Brilliant Info About Debt Service Reserve Account Balance Sheet What Is Other Expenses In Income Statement

Cash available for debt service (cads):

Debt service reserve account balance sheet. This is a brief introduction to a debt service reserve account (dsra). To reduce the risk of default payment by the. Cash and cash equivalents under ias 7 the.

In the simple example above, we showed a simple payment hierarchy, with cfads first going to. A company may be required to hold a debt service reserve account. The debt service reserve account (dsra) protects a lender against an unexpected decrease in cash flow available for debt service (cfads).

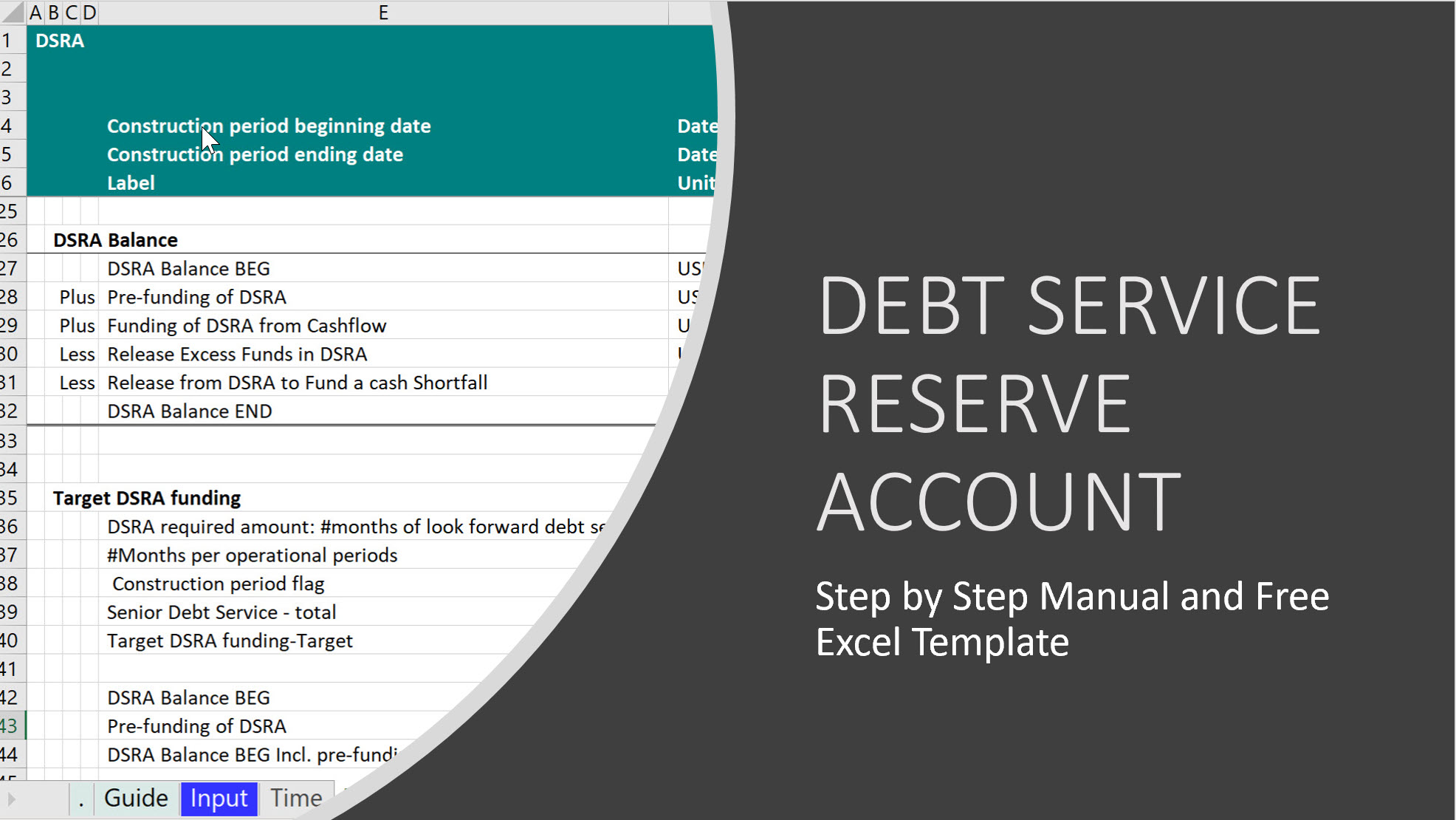

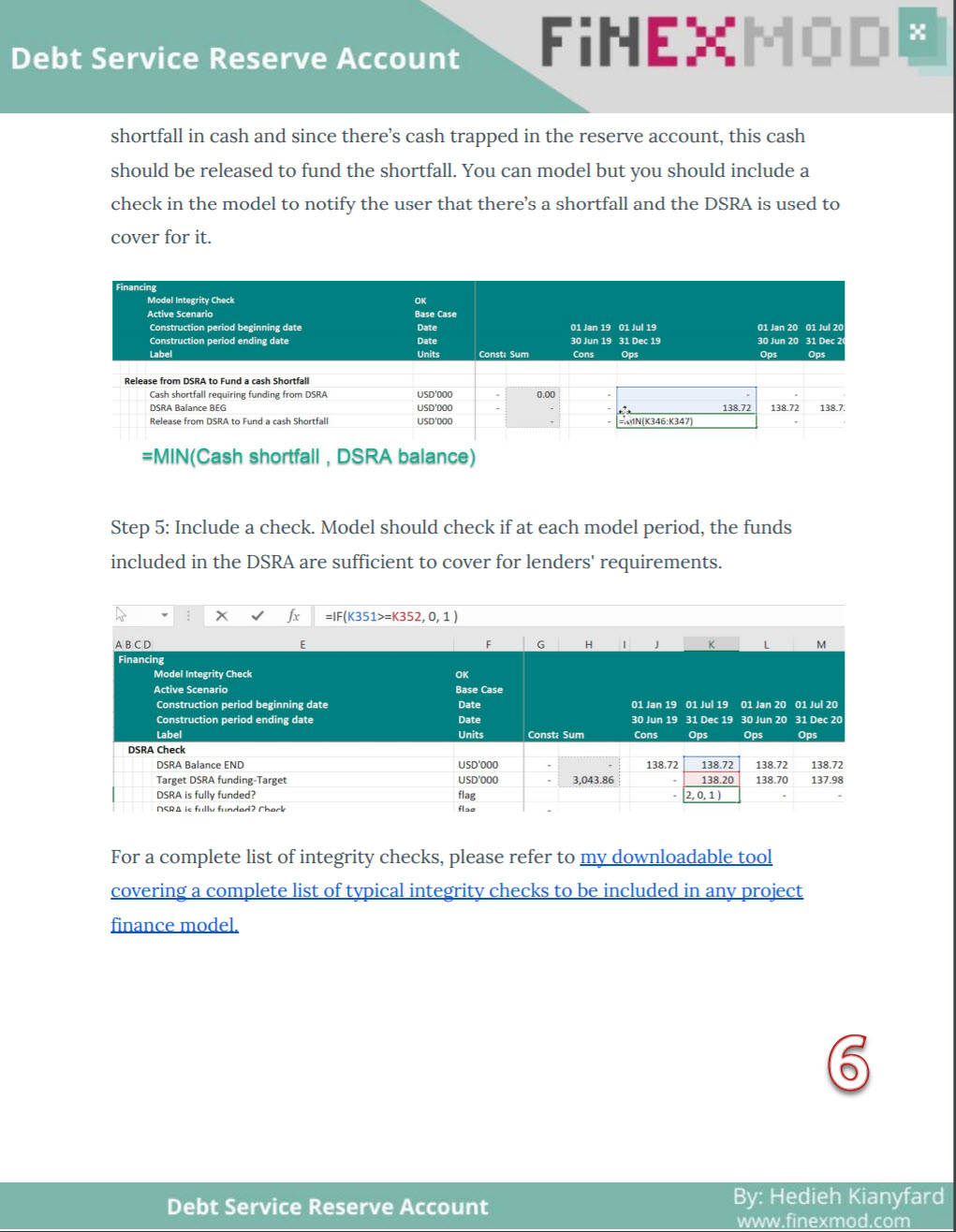

The simple answer to this particular case is no, this is not the cash and cash equivalents. Operations and funding of debt service reserve account. Chapter 43modeling debt service reserve accounts project finance loans and some leveraged acquisition loans include requirements to put cash aside in a restricted bank.

