Awesome Info About Examples Of Operating Financing And Investing Activities Ratio Analysis Mrf Tyres

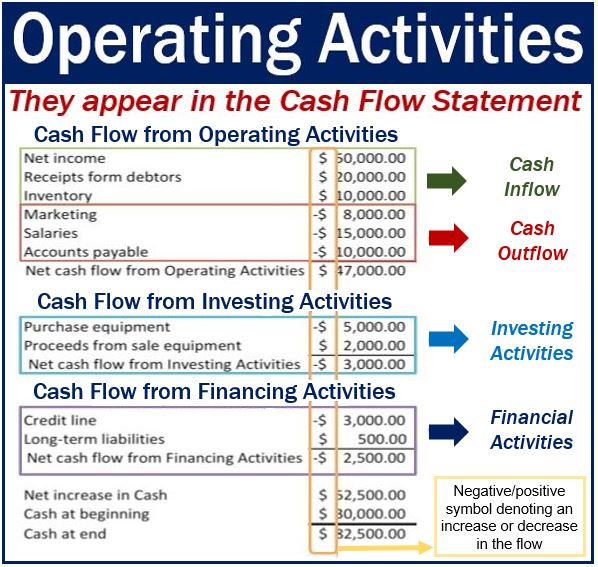

Operating cash flows also include cash.

