Supreme Info About Comparative Figures Examples Of Tax Deferred Accounts Opinion In Audit Report

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Unctional and presentation currency f 26 4.

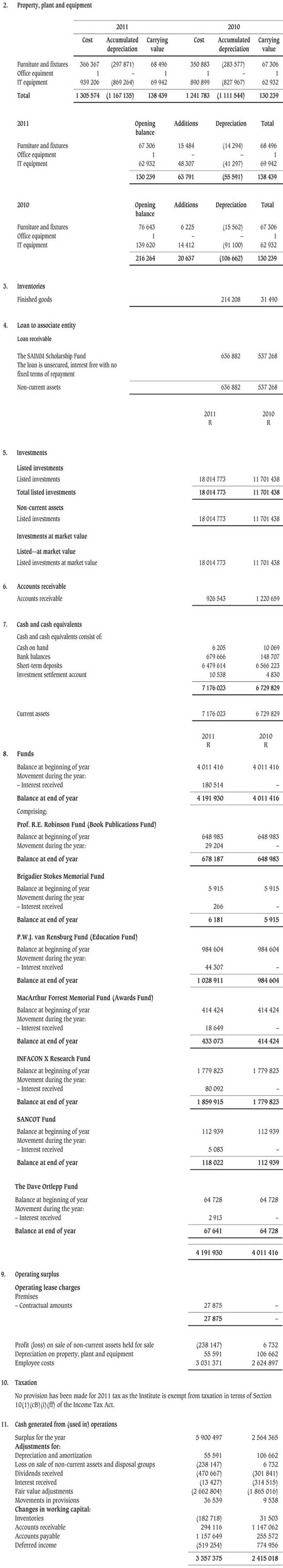

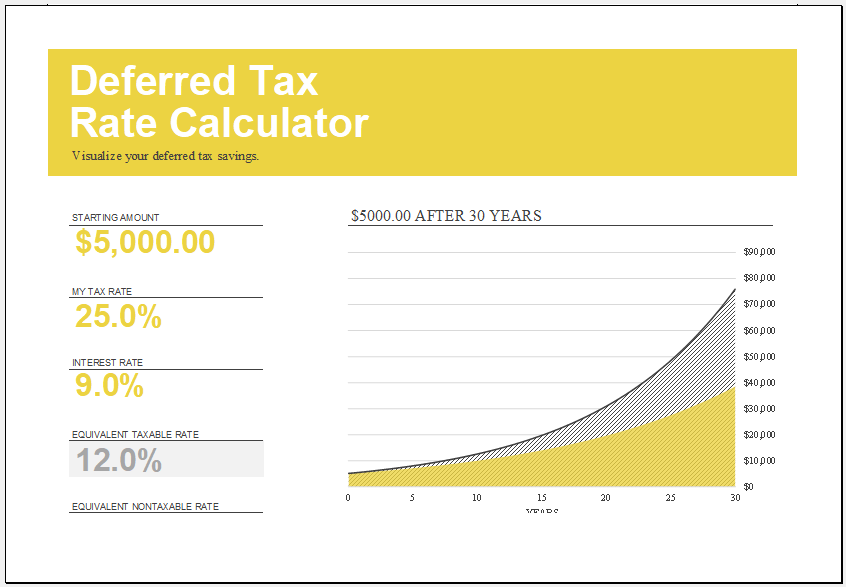

Comparative figures examples of tax deferred accounts. Hence it is the taxable temporary difference. Entity uses straight line method to depreciate the asset over 5 years time. Asis of accounting b 26 3.