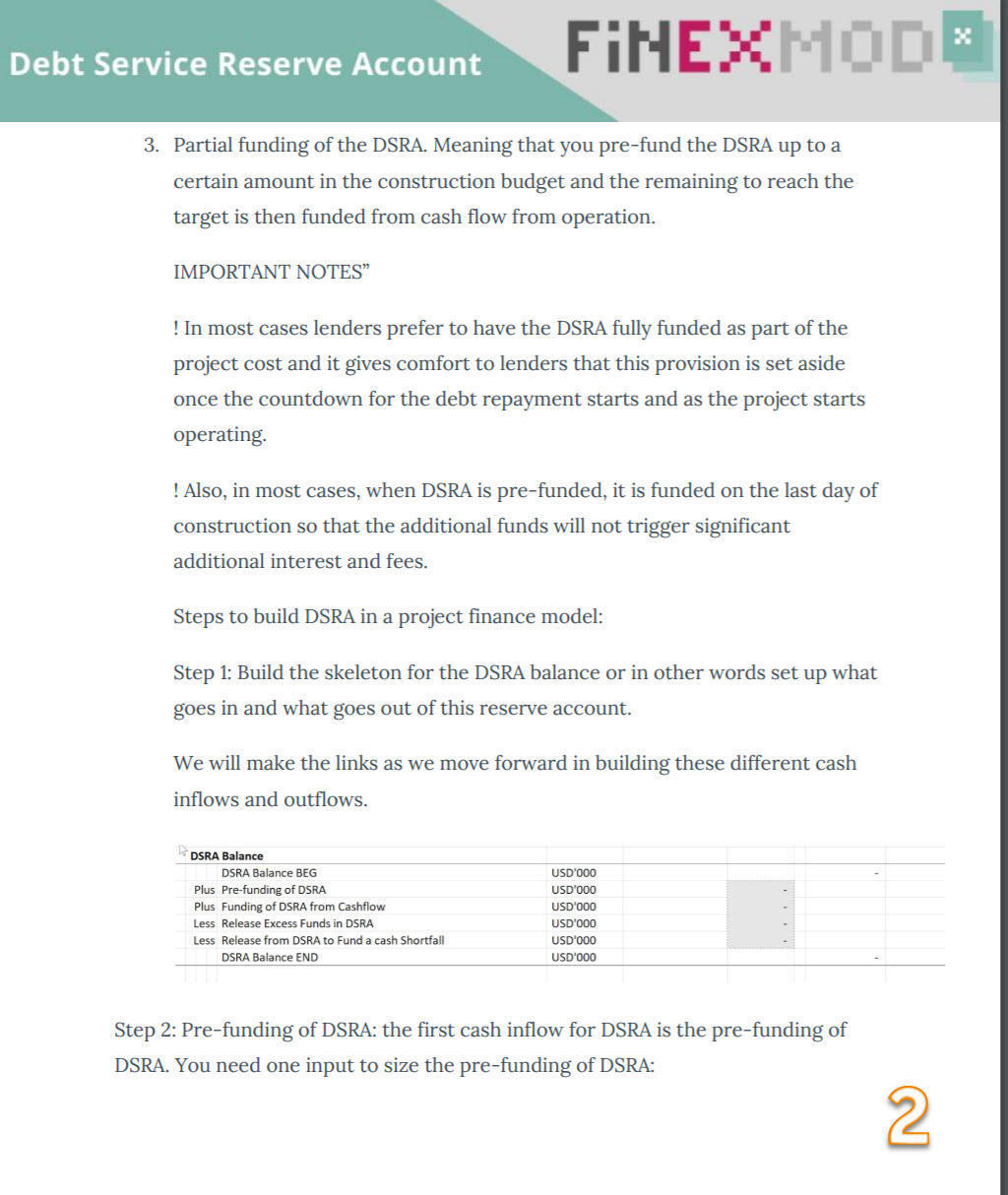

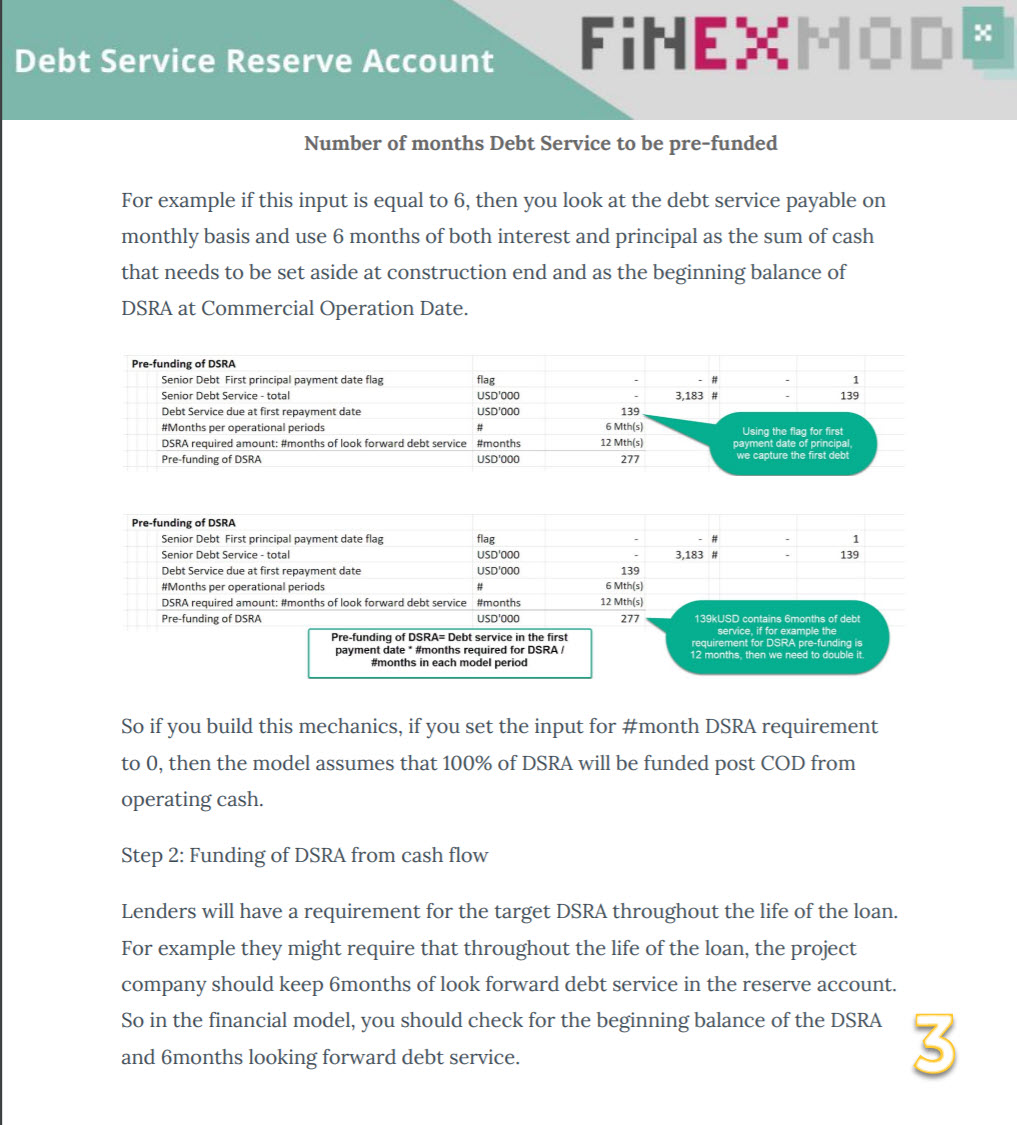

The major maintenance reserve account is usually funded up to certain target balance. It is an extract from pivotal180’s project finance courses: A debt service reserve facility (dsrf) is a service provided in a contractual agreement between the borrower and the lender.

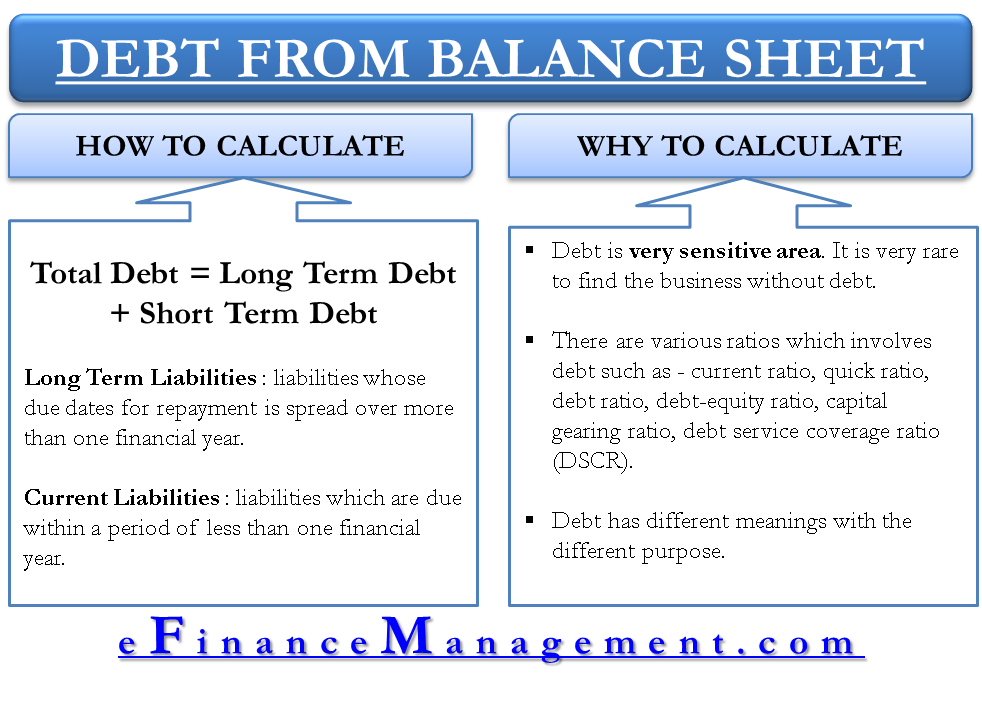

A reserve account is an asset. The target balance for the dsra/c includes both the interest and principal repayment amounts. What is debt service reserve account?.