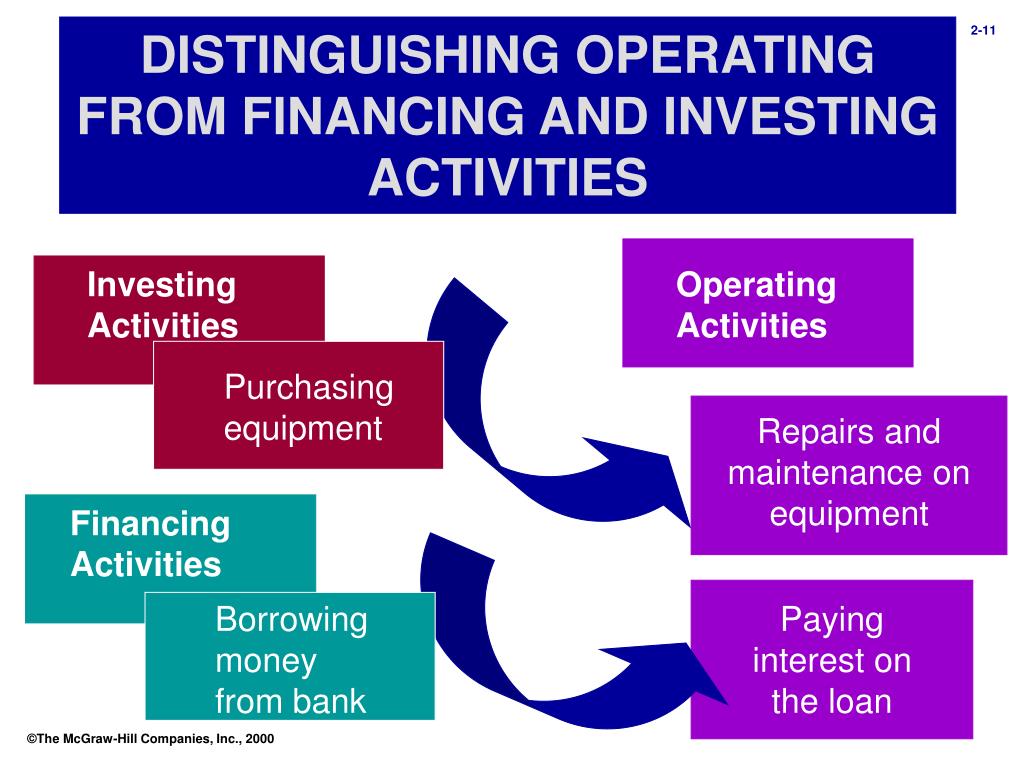

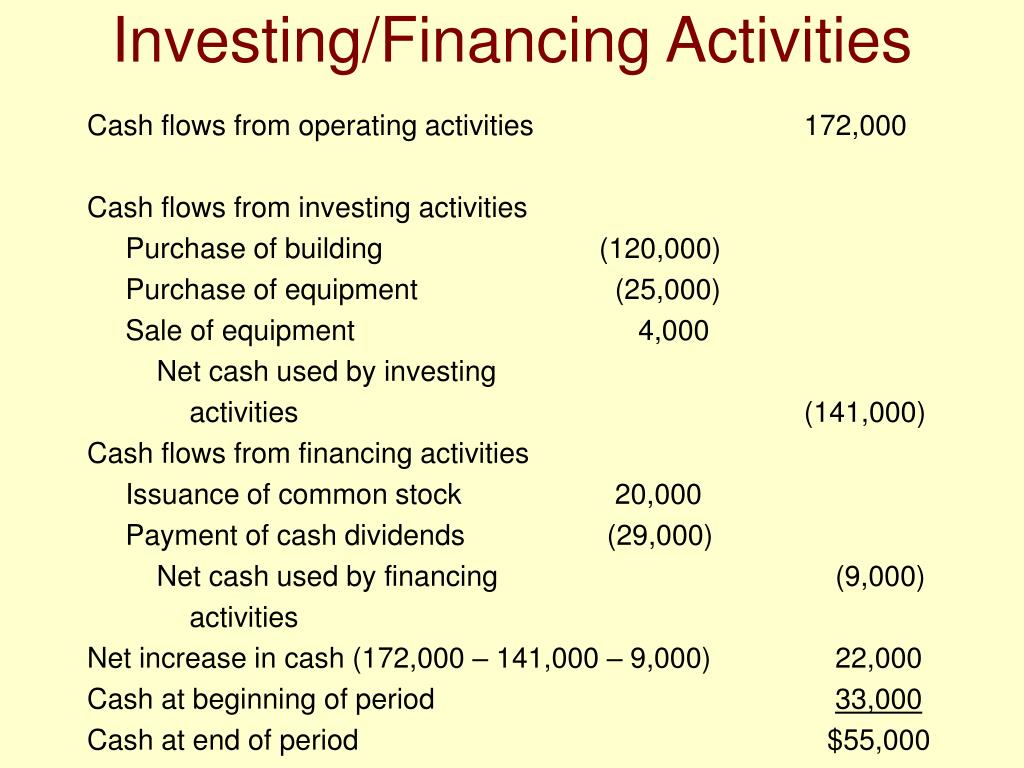

Examples of operating financing and investing activities. The relationship between financing, operating and investing activities is the cornerstone of a successful procurement strategy. For example, an apparel store's operating activities might include the following: Reporting cash flows from investing and financing activities reporting cash flows on a net basis foreign currency cash flows.

There are three types of cash flows: Investing activities focus on the acquisition or disposal of long. Operating activities involve cash flows directly related to a company's core business operations.

For example, operating cash flows include cash sources from sales and cash used to purchase inventory and to pay for operating expenses such as salaries. For example, receipts of investment income (interest and dividends) and payments of interest to lenders are classified as investing or financing activities. 12 mar 2013 the purpose of the discussion on the statement of cash flows was to try to identify ways to make the definitions of operating, investing and financing.

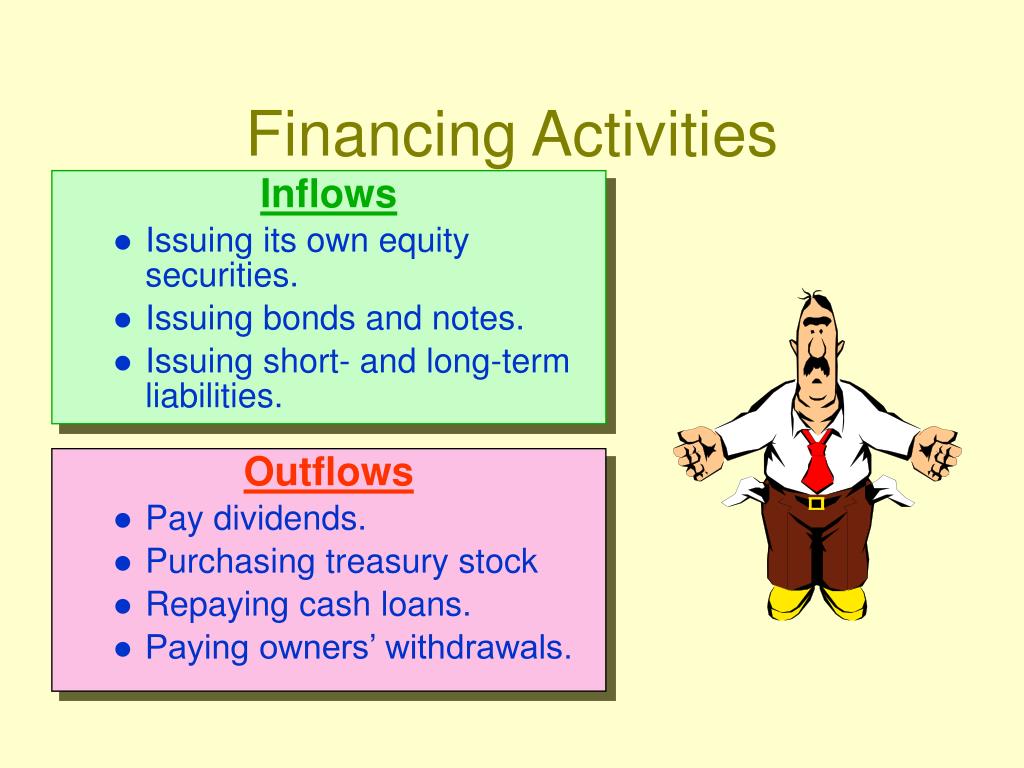

For example, operating cash flows include cash sources from sales and. Because calculating operating profit is one of the best ways to prove how well a business is performing, it can be useful. Examples of financing cash flows include cash proceeds from issuance of debt instruments such as notes or bonds payable, cash proceeds from issuance of capital stock, cash.

Receiving cash from issuing stock or spending cash to repurchase shares. Investing activities include cash activities. For example, operating cash flows include cash sources from sales and.

Financing, investing and operating activities operating activities include cash activities related to net income. Cash flows from operating activities arise from the activities a business uses to produce net income. Serving as evidence of financial health:

The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during. These three activities are closely connected, with. Cash flows from operating activities arise from the activities a business uses to produce net income.

Cash flows from operating activities arise from the activities a business uses to produce net income. Financial analysis cont… today’s session is emphasizing on ‘statement of change in equity &. b. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements.

Buying materials from suppliers and paying for labor to produce clothing. Proceeds from the sale of. Question 1 which of the following would be classified as a cash flow from investing activity?

Cash flow from investing, cash flow from financing, and cash flow from operating activities. The cash flow from operating. If an arrangement is made whereby a cash disbursement is made by a third party (e.g., a financial institution) on behalf of the reporting entity to satisfy the reporting entity’s.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/AppleCFJune2019-7034d23092e14723b39c1c22f5e170b3.jpg)

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)