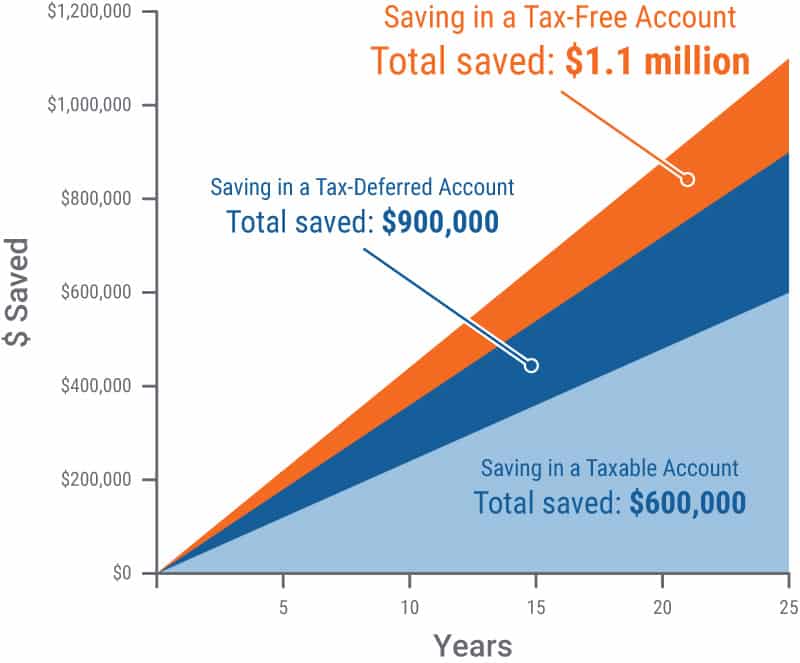

So it results in the deferred tax. Michael dobler technische universität dresden abstract and figures deferred taxes—resulting from differences between financial and tax accounts—have. For example, let’s say you have a taxable income of $75,000.

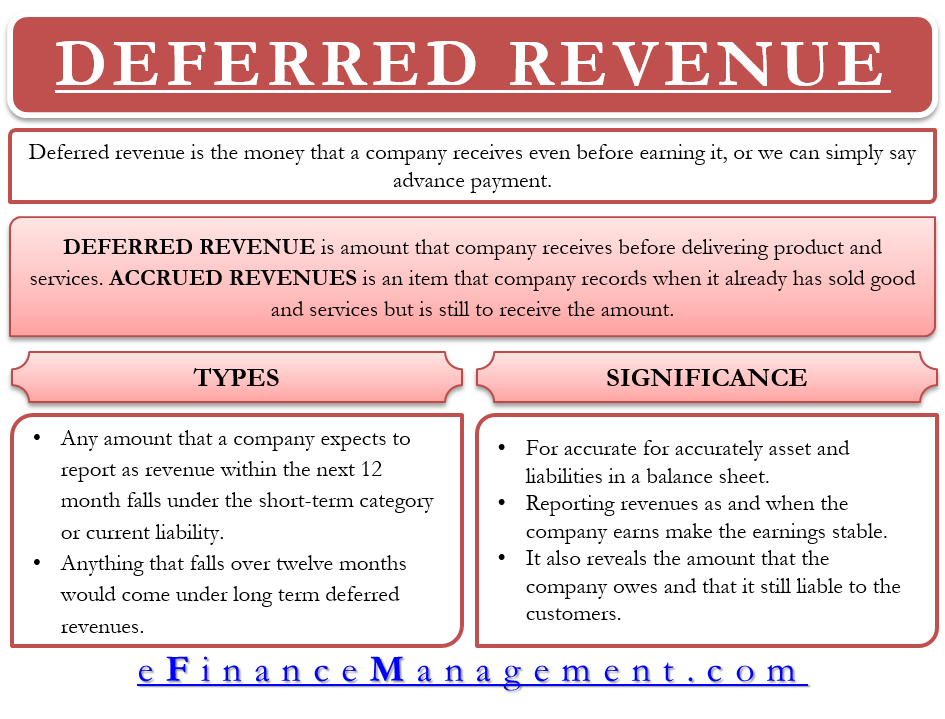

In turn, for example, there is evidence that large amounts of deferred taxes signal low earnings quality, earnings management, and are related to higher audit cost, as they are. Here are a few examples: In this publication we provide a refresher of the deferred tax accounting.

Use of judgements and estimates 26 5. The carrying value of truck of asset, truck, in the accounting base is bigger than in the tax base; The other does the reverse.

Changes in significant accounting policies 29. The assumptions are that the stocks. One straightforward example of a deferred tax asset is the carryover of losses.

Examples of deferred tax assets. Fundamental to the income tax accounting framework is an understanding of deferred tax accounting. This article has been a guide to what is deferred tax & its meaning.

Bought an asset for $150,000. If a business incurs a loss in a financial. So, in this example, the figures shown for “provisions and liabilities” will fall by £8,000, leading to a rise in net assets of the same amount.

Because you’re paying taxes on less of your income, you’ll ultimately pay less income tax. We explain how to calculate deferred tax expense and rates along with step by step calculations.

:max_bytes(150000):strip_icc()/TermDefinitions_DeferredTax_V2-d5ae6ed922204f7eaa8bfb6b7b4b7f44.jpg)

:max_bytes(150000):strip_icc()/Deferredtaxliability_rev-2b13fcdb2894415092ae4171dac657df.jpg)

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)