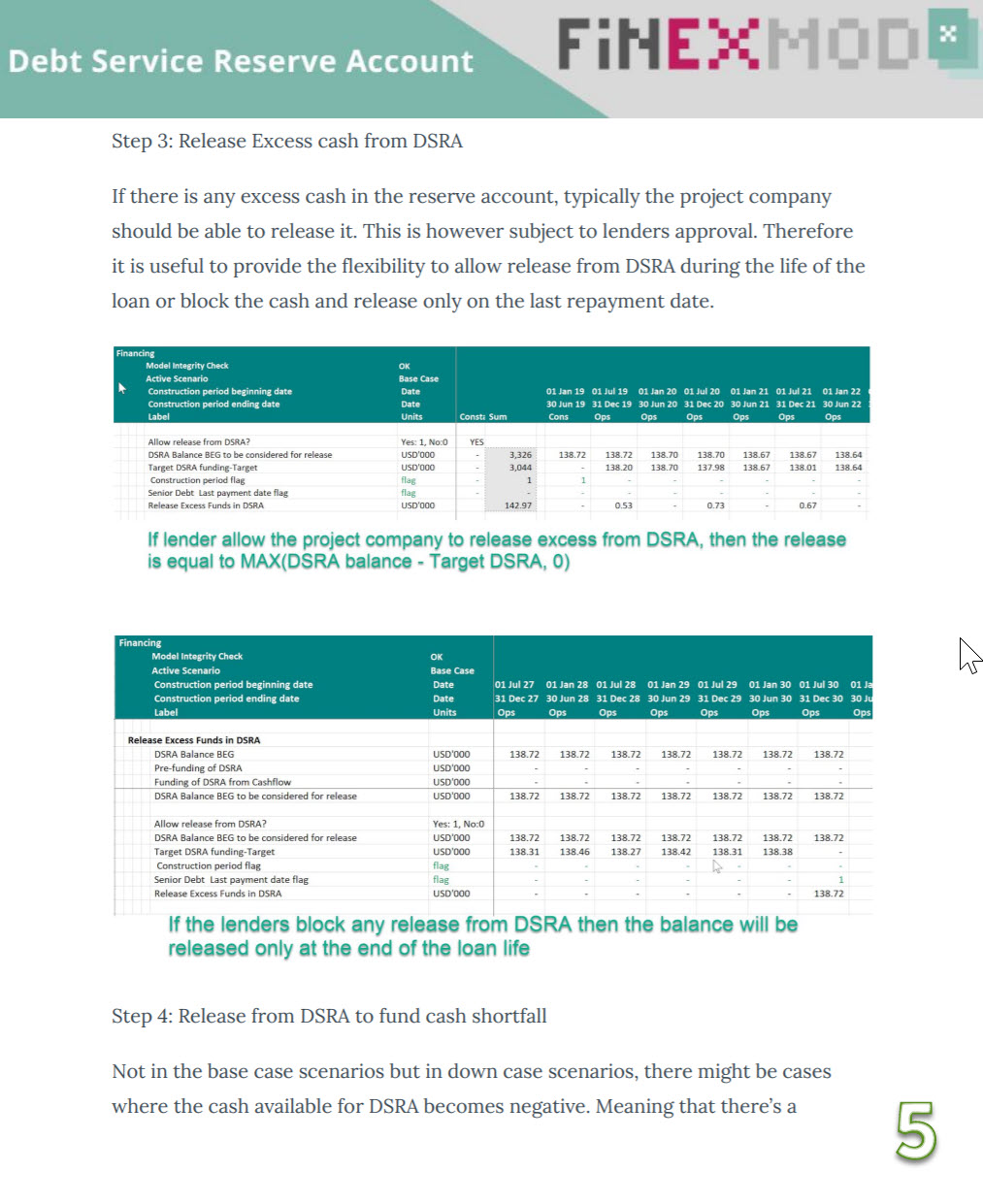

The dsra is usually funded up to a dynamic target balance. Pdf tools share summary debt service reserve accounts are included in project finance transactions and in some acquisition transactions to assure a company. The target balance for the mmra might be set at six, 12, 18, or 24 months of future.

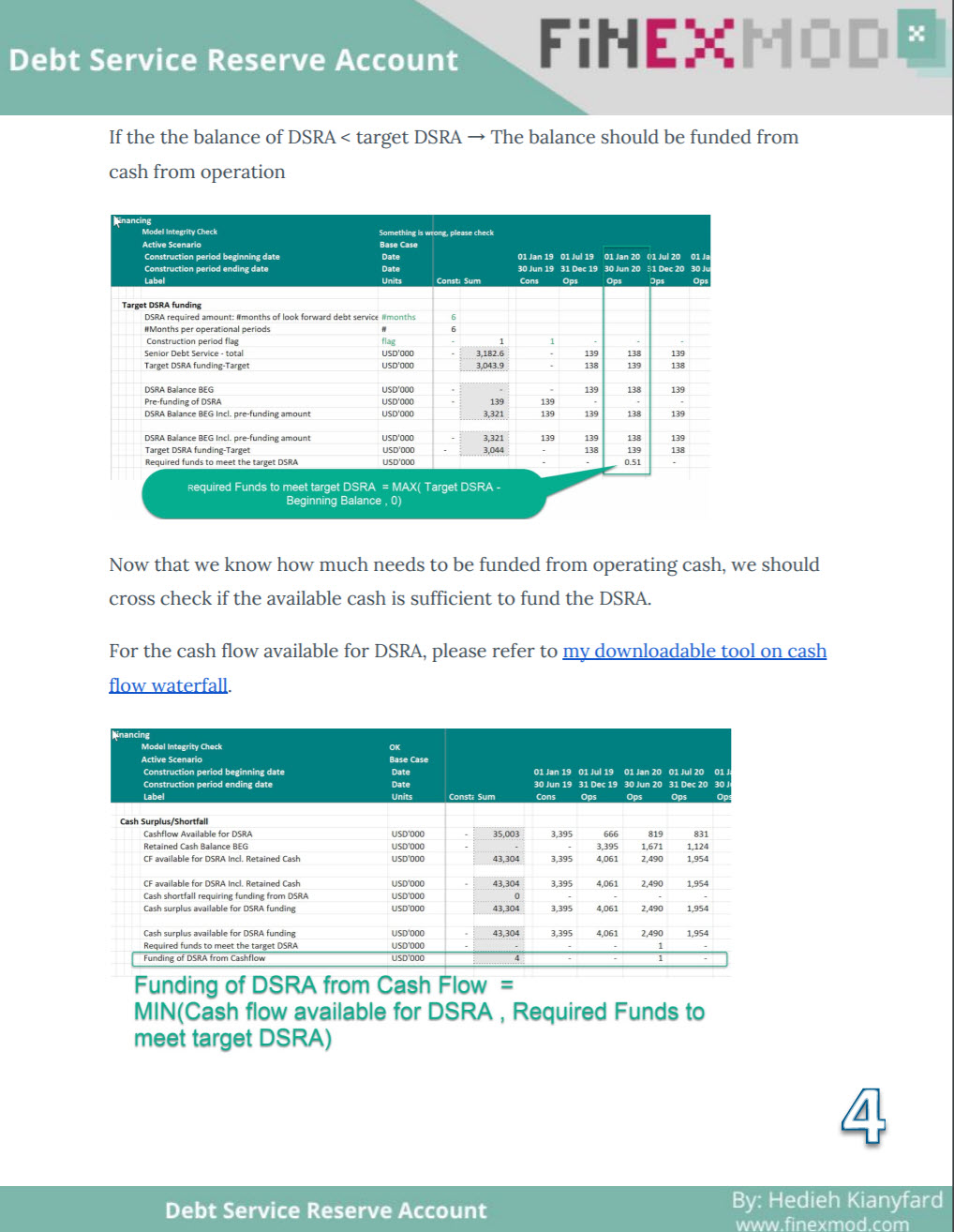

You can calculate this ratio using information available on a company's balance sheet. A debt service reserve account, or dsra, on the face of it, is simple — forecast the debt payments expected over the next 6/12 months and put this money. This might be set at.

A debt service reserve account (dsra) is normally required by the lending banks if you are looking for project financing a dsra is a restricted bank. Identify the company's earnings before taxes or interest from its balance. The dsra is often created once the loan becomes repayable, such as after the construction of a.

The ratio is frequently utilized when a business has debt on its balance sheet through bonds, loans, or credit lines. The target balance for the dsra includes both the interest. These reserves are essentially put aside for a rainy day and it.

The account falls under the current asset section of the balance sheet. The dsra/c is usually funded up to a dynamic target balance. The accounts often occupy a place just underneath the.