a company’s assets as defined by. By understanding this process, investors, analysts, and stakeholders can make informed decisions and assess the company’s overall value. Common size balance sheet is the balance sheet that prepares by management to show both values of each item in assets, liabilities, and equity in currency (usd) and percentages (%) at the end of the accounting period.

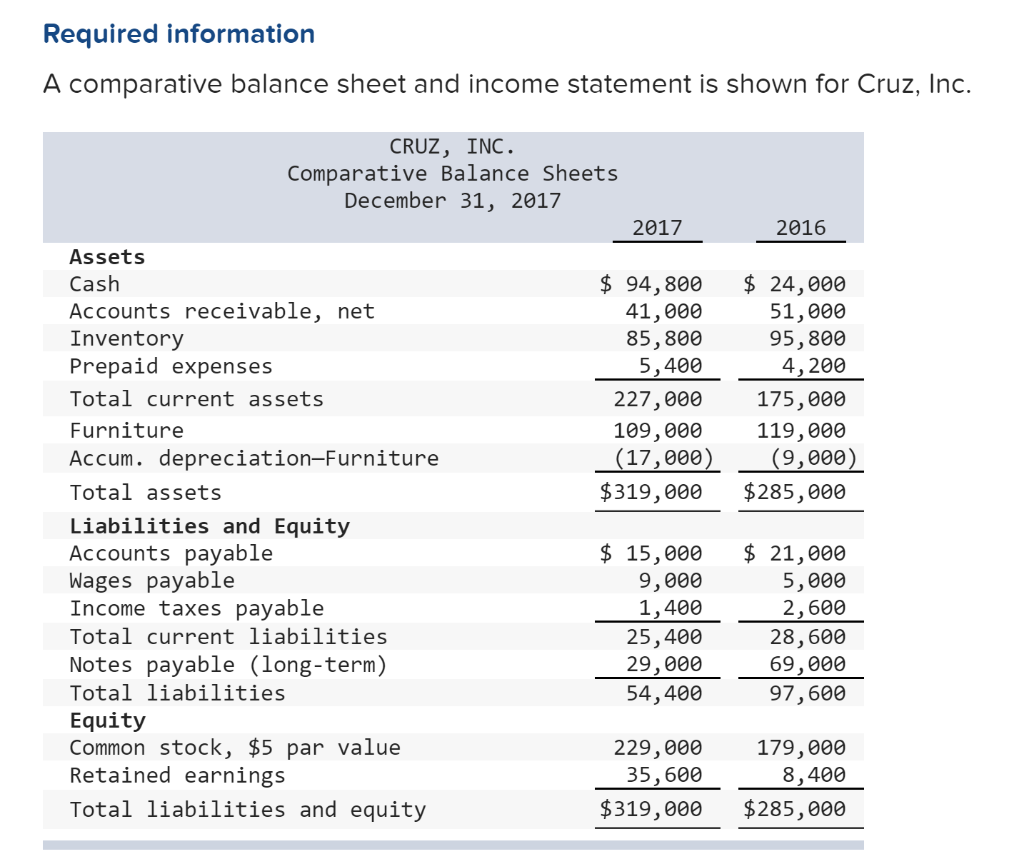

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. For example, let's assume that company xyz's balance sheet looks like this: A common size balance sheet is a financial statement that displays each balance sheet item as a percentage of total assets.

In the balance sheet, the common base item to which other line items are expressed is total assets, while in the income statement, it is total revenues. Balance sheets are typically organized according to the following formula: A common size balance sheet is a refined version of the balance sheet itself, but also includes each single line item as a percentage of total assets, liability and equity apart from the conventional numeric value.

Balance sheets provide the basis for. A common size balance sheet is a balance sheet that displays both the numeric value and relative percentage for total assets, total liabilities, and equity accounts. The balance sheet is based on the fundamental equation: